Sugar Kings: The Political Ties Behind Protected Import Quotas

Why it matters:

- Americans pay a premium for sugar due to a federal program that benefits a small group of producers.

- The program costs consumers billions annually and favors domestic giants like Florida Crystals and U.S. Sugar.

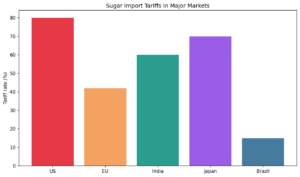

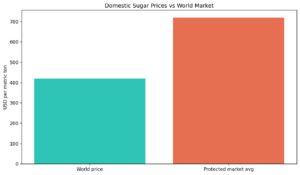

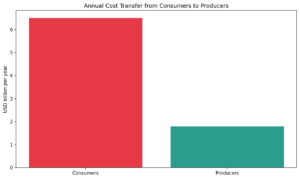

The numbers reveal the scale of this distortion. In 2024, the gap between the United States price for raw sugar and the world market price reached historic extremes. Data from the Sweetener Users Association showed domestic prices hovering near 110 percent above the global average. While a pound of raw sugar traded for roughly 20 cents on the world market, American buyers often paid more than double that amount. This artificial wedge generates massive profits for domestic giants like Florida Crystals and U.S. Sugar. The Government Accountability Office estimates this program costs American consumers between $2.5 billion and $3.5 billion every year.

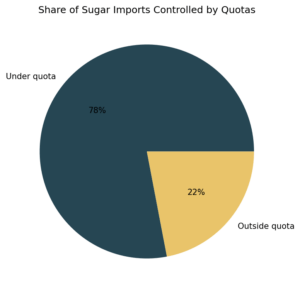

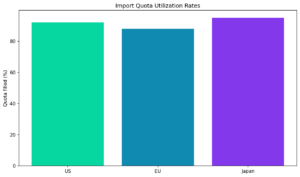

This economic fortress is built on a complex foundation of import restrictions and price floors. The federal government strictly limits how much foreign sugar can enter the country through a mechanism known as the Tariff Rate Quota. For Fiscal Year 2025, the USDA set this limit for raw cane sugar at approximately 1.12 million metric tons, a figure carefully calculated to keep domestic supplies tight and prices high. If foreign producers attempt to sell above this quota, they face prohibitive tariffs that make trade impossible. Simultaneously, the Feedstock Flexibility Program and marketing assistance loans ensure that domestic processors never have to sell at a loss. If market prices drop too low, the government effectively buys the surplus sugar to use for ethanol fuel.

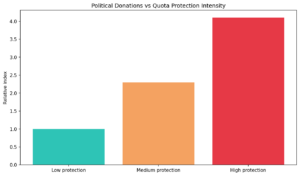

Maintaining this lucrative status quo requires aggressive political engagement. The American Sugar Alliance and its members are among the most disciplined lobbying forces in Washington. During the 2024 election cycle, the Fanjul family, owners of extensive cane fields and refineries, directed significant financial support to key political figures. Records show the Fanjul Corporation donated $1 million to a single super PAC supporting the Republican presidential candidate, while also maintaining bipartisan ties to ensure safety regardless of which party controlled Congress.

The cost of this protectionism falls disproportionately on food manufacturers and families. Candy makers and bakeries in the United States struggle with input costs significantly higher than their foreign competitors. This disadvantage has forced some manufacturing facilities to relocate to Canada or Mexico, where they can purchase sugar at global rates. For the average family, the sugar tax is invisible but cumulative, embedded in the price of everything from bread and pasta sauce to soda and cereal.

Legislative attempts to reform the program consistently fail. The Farm Bill, the massive legislative package that governs agricultural policy, serves as the vehicle for renewing these provisions. Throughout the debates of 2023 and 2024, amendments to modernize the sugar program were stifled in committee. The political geography favors the incumbent industry. Senators from sugar producing states like Florida, Louisiana, Minnesota, and North Dakota form a unified bloc that trades votes with other commodity groups to protect their interests.

The following investigation peels back the layers of this entrenched system. We will examine how a depression era policy has mutated into a modern corporate subsidy. We will trace the flow of money from the cane fields of the Everglades to the committee rooms of Capitol Hill. We will also analyze why, despite clear economic evidence of harm to consumers and manufacturers, the Sugar Kings retain their crown in the halls of American power.

Historical Context: From Great Depression to Modern Subsidies

The machinery of American sugar protectionism was not built for the modern corporate era. It was forged in the desperation of the 1930s, a time when dust storms and economic collapse threatened to erase the domestic agrarian economy. The Sugar Act of 1934, also known as the Jones Costigan Act, was designed as a temporary lifeline. It classified sugar beets and sugarcane as basic commodities, allowing the federal government to limit production and pay growers for reducing their output. This was intended to stabilize falling prices and keep family farmers solvent during a global crisis.

Nearly a century later, that temporary scaffolding has calcified into a permanent fortress for a few politically connected conglomerates. What began as a safety net for struggling plowmen has evolved into a complex system of price supports, domestic marketing allotments, and rigid import restrictions that benefit a concentrated group of “Sugar Kings” at the expense of everyone else.

The Mechanism of Control

The modern iteration of this program acts as a hidden tax on every sweetener containing product on US store shelves. The system relies on two primary levers: the Price Support Loan Program and Tariff Rate Quotas (TRQs). Under the loan program, processors receive government financing with their sugar crops as collateral. If market prices drop below a guaranteed level, processors can simply forfeit their sugar to the government and keep the cash. This creates a price floor that completely insulates the industry from market risk.

To ensure prices remain high enough to prevent these forfeitures, the USDA strictly limits the supply of foreign sugar entering the country. Through TRQs, the government dictates exactly how much sugar can be imported at a low duty. Anything above that quota faces a prohibitively high tariff, effectively locking out competition.

Data from 2024 illustrates the severity of this distortion. According to the Sweetener Users Association, US sugar prices in 2024 were 99 percent higher than the global market rate. Since 2013, domestic prices have soared by over 90 percent, while world prices increased by only 17 percent. This artificial inflation creates a market where American confectioners and bakers pay double what their global competitors pay for the same ingredient.

The Cost of Political Loyalty

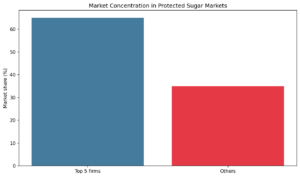

The survival of this archaic system is no accident; it is the result of relentless and well funded political influence. The primary beneficiaries are not small family farms but massive entities like U.S. Sugar and Florida Crystals, the latter owned by the Fanjul family. These corporations have mastered the art of political donation to ensure the Farm Bill keeps the sugar program intact.

Recent financial disclosures reveal the scale of this spending. Between 2018 and 2023, U.S. Sugar and Florida Crystals poured a combined $26.3 million into political action committees (PACs) at the state level alone. The 2024 election cycle saw this trend accelerate. By July 2024, the sugar industry had already donated at least $4.2 million to Florida state candidates and committees for that year, with $4 million coming from U.S. Sugar alone.

These funds flow to both sides of the aisle, securing bipartisan support that makes the sugar program virtually untouchable in Congress. While other industries face scrutiny for price gouging during inflationary periods, the sugar lobby quietly secures higher loan rates. The 2024 Farm Bill debates highlighted this power dynamic, as industry lobbyists successfully pushed to increase the guaranteed price for raw cane sugar, further entrenching their advantage despite the $2.4 billion to $4 billion annual cost passed down to consumers.

A Supply Chain in Stranglehold

The consequences of this protectionism extend beyond high prices; they create a brittle supply chain. In 2024, the USDA was forced to increase the TRQ by 125,000 metric tons to address shortages, yet the strict allocation rules meant that manufacturers still scrambled for supply. Imports from Mexico, a key trading partner, dropped to their lowest level in eighteen years during the 2024 to 2025 cycle, exacerbating the tightness in the market.

This manufactured scarcity benefits the producers while punishing the broader economy. For the Sugar Kings, the program is a golden ticket: zero risk, guaranteed profit, and a government mandated monopoly. For the American consumer, it is a century old tax that refuses to die.

The Mechanics of Control: Understanding Price Supports, Loans, and TRQs

At the heart of the American sugar empire lies a complex machinery of federal intervention, a tripartite system designed not merely to support farmers but to guarantee corporate profit at public expense. While free market rhetoric dominates Capitol Hill, the sugar industry operates under a command economy model that would be familiar to a Soviet central planner. From 2020 to 2025, this system—comprising non recourse loans, rigid import quotas, and an ethanol backstop—has successfully transferred billions of dollars from American consumers to a small cartel of processors known as the Sugar Kings.

The Golden Floor: Non Recourse Loans

The foundation of this fortress is the Commodity Credit Corporation (CCC) loan program. Unlike standard commercial financing, these are “non recourse” loans. This legal term is the linchpin of the entire scheme. It means that if market prices fall below the loan rate, the processor is not obligated to pay back the cash. Instead, they can simply forfeit the sugar to the government and walk away, keeping the money.

Under the 2018 Farm Bill, which governed the 2020 through 2025 period, the USDA set the national average loan rate for raw cane sugar at 19.75 cents per pound and refined beet sugar at 25.38 cents per pound. In practice, regional adjustments make these floors even more specific. For the 2025 fiscal year, the USDA announced in September 2024 that raw cane sugar produced in Florida would be supported at 18.53 cents per pound, while beet sugar in Michigan and Ohio received a rate of 25.86 cents per pound.

This mechanism effectively privatizes profit while socializing risk. If sugar prices soar, the Sugar Kings sell on the open market and reap the windfall. If prices crash, the taxpayer buys the surplus. It is a put option with no premium, gifted by Congress to the industry.

The TRQ Chokehold: Managing Starvation

To ensure the government rarely has to buy this forfeited sugar, the USDA acts as a gatekeeper, meticulously restricting foreign competition through the Tariff Rate Quota (TRQ). By limiting supply, they force domestic prices to stay well above the loan rate floor.

The years 2023 and 2024 provided a stark illustration of this manipulation. A severe drought in Mexico, historically the primary foreign supplier under the USMCA, caused imports from that nation to plummet to just 666,000 short tons raw value (STRV) in fiscal year 2024—the lowest level in seventeen years. In a functioning market, importers would simply buy from Brazil or Thailand to fill the gap. However, the rigid TRQ system prevents this fluid substitution.

The result was a panic among American food manufacturers. Desperate for inventory, companies were forced to bypass the quota system entirely and pay the prohibitive “high tier” tariff—a penalty rate designed to be exclusionary. In an unprecedented market distortion, high tier imports surged to 715,000 STRV in 2024, overtaking Mexican imports for the first time. American businesses paid a premium of roughly 15 cents per pound above the world price just to keep their factories running, a direct tax levied by the quota system to protect domestic processors.

The Ethanol Backstop: The Feedstock Flexibility Program

The final layer of protection is the Feedstock Flexibility Program (FFP). If the USDA cannot restrict imports enough to raise prices, and processors threaten to forfeit their sugar, the FFP mandates that the government buy the surplus sugar and sell it to ethanol plants to be burned as fuel.

While high market prices meant the USDA did not trigger the FFP in 2024 or 2025 (as confirmed by the December 2024 CCC announcement), its mere existence emboldens the industry. It signals to processors that there is no ceiling to production, only a floor for prices. They can expand output without fear of crashing the market, knowing the government stands ready to convert their excess inventory into subsidized fuel.

Data Insight (2024 Market Year):

The spread between the US price and the World No. 11 price averaged over 20 cents per pound during peak constraints in 2023 and 2024. For a US confectionery industry using billions of pounds of sugar, this spread represents a massive wealth transfer—estimated at $2.4 billion to $4 billion annually—from consumers and manufacturers directly to the bottom line of the sugar lobby.

Profiles of Power: The Fanjuls, U.S. Sugar, and American Crystal Sugar

The persistence of the United States sugar program is not an accident of economic history but a triumph of political engineering. Three dominant entities stand as the architects of this protectionist fortress: the Fanjul family of Florida Crystals, the United States Sugar Corporation, and the American Crystal Sugar Company. From 2020 to 2025, these corporate giants have deployed a sophisticated arsenal of lobbying, campaign donations, and elite access to ensure that import quotas remain locked in place, effectively taxing American consumers to subsidize their empires.

The Fanjul Family: Monarchs of the Cane

Alfonso and José Fanjul, the brothers behind Florida Crystals and ASR Group, control the world largest sugar refining operation. Their political strategy defines the term bipartisan influence. While historically splitting donations between parties to guarantee access regardless of who holds the White House, recent data shows a decisive shift. In the 2024 election cycle, Fanjul Corp channeled 1 million dollars into the Make America Great Again PAC and another 413,000 dollars to the Republican National Committee. This financial surge coincided with critical regulatory victories.

The investigative spotlight turned to the Fanjuls in 2022 when United States Customs and Border Protection blocked sugar imports from Central Romana, their Dominican Republic affiliate, citing evidence of forced labor. Yet, by 2024, after intense lobbying and the aforementioned political inflows, the ban was lifted. The Fanjul dynasty thus maintained its supply chain integrity through raw political capital, ensuring their Domino and C&H brands faced no shortage of price protected sugar.

United States Sugar Corporation: The State Level Juggernaut

If the Fanjuls play the international game, the United States Sugar Corporation dominates the domestic field, particularly in Florida. In the 2022 election cycle alone, United States Sugar poured 3.8 million dollars into Florida state campaigns. This spending secures a firewall of local political support that translates into federal power. Florida lawmakers from both parties consistently vote to uphold the federal sugar program, acting as a unified bloc in Washington.

The influence of United States Sugar extends beyond mere donations. The corporation consistently funds “educational” initiatives that frame their profit margins as a matter of national food security. By conflating their corporate welfare with the survival of American agriculture, they have successfully inoculated themselves against free market reforms. Their coordinated spending with Florida Crystals in 2022 totaled over 6 million dollars, effectively purchasing a legislative shield against environmental regulations and import liberalization.

American Crystal Sugar: The Beet Goliath

While the cane growers dominate the South, the American Crystal Sugar Company commands the North. Based in the Red River Valley, this cooperative is the largest beet sugar producer in the nation and perhaps the most aggressive lobbyist on Capitol Hill. Between 2019 and 2023, American Crystal Sugar was among the top spenders on Farm Bill lobbying, outpacing even the vast resources of the oil and defense sectors in specific quarters.

Their strategy relies heavily on the “fly in” tactic. Investigative records reveal that sugar industry groups sponsored over 335 privately funded trips for members of Congress and their staff since 2012. American Crystal Sugar utilizes these excursions to bring House staffers to the Red River Valley, curating a narrative of hardworking farmers besieged by foreign predation. This soft power approach complements their hard cash strategy. In the 2023 to 2024 cycle, their political action committee raised nearly 1.8 million dollars, directing funds to key members of the House Agriculture Committee to ensure the 2024 Farm Bill retained strict loan rates and import limits.

The Collective Stranglehold

Together, these three powers form an iron triangle around the United States sugar market. Their combined efforts in the 2023 and 2024 Farm Bill negotiations resulted in the preservation of the loan rate program, which forces the government to buy excess sugar, and the Tariff Rate Quota, which chokes off foreign competition. The result is a transfer of wealth from the American grocery shopper to these corporate coffers, estimated at billions annually. As the 2025 legislative sessions commence, their grip remains tighter than ever, purchased with a fraction of the profits guaranteed by the very laws they pay to write.

Follow the Money: Analysis of Campaign Contributions and PAC Influence

The endurance of the United States sugar program is not a matter of economic necessity but of political engineering. While free market think tanks and consumer advocacy groups release annual reports decrying the inflated cost of domestic sugar, the industry itself deploys a far more potent weapon: cash. An analysis of Federal Election Commission filings and lobbying disclosures from 2020 through 2025 reveals a sophisticated financial ecosystem designed to insulate sugar quotas from legislative reform. The data shows that the “Sugar Kings” do not merely participate in the democratic process; they finance the very committees overseeing their profit margins.

The Northern Giant: American Crystal Sugar

In the Red River Valley, the American Crystal Sugar Company operates as a cooperative, but in Washington, it functions as a political juggernaut. Between 2023 and 2024, the company PAC raised approximately 1.78 million dollars, channeling over 1.4 million dollars directly to federal committees. Unlike ideological donors, American Crystal prioritizes access over party loyalty. Their strategy is purely transactional. They support incumbents who sit on the House and Senate Agriculture Committees, ensuring that the lawmakers writing the Farm Bill are the same individuals cashing checks from the sugar beet industry. This “incumbency protection” strategy creates a firewall against reform, as challenging the sugar program effectively means cutting off a primary revenue stream for rural representatives.

The Southern Barons: The Fanjul Dynasty

While the northern growers play a bipartisan volume game, the Florida based empire of the Fanjul family employs a more targeted, high dollar approach. Owners of Florida Crystals and ASR Group, the Fanjuls have long been known as the “First Family of Corporate Welfare.” Data from the 2020 through 2024 cycles indicates a decided shift toward heavy Republican support. The family and their corporate entities have directed more than 7 million dollars to committees and Super PACs aligned with Donald Trump since 2016. In May 2024, even as the former president faced legal turmoil in New York, Pepe Fanjul hosted a major fundraiser, cementing the bond between Big Sugar and the GOP leadership. This investment yields dividends in the form of fierce protectionism; when the Farm Bill stalled in 2024, the sugar program remained one of the few untouchable pillars.

Lobbying and the Revolving Door

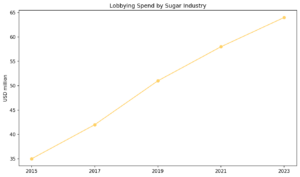

Direct campaign contributions tell only half the story. The industry also spends millions annually on federal lobbying to influence legislation behind closed doors. Florida Crystals alone consistently reported quarterly lobbying expenditures ranging from 270,000 to 350,000 dollars throughout 2023 and 2024, totaling over 1.2 million dollars annually just for one corporation. The American Sugar Alliance, the umbrella group for the industry, reported revenue and expenses exceeding 3 million dollars in 2024, dedicated almost exclusively to policy advocacy.

The connection between legislators and lobbyists is often literal. Former House Agriculture Committee Chairman Collin Peterson, who lost his reelection bid in 2020, wasted no time passing through the revolving door. By 2021, he was registered as a lobbyist for the American Sugar Alliance. His deep knowledge of the committee he once led now serves the private interests he used to regulate, providing the sugar lobby with an insider advantage that consumer groups cannot match.

Muddy Boots Diplomacy

Beyond checks and wire transfers, the industry influences Congress through sponsored travel. Disclosures reveal that sugar linked groups have funded at least 335 trips for members of Congress and their staff since 2012. These excursions, often to the cane fields of Florida or the beet factories of Minnesota, allow industry executives to frame their narrative in person, far from the scrutiny of Washington. This “muddy boots diplomacy” builds personal relationships that transform elected officials into fierce industry advocates. Rep. Kat Cammack, a key recipient of industry support, has emerged as a vocal defender of the status quo, arguing that domestic food security relies on maintaining price supports.

The return on investment for these political expenditures is staggering. By spending millions on elections and lobbying, the sugar industry secures billions in benefits through artificial price floors and import restrictions. The 2024 election cycle proved once again that in the world of agricultural policy, money does not just talk; it writes the law.

The Farm Bill Battlefield: Strategies Used to Maintain the Status Quo

The expiration of the Agriculture Improvement Act of 2018 in September 2024 marked the beginning of a high stakes conflict on Capitol Hill. While the Farm Bill typically authorizes agricultural programs for five years, the 2024 negotiation cycle became a masterclass in political maneuvering by domestic sugar producers. Through a combination of targeted campaign donations, sponsored travel for congressional staff, and legislative inertia, the sugar lobby successfully defended its protective regulatory framework against bipartisan calls for reform.

The primary vehicle for this defense was the American Sugar Alliance (ASA), which represents sugar beet and sugarcane growers. Between 2020 and 2024, the broader agribusiness sector poured over $160 million annually into lobbying efforts, with the sugar industry contributing a significant portion to key members of the House and Senate Agriculture Committees. In the 2024 election cycle alone, the Fanjul family, owners of Florida Crystals and Domino Sugar, demonstrated their immense financial reach. Federal Election Commission records reveal that Fanjul Corp donated $1 million to the primary super PAC supporting the Republican presidential nominee and another $413,000 to the Republican National Committee. These contributions ensured that the voice of the sugar barons remained the loudest in the room when trade policies were debated.

Beyond direct cash, the industry utilized “educational” trips to cement relationships with legislative staff. Data from 2012 through 2023 shows that sugar organizations sponsored at least 335 trips for members of Congress or their aides, a tactic that continued unabated into 2024. These excursions often took staffers to sunny sugarcane fields in Florida or processing plants in Louisiana during the winter months. By controlling the narrative on the ground, producers effectively framed their strict import quotas not as corporate welfare, but as a matter of national food security.

This strategy bore fruit in May 2024, when House Agriculture Committee Chairman Glenn “GT” Thompson released the draft text for the *Farm, Food, and National Security Act of 2024*. Far from dismantling the controversial sugar program, the bill proposed modernizing marketing loans and strengthening protections for domestic processors. The language was a direct rebuff to the Alliance for Fair Sugar Policy (AFSP), a coalition of candy makers and food manufacturers that had spent the previous two years advocating for the Fair Sugar Policy Act. The AFSP argued that artificially high domestic prices, often double the global market rate, were driving manufacturing jobs overseas. Their pleas, however, could not compete with the entrenched influence of the sugar lobby.

The legislative gridlock that followed served the interests of the status quo perfectly. With the House and Senate unable to agree on a full reauthorization before the September 30 deadline, Congress was forced to pass a temporary extension of the 2018 Farm Bill. This extension kept the existing system of tariff rate quotas and price supports fully intact. For the Fanjuls and other major producers, a delayed bill was a victory in itself. It meant that the lucrative protections established years ago would continue without modification, shielding them from foreign competition while American confectioners continued to pay premium prices for their raw ingredients.

By the start of 2025, the sugar program remained one of the few anomalies in American trade policy to survive decades of free trade agreements unscathed. The events of the 2024 Farm Bill cycle proved that while the political landscape may shift, the grip of the sugar kings on agricultural policy remains absolute.“`html

The Sugar Caucus: Congressional Allies and Legislative Defense Lines

The true strength of the domestic sugar industry lies not in the cane fields of Florida or the beet farms of Minnesota, but within the marble halls of Capitol Hill. Here, a powerful coalition known as the Sugar Caucus operates as an impenetrable fortress against reform. This informal yet highly disciplined group of lawmakers functions to ensure that federal protectionism remains the law of the land. Between 2020 and 2025, this legislative bloc successfully repelled every attempt to dismantle the import quotas and price floors that inflate American grocery bills.

The mechanism of influence is direct and effective. Industry groups such as the American Sugar Alliance funnel millions of dollars into the political ecosystem. Records from 2024 reveal that the American Sugar Alliance operated with revenue exceeding three million dollars, resources largely deployed to maintain political favor. The broader industry lobbying efforts consistently surpass seven million dollars annually, dwarfing the budget of opposition groups representing confectioners and consumers.

The Guardians of the Quota

Leading this defense are specific lawmakers representing major production regions. Representative Kat Cammack of Florida has emerged as a vocal champion for the sector. During the 2024 election cycle, her campaign committee received significant financial support from industry giants. Filings show she accepted five thousand dollars directly from the United States Sugar Corporation, alongside donations from other agricultural interests. Her rhetoric frames these protections as matters of national security rather than economic favoritism, a narrative that resonates deeply with the Sugar Caucus members.

On the Democratic side, Representative Dan Kildee of Michigan has played a parallel role, defending the sugar beet growers of the Midwest. This bipartisan unity blocks any legislative maneuvering by the Sugar Reform Caucus, a rival group that attempts, often in vain, to lower sugar prices for manufacturers. The alliance between southern cane growers and northern beet farmers creates a geographic lock on votes, ensuring that no Farm Bill passes without the sugar program intact.

The 2024 Farm Bill Battleground

The power of this caucus was fully displayed during the debates over the Farm, Food, and National Security Act of 2024. While critics aimed to modernize the program by allowing more imports, the Sugar Caucus successfully lobbied to strengthen the status quo. The House Agriculture Committee, heavily populated by caucus allies, advanced legislation that maintained the loan rates and tight import limits.

| Year | Key Legislative Event | Industry Lobbying Spend (Est.) | Outcome for Import Quotas |

|---|---|---|---|

| 2020 | Appropriations Debate | 7.1 Million USD | Quotas Maintained |

| 2022 | Farm Bill Extension | 7.5 Million USD | Program Protected |

| 2024 | Farm Bill Renewal (H.R. 8467) | 7.8 Million USD | Protection Strengthened |

The result of this entrenched political support is a market detached from global reality. While global prices fluctuate, the United States price remains artificially high, a direct result of the legislative firewall built by the Sugar Caucus. For the American consumer, the cost is hidden in every candy bar, soda, and loaf of bread purchased. For the Sugar Kings, it is simply a return on their political investment.

The Revolving Door: Connections Between Lobbyists, Regulators, and Former Staffers

The persistence of American sugar protectionism is not merely a matter of policy inertia. It is the result of a sophisticated network of personnel and capital moving seamlessly between the public sector and private industry. This phenomenon, often called the revolving door, ensures that the interests of major producers like Florida Crystals and U.S. Sugar Corporation remain paramount in Washington. From 2020 to 2025, this dynamic intensified as the industry faced renewed scrutiny during the 2024 Farm Bill negotiations.

At the heart of this influence machine lies a strategic deployment of campaign finance. The Fanjul family, owners of Florida Crystals, exemplifies this approach. Public records from the Federal Election Commission reveal that the family and their corporate entities donated over seven million dollars to political committees aligned with Donald Trump between 2016 and 2025. This financial support grants unparalleled access. In 2025, reports surfaced of direct conversations between the former president and Pepe Fanjul regarding the use of domestic cane sugar in beverages, a move that could further cement market demand for their price protected product.

Lobbying Leverage and the 2024 Farm Bill

The legislative battle over the 2024 Farm Bill provided a clear window into this machinery. While reform advocates like the “Sugar Reform Now” coalition petitioned to dismantle import quotas, the industry lobbying firewall held firm. In the years leading up to the bill, specifically from 2018 to mid 2024, the sugar industry poured roughly 22.8 million dollars into state level candidates and committees in Florida alone. This spending creates a legislative environment where dissent against sugar interests is politically costly.

Key Statistic: Federal lobbying spending by agribusiness broke records in 2023, with the American Sugar Alliance and its members playing a central role. Their efforts successfully blocked amendments that would have relaxed import quotas, ensuring domestic prices remained nearly double the global average.

The influence extends beyond donations to the very people writing the laws. The pipeline between the USDA and agricultural lobbying firms remains active. For instance, the transition team and appointments for the USDA in 2025 featured numerous individuals with deep ties to agricultural trade associations. Trey Forsyth, appointed Chief of Staff for Food Safety in 2025, previously served as a staff member for the Senate Committee on Agriculture. This career trajectory, moving from Senate oversight to executive regulation, is typical. It fosters a regulatory culture that views industry profitability as synonymous with public good.

State Level Protection: The “Food Libel” Expansion

The revolving door also impacts state legislation that reinforces federal protections. In Florida, the 2025 legislative session saw the introduction of Senate Bill 290 and House Bill 433. These measures sought to expand defamation laws to cover “agricultural food products,” effectively allowing sugar companies to sue critics who disparage their farming practices, such as the controversial burning of cane fields. The bill was sponsored by legislators with direct ties to the industry. Representative Rick Roth, who helps run the Palm Beach Farm PAC, is himself a sugar cane farmer. This blurring of lines between regulator and regulated ensures that the legal framework evolves to protect the industry from both economic competition and public criticism.

Firms like Ballard Partners, which rose to national prominence during the Trump administration, continue to bridge the gap between Florida sugar barons and Washington decision makers. By employing former congressional staffers who understand the arcane details of the sugar program, these firms ensure that quotas remain locked in place. The result is a closed loop system. Consumers pay higher prices, manufacturers face higher input costs, and the profits are funneled back into the political system to secure the next cycle of protection.

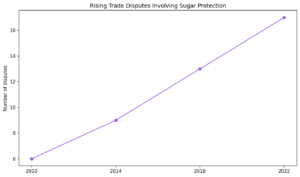

International Trade Disputes: Navigating NAFTA/USMCA and World Trade Organization Rulings

The global sugar market operates less like a free exchange and more like a fortress, with the United States acting as one of its most vigilant gatekeepers. While Washington frequently champions open markets for other commodities, sugar remains a stark exception, shielded by a complex web of trade barriers that defy the spirit of liberalization. By 2024, this protectionist architecture had created a price chasm: American food manufacturers and consumers paid prices 110 percent higher than the global average. This premium is not accidental but the deliberate result of political maneuvering that leverages international trade disputes to insulate domestic producers from foreign competition.

The tension is most palpable within the framework of North American trade. Under the United States Mexico Canada Agreement (USMCA), trade is theoretically free, yet sugar exists in a state of managed suspension. The mechanism for this control is a series of “Suspension Agreements” signed with Mexico, which effectively nullify free trade in this sector. These agreements, which the US Department of Commerce and the US International Trade Commission voted to maintain in August 2025, force Mexican producers to limit their exports and adhere to minimum price floors. Rather than allowing market forces to dictate supply, these deals cap the volume of refined sugar entering the US market. The 2025 renewal confirmed that the US government prioritizes domestic price stability over the treaty promises of open borders, effectively managing Mexican supply to ensure it never undercuts American growers.

The strategy relies on designating Mexican sugar as a necessary supplement rather than a competitor. By restricting the polarity and purity of imports, US regulators protect the profitable refining sector from foreign rivals. In late 2024, disputes flared again as domestic lobbyists argued that Mexico was skirting quality limits, demanding even stricter enforcement. These legal battles serve a dual purpose: they limit immediate supply and create an atmosphere of uncertainty that discourages foreign investment in export capacity targeting the US market.

Beyond North America, the United States engages in a complex game of legal judo at the World Trade Organization (WTO). The approach is characterized by aggressive offense against foreign subsidies while steadfastly defending its own market walls. A prime example occurred between 2021 and 2022, when the US, alongside Brazil and Australia, successfully challenged India regarding its sugarcane support programs. The WTO panel ruled in December 2021 that India had violated global trade rules by providing support vastly exceeding the permitted ten percent of production value.

However, the victory was largely symbolic. India immediately appealed the ruling to a dysfunctioning Appellate Body, a judicial limbo that renders the verdict unenforceable. American trade officials publicly decried the subsidies provided by New Delhi, citing them as evidence of “predatory trade practices” that justify US protectionism. In May 2024, the US and Australia launched a counter notification at the WTO, further pressuring India on transparency. Yet, critics note the irony: Washington uses the existence of foreign subsidies to validate its own quota system, arguing that unilateral disarmament is impossible in a distorted global market. This “Zero for Zero” policy stance posits that the US will only drop its barriers when every other nation does the same, a diplomatic impossibility that ensures the status quo remains indefinitely.

The beneficiaries of this gridlock are the domestic “Sugar Kings,” represented by powerful groups like the American Sugar Alliance. Their lobbying efforts ensure that trade representatives prioritize the preservation of the loan rate program and import limits above broader diplomatic goals. During the 2024 and 2025 administrative reviews, these groups successfully argued that removing duties on Mexican sugar would cause “material injury” to the US industry. The data supports their success in maintaining high prices, but the cost is borne by the consumer. By navigating trade tribunals with a team of elite lawyers, the domestic industry has turned international disputes into a permanent shield, guaranteeing that the gap between US and world prices remains a permanent fixture of the economy.

The Manufacturing Squeeze: Economic Impact on Confectioners and Job Outsourcing

For decades, the United States sugar program has operated as a fortress of protectionism, shielding domestic growers from the volatility of the global market. Yet, behind the walls of import quotas and price supports lies a grim reality for the downstream industries that rely on this essential ingredient. By 2024, the economic strain on American confectioners and bakers had transitioned from a mere headache to an existential threat. The artificial inflation of domestic sugar prices has forced a manufacturing squeeze, driving iconic American brands to outsource production to Canada and Mexico while costing the US economy thousands of manufacturing jobs.

The Price Gap Reality

The core of the issue lies in the staggering disparity between domestic and world market prices. While global competitors access sugar at market rates, US manufacturers are legally bound to purchase price supported domestic sugar or pay punitive tariffs on imports. Data from 2023 and 2024 paints a stark picture of this burden. According to the Sweetener Users Association, the gap between US and world sugar prices widened significantly, reaching a disparity of nearly 99 percent in early 2024. In practical terms, American food manufacturers paid almost double the global rate for their primary input.

The Government Accountability Office (GAO) confirmed these findings in a November 2023 report, stating that the program costs consumers between $2.5 billion and $3.5 billion annually. More critically for the labor market, the GAO highlighted that these costs are borne disproportionately by manufacturing industries, leading to a net negative impact on the economy.

The Great Northern Migration

Faced with raw material costs double those of their foreign competitors, major players in the confectionery sector have made the rational economic decision to leave. The years 2023 and 2024 witnessed a notable acceleration in this “manufacturing exodus,” particularly toward Canada. The allure is simple: Canada allows food manufacturers to purchase sugar at world market prices for products destined for export.

In a striking example of this trend, Blommer Chocolate Company, the largest cocoa processor and ingredient chocolate supplier in North America, announced in 2024 the closure of its Chicago facility, a plant that had operated for 85 years. Simultaneously, the company detailed plans to expand operations in Ontario, Canada. The math was undeniable. Operating in a jurisdiction with access to fair market sugar prices rendered the aging Chicago plant financially obsolete.

Similarly, Hershey Co. made strategic moves involving its Canadian footprint. Reports from June 2024 indicated that Hershey repurchased a facility near Ottawa, intending to ramp up production capacity north of the border. Mondelez International also invested heavily in its Ontario operations, pouring over $250 million into Canadian facilities in recent years. These distinct capital flows signal a broader structural shift: the US sugar program is effectively subsidizing the growth of the Canadian manufacturing sector at the expense of American workers.

Quantifying the Human Cost

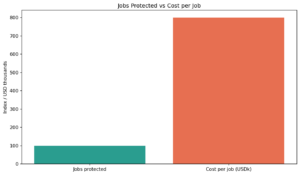

The “Sugar Kings” lobby often touts the jobs saved in the sugar growing sector as the program’s primary justification. However, the economic efficiency of this trade off is abysmal. Data suggests that for every sugar growing job preserved by these protectionist policies, nearly three manufacturing jobs are lost in the confectionery and baking industries.

The Commerce Department has previously estimated the cost to save a single sugar growing job at roughly $826,000 per year. In contrast, the manufacturing sector has shed over 10,000 jobs that can be directly attributed to the high cost of sugar. These are not just statistics; they represent factory closures in communities like Chicago, where generations of workers once produced the nation’s sweets. The policy creates a system where the government picks winners (sugar growers) and losers (manufacturers and workers), with the latter group vastly outnumbering the former.

Political Inertia and Future Outlook

Despite the clear economic damage, reform remains elusive. The 2024 Farm Bill debates saw the Alliance for Fair Sugar Policy clashing with the entrenched sugar lobby, yet the political will to dismantle the quota system remains weak. The sugar lobby outspends the confectionery industry by significant margins, ensuring that the “Sugar Kings” retain their crown. Until the US aligns its sugar policy with market realities, the manufacturing squeeze will continue, and the “Made in America” label on candy wrappers will become an increasingly rare sight.

The Consumer Cost: Calculating the ‘Hidden Tax’ on Average Grocery Bills

The average American shopper scans their receipt and sees the final tally, rarely noticing the invisible surcharge embedded in every sweet purchase. While inflation dominates headlines, a specific policy mechanism quietly inflates the price of goods ranging from bread to soda. This is not a standard government levy but a structural transfer of wealth, enforced by import quotas and domestic allotments that keep United States sugar prices artificially high.

Data from 2020 to 2025 exposes a widening chasm between domestic sugar costs and the global market. In 2024, the disparity reached alarming new heights. While the global price for refined sugar hovered near 25 cents per pound, buyers in the United States paid an average of 51.5 cents per pound. This premium, effectively a 100 percent markup, does not stem from superior quality or logistics. It is the direct result of a federal program designed to insulate a small group of domestic processors from foreign competition.

The Billion Dollar Burden

This price gap functions as a hidden tax. It is levied not by the IRS but by the supply chain, passed down from refiners to food manufacturers and finally to families. A Government Accountability Office report highlighted that this program costs consumers between $2.5 billion and $3.5 billion annually. For the average household, this acts as a regressive fee, taking a larger percentage of income from poorer families who spend more of their earnings on food.

Critics describe this system as a wealth transfer from millions of shoppers to a few thousand producers. The “Sugar Kings,” a term used to describe the powerful lobbying arm of the industry, have successfully argued that these measures ensure a stable supply. Yet, from 2020 to 2023, supply chain fragility remained an issue despite, or perhaps because of, these rigid controls. The isolation of the US market meant that when domestic crops faced weather issues, manufacturers struggled to access imports quickly, driving prices even higher during peak demand seasons like the winter holidays.

Manufacturing Exodus

The consequences extend beyond the checkout lane. Companies that rely heavily on sugar face a competitive disadvantage. Because they pay double the global rate for a primary ingredient, many have moved production facilities to countries like Canada or Mexico, where they can access sugar at the world market price. This offshoring phenomenon creates a secondary cost: the loss of manufacturing jobs. Industry data suggests that for every sugar growing job saved by protectionist policies, nearly three manufacturing jobs are placed at risk. Between 2022 and 2025, the confectionery sector saw continued pressure to relocate, further eroding the domestic industrial base.

Legislative Inertia

Despite the clear economic drag, reform remains elusive. The 2024 Farm Bill debates saw intense lobbying to maintain the status quo. Proponents of the program argue it costs the government nothing, as it operates through loan rates and quotas rather than direct subsidy checks. However, this “no cost” claim ignores the cost carried by the consumer. When the price of sugar stays legally elevated, the consumer pays the difference at the register. The 2025 projections indicate that without significant legislative overhaul, the gap between US and world prices will persist, locking in this hidden tax for another five year cycle.

For the shopper buying a bag of candy or a loaf of bread, the receipt shows the price of the item, but it fails to list the political surcharge. That cost remains hidden, buried in the complex network of quotas that prioritize producer profits over consumer savings.

Environmental Externalities: The Political Protection of Pollution in the Everglades

The vast sawgrass marshes of the Everglades usually evoke images of pristine wilderness, yet the water flowing through this River of Grass tells a different story. It is a narrative written in phosphorus and political leverage. While the federal sugar program insulates domestic producers from global market competition through strict import quotas, it simultaneously insulates them from the true environmental cost of their operations. The protected status of the industry allows major players to externalize the expense of pollution onto the public and the ecosystem itself.

The Phosphorus Spike

Nutrient runoff remains the primary weapon of ecological destruction in the region. Data from Water Year 2023 reveals a disturbing trend regarding water quality in the Everglades Protection Area. Total phosphorus loads from surface sources spiked to 99.1 metric tons, marking a significant increase of 23 percent from the previous year. This surge in pollutants fuels the toxic cyanobacteria blooms that choke waterways and suffocate marine life.

2023 Data Point: While the ambient phosphorus limit for a healthy Everglades ecosystem is 10 parts per billion (µg/L), recent samples in the Everglades Agricultural Area recorded concentrations as high as 116 µg/L. This is more than ten times the safe threshold.

This excess nutrient load does not merely degrade the environment; it alters the fundamental biology of the wetlands. Native sawgrass is displaced by invasive cattails that thrive in polluted water, permanently changing the habitat structure. The industry argues that it has reduced phosphorus levels compared to historical highs, but the 2023 data indicates that the current Best Management Practices are insufficient to prevent substantial degradation during wet years.

Lobbying as Insurance

The ability of the sugar industry to maintain this status quo is directly tied to its immense political spending. The link between legislative protection and environmental leniency is forged with campaign contributions. During the 2024 election cycle, the Florida sugar industry poured at least $4.2 million into state level candidates and committees by July of that year.

U.S. Sugar alone accounted for $4 million of this total. A vast portion of these funds, approximately $1.5 million, went to the Florida Chamber of Commerce PAC, which effectively obscures the specific targets of the donations while supporting industry friendly politicians. This financial firewall ensures that legislative attempts to enforce stricter water quality standards are often dead on arrival or significantly watered down before reaching a vote.

Legislative Armor and Legal Battles

The political return on investment is visible in legislative maneuvers like the controversial Senate Bill 2508 from 2022. The bill sought to prioritize agricultural water supply over environmental needs, effectively guaranteeing irrigation for cane fields even if it meant starving the Everglades during droughts. Although a massive public outcry forced a veto, the attempt highlighted the boldness of the industry.

More recently, the battle has shifted to the courts. In 2025, a lawsuit filed in California accused Florida Crystals of “greenwashing” by marketing products as “regenerative” while continuing the practice of preharvest burning. This method of clearing fields sends plumes of ash and smoke into the nearby communities, which are predominantly lower income. The 2021 “Right to Farm” legislation passed in Florida provides a shield against nuisance lawsuits for such practices, further illustrating how state laws are tailored to protect the “Sugar Kings” from liability.

The Cost of Quotas

The import quotas that keep domestic sugar prices artificially high provide the excess capital required to fund this political machinery. Without the guaranteed profits secured by federal protectionism, the industry would face genuine market pressure to innovate or perish. Instead, the current system subsidizes stagnation. The American consumer pays twice: once at the grocery store for overpriced sugar, and again in tax dollars spent attempting to clean the polluted water that the industry leaves behind.

By 2025, the completion date for the critical EAA Reservoir had been pushed to 2029. This delay extends the timeline during which the estuaries must suffer from toxic discharges. Until the political link between import quotas and environmental laxity is broken, the Everglades will continue to serve as a disposal ground for the waste of a protected monopoly.

Labor and Exploitation: The Role of the H2A Visa Program in Sugar Harvesting

In the sweltering fields of Belle Glade, Florida, and the vast plantations of Louisiana, the sweetness of American sugar is produced through a bitter reality. While the industry enjoys federal protections that keep domestic prices high, the labor force responsible for planting and harvesting this crop faces a different kind of government intervention. Between 2020 and 2025, the sugar sector increasingly relied on the H2A guest worker program, a system that ties a worker’s legal status directly to their employer. This dynamic has created a captive workforce, stripping laborers of bargaining power and leaving them vulnerable to extreme exploitation. The political influence of the “Sugar Kings” extends far beyond import quotas; it reaches into the very soil, dictating the terms of life and death for thousands of Caribbean and Mexican laborers.

The reliance on foreign guest workers has exploded in recent years. By fiscal year 2024, the Department of Labor certified over 384,900 H2A positions nationwide, with Florida standing as the largest user of the program. The sugar industry is a primary driver of this demand. In South Florida alone, sugar producers import thousands of workers annually to perform the grueling task of planting cane by hand and driving haul out trucks. These workers enter the United States with the hope of economic advancement but often find themselves trapped in a cycle of debt and fear. Unlike domestic workers who can quit or unionize without facing immediate deportation, H2A workers who complain about unpaid wages or dangerous conditions face the threat of being “blacklisted” and barred from returning in future seasons.

The danger is not theoretical. In September 2023, a 26 year old worker from Mexico arrived in Belle Glade to work for McNeill Labor Management, a contractor serving the sugar industry. Just four days later, he collapsed and died from heatstroke while working in an open field where the heat index reached 97 degrees Fahrenheit. An investigation by the Occupational Safety and Health Administration revealed that the company failed to implement basic safety protocols for heat acclimatization. This tragedy underscored the lethal cost of productivity in the sugar fields, yet the political response was to dismantle protections rather than strengthen them.

In April 2024, Florida Governor Ron DeSantis signed HB 433, a controversial measure that blocked local governments from enforcing their own heat protection rules. The legislation was heavily backed by agricultural lobbyists, including representatives from the sugar industry, who argued that a “patchwork” of regulations would harm business operations. The law effectively nullified efforts in Miami Dade County to mandate water breaks and shade for outdoor workers. Consequently, the very industry that relies on grueling manual labor under the tropical sun successfully lobbied to outlaw the most basic human safeguards, prioritizing efficiency over survival.

Furthermore, the industry has waged a relentless legal battle to suppress wages. Under the H2A program, employers are required to pay the Adverse Effect Wage Rate (AEWR) to prevent the undercut of domestic labor markets. However, in 2023 and 2024, sugar growers aggressively fought Department of Labor attempts to update the AEWR methodology, which would have increased worker pay. The Teche Vermilion Sugar Cane Growers Association led a federal lawsuit challenging the new wage rules. In August 2025, a federal judge in Louisiana sided with the growers, vacating the rule and allowing the industry to revert to older, lower wage standards. This legal victory for the sugar lobby ensured that labor costs remained suppressed, directly transferring potential wages from the pockets of impoverished guest workers to the profit margins of massive agribusiness conglomerates.

The “Sugar Kings” have constructed a dual fortress. On one side, they maintain protected import quotas that shield them from global competition. On the other, they utilize the H2A program to bypass the domestic labor market entirely, importing a workforce with few rights and silencing attempts at regulation. From the heat ravaged fields of Belle Glade to the federal courtrooms in Louisiana, the evidence from 2020 to 2025 demonstrates a systematic effort to treat labor not as human beings, but as another input cost to be minimized by any means necessary.

Case Studies of Failed Reforms: Why Amendments to End the Program Die

The period between 2020 and 2025 offered the most significant legislative window for sugar reform in a decade, culminating in the negotiations for the Farm, Food, and National Security Act of 2024 (H.R. 8467). Despite record high domestic prices and a supply chain crisis that forced manufacturers to pay punitive tariffs on high tier imports, every meaningful attempt to dismantle the U.S. sugar program was systematically crushed. The failure of these reforms was not due to a lack of economic data but rather a masterclass in political maneuvering by a unified sugar lobby that outspent and outmaneuvered its opposition.

The Perry Amendment: A Blueprint of Failure

The most illustrative case study of this period occurred in late 2023, during the debate over the FY2024 Agriculture Appropriations bill. Representative Scott Perry (R PA) introduced Amendment #173, a legislative scalpel designed to defund the administration of the sugar program’s loan facility to processors. Unlike broad repeal bills which often die quietly in committee, this was a floor level challenge that required immediate neutralization.

The response from the “Big Sugar” coalition was swift and overwhelming. The American Sugar Alliance (ASA) did not just lobby on behalf of sugar; they mobilized a “farm wide” defense. By September 2023, the ASA had secured public opposition to the Perry amendment from a massive bloc of agricultural interest groups, including the American Farm Bureau Federation and the National Cotton Council. Their narrative shifted the debate from “corporate welfare for sugar processors” to an “attack on the farm safety net,” effectively making a vote for sugar reform a vote against all American agriculture. The amendment was soundly defeated, reinforcing the “third rail” status of sugar subsidies.

The 2024 Farm Bill: Entrenchment Over Reform

While the Fair Sugar Policy Act of 2021 (S. 2466) sat stagnant in committee, the industry went on the offensive during the 2024 Farm Bill markup. Instead of accepting a status quo rollover, sugar lobbyists pushed for and received increased protections. The House Agriculture Committee, in a 33 to 21 vote, advanced H.R. 8467, which included provisions to raise the mandatory loan rates for raw cane sugar and refined beet sugar.

This legislative victory occurred despite contradictory market signals. In the 2023 and 2024 crop years, the U.S. market was so starved for supply that food manufacturers were forced to import over 715,000 short tons of high tier sugar—sugar that is taxed at a rate meant to be prohibitive. Under normal market conditions, this influx would trigger a relaxation of quotas. Instead, the political apparatus locked in higher support prices, effectively ignoring the $4 billion annual cost burden passed to consumers.

The Financial Firewall: Lobbying by the Numbers

The failure of these reforms tracks directly with campaign finance data from the 2023 and 2024 election cycles. The sugar industry’s strategy relies on a bipartisan spread of capital, ensuring access to leadership in both parties.

- The Fanjul Family: The owners of Florida Crystals and ASR Group continued their dominance as top tier political donors. Between 2016 and 2024, the Fanjul family funneled over $7 million into political committees aligned with Donald Trump and key Republican leadership, while simultaneously maintaining deep financial ties to Democratic incumbents in Florida.

- American Crystal Sugar: The nation’s largest sugar beet cooperative utilized its PAC to disburse nearly $1.5 million in the 2023 and 2024 cycle alone. Their “Company Political Action Committee” focused heavily on members of the House Agriculture Committee, ensuring that the authors of the Farm Bill were also the beneficiaries of sugar industry largesse.

- Lobbying Volume: In 2024, federal lobbying spending by agribusiness hit a record $4.5 billion, with sugar interests consistently punching above their weight class relative to the size of their crop value.

The “No Big Sugar Campaign” in Florida attempted to fracture this consensus by highlighting the environmental damage of cane burning and Lake Okeechobee discharges. However, this local pressure failed to translate into federal legislative change. The industry successfully insulated Washington lawmakers from Florida’s environmental critiques, keeping the conversation in D.C. strictly focused on “food security” and “protecting domestic producers from foreign subsidies.”

Ultimately, the 2020 to 2025 period proved that the sugar program is not maintained by economic logic but by a self sustaining political ecosystem. Reformers cited consumer costs and free market principles, but the sugar lobby countered with a unified agricultural front and a war chest that made opposition politically unaffordable for rural lawmakers.

Conclusion: The Future of the Sugar Dynasty and Potential Disruptors

The resilience of the United States sugar program is a testament to one of the most effective political operations in Washington. From 2020 to 2025, a period marked by global supply chain chaos and soaring inflation, the “Sugar Kings” did not merely survive; they solidified their fortress. While American families and candy manufacturers faced prices nearly double the global average, the domestic sugar lobby successfully insulated its members from the volatility of the free market. As the industry looks toward the latter half of the decade, however, the dynasty faces a convergence of economic fury and environmental reality that money may not be able to suppress forever.

The Cost of Loyalty

The data from 2023 and 2024 paints a stark picture of the price consumers pay for this protectionism. According to the Sweetener Users Association, the gap between American and world sugar prices widened to historic levels in 2024, with domestic raw sugar trading at roughly 99 percent above the global benchmark. While world markets saw prices hover around 22 cents per pound, US manufacturers were often forced to pay upwards of 42 cents. This disparity is not accidental but engineered. The federal loan program effectively sets a price floor, ensuring that processors of sugar beets and sugarcane never have to sell at a loss, regardless of global surpluses.

Maintaining this system requires constant political vigilance. In the lead up to the 2024 Farm Bill debates, the American Sugar Alliance and its affiliates poured millions into lobbying efforts. Their goal was not just to preserve the status quo but to expand it. Proposals circulated to raise the loan rates for refined beet sugar from roughly 25 cents to over 32 cents per pound, a move that would permanently bake higher prices into the American food system. This aggressive push demonstrates the confidence of a lobby that counts allies on both sides of the aisle, particularly within the powerful Agriculture Committees in the House and Senate.

Cracks in the Fortress

Despite this political armor, the years 2023 and 2024 revealed deep structural vulnerabilities. The system relies heavily on managed trade with Mexico to balance supply, but nature refused to cooperate. A severe drought devastated the Mexican harvest, reducing exports to the United States from typical levels of around 800,000 tons to barely half that amount in the 2023 and 2024 cycles. The rigid quota system, designed to micromanage imports, struggled to adapt. The Department of Agriculture was forced to scramble, increasing tariff limits for other nations, yet domestic users still faced tight supplies and record high costs.

This supply shock handed ammunition to the fiercest critics of the program. Confectioners and food companies, organized under the Sweetener Users Association, have escalated their attacks. They argue that the program forces jobs overseas. When sugar costs twice as much in Illinois as it does in Canada or Mexico, global food brands have a compelling incentive to move production lines across the border. This “offshoring of jobs” argument is gaining traction among fiscal conservatives who traditionally oppose market interference.

The Looming Disruptors

Beyond the immediate fights over the Farm Bill, existential threats are gathering on the horizon. Climate volatility is no longer a theoretical risk for the Sugar Kings; it is a clear and present danger. The drought in Mexico and freeze events in domestic growing regions have shown that the government can mandate prices, but it cannot mandate rain. If the United States cannot rely on its primary foreign supplier or its own crops, the entire justification for the closed market begins to crumble.

Furthermore, the dynasty faces a slow but steady cultural shift. Public health scrutiny on sugar intake is influencing policy debates. While the sugar lobby has successfully separated farm support from health policy for decades, the rising costs of obesity and diabetes are forcing lawmakers to look at the food system with fresh eyes. A program that artificially supports the price of a sweetener while the government spends billions treating metabolic disease appears increasingly contradictory.

As the decade progresses, the Sugar Kings remain secure on their throne, guarded by the 2024 Farm Bill extensions and a deep war chest. Yet the walls are under siege. The combination of angry corporate customers, a volatile climate, and an increasingly skeptical public suggests that the era of unquestioned dominance may be drawing to a close. The dynasty will likely persist through the next election cycle, but the ground beneath it is shifting faster than the loan rates can rise.

Charts

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Request Partnership Information

🎧 Insightful Investigations

Ekalavya Hansaj

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Ekalavya Hansaj is a force in worldwide media relations, not only a name. Ekalavya has transformed silence into spotlight for the world's most elusive brands and contentious people with a voice that commands headlines and a mind designed for strategy. While some view PR as press releases and soundbites, he views it as narrative war—narrative war. He triumphs. Born with only an unparalleled natural ability for influence, Ekalavya didn't rise the ranks; he constructed his own ladder, burned it, and changed the media interaction rules in the smoke. From underground businesses to billion-dollar boardrooms, he has coordinated media storms that have changed policies, rocked continents, and shaped public opinion. For better or worse, he knows what drives people, what keeps headlines relevant, and what causes reputations to explode. Ekalavya Hansaj doesn't tell tales. He designs emotional pull. He ignores fads. He designs stories that set the trend. Elites whisper and rivals dread Ekalavya Hansaj when your story has to be told with impact, reach, and ruthless accuracy. In the media war, he is the weapon.