The Hidden Cost of Crumbling Bridges: Why Infrastructure Audits Fail

Why it matters:

- The collapse of the Fern Hollow Bridge in Pittsburgh highlights a critical failure in modern infrastructure management due to reliance on manual inspections.

- Technology like Structural Health Monitoring (SHM) and drones offer more efficient and proactive solutions, but barriers such as regulatory inertia and data management challenges hinder widespread adoption.

On a snowy morning in January 2022, the Fern Hollow Bridge in Pittsburgh collapsed into the park below, taking a municipal bus and several cars with it. The steel legs of the bridge had deteriorated to the point of failure. The crumbling bridges had been inspected regularly. The National Transportation Safety Board released a report in February 2024 that pinpointed the cause: extensive corrosion and section loss in a transverse tie plate. Human inspectors had noted the decay for years, but the severity was underestimated, and the urgency was lost in a sea of paperwork. This disaster underscores a critical failure in modern infrastructure management. We rely on eyes and flashlights to inspect complex structures when digital twins and artificial intelligence could predict failures before they happen.

The Visual Inspection Standard

The National Bridge Inspection Standards (NBIS) were established decades ago and still govern how we monitor the safety of over 617,000 bridges across the United States. These regulations prioritize visual assessment. Inspectors must typically be within an arm of the component they are checking. While this hands on approach is valuable, it is subjective and prone to error. An inspector might miss internal corrosion or fatigue cracks that are invisible to the naked eye. In the case of Fern Hollow, the visual checks documented the rust but failed to quantify the structural loss accurately enough to trigger an immediate closure.

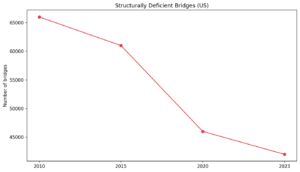

This reliance on manual observation creates a reactive system. We find problems only after they become visible, often when the damage is already severe. The American Society of Civil Engineers (ASCE) gave US bridges a grade of C in their 2021 report, noting that 42 percent of all bridges were at least 50 years old. By 2023, the Federal Highway Administration (FHWA) reported that over 43 percent of bridges were structurally deficient or functionally obsolete. The sheer volume of aging infrastructure overwhelms the capacity of human inspection teams.

The Promise of Digital Monitoring

Technology offers a solution through Structural Health Monitoring (SHM). This field uses wireless sensors to measure vibration, strain, and tilt in real time. These sensors feed data into AI algorithms that can detect anomalies instantly. For example, a shift in how a bridge vibrates after a heavy truck passes can indicate internal weakness long before a crack appears on the surface.

Drones also provide a safer and more thorough alternative to hanging off the side of a bridge in a bucket truck. High resolution cameras and thermal imaging can map a structure in 3D, creating a digital twin that engineers can analyze from a desk. However, data from 2025 indicates that the drone bridge inspection market is still niche, with revenue estimated at just $0.19 billion. The technology exists, but it is not being bought or used at scale.

Barriers to Adoption

Why are we not covering every major bridge with sensors? The primary hurdle is regulatory inertia. The FHWA allows advanced technology to supplement visual inspections but rarely permits it to replace them. This means bridge owners must pay for the expensive manual inspection required by law plus the cost of new technology. For cash strapped municipalities, this double cost is impossible to justify.

Furthermore, the data produced by these systems can be overwhelming. A single bridge with fifty sensors generates terabytes of data. Without sophisticated AI to interpret this information, it becomes noise. Many civil engineering departments lack the data scientists needed to manage this flow of information. The industry faces a skills gap where the people responsible for maintenance are not trained in the digital tools that could make their jobs easier.

The Cost of Inaction

The hesitation to modernize has a steep price. The ASCE estimates that the investment gap for bridge rehabilitation is massive. By failing to adopt predictive maintenance, we are forced to spend more on emergency repairs and replacements. A sensor system might cost fifty thousand dollars to install, but it can extend the life of a bridge by years by identifying minor repairs before they become major structural failures. In contrast, the replacement of the Fern Hollow Bridge cost over $25 million.

We are stuck in a cycle of decay. Until regulations update to treat data as equal to human observation, and until funding models shift to prioritize smart preventative measures, we will continue to be surprised by failures that were actually predictable. The technology is ready. The infrastructure is waiting. Only the system stands in the way.

The Economic Ripple Effect: Supply Chain Disruptions and Commuter Costs

When the Francis Scott Key Bridge collapsed into the Patapsco River in March 2024, the immediate horror focused on the tragic loss of human life. Yet, as the dust settled and the Port of Baltimore fell silent, a secondary disaster began to unfold. This second crisis was not structural but financial, an invisible wave of economic destruction that surged through the American supply chain. The collapse did not just sever a roadway; it amputated a vital artery of global trade, costing the Maryland economy an estimated $15 million per day in lost revenue. This catastrophe serves as a grim case study for a nationwide failure, revealing how overlooked defects in aging infrastructure eventually extract a massive toll on commerce and commuters alike.

The premise of infrastructure management is simple: regular audits detect issues before they become disasters. However, data from 2020 to 2025 suggests this system is broken. Visual inspections often miss critical fatigue cracks, and funding models prioritize ribbon cutting ceremonies over unglamorous maintenance. The result is a network of bridges that are not merely old but actively decaying, acting as ticking time bombs for the national economy.

The Freight Logjam: A Multibillion Dollar Gamble

The supply chain relies on predictability. When a major span fails, the detour is measured not just in miles but in millions of dollars. The 2021 closure of the Hernando de Soto Bridge, which connects Tennessee and Arkansas, illustrates the fragility of this network. A routine inspection discovered a fracture in a steel beam, a defect so severe it forced an immediate shutdown. This bridge was a linchpin for freight, supporting the movement of $400 billion in goods annually along the I40 corridor.

For the trucking industry, the closure was catastrophic. Drivers faced detours that turned fifteen minute crossings into ordeals lasting over an hour. The trucking sector operates on razor thin margins, and fuel is a primary expense. When thousands of trucks are forced to idle or reroute, the costs cascade down to the consumer. The Hernando de Soto incident revealed a terrifying gap in audit protocols: subsequent investigations showed the fracture was visible in drone footage from years prior, yet human inspectors had missed it. This audit failure converted a routine maintenance issue into a national supply chain emergency.

The Commuter Toll: Lost Time and Local Ruin

While freight disruptions grab national headlines, the local economic bleed is equally severe. The emergency closure of the Washington Bridge in Rhode Island in late 2023 offers a stark example of how infrastructure failure decimates local businesses. The bridge carries Interstate 195 over the Seekonk River, a critical vein for Providence. When engineers found severed tension rods, they shut it down instantly, severing the connection between the East Bay and the capital.

The fallout was immediate. A study by local universities and hospitality associations revealed that the closure cost the Rhode Island hospitality sector $114 million in the first twelve months alone. Restaurants sat empty as diners refused to brave the traffic snarls. The projected long term impact is even more dire, with estimates suggesting a total economic loss of $748 million by 2029 if reconstruction timelines drag on. For the average commuter, the bridge failure functioned as a massive, unlegislated tax. The cost of fuel, vehicle wear, and lost productivity erodes household income, all because a fracture critical component was allowed to deteriorate beyond repair.

The Audit Gap: Why We Miss the Warning Signs

Why do these failures persist despite federal mandates? The answer lies in the limitations of the current audit model. Most inspections rely on visual assessments, which are subjective and prone to human error. In the case of the Memphis bridge, the crack went unnoticed until it nearly sheared the beam. Advanced non destructive evaluation technologies exist but are expensive and deployed sparingly.

Furthermore, the financial data from the American Road & Transportation Builders Association (ARTBA) highlights a disconnect between spending and safety. While contract awards for highway and bridge work reached a record $121 billion in 2024, much of this capital flows toward new construction or surface level repairs rather than deep structural rehabilitation. We are building new lanes while the foundations of existing spans rot. With over 42,000 bridges still classified as structurally deficient across the United States, the backlog of deferred maintenance ensures that the economic ripple effects of the next collapse are already written into the ledger.

The true cost of a crumbling bridge is never just the price of concrete and steel required to fix it. It is the shuttered business in Providence, the idling truck in Memphis, and the silent port in Baltimore. Until audits evolve from passive observation to active intervention using modern technology, these hidden costs will continue to burden the economy, one fracture at a time.

Hidden Environmental Costs: Construction Waste and Detour Emissions

When a bridge fails, the public sees the immediate crisis of steel in the water or concrete on the ravine floor. Yet a secondary disaster unfolds invisibly in the atmosphere, one that infrastructure audits consistently fail to measure. Between 2020 and 2025, as high profile spans like the Fern Hollow Bridge in Pittsburgh and the Washington Bridge in Rhode Island succumbed to decay, they triggered massive spikes in carbon emissions and physical waste. These environmental debts are rarely calculated in the financial ledgers of state transport departments, leaving a significant gap in our understanding of the true cost of deferred maintenance.

The most immediate environmental penalty comes from the tailpipes of diverted traffic. When the Fern Hollow Bridge collapsed in early 2022, it severed a critical artery carrying 21,000 vehicles daily. Suddenly, thousands of drivers were forced onto a detour that added approximately twenty minutes to every commute. Multiplied across nearly a year of reconstruction, this resulted in hundreds of thousands of extra miles driven, burning mostly fossil fuels. In Rhode Island, the abrupt 2023 closure of the Washington Bridge westbound lanes created an even larger crisis. With traffic volumes usually exceeding 90,000 vehicles a day, the resulting gridlock forced cars to idle for hours or take long deviations. Data from 2024 indicated that transportation already accounted for nearly 38 percent of the greenhouse gas emissions in Rhode Island. The bridge failure exacerbated this significantly, effectively erasing gains made by other green initiatives that year.

Beyond the exhaust fumes lies the heavy toll of physical waste. The United States generates roughly 600 million tons of construction and demolition debris annually, a figure that includes the shattered remains of failed infrastructure. When the Fern Hollow Bridge was replaced, the emergency project required twenty one massive prestressed concrete beams, each weighing over 100 tons. The production of this new concrete is chemically intensive, releasing vast amounts of carbon dioxide. This is known as “embodied carbon,” which refers to the emissions locked into the material itself. A 2024 study comparing bridge materials found that concrete structures can carry an embodied carbon footprint over 26 percent higher than steel equivalents. By allowing the original bridge to deteriorate to the point of total replacement, the city not only lost an asset but was forced to incur this heavy new carbon debt immediately, rather than spreading it out over a longer service life of a well maintained structure.

Current auditing protocols are blind to these externalities. The National Transportation Safety Board produced an exhaustive 2024 report on the Fern Hollow collapse, detailing the corrosion of the transverse tie plate and the failure of inspectors to scrape away rust. It rightfully blamed the City of Pittsburgh for ignored maintenance recommendations. However, nowhere in standard engineering audits is the “cost” of the collapse measured in tons of additional carbon dioxide or cubic yards of landfill space. Financial audits look at the dollar cost of steel and labor, treating the environmental fallout as zero. This accounting failure encourages a reactive approach where leaders delay repairs until a structure is critical, ignoring the fact that emergency replacement is far more carbon intensive than preventative repair.

BR_chart1_deficient

A true infrastructure audit must evolve. It should account for the “shadow” emissions of a closure. If a bridge repair costs five million dollars but avoids a closure that would generate ten thousand tons of excess carbon from detours, the audit must reflect that value. Until oversight bodies begin to tally the wasted fuel and the embodied carbon of premature demolition, the true cost of our crumbling bridges will remain dangerously underestimated.

Liability and Accountability: Who Pays When an Audit Fails?

On a frigid morning in January 2022, the Fern Hollow Bridge in Pittsburgh collapsed into a ravine, taking a municipal bus and several passenger vehicles with it. Miraculously, no lives were lost, but the structural failure exposed a deep fracture in the American infrastructure oversight system. By September 2024, the City of Pittsburgh agreed to settle claims from the victims. The total amount offered was exactly $500,000. This sum was not per victim but a total cap for the entire incident, split among everyone injured.

This payout, limited by Pennsylvania state law, illustrates a stark reality in the world of public works: when bridges fail due to negligence or overlooked decay, the entity responsible for maintaining them often pays the least. The financial burden instead shifts to private engineering firms, insurance carriers, and ultimately the taxpayer.

The Sovereign Immunity Shield

The reason Pittsburgh paid only half a million dollars for a catastrophic failure lies in the legal doctrine of sovereign immunity. Most US states maintain strict caps on damages that can be recovered from government entities. In Pennsylvania, the Political Subdivision Tort Claims Act limits liability to $500,000 per aggregate occurrence. Whether one person is injured or fifty people are killed, the city pays the same maximum amount.

This legal shield forces plaintiffs to look elsewhere for compensation. In the Fern Hollow case, lawyers for the victims turned their sights on the private sector. Lawsuits filed in 2024 targeted the engineering consultants who had inspected the bridge years prior. The argument was that these firms, including CDM Smith and Gannett Fleming, failed to identify the severity of the corrosion that led to the collapse. While the government enjoys statutory protection, private contractors possess no such immunity. They effectively become the insurance policy for the state, creating a dynamic where the inspector carries more financial risk than the owner of the bridge.

The Cost of Missed Warnings

The repercussions of a failed audit extend beyond legal settlements. In May 2021, a routine mechanical inspection on the Hernando de Soto Bridge, which connects Arkansas and Tennessee, was interrupted when a contractor spotted a massive crack in a steel support beam. The bridge was immediately shut down.

Subsequent investigations revealed that the fracture had been visible in inspection videos from 2016, 2019, and 2020 yet was missed by the Arkansas Department of Transportation inspectors. The department fired the inspector responsible, but the economic damage was already done. The trucking industry estimated the closure cost roughly $2.4 million per day in delays and rerouting expenses. Unlike direct repair costs, these economic losses are rarely recovered from the state. The freight companies and consumers absorbed the financial blow of the oversight failure, a hidden tax imposed by crumbling infrastructure.

Taxpayers as the Lender of Last Resort

When the scale of disaster exceeds private insurance limits, the federal government steps in as the financier. The March 2024 collapse of the Francis Scott Key Bridge in Baltimore introduced a maritime twist to liability. The owner of the ship that struck the bridge petitioned to limit its liability to approximately $43 million under the Limitation of Liability Act of 1851. With replacement costs estimated between $1.7 billion and $4 billion, the gap is astronomical.

Federal officials moved quickly to cover the upfront costs of debris removal and reconstruction, utilizing emergency funds. While the government vowed to pursue reimbursement from responsible parties, the timeline for such litigation spans years. In the interim, the American taxpayer underwrites the risk. If the shipping company successfully limits its liability in court, the vast majority of the rebuilding bill will remain with the public treasury.

The Accountability Vacuum

The current system creates a paradox of accountability. Government agencies own the assets but are shielded from the full cost of their failure. Private engineering firms perform the inspections but operate under contracts that often attempt to limit their own exposure, though courts are increasingly piercing these veils. Meanwhile, the audits themselves focus on compliance rather than resilience.

Data from 2020 through 2025 suggests that litigation following infrastructure failures is becoming more complex and expensive. Legal battles now drag on for years as defendants point fingers at one another. The City of Pittsburgh blamed the engineers; the engineers blamed the city for ignoring maintenance recommendations. In the end, the check written by the city was nominal, while the legal fees incurred by the private firms likely exceeded the settlement itself.

As states outsource more inspection work to private companies, the line of accountability blurs further. The public assumes that a passing grade on an inspection report guarantees safety. The reality is that an audit often serves merely as a snapshot in time, legally sufficient to clear a regulatory hurdle but practically insufficient to predict a catastrophe. Until liability laws are reformed to align financial risk with actual responsibility, the true cost of these failures will continue to land on those who can least afford it: the commuters driving over the bridge and the taxpayers paying to rebuild it.

The Future of Auditing: Digital Twins, Drones, and Predictive Analytics

The collapse of the Fern Hollow Bridge in Pittsburgh in January 2022 was not a sudden act of nature. It was a slow and visible decay that went unnoticed by the very system designed to prevent it. A 2024 investigation by the National Transportation Safety Board revealed a grim reality: the city failed to act on repeated maintenance recommendations, and inspections were plagued by oversight. Similarly, in 2021, a massive fracture was found on the Hernando de Soto Bridge connecting Tennessee and Arkansas. The truly disturbing detail? The crack had been visible in drone footage from 2019, yet human reviewers simply missed it. These incidents expose the fatal flaw in traditional auditing: it relies too heavily on subjective human judgment and sporadic checks.

The era of the clipboard and flashlight is ending. A new triad of technology is emerging to replace it, promising an audit system that never sleeps and rarely misses a beat. This is the age of digital twins, autonomous drones, and predictive analytics.

The Rise of the Digital Twin

A digital twin is more than a 3D model. It is a living virtual replica of a physical asset, updated in real time with data from sensors embedded in the concrete and steel. Between 2020 and 2025, the adoption of this technology accelerated as infrastructure owners realized its value for continuous auditing. Market analysis from 2025 projects the global digital twin sector to grow from roughly 21 billion dollars in 2025 to over 150 billion dollars by 2030. This explosion in value reflects a shift in strategy. Instead of visiting a bridge once every two years, engineers can now visit its digital ghost every morning.

For auditors, this means access to a historical record of stress, vibration, and temperature that spans years rather than moments. If a support beam begins to warp, the digital twin flags the anomaly immediately, allowing for intervention long before a physical crack appears.

Drones: The Eyes That Never Blink

The Hernando de Soto Bridge incident proved that gathering data is not enough; the quality and frequency of analysis matter. This is where the drone market is stepping in. Industry reports show the drone bridge inspection sector growing from 0.15 billion dollars in 2024 to 0.19 billion dollars in 2025. These machines are no longer just flying cameras. Equipped with thermal imaging and LiDAR, they can detect delamination inside concrete decks that human inspectors cannot see.

Advanced drones are now capable of flying autonomously along preprogrammed paths, ensuring that every bolt and weld is imaged from the exact same angle during every inspection. This consistency allows software to overlay images from 2023 atop those from 2025, automatically highlighting changes as small as a hairline fracture. This eliminates the “human error” that allowed a visible crack to go unreported for two years on the Mississippi River crossing.

Predictive Analytics: From Reactive to Proactive

The final piece of this technological puzzle is predictive analytics. By feeding the massive datasets from drones and digital twins into machine learning algorithms, agencies can move from repairing broken things to preventing the break. Data from 2020 to 2025 suggests that predictive maintenance can slash emergency repair costs by up to 85 percent.

Consider the Oresund Bridge connecting Denmark and Sweden. Its operators now use AI driven systems to perform continuous evaluation. The software analyzes sensor data to predict fatigue years in advance. This shifts the financial model of infrastructure entirely. Audits become forward looking tools for capital planning rather than backward looking reports on decay.

The Obstacle of Data Overload

Despite these advancements, the transition is not seamless. The sheer volume of data generated by a single digital twin can overwhelm legacy servers and municipal budgets. Furthermore, the 2024 NTSB report on Fern Hollow highlighted a persistent issue: technology is useless if the bureaucracy ignores the warning. The sensor may scream “danger,” but if the department lacks the funds or the will to close the lane, the bridge will still fall.

The future of auditing lies not just in better tools, but in a system that forces accountability. Digital twins and drones provide the evidence. Predictive analytics provides the timeline. It is now up to the human element to provide the action.

Conclusion: Reforming the System to Prevent the Next Collapse

The catastrophic failure of the Fern Hollow Bridge in Pittsburgh on January 28, 2022, served as a grim awakening for infrastructure managers worldwide. While no lives were lost in that specific incident, the subsequent investigation by the National Transportation Safety Board (NTSB), released in February 2024, exposed a terrifying reality. The bridge did not fail solely due to age or weather. It failed because the system designed to protect it was broken. The NTSB report highlighted a “failure to act” on repeated maintenance recommendations and noted that accurate load rating calculations would have reduced the posted limit from 26 tons to just 3 tons. This collapse was not an accident of nature but a bureaucratic disaster.

Two years later, the destruction of the Francis Scott Key Bridge in Baltimore demonstrated a different but equally urgent vulnerability. While triggered by a ship collision rather than internal decay, the 2024 disaster underscored the fragility of non-redundant structures where a single point of failure can spell total ruin. These events, bookending a period of intense scrutiny between 2020 and 2025, prove that the traditional methods of auditing and maintaining our critical arteries are no longer sufficient.

The scope of the problem is vast. According to the 2024 Bridge Report by the American Road & Transportation Builders Association (ARTBA), over 221,800 spans across the United States need major repair or replacement. While the number of bridges rated “structurally deficient” fell slightly to 42,067 in 2024, the pace of improvement is dangerously slow. At the current rate, it would take decades to clear the backlog, a timeline we cannot afford. The Infrastructure Investment and Jobs Act (IIJA) has injected $27.5 billion into bridge programs since 2021, yet funding alone cannot fix a flawed oversight model.

The core defect lies in the reliance on visual inspections. As seen in the Fern Hollow case, inspectors often documented corrosion for years, yet city officials ignored the warnings until gravity took over. Subjective visual checks fail to capture the internal rate of decay in steel and concrete. To prevent the next collapse, audits must transition from reactive visual logs to proactive digital monitoring. The era of the clipboard must end.

Advanced technology offers a path forward. Structural health monitoring systems can now utilize wireless sensors to detect minute changes in vibration, tilt, and strain in real time. These digital tools provide an objective truth that bureaucratic inertia cannot hide. By 2025, forward thinking agencies began integrating “digital twins,” virtual replicas of physical bridges that simulate stress scenarios and predict failures before they manifest. Drones equipped with infrared thermography can now scan concrete for delamination invisible to the naked eye, removing human error and safety risks from the equation.

However, technology is useless without accountability. The NTSB Chair Jennifer Homendy, during the Fern Hollow briefing, poignantly noted that “everybody wants to build and nobody wants to do maintenance.” Reforming the system requires a cultural shift where ribbon cutting ceremonies for new projects are less celebrated than the quiet, unglamorous work of preservation. We need laws that mandate immediate action when digital audits flag critical thresholds. If a sensor indicates a load rating drop, the bridge must close automatically, removing political hesitation from the decision.

The hidden cost of crumbling bridges is not just the price of reconstruction but the erosion of public trust. When infrastructure fails, it severs the physical and social bonds of a community. By embracing data led auditing, enforcing strict maintenance mandates, and utilizing modern sensor networks, we can transform our infrastructure from a decaying liability into a resilient foundation. The warning signs from Pittsburgh and Baltimore are clear. We possess the tools to read them. We only lack the will to act before the next span falls.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Request Partnership Information

Waayers ,Inc.

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Waayers, Inc. is a world-class broadcasting, news publishing, and content production company based in San Francisco. With a commitment to delivering high-quality, engaging, and informative content, Waayers has become a trusted name in global media. Our team of skilled journalists, content creators, and producers works tirelessly to bring the latest news, insightful stories, and innovative broadcasts to audiences worldwide. From breaking news to in-depth documentaries, Waayers specializes in producing content that informs, inspires, and entertains. Leveraging cutting-edge technology and a global network of experts, we provide comprehensive coverage on a wide range of topics including politics, culture, business, technology, and more. At Waayers, we aim to redefine the way people experience news and entertainment, shaping the future of broadcasting with a focus on accuracy, creativity, and a deep commitment to delivering the best in digital media.