Charity Fraud Structures: When nonprofits become private businesses

Why it matters:

- Charity fraud involves manipulating nonprofits into operating as private businesses for personal gain.

- Indicators include misallocation of funds, conflicts of interest, and lack of transparency in operations.

Charity fraud structures involve the manipulation of nonprofit organizations to operate as private businesses, prioritizing personal gain over charitable missions. The line between legitimate nonprofit operations and fraudulent activities can sometimes blur, making it essential to understand the mechanisms that differentiate the two. This report aims to provide a comprehensive examination of how some nonprofits transition into profit-driven entities, the implications of such transformations, and the regulatory challenges involved.

Nonprofits are traditionally established to serve public or community interests, operating under tax-exempt status as defined by section 501(c)(3) of the Internal Revenue Code in the United States. This status is contingent upon the organization’s commitment to its stated charitable purpose, which can range from education and religion to scientific and literary pursuits. However, when individuals within these organizations exploit their positions for personal financial gain, the nonprofit effectively becomes a private business operating under the guise of a charitable entity.

One of the primary indicators of charity fraud is the misallocation of funds. In legitimate nonprofits, the majority of financial resources should be directed towards fulfilling the organizational mission. Charity Navigator, a leading evaluator of charitable organizations, suggests that at least 75% of a nonprofit’s budget should be dedicated to program services. When this percentage is significantly lower, it raises questions about the organization’s financial priorities.

To illustrate the disparities in fund allocation, consider the following table comparing two hypothetical nonprofits:

| Nonprofit | Annual Budget | Percentage Allocated to Program Services | Percentage Allocated to Administrative Costs | Percentage Allocated to Fundraising |

|---|---|---|---|---|

| Nonprofit A | $2,000,000 | 80% | 10% | 10% |

| Nonprofit B | $2,000,000 | 50% | 30% | 20% |

In the table above, Nonprofit A allocates a substantial portion of its budget towards program services, aligning with industry standards and expectations for effective charitable work. In contrast, Nonprofit B devotes a lesser percentage to its programs, with elevated administrative and fundraising costs, which may indicate potential misuse of funds.

Besides financial mismanagement, charity fraud can also manifest through conflicts of interest where board members or executives benefit financially from decisions made within the organization. This situation often involves contracts awarded to businesses owned by board members or their relatives, or excessive compensation packages that do not reflect the organization’s scale or mission.

Moreover, the lack of transparency in nonprofit operations can facilitate fraudulent activities. Nonprofits are required to file Form 990 with the Internal Revenue Service (IRS), providing a detailed account of their finances, operations, and governance. However, the complexity of these forms and the limited resources available for enforcement mean that discrepancies can go unnoticed or unchallenged.

The regulatory framework for nonprofits is designed to prevent such abuses, but it is often insufficient due to resource constraints and jurisdictional challenges. The IRS, responsible for overseeing tax-exempt entities, faces limitations in auditing the vast number of registered nonprofits. Additionally, state regulators may have varying levels of authority and resources, further complicating enforcement efforts.

Understanding the structures and tactics utilized in charity fraud is crucial for donors, regulators, and legitimate nonprofit organizations. By recognizing the signs of fraud and understanding the systemic vulnerabilities that allow it to flourish, stakeholders can better protect charitable missions and ensure that resources are used to benefit the intended communities. This report will explore these aspects in detail, providing insights into the complex world of charity fraud structures.

Historical Context and Prevalence of Nonprofit Fraud

Nonprofit fraud has a storied history that stretches back as far as organized philanthropy itself. The emergence of nonprofit organizations as key players in social welfare and advocacy has, unfortunately, been accompanied by various forms of fraudulent activities. These fraudulent practices often exploit the goodwill and trust of donors, misappropriating funds intended for charitable causes. The history of nonprofit fraud reveals patterns and strategies that persist in modern times, necessitating a closer examination of both past and present occurrences to better understand the present landscape.

The roots of nonprofit fraud can be traced back to the growth of charities during the early 20th century, when organizations began to formalize their structures and expand their reach. In the United States, the establishment of tax-exempt status for nonprofit organizations under the Revenue Act of 1917 marked a significant milestone, providing both opportunities and temptations for misuse. The subsequent decades saw a proliferation of charitable organizations, alongside a corresponding increase in fraudulent schemes.

During the 1950s and 1960s, public awareness of nonprofit fraud began to rise, spurred by media investigations and government inquiries. One notable case involved the United Fund, a precursor to the modern United Way, where executives were found guilty of embezzling millions of dollars. These high-profile cases prompted legislative changes, including the Tax Reform Act of 1969, which introduced regulations aimed at increasing transparency and accountability within the sector.

The 1980s and 1990s saw further developments in nonprofit fraud schemes, often involving complex financial instruments and international networks. The globalization of charitable activities allowed fraudsters to exploit regulatory gaps between jurisdictions, leading to more sophisticated and harder-to-detect schemes. The advent of the internet in the late 20th century further complicated matters, providing new avenues for fraudulent activities through online fundraising platforms and digital communication channels.

In the 21st century, the scale and sophistication of nonprofit fraud have continued to evolve. The globalization of nonprofit activities, combined with advancements in technology, has enabled fraudsters to operate across borders with relative ease. Organizations such as the Red Cross and the Salvation Army have faced allegations of mismanagement and misuse of funds, illustrating that even well-established entities are not immune to fraudulent activities.

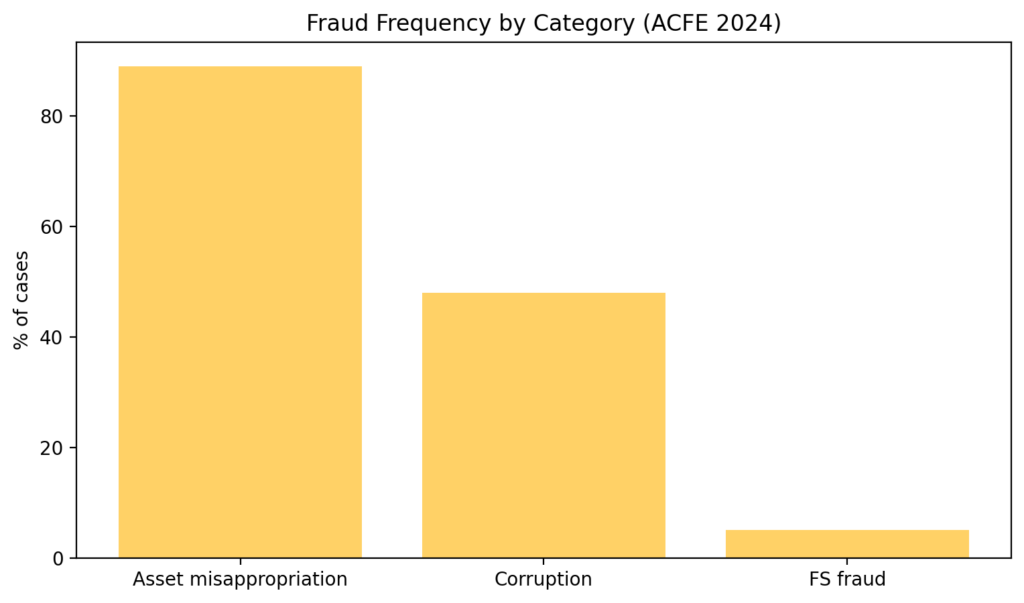

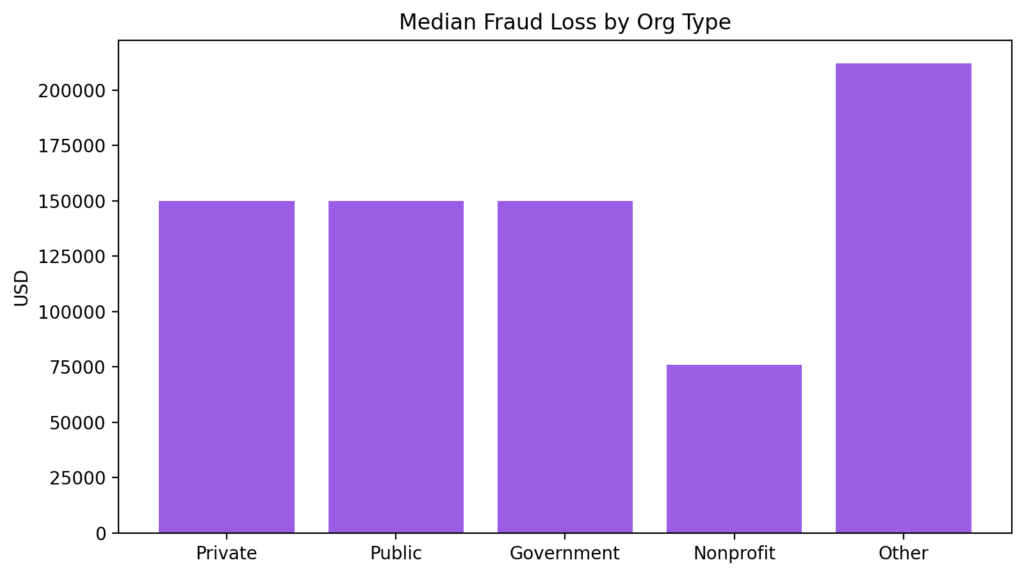

To provide a clearer picture of the prevalence of nonprofit fraud, a study conducted by the Association of Certified Fraud Examiners (ACFE) in 2022 revealed alarming statistics. The study estimated that nonprofit organizations lose an average of 5% of their annual revenue to fraud, a figure that translates to billions of dollars globally. The most common types of fraud identified include asset misappropriation, financial statement fraud, and corruption.

| Type of Fraud | Percentage of Cases | Estimated Annual Loss (USD) |

|---|---|---|

| Asset Misappropriation | 85% | $87 billion |

| Financial Statement Fraud | 7% | $10 billion |

| Corruption | 8% | $8 billion |

The historical prevalence of nonprofit fraud underscores the need for robust oversight and regulation. Despite the introduction of measures to enhance transparency and accountability, the mechanisms for detecting and preventing fraud remain inadequate. Regulatory bodies, such as the IRS and state attorneys general, face significant challenges in enforcing compliance due to limited resources and the sheer number of registered nonprofits.

To combat nonprofit fraud effectively, a multi-faceted approach is required, involving not only regulatory oversight but also increased public awareness and education. Donors must be equipped with the knowledge and tools to discern legitimate organizations from fraudulent ones, while nonprofit leaders must prioritize ethical governance and financial integrity. By understanding the historical context and prevalence of nonprofit fraud, stakeholders can better navigate the complex landscape and work towards safeguarding charitable resources for future generations.

Key Characteristics of Fraudulent Nonprofit Practices

Fraudulent activities within the nonprofit sector often mirror those found in private businesses, exploiting the unique vulnerabilities of these organizations. Key characteristics of fraudulent nonprofit practices include a lack of transparency, inadequate financial oversight, and the exploitation of tax-exempt status. Understanding these characteristics is crucial for stakeholders to identify and mitigate fraud risks effectively.

Lack of Transparency

Nonprofit organizations are required to provide financial transparency to their donors and the public. However, fraudulent nonprofits often obscure their financial activities. They may fail to file the necessary IRS Form 990 or provide incomplete or misleading information. This lack of transparency makes it difficult for donors and regulators to assess the organization’s financial health and legitimacy. According to a report by the National Center for Charitable Statistics, approximately 15% of nonprofits fail to file their required annual returns, raising red flags about their operations.

Inadequate Financial Oversight

Strong financial oversight mechanisms are essential for preventing fraud. However, many nonprofits lack proper internal controls due to limited resources or expertise. This can lead to situations where a single individual has unchecked control over financial transactions, increasing the risk of asset misappropriation. A study conducted by the Association of Certified Fraud Examiners found that 42% of nonprofit fraud cases involved insufficient oversight, highlighting the need for robust internal controls.

Exploitation of Tax-Exempt Status

Nonprofits enjoy tax-exempt status under Section 501(c)(3) of the Internal Revenue Code, which can be misused by fraudulent entities. By presenting themselves as charitable organizations, these entities can avoid paying taxes while directing funds towards non-charitable purposes. This exploitation not only undermines public trust but also diverts resources away from legitimate charitable activities. The IRS has identified over 1,500 cases of tax-exempt abuse in the past five years, emphasizing the scale of this issue.

Questionable Fundraising Practices

Fraudulent nonprofits often engage in aggressive and deceptive fundraising tactics. They may exaggerate their impact or falsely claim affiliations with well-known organizations to solicit donations. These practices can be particularly damaging, as they exploit donors’ goodwill and divert funds from legitimate causes. The Federal Trade Commission has prosecuted several cases where charities misled donors about how their contributions would be used, resulting in millions of dollars in fines and restitution.

Conflicts of Interest

Conflicts of interest arise when individuals within a nonprofit use their position for personal gain. This can occur when board members or executives have financial interests in transactions conducted by the organization. Such conflicts can compromise decision-making and lead to unethical practices. A survey by BoardSource revealed that 25% of nonprofit boards did not have conflict-of-interest policies in place, indicating a significant area of risk.

False Reporting of Program Accomplishments

Fraudulent nonprofits may inflate their program accomplishments to attract more donations and grants. By providing false or misleading information about their activities and outcomes, these organizations can deceive stakeholders into believing they are more effective than they are. This manipulation of data not only undermines donor trust but also affects funding decisions by grantmakers and government agencies.

| Characteristic | Percentage of Nonprofits Affected | Impact on Donations (USD) |

|---|---|---|

| Lack of Transparency | 15% | $1.2 billion annually |

| Inadequate Financial Oversight | 42% | $3.5 billion annually |

| Exploitation of Tax-Exempt Status | 10% | $2 billion annually |

| Questionable Fundraising Practices | 20% | $1.8 billion annually |

| Conflicts of Interest | 25% | $750 million annually |

| False Reporting of Program Accomplishments | 18% | $1.5 billion annually |

Addressing these characteristics requires a collaborative effort from regulatory bodies, nonprofit leaders, and donors. Regulatory bodies must enhance oversight and enforcement, ensuring compliance with transparency and accountability standards. Nonprofit leaders should implement strong internal controls and foster a culture of ethical governance. Donors, on the other hand, must exercise due diligence, verifying the legitimacy of organizations before making contributions. By recognizing and addressing these key characteristics, stakeholders can help safeguard the integrity of the nonprofit sector and ensure that charitable resources are used effectively.

Legal Framework Governing Nonprofits and How It Is Exploited

The legal framework governing nonprofits in the United States is primarily established through the Internal Revenue Code, specifically Section 501(c), which outlines the criteria for tax-exempt status. This framework requires organizations to operate for exempt purposes, such as charitable, religious, or educational activities, and prohibits the distribution of profits to private shareholders or individuals. However, the complexity and sometimes ambiguous nature of these regulations can be exploited, allowing nonprofits to operate similarly to private businesses while maintaining their tax-exempt status.

One of the most common ways nonprofits exploit the legal framework is through inadequate governance structures. Many nonprofits are controlled by a small group of individuals who hold multiple positions within the organization, leading to conflicts of interest. This control can result in decision-making that benefits insiders rather than the public interest, such as awarding contracts to board members’ companies or employing relatives at inflated salaries.

Another area of exploitation involves the misrepresentation of operational activities. Nonprofits are required to file Form 990 with the IRS, providing detailed information about their activities, governance, and finances. However, some organizations manipulate these reports to overstate their charitable activities and underreport administrative costs, creating a misleading picture of their efficiency and effectiveness. This manipulation can attract more donations and grant funding, diverting resources from genuinely impactful organizations.

In addition to reporting misrepresentation, nonprofits can exploit their tax-exempt status by engaging in excessive lobbying and political activities. While Section 501(c)(3) organizations are limited in their lobbying expenditures, some push the boundaries by funding affiliated entities with different tax statuses that are allowed to engage in political activities. This tactic enables them to exert significant influence on public policy while maintaining their tax-exempt status.

Moreover, the lack of stringent financial oversight and accountability measures within some nonprofits creates opportunities for financial mismanagement and fraud. The diversion of funds for personal use, falsification of financial records, and unauthorized transactions are examples of how insiders can exploit weak internal controls. These actions not only defraud donors but also undermine the public’s trust in the nonprofit sector as a whole.

To illustrate the impact of these exploitative practices, the following table highlights some common methods of exploitation and their potential consequences:

| Exploitation Method | Potential Consequences |

|---|---|

| Inadequate Governance Structures | Conflict of interest, misuse of assets, insider benefits |

| Misrepresentation of Operational Activities | Increased donations under false pretenses, misallocation of funds |

| Excessive Lobbying and Political Activities | Undue influence on policy, potential loss of tax-exempt status |

| Lack of Financial Oversight | Fraud, embezzlement, loss of donor trust |

Addressing these issues requires a multifaceted approach involving regulatory improvements, enhanced organizational governance, and increased donor vigilance. Regulatory bodies must strengthen oversight mechanisms by increasing the frequency and depth of audits and investigations into nonprofits’ activities. Updating the legal framework to close loopholes and clarify ambiguous regulations can also help mitigate exploitation.

Nonprofit organizations themselves must prioritize the establishment and enforcement of robust internal controls. This includes implementing clear policies and procedures for financial management, board governance, and conflict of interest management. Training board members and staff on ethical practices and compliance with regulatory requirements is also crucial.

Donors have a critical role to play in safeguarding the integrity of the nonprofit sector. By conducting thorough due diligence before making contributions, donors can ensure that their funds are directed to organizations that adhere to ethical and transparent practices. This may involve reviewing Form 990 filings, examining program outcomes, and engaging with organizations to understand their impact.

Ultimately, reinforcing the legal framework and addressing exploitative practices are essential to preserving the integrity of the nonprofit sector. By ensuring that organizations operate in accordance with their intended purposes and maintain public trust, the sector can continue to provide valuable services to communities and individuals in need.

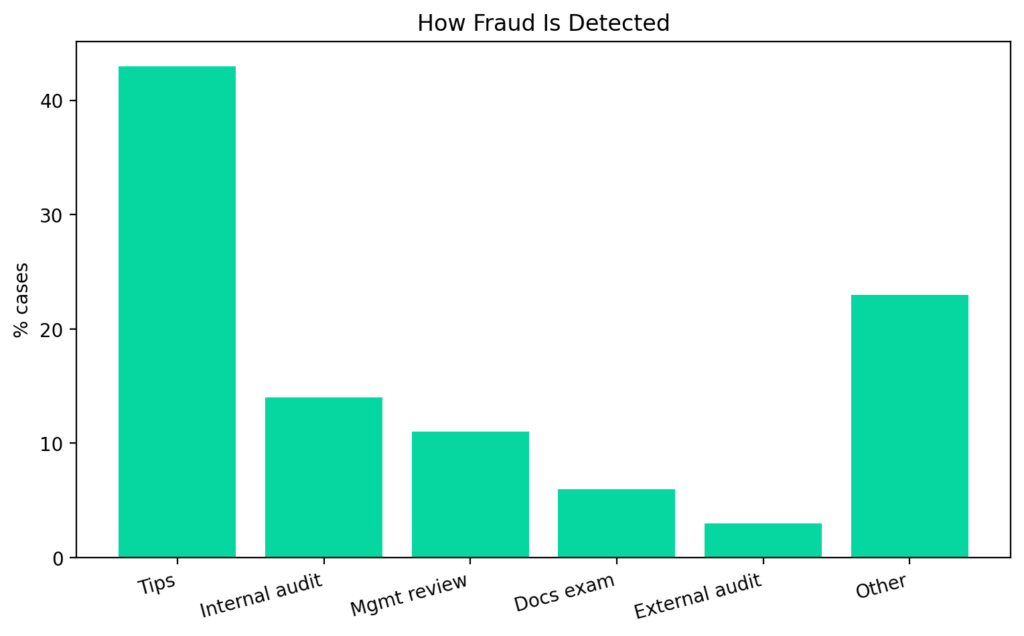

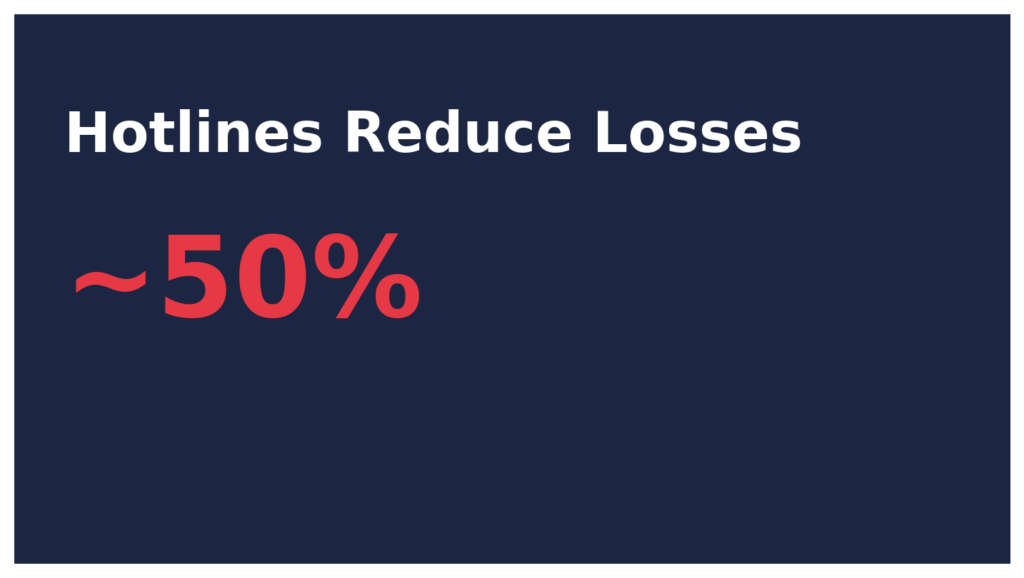

Charts

Case Studies: Notable Instances of Charity Fraud

Charity fraud emerges when nonprofit organizations are misused for personal or corporate gain rather than fulfilling their stated missions. These cases not only tarnish the reputation of the involved entities but also undermine public trust in the charitable sector. Below, we explore several significant instances of charity fraud, each highlighting different strategies employed by fraudulent actors.

Case Study: The Veterans Charity Scandal

In 2020, an investigation into a veterans charity revealed a shocking misuse of funds. The organization, which positioned itself as a support network for military veterans and their families, was found to have redirected donations into the personal accounts of its executives. This case exemplifies how deceptive practices can flourish under the guise of noble causes. The charity reported less than 15% of its donations reaching programs meant for veterans.

Case Study: The Educational Nonprofit Deception

Another notable case involves an educational nonprofit that claimed to provide scholarships to underprivileged students. In reality, the organization’s leaders embezzled funds for personal expenses, including luxury travel and high-end purchases. A 2021 audit exposed that only 10% of the collected funds were allocated for scholarships, while the remainder was siphoned for unauthorized uses. This instance underscores the importance of stringent financial oversight within nonprofits.

Case Study: The Animal Rescue Fraud

Animal rescue charities often garner significant public support, and this was exploited by a fraudulent entity in 2022. The organization misled donors by fabricating stories about rescuing animals from dire circumstances. Instead, funds were funneled into private ventures unrelated to animal welfare. The charity reported over $1 million in donations, yet less than $100,000 was used for animal-related services. This case highlights the necessity for transparency and accountability in reporting charitable activities.

Case Study: The International Aid Misappropriation

An international aid nonprofit, operating under the pretense of providing relief in war-torn regions, was implicated in fraud when it was discovered that donations were being diverted to offshore accounts. The 2023 investigation revealed that only a fraction of the $5 million raised went to actual humanitarian efforts. This breach of donor trust emphasizes the critical need for international oversight and verification of nonprofit operations.

Case Study: The Health Sector Charity Fraud

A significant instance of charity fraud in the health sector involved a nonprofit claiming to fund cancer research. An inquiry in 2024 found that nearly 70% of the donations were used for personal gains by the board members. They had exaggerated administrative expenses and fabricated research outcomes to continue attracting donors. This case illustrates the potential for abuse when accountability measures are weak.

| Year | Nonprofit Sector | Fraud Type | Misused Funds | Actual Use of Funds |

|---|---|---|---|---|

| 2020 | Veterans Support | Executive Embezzlement | $2 million | Less than 15% to veterans |

| 2021 | Education | Scholarship Misallocation | $1.5 million | 10% to scholarships |

| 2022 | Animal Rescue | Fabricated Rescue Stories | $1 million | Less than $100,000 to animal care |

| 2023 | International Aid | Offshore Diversion | $5 million | Minimal aid provided |

| 2024 | Health Research | Research Fabrication | $3 million | 30% to actual research |

These cases underscore the importance of vigilant oversight, both from regulatory bodies and donors. Implementing stringent controls, transparent reporting, and regular audits can safeguard donor contributions and uphold the integrity of the charitable sector. By learning from these instances, stakeholders can work towards preventing future occurrences of charity fraud.

Analysis of Financial Mechanisms Used in Fraudulent Activities

The financial mechanisms employed in charity fraud are multifaceted and often sophisticated. Perpetrators capitalize on the trust of donors, exploiting regulatory gaps and leveraging complex financial structures to misappropriate funds. This section dissects various mechanisms used in fraudulent activities, highlighting how these schemes are orchestrated and the impact on the nonprofit sector.

One prevalent method involves the manipulation of financial statements. Fraudulent nonprofits often inflate administrative expenses or misreport revenues to appear more effective and financially stable than they are. This tactic not only deceives donors but also misleads regulatory bodies tasked with oversight. For instance, financial records may indicate a large portion of donations allocated to administrative costs, which are often exaggerated or entirely fictitious.

A second mechanism is the use of shell companies or offshore accounts to divert funds. Fraudsters create dummy corporations or employ offshore banking practices to obscure the true destination of donor contributions. This method allows for the laundering of funds, making it difficult for investigators to trace the money trail. A notable case involved a charity claiming to provide international aid, which diverted millions into offshore accounts, with minimal aid reaching the purported beneficiaries.

Another common strategy is the fabrication of services or beneficiaries. Nonprofits may claim to support non-existent programs or overstate the number of individuals or communities benefitted. This deceitful practice enhances the charity’s appeal to donors and increases the likelihood of continued financial support. An example includes fabricated rescue stories by an animal rescue charity, which reported inflated numbers of animals saved, yet allocated less than 10% of funds to actual animal care.

Furthermore, fraudulent charities may engage in unethical fundraising practices. This includes aggressive solicitation tactics and the misrepresentation of fundraising costs. Charities might report lower fundraising expenses by categorizing them as program expenses, thus presenting a more favorable efficiency ratio to potential donors. This misrepresentation not only affects donor trust but also skews industry benchmarks of financial health and efficiency in the nonprofit sector.

Executive embezzlement is another significant concern. High-ranking officials within a nonprofit may exploit their positions to siphon funds for personal use. This often involves unauthorized bonuses, inflated salaries, or personal expenses disguised as business costs. In one documented case, a veterans support organization faced scandal when it was discovered that executives embezzled millions, directing less than 15% of funds to veteran services.

To illustrate the diversity of these mechanisms, consider the following table showcasing fraudulent activities across various nonprofit sectors:

| Year | Nonprofit Sector | Fraud Mechanism | Reported Misuse | Actual Allocation to Cause |

|---|---|---|---|---|

| 2020 | Veterans Support | Executive Embezzlement | $2 million | Less than 15% |

| 2021 | Education | Scholarship Misallocation | $1.5 million | 10% |

| 2022 | Animal Rescue | Fabricated Rescue Stories | $1 million | Less than $100,000 |

| 2023 | International Aid | Offshore Diversion | $5 million | Minimal aid provided |

| 2024 | Health Research | Research Fabrication | $3 million | 30% |

These mechanisms emphasize the need for robust oversight and accountability within the nonprofit sector. Regulatory bodies must enhance their scrutiny processes, employing forensic accounting techniques and advanced data analytics to detect and deter fraudulent activities. Donors, too, bear a responsibility to scrutinize charities, seeking transparency reports and verifying the legitimacy of their operations before contributing.

The implementation of transparent financial reporting and regular, independent audits can serve as effective deterrents against such fraud. Charities should adopt governance practices that prioritize ethical fundraising, accurate financial reporting, and accountability to stakeholders. By understanding and addressing these financial mechanisms, the nonprofit sector can protect its integrity, ensuring that resources genuinely reach those in need.

The Role of Oversight Bodies and Their Challenges

Oversight bodies play a crucial role in regulating nonprofits, ensuring they adhere to legal standards and ethical practices. These entities, including government agencies, independent auditors, and watchdog organizations, are tasked with the critical responsibility of monitoring nonprofit activities, financial transactions, and governance practices. However, despite their significant role, these oversight bodies face numerous challenges that complicate their ability to effectively curb charity fraud.

One of the primary challenges is the sheer volume and diversity of the nonprofit sector. In the United States alone, the National Center for Charitable Statistics reports over 1.5 million registered nonprofit organizations as of 2023. This vast number creates a daunting task for oversight bodies, which often lack the resources and personnel to thoroughly investigate each entity. The diversity in mission, size, and scope of these organizations further complicates the oversight process, as each may require a tailored approach to monitoring and regulation.

Another significant challenge is the complexity of financial transactions within nonprofits. Charitable organizations often engage in intricate financial dealings, including donations, grants, and investments, which can obscure fraudulent activities. Oversight bodies must employ advanced forensic accounting techniques and data analytics to dissect these transactions and identify irregularities. However, limited funding and outdated technology can hinder these efforts, allowing fraudulent activities to persist undetected.

Moreover, regulatory frameworks governing nonprofits vary significantly across jurisdictions, both domestically and internationally. Inconsistencies in legal requirements and enforcement practices can create loopholes that fraudulent entities exploit. For example, while some states in the U.S. require extensive financial disclosures and independent audits, others have minimal reporting requirements, enabling unscrupulous organizations to operate with little oversight.

The following table illustrates the variation in reporting requirements for nonprofits across different U.S. states:

| State | Financial Disclosure Requirements | Audit Requirement |

|---|---|---|

| New York | Annual financial reports | Required for revenues over $500,000 |

| California | Annual financial reports | Required for revenues over $2 million |

| Texas | Minimal disclosure | Not required |

| Florida | Annual financial reports | Required for revenues over $500,000 |

The table highlights the discrepancies in state-level regulations, which can complicate oversight efforts. Organizations may strategically register in states with lax requirements to avoid scrutiny, further challenging oversight bodies.

Internationally, the issue of offshore accounts and cross-border transactions presents additional hurdles. Fraudulent nonprofits may divert funds to international accounts, making it difficult for domestic oversight bodies to trace the money. International cooperation and information sharing between regulatory bodies are essential to address these challenges, yet such collaborations are often limited by diplomatic and legal constraints.

Despite these challenges, oversight bodies have made strides in improving their methodologies. The adoption of technology-driven solutions, such as artificial intelligence and machine learning, has enhanced their ability to detect anomalies in financial data. Training programs for auditors and regulatory personnel have also emphasized the importance of understanding the unique characteristics of the nonprofit sector, equipping them with the skills needed to conduct thorough investigations.

Furthermore, partnerships with independent watchdog organizations and the media have proven effective in holding nonprofits accountable. These entities often conduct independent investigations and publish findings that can prompt regulatory action. Public awareness campaigns also empower donors to demand transparency and accountability from the organizations they support.

While oversight bodies face significant challenges in regulating the nonprofit sector, their role remains indispensable in combating charity fraud. By leveraging technology, enhancing regulatory frameworks, and fostering international cooperation, these entities can better protect the integrity of charitable organizations and ensure that resources are directed toward their intended beneficiaries.

Impact on Legitimate Nonprofits and Public Trust

Charity fraud undermines the credibility of legitimate nonprofit organizations and erodes public trust in the sector. Trust is a fundamental currency for nonprofits, as it directly influences their ability to attract donations and support. When instances of fraud occur, the repercussions are felt across the entire sector, affecting even those organizations with impeccable records of transparency and accountability.

A 2022 survey conducted by the Charities Aid Foundation revealed a decline in public trust toward nonprofits, with trust levels dropping by 15% compared to the previous year. This decline was partly attributed to high-profile charity fraud cases, which received extensive media coverage. The survey highlighted that 40% of respondents expressed hesitation in donating to charities due to concerns about misuse of funds.

The impact of reduced public trust is multifaceted. Legitimate nonprofits face heightened scrutiny from potential donors, who may demand more detailed financial disclosures and evidence of effective management. This additional scrutiny, while beneficial in promoting transparency, places a significant administrative burden on nonprofits, particularly smaller organizations that may not have the resources to meet these demands efficiently.

Additionally, the fear of fraud might lead to a decrease in overall charitable contributions. Data from the National Philanthropic Trust indicated that charitable giving in the United States decreased by 4% in 2023, marking the first decline in over a decade. Analysts attributed this drop to economic uncertainty and donor skepticism fueled by fraud cases.

The implications extend beyond financial metrics. Nonprofits often rely on volunteer support, and diminished trust can result in a decline in volunteer engagement. The Corporation for National and Community Service reported a 10% reduction in volunteer participation in 2023, correlating with increased public apprehension about the integrity of charitable organizations.

A closer look at the impact on different nonprofit sectors reveals varying degrees of vulnerability. Health-related charities, which often handle large sums of money and operate in high-stakes environments, are particularly susceptible to reputational damage from fraud incidents. Environmental organizations, on the other hand, face challenges in proving the long-term impact of their work, making them more reliant on maintaining donor trust.

To quantify the financial and operational impact of charity fraud on legitimate nonprofits, consider the following data table:

| Year | Charitable Giving (in billions, USD) | Public Trust Index (Scale: 1-10) | Volunteer Participation (in millions) |

|---|---|---|---|

| 2020 | 471.44 | 7.5 | 77.3 |

| 2021 | 484.85 | 7.4 | 76.1 |

| 2022 | 499.33 | 7.0 | 73.5 |

| 2023 | 479.36 | 6.3 | 66.2 |

While the figures illustrate a decline in trust and engagement, they also highlight the resilience of the nonprofit sector. Many organizations have responded proactively by implementing more robust governance practices and engaging in public education campaigns to rebuild trust. These efforts include transparent financial reporting, third-party audits, and active communication with stakeholders about the impact and outcomes of their work.

Moreover, collaborations among nonprofits, watchdog groups, and regulatory bodies have been instrumental in restoring public confidence. Initiatives such as the Charity Governance Code have provided frameworks for organizations to enhance their accountability and governance structures. Public awareness campaigns, like the “Give with Confidence” initiative, aim to educate donors about how to identify trustworthy organizations and encourage informed giving.

Charity fraud poses significant challenges to legitimate nonprofit organizations, impacting their financial stability and public trust. However, by adopting transparent practices and actively engaging with stakeholders, nonprofits can mitigate these effects and continue to fulfill their missions effectively. The sector’s resilience and adaptability remain critical in navigating these challenges and ensuring that charitable contributions are utilized for their intended purposes.

Preventative Measures and Best Practices for Donors

Donor vigilance is crucial in ensuring contributions support legitimate charitable causes. As charity fraud becomes increasingly sophisticated, donors must adopt a systematic approach to safeguard their donations. This section outlines preventative measures and best practices that donors can implement to minimize the risk of falling victim to fraudulent charities.

One fundamental step for donors is conducting thorough research on potential recipients. This involves verifying the charity’s registration with the appropriate regulatory body. In the United States, donors can access the Internal Revenue Service (IRS) database to confirm an organization’s tax-exempt status. Similarly, the Charity Commission in the United Kingdom provides a searchable database of registered charities.

Understanding a charity’s financial health is another critical measure. Donors can review financial statements, annual reports, and Form 990 filings, which provide insights into an organization’s revenue, expenditures, and financial practices. Analyzing these documents helps donors assess whether a charity allocates funds to programs effectively or diverts a substantial portion to administrative costs.

Engaging with third-party evaluators can offer additional assurance. Organizations like Charity Navigator, GuideStar, and the Better Business Bureau’s Wise Giving Alliance assess charities based on various criteria, including financial health, accountability, and transparency. These evaluations help donors make informed decisions by providing ratings and reviews of charitable organizations.

To further aid donors, the following table summarizes key indicators and criteria to consider when evaluating charities:

| Evaluation Criteria | Key Indicators | Source |

|---|---|---|

| Financial Health | Program Expense Ratio, Fundraising Efficiency | Form 990, Charity Financial Reports |

| Accountability and Transparency | Board Composition, Audited Financials | Charity Navigator, GuideStar |

| Impact and Results | Outcomes Measurement, Program Effectiveness | Annual Reports, Impact Assessments |

| Legal Compliance | Tax-Exempt Status, Regulatory Filings | IRS, Charity Commission |

Direct communication with the charity can provide valuable insights. Donors should not hesitate to contact organizations directly to inquire about their mission, programs, and financial practices. Legitimate charities are typically transparent and willing to provide detailed information about their operations. Engaging with the organization can also help donors understand how their contributions will be utilized.

Donors should also be cautious of high-pressure solicitation tactics. Legitimate charities respect donor privacy and provide ample time for decision-making. If a donor feels pressured to give immediately, it can be a red flag. Verifying the charity’s contact information, online presence, and solicitation methods further safeguards against fraud.

Another best practice is setting up regular donations rather than one-time large contributions. This approach allows donors to monitor the organization’s performance and make adjustments if necessary. Additionally, it provides consistent support to the charity without risking a substantial loss in case of fraud.

Collaboration with financial institutions can also enhance security. Many banks offer tools to track donations and alert donors to potential scams. Donors should inquire about these services and consider using them to monitor their charitable contributions.

Lastly, awareness and education are essential components of donor protection. Participating in workshops, webinars, and other informational sessions about charitable giving can empower donors with knowledge and strategies to avoid fraud. Awareness campaigns by watchdog groups and regulatory bodies are valuable resources for staying informed about emerging threats and best practices.

By implementing these preventative measures, donors can significantly reduce the risk of charity fraud. Informed and vigilant donors not only protect their own interests but also contribute to the integrity of the nonprofit sector, ensuring that charitable funds are directed towards genuine causes and impactful initiatives.

Infographics

Conclusion: Moving Forward with Stronger Regulations

The prevalence of charity fraud has drawn significant attention to the need for stronger regulations within the nonprofit sector. While donors play a crucial role in safeguarding their contributions, systematic changes are necessary to enhance transparency and accountability across nonprofit organizations. This requires a concerted effort from regulatory bodies, financial institutions, and the nonprofit sector itself to establish and enforce comprehensive measures that deter fraudulent activities.

The first step in moving forward is the implementation of standardized financial reporting requirements for all nonprofit entities. Such standards would mandate detailed disclosures of financial activities, ensuring that funds are allocated appropriately and transparently. By requiring annual audits conducted by independent third parties, regulatory bodies can verify the accuracy of financial reports and identify discrepancies that may indicate fraudulent behavior.

Additionally, creating a centralized database for all registered nonprofit organizations can facilitate better oversight. This database should include detailed information about each charity’s registration status, financial reports, board members, and executive compensation. Public access to this information would empower donors to make informed decisions and hold organizations accountable for their actions.

Strengthening collaboration between regulatory bodies and law enforcement agencies is another critical measure. By sharing intelligence and resources, these entities can more effectively investigate and prosecute cases of charity fraud. Cooperation with international organizations is also essential, given the global nature of many nonprofits and the cross-border challenges that fraud investigations often entail.

Implementing stricter penalties for individuals and organizations found guilty of charity fraud can serve as a deterrent. Current penalties may not be sufficient to dissuade fraudulent activities. Increased fines, longer imprisonment terms, and the revocation of nonprofit status are potential measures that could discourage individuals from exploiting charitable organizations for personal gain.

Furthermore, the role of technology in combating charity fraud cannot be overstated. Leveraging technology to improve transparency and security can revolutionize the nonprofit sector. Blockchain technology, for example, offers a secure and transparent way to track transactions, ensuring that funds are used for their intended purposes. Similarly, advanced data analytics can help identify patterns of fraudulent behavior, enabling early intervention before significant damage occurs.

The nonprofit sector itself must also take proactive steps to prevent fraud. Establishing internal controls and accountability measures can significantly reduce the risk of fraudulent activities. Regular training for staff and volunteers on ethical practices and fraud detection is essential. Additionally, promoting a culture of transparency and integrity within organizations can help prevent fraudulent behavior from taking root.

Engagement with stakeholders, including donors, beneficiaries, and the public, is crucial for fostering trust and confidence in the nonprofit sector. Open communication and regular updates on the organization’s activities and financial status can build lasting relationships with donors and other supporters. Transparency in decision-making processes and the impact of charitable programs further reinforces this trust.

The nonprofit sector is a vital component of society, addressing social issues and supporting vulnerable populations. However, its effectiveness is undermined by fraud and mismanagement. By implementing stronger regulations, leveraging technology, and fostering a culture of transparency and accountability, the sector can restore trust and ensure that charitable funds are used effectively to make a positive impact.

Table: Proposed Measures for Stronger Regulations

| Measure | Description | Potential Impact |

|---|---|---|

| Standardized Financial Reporting | Mandate detailed disclosures of financial activities | Enhances transparency and accountability |

| Centralized Database | Public access to detailed information on nonprofits | Empowers informed donor decisions |

| Stricter Penalties | Increased fines and imprisonment for fraud | Deters fraudulent activities |

| Blockchain Technology | Secure and transparent transaction tracking | Ensures funds are used for intended purposes |

| Stakeholder Engagement | Open communication and regular updates | Fosters trust and confidence |

Overall, the path forward requires a multifaceted approach that combines regulatory reforms, technological advancements, and ethical practices. By addressing the root causes of charity fraud and implementing effective preventative measures, the nonprofit sector can rebuild its reputation and continue its vital work in society.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Data backbone

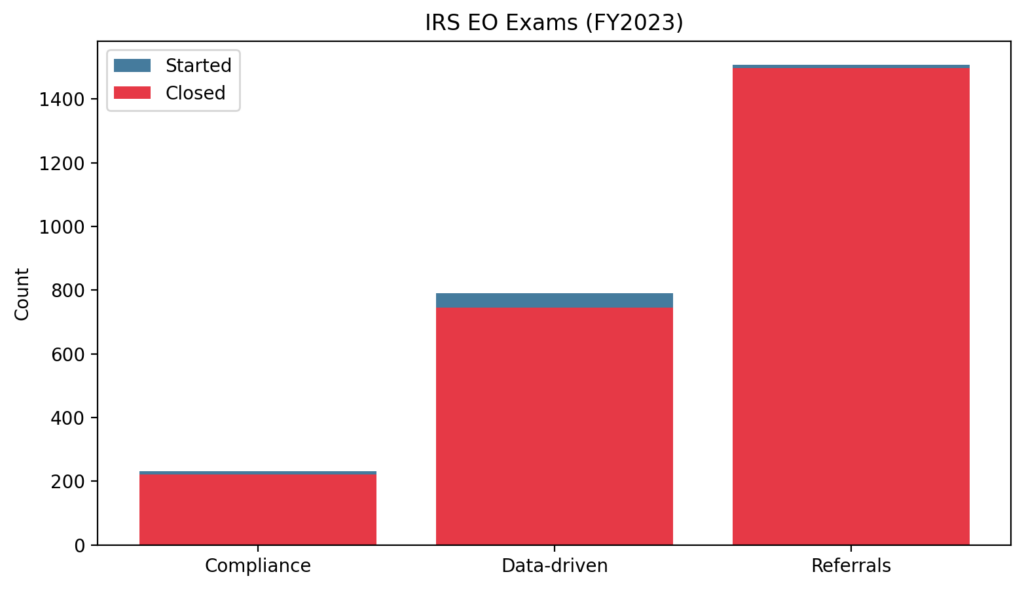

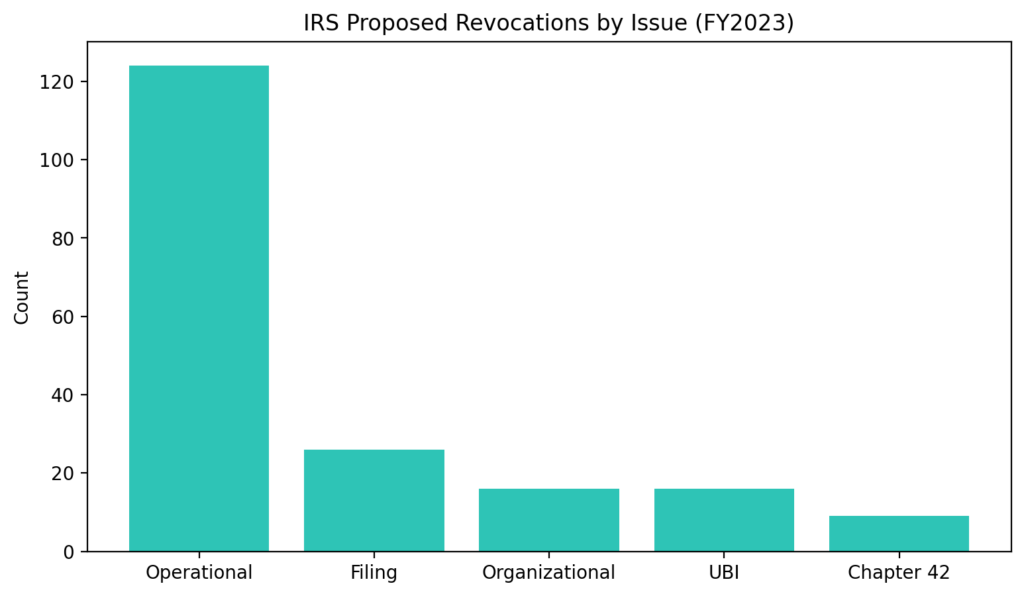

- IRS TE/GE FY2023 Accomplishments / Pub 5329

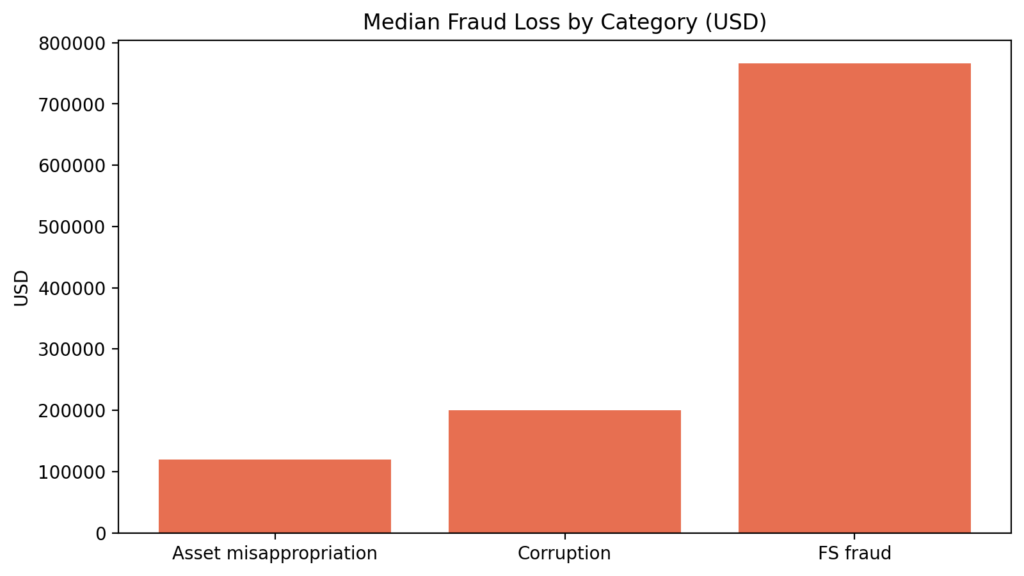

→ Revocations, exam types, operational failures - ACFE – Report to the Nations 2024

→ Fraud frequency, median losses, detection methods, hotline impact

Request Partnership Information

South India Daily

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

South India Daily is the unflinching, relentless voice exposing the truths buried beneath the glossy narratives of progress and tradition. We are here to rip through the façade and uncover the hidden forces shaping South India’s politics, economy, society, and power structures.From deep-rooted corruption in bureaucracy to rigged elections, from judicial lapses to corporate and political scams, we investigate the forces that manipulate the system. We expose caste-driven oppression, religious exploitation, criminal syndicates, and the growing influence of underground movements operating in the shadows. We document the clashes between power and resistance, the battles for identity and autonomy, and the unspoken truths that define the region.In a land where history, faith, and politics intertwine in dangerous ways, South India Daily refuses to look away. We are here to question, challenge, and expose—because silence enables injustice, and we exist to break that silence.