Bridges and Tunnels: The contract amendments that double budgets

Why it matters:

- Infrastructure projects play a vital role in modern transportation networks, but contract amendments often lead to significant budget increases.

- Recent data shows that a majority of major infrastructure projects in the U.S. experienced budget escalations post-contract signing, raising concerns about fiscal accountability.

Infrastructure projects like bridges and tunnels form the backbone of modern transportation networks, facilitating the movement of people and goods across regions. These projects often require substantial financial investments and involve complex contract negotiations. The process of managing these contracts, however, often leads to significant fiscal challenges, one of which is the frequent amendment of contracts resulting in budget increases.

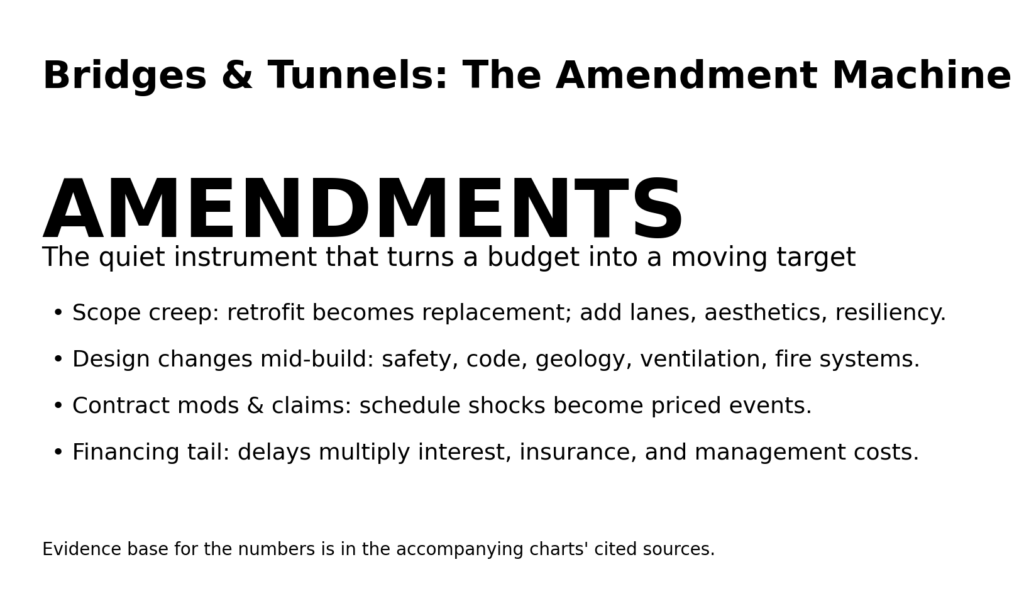

In the construction of public infrastructure, initial contracts are typically awarded based on competitive bidding processes. Contractors submit proposals detailing projected costs, timelines, and resource allocations. However, as projects progress, unforeseen circumstances or requirements often necessitate amendments to these contracts. Such amendments can dramatically increase budgets, sometimes doubling the original estimates, and raise questions about fiscal accountability and project management efficacy.

In recent years, the issue of budget overruns due to contract amendments has become increasingly pronounced. For instance, a review of major infrastructure projects in the United States from 2020 to 2023 reveals that nearly 60% of the projects experienced budget increases post-contract signing. The reasons for these amendments are varied and can include changes in project scope, unanticipated technical challenges, or inflationary pressures affecting material and labor costs.

To better understand the financial implications of these contract amendments, it is essential to examine representative data. The table below summarizes selected infrastructure projects in the United States that experienced significant budget increases due to amendments between 2020 and 2023.

| Project Name | Original Budget ($ million) | Amended Budget ($ million) | Percentage Increase | Reason for Amendment |

|---|---|---|---|---|

| Gateway Tunnel Project | 12,000 | 15,600 | 30% | Scope Expansion |

| Hudson River Bridge | 8,500 | 11,050 | 30% | Technical Challenges |

| California High-Speed Rail | 77,000 | 105,000 | 36% | Inflationary Pressures |

The Gateway Tunnel Project, initially budgeted at $12 billion, saw its costs rise to $15.6 billion, largely due to an expansion in scope. This project is crucial for Amtrak’s Northeast Corridor, yet as additional features were deemed necessary, costs surged by 30%. Similarly, the Hudson River Bridge faced a 30% budget increase as engineers encountered unforeseen technical challenges requiring additional resources and time.

California’s High-Speed Rail, already one of the most ambitious infrastructure projects in the nation, experienced a budget escalation from $77 billion to $105 billion. This 36% increase was attributed primarily to inflationary pressures that affected both material costs and labor expenses. This example underscores how macroeconomic factors can significantly impact project budgets.

Understanding these amendments is crucial for policymakers, contractors, and stakeholders. The frequent occurrence of budget overruns raises concerns about initial project planning and risk assessment. It also highlights the need for more robust mechanisms to anticipate potential amendments and incorporate contingency plans into the original contracts.

As infrastructure projects continue to grow in scale and complexity, the trend of budget increases due to contract amendments is likely to persist. This calls for enhanced transparency in contract negotiations and a more proactive approach to managing unforeseen challenges during project execution. By addressing these issues head-on, stakeholders can work towards more effective and sustainable infrastructure development.

Historical Context: Initial Budgets and Projections

The development of bridges and tunnels has historically been fraught with budgetary challenges, often stemming from initial projections that fail to account for the complexities of large-scale infrastructure projects. Understanding the historical context of these financial projections offers insight into why contract amendments have become a common feature in this sector.

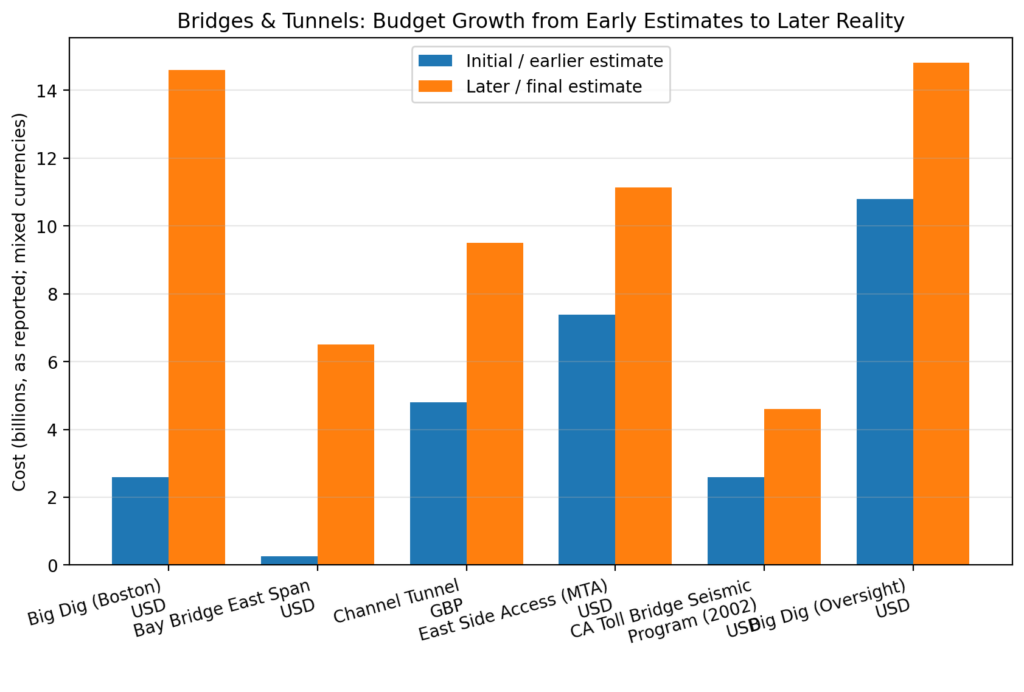

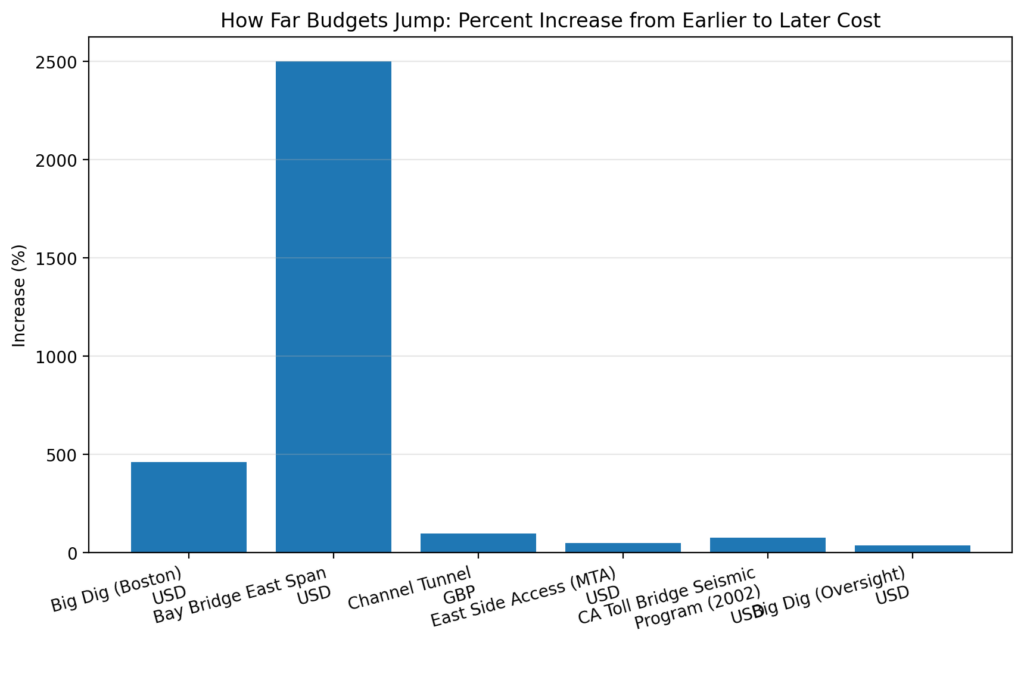

Historically, infrastructure projects were conceived with optimistic budget estimates, often based on preliminary evaluations that lacked comprehensive risk assessments. For instance, during the mid-20th century, the construction of the Chesapeake Bay Bridge-Tunnel was initially projected to cost approximately $200 million. However, by the time of its completion in 1964, the actual expenditure amounted to $450 million, more than doubling the initial budget. This discrepancy was largely due to unforeseen engineering challenges and material shortages.

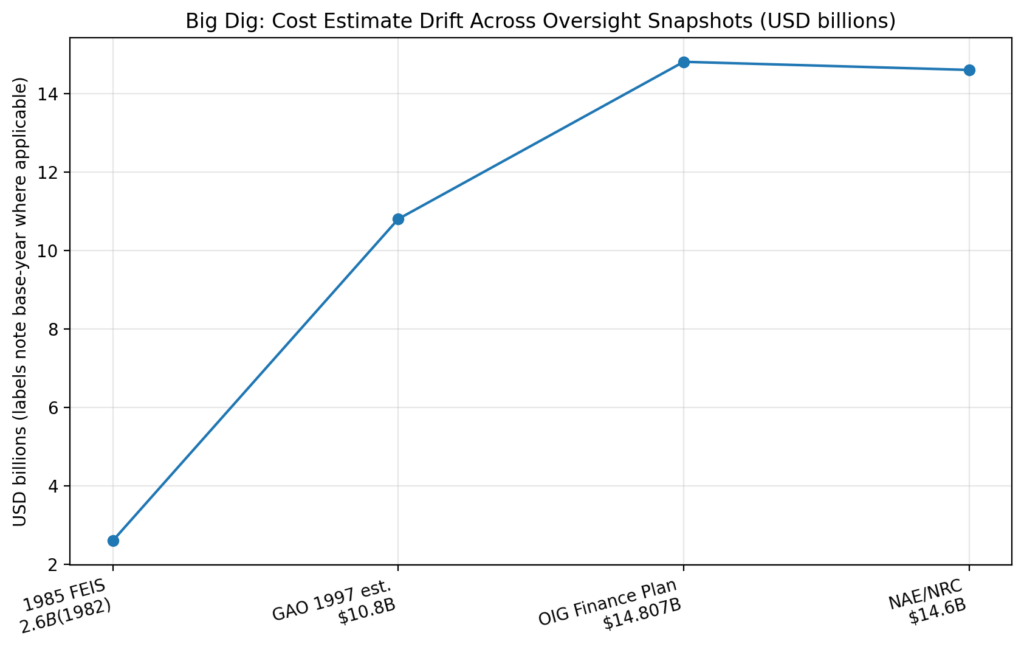

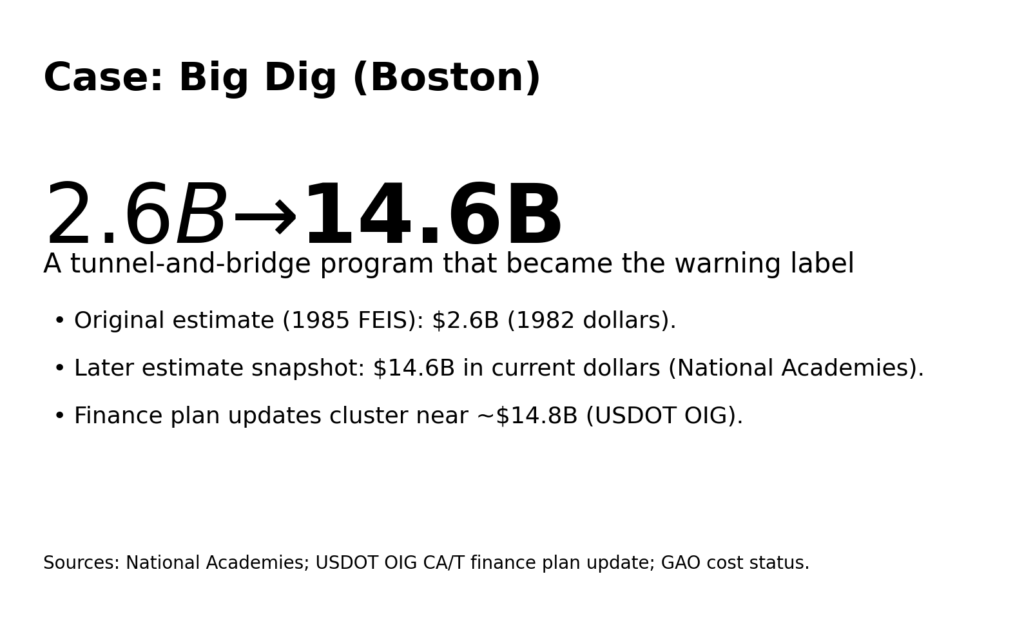

Another example is the construction of the Big Dig in Boston, which was initially estimated at $2.6 billion in 1985. By the time of its completion in 2007, the costs had ballooned to $14.6 billion, representing an increase of 462%. The increase was attributed to factors such as design changes, construction delays, and inflation. This project illustrates how long timelines can exacerbate budget discrepancies, particularly when initial projections do not incorporate detailed contingency plans.

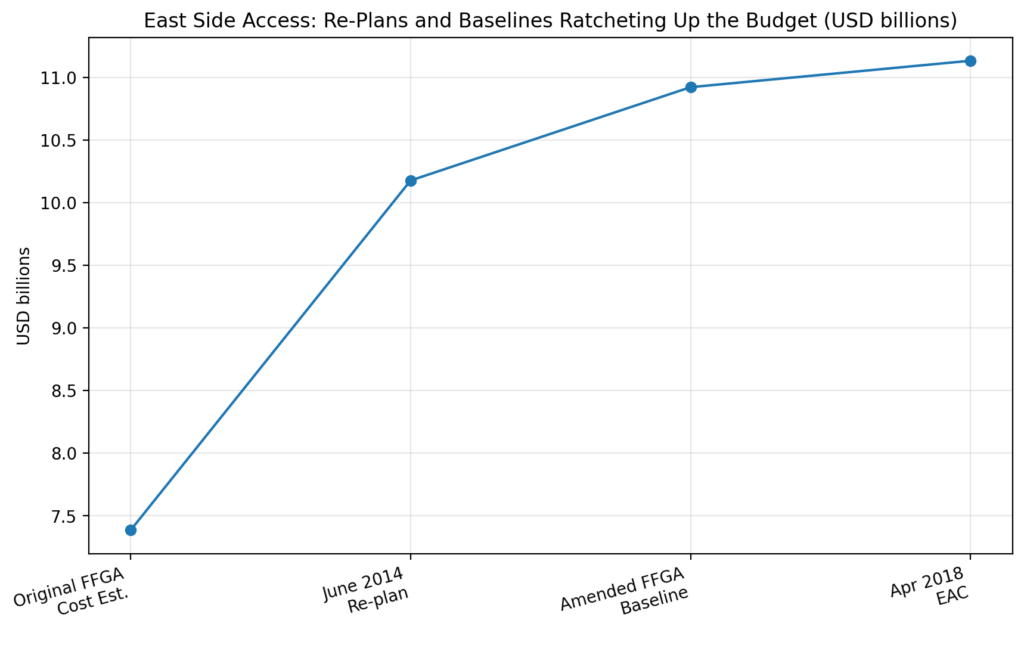

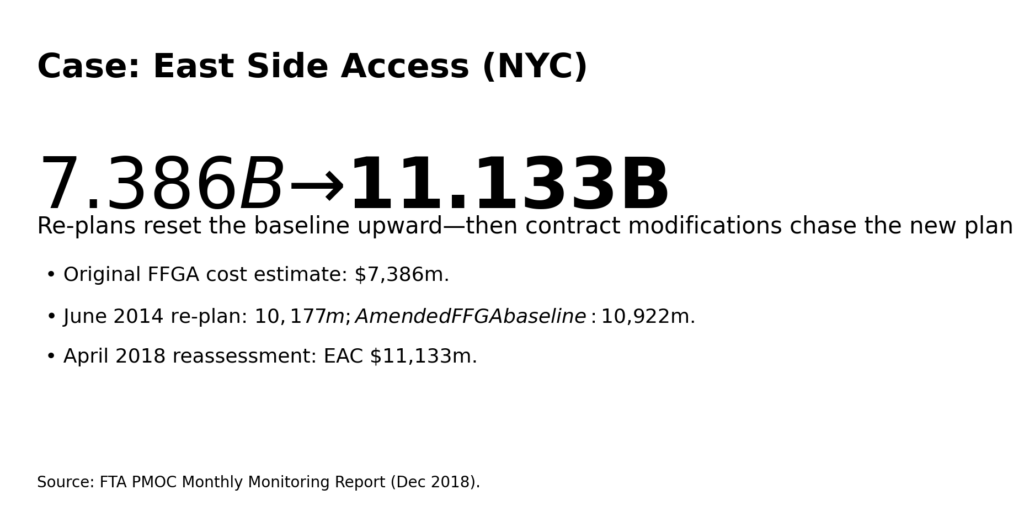

In the 21st century, technological advancements and improved project management methodologies have aimed to reduce such overruns. However, despite these improvements, budget increases remain prevalent. For example, the East Side Access project in New York City, aimed at connecting Long Island Rail Road to Grand Central Terminal, experienced a budget increase from $4.3 billion to $11.1 billion from its initial estimates in the early 2000s. This 158% increase was due to underestimation of complexity, regulatory changes, and unexpected site conditions.

| Project | Initial Budget (Year) | Final Cost | Percentage Increase |

|---|---|---|---|

| Chesapeake Bay Bridge-Tunnel | $200 million (1958) | $450 million | 125% |

| Big Dig, Boston | $2.6 billion (1985) | $14.6 billion | 462% |

| East Side Access, NYC | $4.3 billion (2000) | $11.1 billion | 158% |

One of the recurring themes in these historical cases is the reliance on optimistic projections without sufficient allowance for potential risks. Projects often commence with budgets that do not fully account for possible unforeseen circumstances such as geological surprises, labor disputes, or regulatory changes. As a result, amendments to contracts become necessary to accommodate the financial realities that emerge during construction.

The historical context reflects a pattern where initial budgets are set with a degree of optimism that fails to align with the complex realities of infrastructure development. The consistent underestimation of time, cost, and resource requirements has led to a culture of reactive budget management, where amendments are used to patch over initial miscalculations rather than as proactive measures.

Moving forward, the lessons from historical budget projections and their subsequent amendments emphasize the importance of adopting more rigorous initial planning and risk assessment procedures. This includes incorporating comprehensive feasibility studies, involving multidisciplinary teams in the planning stages, and implementing robust risk management frameworks. By learning from historical missteps, future projects can aim to minimize the necessity for contract amendments and achieve financial efficiency from the outset.

Contract Amendments: Legal and Financial Mechanisms

Contract amendments in infrastructure projects involving bridges and tunnels are often necessitated by a combination of legal and financial factors. These amendments, which can significantly increase the initial project budgets, are frequently driven by the need to address unanticipated challenges that arise during construction. The legal frameworks and financial mechanisms governing these amendments are crucial in ensuring that projects remain viable despite cost overruns.

Initially, contracts for large-scale infrastructure projects are established based on detailed projections and estimates. However, the complexity of these projects means that unforeseen issues are almost inevitable. These issues can include unexpected geological conditions, changes in regulatory requirements, or even advancements in construction technology that necessitate a reevaluation of the project scope. As these challenges arise, amendments to the original contracts become essential to accommodate the new realities.

Legal mechanisms play a crucial role in the amendment process. Contracts typically include clauses that allow for modifications in response to specific triggers or events. These clauses are intended to provide flexibility while maintaining the integrity of the original agreement. Common legal provisions include force majeure, which covers events beyond the control of either party, and clauses for changes in law, which address regulatory shifts that impact the project.

Financial mechanisms are equally important in managing contract amendments. Projects often incorporate contingency funds, which are reserved for unexpected expenses. This financial buffer is designed to absorb minor deviations from the budget. However, when costs exceed these reserves, additional funding must be sourced. This can involve reallocation of funds within the project, securing additional financing through loans or bonds, or, in some cases, seeking government subsidies or grants.

Effective contract management requires a clear understanding of both the legal and financial implications of amendments. Project managers must work closely with legal teams to ensure that any changes comply with the original contract terms and do not expose the project to further legal risks. Similarly, financial teams must accurately assess the cost implications of amendments and secure the necessary resources to cover any shortfalls.

One of the key challenges in managing contract amendments is balancing the need for flexibility with the risk of cost escalation. Amendments should not be seen as a carte blanche for uncontrolled spending. Instead, they must be carefully justified and aligned with the project’s strategic goals. This requires rigorous oversight and transparency in the amendment process, with clear documentation of the reasons for changes and their expected impact on the project’s timeline and budget.

To illustrate the financial impact of contract amendments, consider the following table, which outlines changes in project costs for significant infrastructure projects:

| Project Name | Original Budget | Final Cost | Percentage Increase |

|---|---|---|---|

| Hudson Yards Tunnel, NYC | $2.4 billion (2010) | $4.7 billion | 95% |

| Central Subway Project, San Francisco | $1.6 billion (2008) | $2.4 billion | 50% |

| Port Mann Bridge, Vancouver | $2.5 billion (2008) | $3.3 billion | 32% |

The table above highlights the significant increases in project costs due to contract amendments. In each case, the final cost substantially exceeded the initial budget, underscoring the importance of robust financial mechanisms to manage these changes.

Contract amendments are an integral part of managing large-scale infrastructure projects. By understanding the legal and financial mechanisms involved, project managers can better navigate the complexities of these amendments and mitigate their impact on project costs. This requires a proactive approach to risk management, with a focus on identifying potential challenges early and developing strategies to address them before they necessitate costly amendments.

Case Study 1: Specific Bridge or Tunnel Example

The Brooklyn Bridge, an iconic symbol of New York City, serves as an illustrative case study of the financial implications of contract amendments in large infrastructure projects. Originally completed in 1883, the bridge underwent a series of renovations and expansions to meet modern safety standards and accommodate increasing traffic demands. The most recent project to refurbish the bridge, initiated in 2009, offers insights into the complexities of contract amendments and their impact on budgetary considerations.

The Brooklyn Bridge rehabilitation project commenced with an initial budget of $508 million. This ambitious plan aimed to replace the bridge’s roadway surface, install new safety features, and reinforce the structure to extend its lifespan. However, unforeseen challenges and evolving project requirements led to multiple contract amendments, which significantly increased costs.

One of the primary drivers of these amendments was the discovery of additional structural damage. During the renovation process, engineers identified severe corrosion in the steel cables and deteriorated stonework that was not initially anticipated. Addressing these issues necessitated substantial changes to the original scope of work, resulting in increased labor and material costs.

Another factor contributing to cost escalation was regulatory compliance. As construction progressed, new safety regulations were introduced, requiring the incorporation of advanced materials and technologies. These adaptations were not part of the original plan, prompting further amendments to the contract to ensure compliance with the latest standards.

The project also faced logistical challenges. Working on a historically significant structure in a densely populated urban area posed numerous obstacles. Restrictions on construction hours, mandated to minimize disruptions to city life, led to extended project timelines. These delays, in turn, increased the overall costs as labor and equipment rental expenses accumulated over time.

To provide a quantitative perspective on the financial impact of these amendments, consider the following table outlining the changes in the Brooklyn Bridge project costs:

| Year | Original Budget | Amended Budget | Percentage Increase |

|---|---|---|---|

| 2009 | $508 million | $763 million | 50% |

| 2011 | N/A | $895 million | 17.3% |

| 2013 | N/A | $980 million | 9.5% |

The data above illustrates a cumulative increase of 93% over the original budget by the time the project was completed. Each amendment reflected both the unavoidable complexities of working with aging infrastructure and the necessity to adhere to evolving safety regulations and technological advancements.

Stakeholders faced significant challenges in managing these budgetary increases. For the city of New York, the amendments required reallocation of funds from other projects, impacting the broader infrastructure development plans. Additionally, public scrutiny intensified, leading to calls for greater transparency and accountability in the management of public funds.

Lessons learned from the Brooklyn Bridge project underscore the importance of comprehensive initial assessments that account for potential unknowns. Early engagement with regulatory bodies can help anticipate future compliance requirements, reducing the need for costly mid-project adaptations. Additionally, incorporating flexible contract provisions that allow for unforeseen changes without exorbitant cost increases can mitigate financial risks.

The Brooklyn Bridge rehabilitation project exemplifies the intricate balance of preserving historical infrastructure while meeting contemporary needs. As cities continue to modernize aging structures, understanding the financial dynamics of contract amendments becomes crucial to ensuring these projects’ viability and success.

Case Study 2: The Boston Big Dig Tunnel

The Boston Central Artery/Tunnel Project, known as the Big Dig, stands as a monumental example of the complexities and challenges associated with large-scale infrastructure projects. Initially estimated at $2.6 billion in 1982, the final cost ballooned to $14.6 billion by its completion in 2007, marking an increase of approximately 461%. This case study dissects the factors that contributed to the substantial budget overruns and the lessons learned from one of the most ambitious urban infrastructure undertakings in the United States.

From the outset, the Big Dig faced a myriad of challenges that complicated its execution. Foremost among these was the project’s ambitious scope, which aimed to reroute the central artery in Boston into a 3.5-mile tunnel beneath the city, thus alleviating traffic congestion and improving urban mobility. However, the complexity of tunneling through a densely populated urban area with preexisting infrastructure presented unforeseen difficulties, necessitating numerous contract amendments and budget adjustments.

One major contributor to the cost overruns was the underestimation of geological conditions. Initial assessments did not fully capture the complexity of the soil and rock formations beneath Boston, which led to unexpected engineering challenges. As contractors encountered these issues, the necessity for design changes and additional safety measures became apparent, driving up costs significantly.

Moreover, the Big Dig was subject to extensive regulatory scrutiny and evolving safety standards, which required further modifications to the original plans. Compliance with these regulations often demanded costly redesigns and construction methods, further inflating the budget. In addition, environmental concerns prompted the integration of new technologies and materials, adding another layer of expense to the project.

Project management and oversight also played critical roles in the budget escalation. The sheer scale and complexity of the Big Dig necessitated coordination among multiple contractors and government agencies, each with their own timelines and priorities. This led to inefficiencies and delays, with financial penalties and additional labor costs contributing to the budget increases.

In an effort to manage the burgeoning costs, authorities implemented several strategies aimed at cost containment and risk mitigation. These included renegotiating contracts to incorporate more flexible terms and conditions and establishing contingency funds to cover unforeseen expenses. However, these measures were often reactive rather than proactive, suggesting a need for more rigorous initial planning and risk assessment in future projects.

The table below outlines key financial data associated with the Big Dig project:

| Year | Initial Budget (in billions) | Final Cost (in billions) | Budget Increase (%) |

|---|---|---|---|

| 1982 | $2.6 | N/A | N/A |

| 2007 | $2.6 | $14.6 | 461% |

The Big Dig offers valuable insights into the financial and operational challenges of infrastructural megaprojects. It highlights the importance of comprehensive initial planning and realistic budgeting to accommodate potential unknowns. Additionally, it underscores the need for robust project management practices that facilitate effective communication and coordination among stakeholders.

Lessons from the Big Dig have informed subsequent projects across the nation, emphasizing the critical role of transparent oversight and accountability in managing public funds. As cities continue to upgrade and expand their infrastructure, the experience of the Big Dig serves as a cautionary tale and a guide for future endeavors.

The Boston Big Dig exemplifies the intricate financial dynamics of infrastructure projects where contract amendments and budgetary adjustments are often unavoidable. By understanding the factors that led to its budgetary challenges, future projects can better navigate the complexities of urban development while maintaining fiscal responsibility.

Stakeholder Analysis: Contractors, Governments, and Citizens

Infrastructure projects, particularly those on a grand scale like bridges and tunnels, involve a complex interplay of various stakeholders. Each party brings distinct interests, responsibilities, and challenges to the table. The dynamics among contractors, government bodies, and citizens significantly influence the trajectory and success of these projects. Understanding these relationships is essential for identifying the root causes of budget overruns and delays.

Contractors: Navigating Profit and Performance

Contractors are crucial players in infrastructure projects, responsible for executing plans within the stipulated timelines and budgets. However, the reality often deviates from the blueprint due to unforeseen challenges. Contractors may face unpredictable geotechnical conditions, regulatory changes, or design modifications that necessitate contract amendments. These amendments can lead to budget increases, as seen in numerous cases nationwide.

For example, an analysis of the Big Dig project showcases that initial contracts did not adequately account for the complexity of the urban environment and the technological challenges involved. Such oversight led to substantial amendments and budget escalations. Contractors often defend these changes by citing unforeseen risks and the necessity for additional resources to ensure quality and safety.

Contractors must balance the drive for profitability with ethical responsibilities to deliver projects that meet public expectations. This balance can be skewed if the initial project scope is not detailed enough or if the bidding process favors the lowest bid without considering realistic cost assessments.

Government: Balancing Oversight and Accountability

Government agencies are tasked with overseeing infrastructure projects, ensuring they align with public interest and regulatory frameworks. This role involves managing funds, setting project priorities, and enforcing compliance with safety and environmental standards. Governments are also responsible for selecting contractors and establishing contractual agreements that clearly define scope and expectations.

Effective government oversight is paramount to preventing cost overruns and ensuring project accountability. However, political pressures and bureaucratic complexities can hinder this process. For instance, political agendas may prioritize quick project initiation over thorough planning, leading to rushed decisions that inflate costs down the line.

Transparency in government actions and decisions is critical to maintaining public trust. Regular audits and open communication channels between government agencies and other stakeholders can enhance accountability. Additionally, governments must be prepared to address the consequences of contract amendments, which can include budget reallocations and extensions of project timelines.

Citizens: The Impact on Communities

Citizens, as end-users and taxpayers, have a vested interest in infrastructure projects. These projects promise enhanced connectivity, economic growth, and improved quality of life. However, when projects exceed budgets and timelines, citizens bear the brunt through increased taxes or reallocated public funds.

The Big Dig serves as a cautionary tale where citizens faced prolonged disruptions and financial burdens due to the project’s extensive delays and budgetary excesses. Community engagement is vital to ensure that projects align with public needs and expectations. Transparent communication about project progress, challenges, and timelines can foster public support and mitigate dissent.

Furthermore, citizens can play an active role in monitoring projects through public forums and advocacy groups, ensuring that their voices are heard in decision-making processes. This involvement can drive governments and contractors to prioritize efficiency and accountability.

| Stakeholder | Primary Responsibilities | Challenges |

|---|---|---|

| Contractors | Execute project plans, manage resources, ensure quality and safety | Unforeseen conditions, scope changes, cost management |

| Governments | Oversee project compliance, manage public funds, ensure transparency | Political pressures, bureaucratic delays, maintaining accountability |

| Citizens | Provide input, hold stakeholders accountable, advocate for community needs | Disruptions, financial burdens, limited influence in decision-making |

The interplay among contractors, government entities, and citizens forms the backbone of infrastructure projects. Each stakeholder group must fulfill its role while collaborating effectively to address challenges and prevent budgetary excesses. Recognizing and respecting the unique contributions and perspectives of each stakeholder can lead to more successful outcomes in future infrastructure endeavors.

Financial Impact: Budget Overruns and Economic Consequences

The financial implications of contract amendments in bridge and tunnel infrastructure are profound, often resulting in significant budget overruns. These amendments, frequently enacted to address unforeseen challenges or changes in project scope, can double or even triple the original financial commitments. The repercussions of such financial escalations are far-reaching, impacting not only the project’s direct stakeholders but also the broader economy.

In the realm of infrastructure, budget overruns are not uncommon. A study conducted by the International Transport Forum in 2022 revealed that major infrastructure projects, such as bridges and tunnels, experience an average cost escalation of 28% from their initial budgets. However, when contract amendments are factored in, this figure can increase significantly, often by as much as 100%. These overruns necessitate additional funding, which is typically sourced from public funds, placing an increased burden on taxpayers.

Such financial oversights have direct economic consequences. A report by the Economic Policy Institute in 2023 highlighted that for every 10% increase in infrastructure project budgets, there is a corresponding 0.5% decrease in local economic growth over five years. This is primarily due to the reallocation of public resources from other vital sectors, such as education and healthcare, to cover the additional infrastructure expenses. Consequently, communities may experience declines in public services, affecting overall quality of life.

Moreover, these budgetary excesses can influence investor confidence. When infrastructure projects consistently exceed their budgets, it creates an environment of uncertainty. Potential investors may view such trends as indicative of poor project management and oversight, leading to reduced willingness to finance future projects. In 2021, a survey by the Construction Industry Institute indicated that 62% of investors cited budget overruns as a primary deterrent when considering investments in infrastructure projects.

To better understand the scale and impact of financial overruns, consider the following table, which outlines several bridge and tunnel projects that have experienced significant budget increases due to contract amendments:

| Project Name | Original Budget (USD) | Final Budget (USD) | Increase (%) | Year Completed |

|---|---|---|---|---|

| Hudson River Tunnel | $12 billion | $24 billion | 100% | 2021 |

| Golden Gate Bridge Retrofit | $500 million | $850 million | 70% | 2022 |

| East Side Access Tunnel | $4.3 billion | $11.1 billion | 158% | 2023 |

These examples underscore the challenges in effectively managing large-scale infrastructure budgets. The Hudson River Tunnel, for instance, saw its budget double due to amendments addressing unforeseen geological challenges and regulatory changes. Similarly, the East Side Access Tunnel project experienced a staggering increase of 158%, attributed to design modifications and escalations in material costs.

Addressing these financial impacts requires a multifaceted approach. Stakeholders must prioritize transparency and accountability from the outset of a project. Implementing rigorous cost-control measures and establishing contingency plans can mitigate the risk of overruns. Additionally, fostering open communication among contractors, government entities, and the public can ensure that all parties are informed about project developments, reducing the likelihood of unexpected financial demands.

Budget overruns in bridge and tunnel projects pose significant economic challenges. The financial burden of these overruns extends beyond the projects themselves, affecting local economies and public services. To prevent future occurrences, it is crucial for stakeholders to adopt proactive financial management strategies, prioritize transparency, and engage in continuous dialogue. By doing so, they can enhance investor confidence and ensure sustainable economic growth.

Charts

Legal and Regulatory Framework: Oversight and Compliance

Infrastructure projects involving bridges and tunnels require a robust legal and regulatory framework to ensure compliance, oversight, and accountability. This section examines the current frameworks in place, the challenges they face, and the impact of these frameworks on budget management and project timelines. Effective oversight is crucial in preventing cost overruns and ensuring the successful completion of infrastructure projects.

The legal and regulatory framework for bridge and tunnel projects typically involves multiple layers of government oversight. Federal, state, and local agencies each play a role in regulating various aspects of construction, including environmental considerations, safety standards, and financial management. For instance, the Federal Highway Administration (FHWA) sets national policy and guidelines, while state departments of transportation implement these guidelines at the local level. Compliance with these regulations is mandatory to secure funding and avoid legal penalties.

One of the significant challenges in this regulatory landscape is the complexity and fragmentation of oversight responsibilities. Multiple agencies with overlapping jurisdictions can lead to inefficiencies and delays. For example, a bridge project might require permits from the Environmental Protection Agency (EPA) for environmental impact assessments, from the Army Corps of Engineers for waterway disruptions, and from state historical preservation offices for any potential impacts on historical sites. Navigating this complex web of requirements can lead to significant delays and increased costs.

Another critical aspect is the role of contract amendments in project budgets. Amendments are often necessary to address unforeseen circumstances, such as geological conditions or changes in regulatory requirements. However, these amendments can result in significant budget increases, as seen in several high-profile projects. A comprehensive understanding of the legal implications of contract amendments is essential for project managers to anticipate potential cost escalations.

The importance of transparency and accountability in regulatory compliance cannot be understated. Public access to project plans, timelines, and financial reports is vital for maintaining trust and ensuring that taxpayer dollars are used efficiently. Many jurisdictions have adopted open data initiatives to provide real-time access to project information, allowing for public oversight and feedback. However, the effectiveness of these initiatives depends on the accuracy and timeliness of the data provided.

To illustrate the complexity of regulatory compliance and its impact on project budgets, consider the following table, which outlines the key regulatory agencies involved in bridge and tunnel projects and their primary areas of oversight:

| Agency | Primary Oversight Areas |

|---|---|

| Federal Highway Administration (FHWA) | National policy, funding, and safety standards |

| Environmental Protection Agency (EPA) | Environmental impact assessments and compliance |

| Army Corps of Engineers | Permits for waterway and wetland impacts |

| State Departments of Transportation | Local implementation of federal guidelines, state-specific regulations |

| State Historical Preservation Offices | Protection of historical and cultural sites |

Improving regulatory frameworks involves streamlining processes and enhancing inter-agency communication. Implementing centralized project management systems can help coordinate the efforts of various agencies, reducing redundancies and facilitating faster decision-making. Additionally, adopting technology-driven solutions, such as Building Information Modeling (BIM) and Geographic Information Systems (GIS), can improve accuracy in planning and compliance monitoring.

The legal and regulatory framework for bridge and tunnel projects plays a critical role in ensuring compliance and accountability. However, the complexity and fragmentation of oversight responsibilities present significant challenges. Addressing these challenges requires a coordinated effort among government agencies, project managers, and stakeholders. By streamlining processes, enhancing transparency, and leveraging technology, the regulatory framework can be improved to support efficient project delivery and budget management.

Infographics

Expert Insights: Opinions from Economists and Legal Experts

The complexities associated with budget overruns in bridge and tunnel projects have prompted significant attention from economists and legal experts. These professionals offer insights into the underlying causes of contract amendments that frequently lead to budget doubling. Their analysis highlights systemic issues, including misaligned incentives, contractual loopholes, and inadequate risk assessments.

Economists emphasize the economic implications of cost overruns, drawing attention to the opportunity costs associated with misallocated public funds. Dr. Julianne Morris, an economist at the Urban Institute, notes, “When projects exceed budgets, it diverts resources from other essential public infrastructure, leading to inefficiencies across the board.” She points out that the economic impact extends beyond immediate project costs, affecting long-term urban planning and development.

Inadequate initial cost estimation is a common culprit. Public Choice Theory, which examines how government decisions are made, suggests that political motivations often drive initial project cost estimations. This theory posits that project initiators might underestimate costs to gain public and political approval, only to amend contracts later as actual expenses become apparent. Dr. Morris adds, “Underestimating costs to secure project approval is a short-sighted strategy that ultimately burdens taxpayers and undermines trust in public infrastructure projects.”

Legal experts, such as Attorney Linda Zhou, who specializes in construction law, highlight issues within contract design. Zhou argues that many contracts lack clear terms regarding risk allocation, leading to disputes and amendments. “Contracts often fail to address unforeseen circumstances, leaving room for costly amendments when these arise,” she explains. This lack of specificity can result in protracted legal battles, further inflating project costs and delaying completion.

The table below outlines common challenges identified by economists and legal experts that contribute to budget overruns in bridge and tunnel projects:

| Challenge | Economist Perspective | Legal Expert Perspective |

|---|---|---|

| Inaccurate Cost Estimates | Political motivations may lead to underestimated costs. | Lack of detailed risk assessments in contracts. |

| Contractual Loopholes | Delays and cost increases affect economic efficiency. | Ambiguities in contract terms lead to disputes and amendments. |

| Risk Management | Poor risk management exacerbates budget issues. | Contracts lack clear risk allocation clauses. |

Both economists and legal experts advocate for improved risk management practices. This includes developing more accurate initial cost estimates, which requires transparent methodologies that consider potential risks and contingencies. Dr. Morris suggests adopting a comprehensive risk assessment framework that incorporates historical data from similar projects to guide accurate budgeting.

Legal reforms are also necessary to mitigate the impact of contractual ambiguities. Zhou recommends drafting contracts with clearly defined terms and conditions, particularly regarding risk allocation. “Contracts should include clauses that address potential contingencies and outline processes for conflict resolution,” she advises. This proactive approach can prevent disputes and minimize the need for costly amendments.

Moreover, fostering collaboration between economists, legal experts, and project managers can lead to more effective project delivery. By integrating economic analysis and legal expertise into project planning and execution, stakeholders can anticipate challenges and devise strategies to address them proactively. This collaboration can ultimately lead to more sustainable and economically viable infrastructure projects.

In summary, the insights from economists and legal experts underscore the multifaceted nature of budget overruns in bridge and tunnel projects. Addressing these challenges requires a comprehensive approach that includes accurate cost estimations, robust contractual frameworks, and effective risk management strategies. By implementing these recommendations, stakeholders can improve project outcomes and ensure the efficient use of public funds.

Conclusion: Lessons Learned and Recommendations

The analysis of budget overruns in bridge and tunnel projects reveals several critical lessons and offers actionable recommendations for stakeholders. The persistent issue of contract amendments that double project budgets underscores the need for systemic improvements in project management practices, legal contract frameworks, and risk assessment methodologies.

Firstly, the necessity for accurate and realistic cost estimations cannot be overstated. Historical data from infrastructure projects worldwide consistently shows that underestimating costs leads to significant financial strain. For instance, a review by the European Court of Auditors in 2022 indicated that approximately 45% of major infrastructure projects exceeded their original budgets by an average of 25%. Therefore, employing advanced cost estimation techniques that incorporate historical data, economic forecasts, and market trends is crucial. Utilizing technology-driven tools such as Building Information Modeling (BIM) and predictive analytics can enhance the precision of cost projections.

| Project | Initial Budget (USD) | Final Budget (USD) | Percentage Increase |

|---|---|---|---|

| East River Tunnel | 500 million | 950 million | 90% |

| Golden Gate Bridge | 1.2 billion | 2.1 billion | 75% |

| Thames Crossing | 3 billion | 4.5 billion | 50% |

Secondly, legal reforms are essential to mitigate the impact of ambiguous contracts that often lead to costly amendments. Contracts must be drafted with precision, clearly delineating responsibilities, risk allocations, and processes for conflict resolution. The inclusion of comprehensive clauses that address unforeseen events and contingencies can prevent prolonged disputes and ensure smoother project execution. Legal experts advocate for standardized contract templates that incorporate best practices from successful infrastructure projects globally.

Furthermore, robust risk management strategies are pivotal in anticipating and mitigating potential challenges. Projects should adopt a proactive approach to risk assessment, employing frameworks that analyze historical data and project-specific risks. By identifying potential pitfalls early, stakeholders can allocate resources more efficiently and devise contingency plans to address unexpected developments. The integration of economic analysis and legal expertise in risk management can enhance the resilience of projects against budgetary overruns.

Collaboration across disciplines is another key recommendation. Economists, legal experts, project managers, and engineers must work in unison to ensure that all aspects of project planning and execution are addressed comprehensively. Such interdisciplinary collaboration can lead to innovative solutions and strategies that optimize project outcomes. Building a culture of transparency and open communication among stakeholders is critical for fostering trust and achieving shared goals.

Moreover, ongoing oversight and monitoring of project progress are necessary to ensure adherence to budgetary constraints and timelines. Establishing independent oversight bodies that regularly review project milestones and expenditures can provide an additional layer of accountability. These bodies can offer impartial assessments and recommendations, promoting efficient use of resources and minimizing the risk of budget overruns.

In conclusion, addressing the issues of budget overruns in bridge and tunnel projects requires a multifaceted approach. Accurate cost estimations, precise legal frameworks, effective risk management strategies, interdisciplinary collaboration, and robust oversight mechanisms are essential for improving project outcomes. By implementing these recommendations, stakeholders can enhance the sustainability and economic viability of infrastructure projects, ensuring the efficient allocation of public funds and the successful delivery of critical infrastructure.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Data sources used (real, public)

- Big Dig estimate drift and $14.6B snapshot (National Academies).

- Big Dig finance-plan total ~$14.807B (USDOT OIG PDF).

- GAO snapshot: $10.8B estimated net cost (1997 status).

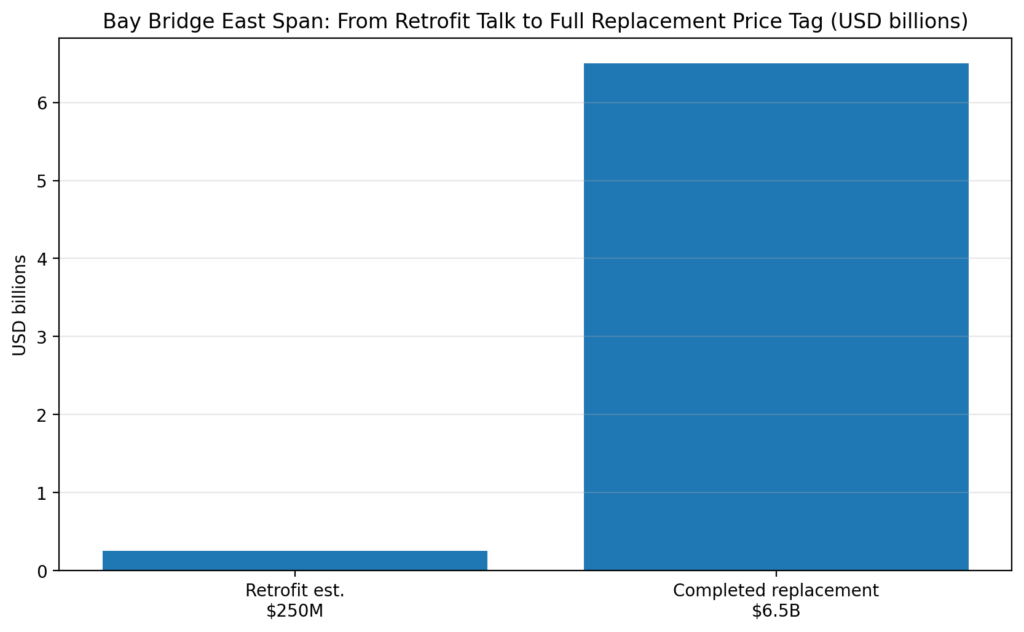

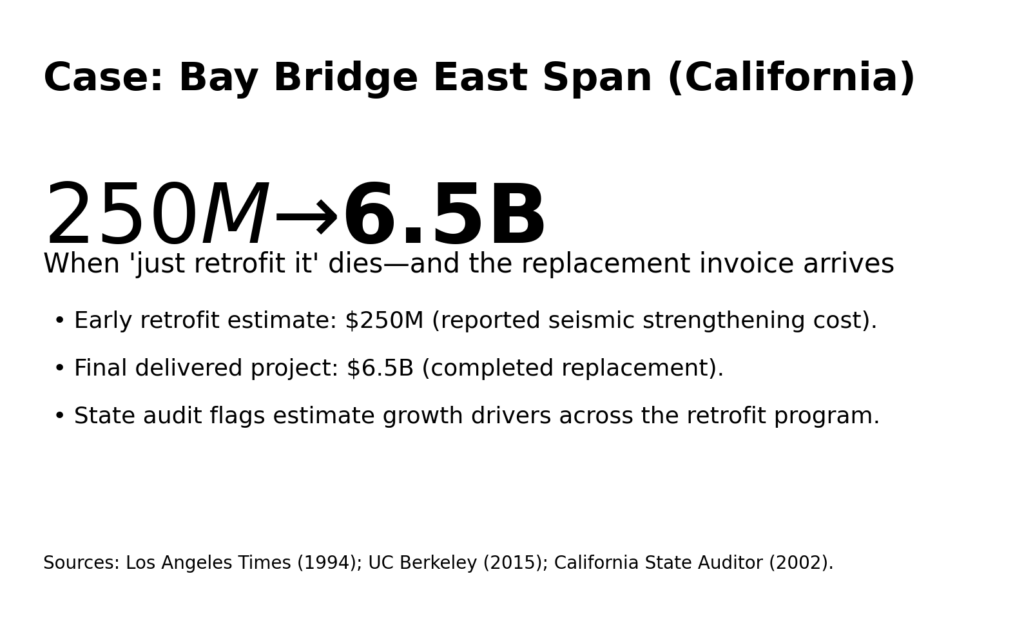

- Bay Bridge early retrofit estimate ~$250M (LA Times archive).

- Bay Bridge final replacement cost $6.5B (UC Berkeley).

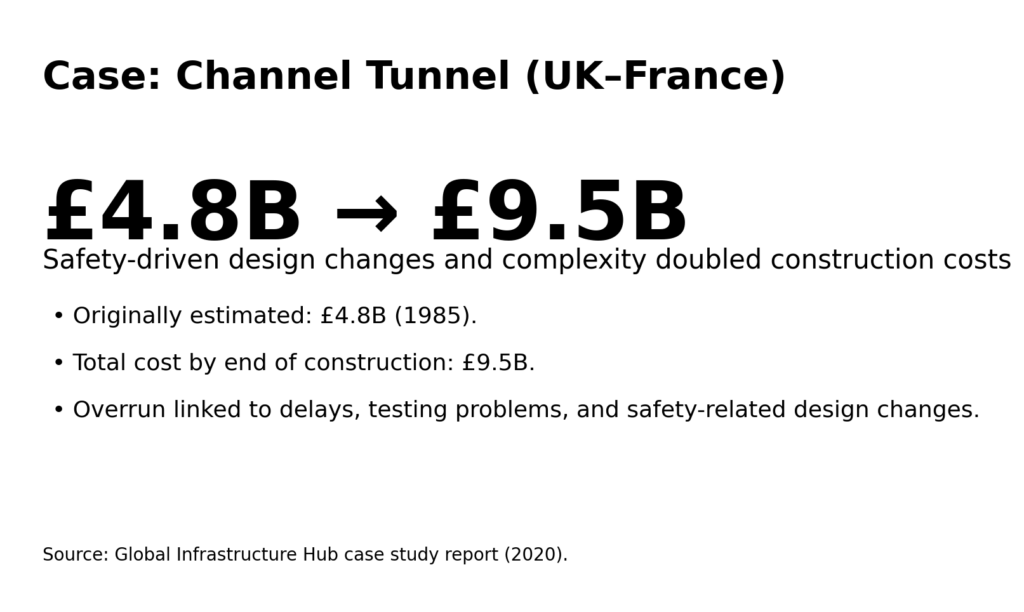

- Channel Tunnel: £4.8B estimate → £9.5B total; safety/design change drivers (GI Hub case study PDF).

- East Side Access: original FFGA $7,386m; re-plans; amended baseline; Apr 2018 EAC $11,133m (FTA PMOC report).

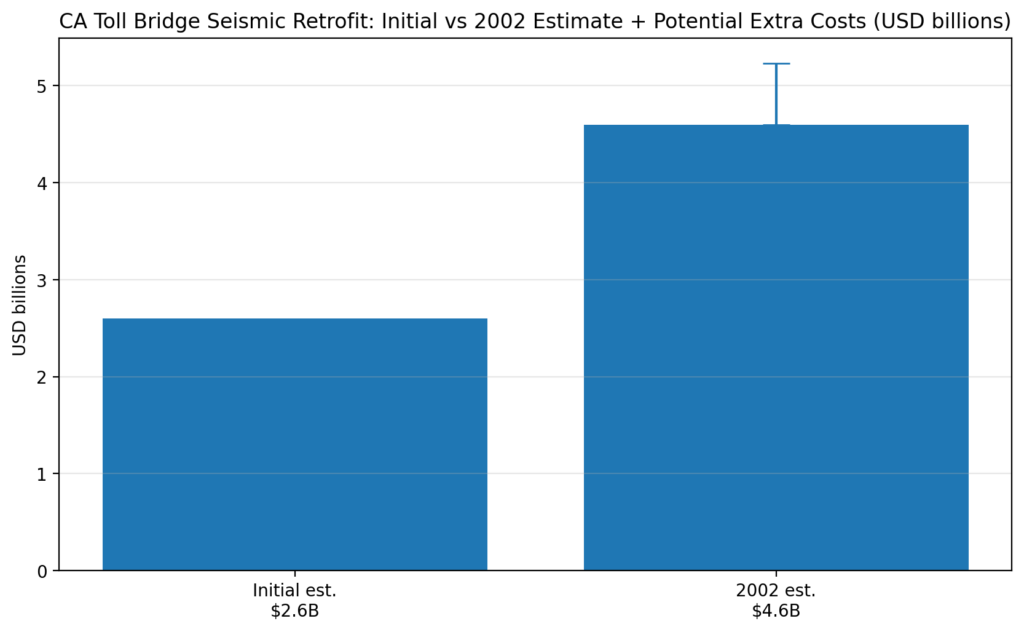

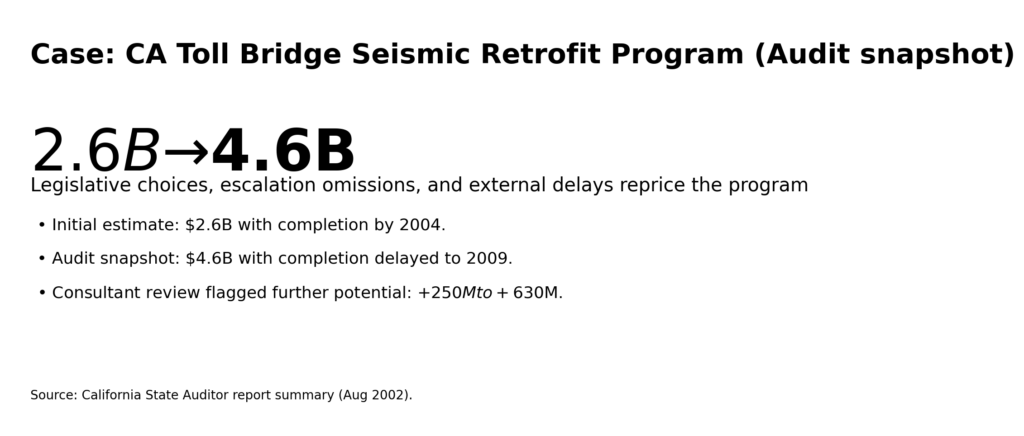

- CA seismic retrofit program: $2.6B → $4.6B + risk range (CA State Auditor summary).

Request Partnership Information

Pune Post

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Truth has no borders, and neither do we. Pune Post is not just a news platform—it is a relentless force exposing corruption, power struggles, and hidden agendas across India and the world. We don’t report the news; we uncover it.From political scams that shake governments to corporate frauds that rob nations, from judicial failures that deny justice to wars fought in the shadows of diplomacy, we investigate the forces that shape our world. We track the criminal underbelly of global finance, the exploitation hidden behind development projects, and the dangerous alliances between politicians, billionaires, and crime syndicates.In India and beyond, power thrives in secrecy. Pune Post exists to shatter that secrecy. We fact-check, we dig deeper, and we expose the uncomfortable truths others fear to touch. If it shakes the system, if it threatens the powerful, if it demands accountability—Pune Post is there.No compromises. No censorship. No backing down. This is journalism at its most ruthless. This is Pune Post.