Why it matters:

- The sharing economy's evolution from a grassroots concept to a global asset class has transformed cities worldwide.

- The financialization of residential spaces for short-term rentals has led to housing crises and regulatory challenges in urban centers.

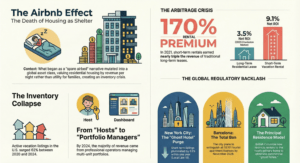

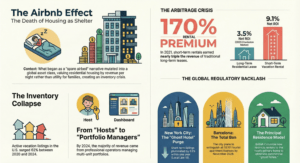

The innocent origins of the sharing economy are now a distant memory. What began as a bohemian notion of renting out a spare room or an air mattress has mutated into a global asset class that devours residential inventory. By early 2026, the transformation of housing into a financial vehicle for tourists had fundamentally altered the DNA of cities worldwide. This phenomenon, often termed the “Airbnb Effect,” is no longer a fringe annoyance for neighbors but a central driver of the short-term rental crisis afflicting urban centers from Barcelona to New York.Between 2020 and 2024, the landscape of temporary lodging shifted dramatically. Data reveals that the supply of active vacation listings in the United States surged by 62 percent during this period. Investors, flush with capital and chasing yield, flooded into residential neighborhoods, converting starter homes into high turnover hotels. The narrative of the “host” changed from a local resident earning extra cash to a portfolio manager overseeing dozens of units. By the start of 2026, AirDNA projected that the premium for operating a vacation rental over a standard mortgage would hit nearly 989 dollars per month, a financial incentive so powerful it effectively devalued the concept of permanent residency.

From Homes to Assets

The core of this crisis lies in the commodification of shelter. Residential space is now valued not by its utility to a family, but by its potential revenue per available night (RevPAR). This financialization has severed the link between local wages and housing costs. In Barcelona, a city that became the poster child for overtourism, rents skyrocketed by 70 percent in the decade leading up to 2024. The situation became so untenable that in June 2024, Mayor Jaume Collboni announced a radical plan to extinguish all 10,101 tourist apartment licenses by November 2028. The goal was simple: return housing to the people who live there. The sheer necessity of such a ban highlights the failure of the market to regulate itself; without intervention, the profit motive of tourism simply outcompetes the basic need for shelter.

The Regulatory Backlash and Market Reality

Cities attempting to curb this trend have faced complex results. New York City enforced Local Law 18 in September 2023, one of the strictest crackdowns in history. The legislation required hosts to register and be present during stays, effectively banning the “ghost hotel” model. Consequently, listings for stays under 30 days plummeted by 83 percent between July 2023 and July 2024, dropping from roughly 22,000 to just 3,700. Yet, the aftermath exposed the deep entrenchment of the housing crisis. Rents in the city continued to rise by 3.4 percent the following year, proving that while vacation rentals exacerbate scarcity, they are part of a larger web of housing dysfunction. However, the removal of 18,000 units from the tourist market marked a significant reclamation of space for potential residential use.

The Future of Displacement

Looking ahead through 2026, the industry shows no sign of returning to its humble roots. Global revenue for the sector is on a trajectory to reach 500 billion dollars by 2030, growing at a compound annual rate of 16 percent. Institutional capital is beginning to circle the wagon, viewing these properties as a distinct asset class comparable to commercial real estate. As interest rates moderated to around 6 percent in early 2025, the barrier to entry for investors lowered again, threatening a new wave of acquisitions in secondary cities and rural towns.

The “Airbnb Effect” is thus not merely about noisy tourists or lockboxes on gates; it is about the systematic extraction of housing stock from the local community. When a studio apartment earns more in three nights than a worker can pay in a month, the housing market ceases to function for citizens. It functions only for capital. As we move deeper into the decade, the battle lines are drawn between the right to housing and the right to unchecked commercial extraction.

Short-term rental crisis

The Evolution of Hosting: From Spare Airbeds to Professional Property Management

The founding mythology of the short term rental market is well known. In 2007, two designers in San Francisco inflated air mattresses to pay their rent during a conference. This “spare room” narrative fueled the early explosive growth of platforms like Airbnb, selling the idea that anyone could monetize their extra space. By 2026, however, this story has become a relic. The modern reality is a high stakes industry dominated by asset management firms, technology conglomerates, and professional property managers who have fundamentally altered the housing landscape.

The Professional Pivot: 2020 to 2024

The decisive shift away from casual hosting began in earnest during the pandemic. While amateur hosts struggled with complex sanitization protocols and fluctuating demand in 2020, professional operators capitalized on the chaos. They had the capital to weather the storm and the infrastructure to implement contactless entry and rigorous cleaning standards. This period cleared out the hobbyists, leaving a vacuum that corporate entities quickly filled.

Data from 2024 confirms this consolidation. By that year, the “Top Performing Segment” in the industry was not the single unit owner but hosts managing between three and ten properties. These operators, often using sophisticated dynamic pricing software, earned 20 percent to 40 percent more revenue per listing than their self managed counterparts. In Canada alone, a 2024 report highlighted that 80 percent of platform revenue came from whole unit rentals where the owner was not present, with multi unit operators generating nearly a third of all income. The “host” was no longer a person; it was a portfolio.

The Rise of the Mega Manager

By 2025, the industry witnessed significant corporate consolidation. A landmark event occurred in April 2025 when Casago completed its acquisition of Vacasa, merging two giants to form a North American behemoth. This move signaled the end of the fragmentation phase and the beginning of the “Mega Manager” era. These companies do not just list homes; they manage entire neighborhoods. They utilize algorithmic pricing that adjusts rates hourly, ensuring maximum yield in a way no individual owner can match.

Key Statistic: By 2025, direct bookings (reservations made through a manager’s own website rather than a third party platform) grew to represent 28 percent of the market share. This indicates that professional managers are now powerful enough to bypass the very platforms that birthed them.

Technology Driven Displacement

The professionalization of hosting is powered by a new layer of technology that removes the human element entirely. In late 2024, Airbnb expanded its “Co Host Network,” onboarding over 10,000 experienced operators to manage listings for absentee owners. While marketed as a helping hand, this feature effectively allows investors to buy up housing stock in cities they have never visited, outsourcing the operations to local logistics teams. The result is a detached form of ownership where housing becomes a pure financial asset.

This efficiency comes at a cost to local communities. In New York City, the enforcement of Local Law 18 in late 2023 aimed to curb this trend by banning short term rentals for less than 30 days. However, professional operators proved highly adaptive. Demand merely shifted across the Hudson River to Jersey City and Newark, where demand surged by over 31 percent in 2024. The professional operators did not disappear; they simply migrated, taking their capital and displacement effects with them.

The 2026 Outlook

As we move through 2026, the transformation is complete. The market is now defined by “tech enabled” hospitality brands like Sonder and Awaze, the latter managing over 110,000 holiday lets across Europe. The quaint notion of a host greeting a guest with a set of keys is largely gone, replaced by smart locks, AI chatbots, and outsourced cleaning crews. For local housing markets, this means competing not just with tourists, but with multinational corporations that view every apartment as a potential high yield hotel room.

The Economics of Arbitrage: Comparing Long Term Leases vs. Short Term Yields

The transformation of housing into a financial asset is not a new phenomenon, yet the arrival of platform based tourism has accelerated this shift with ruthless efficiency. At the heart of the crisis lies a simple, cold calculation known as rental arbitrage. This economic mechanism drives landlords to remove properties from the residential market, where they serve local families, and reposition them in the hospitality sector to serve transient visitors. The motivation is purely mathematical: the yield gap between a traditional twelve month lease and a calendar filled with nightly bookings has become too wide for capital to ignore.

Between 2020 and 2026, this gap created a gravitational pull that sucked millions of housing units out of the long term supply. Data from the onset of this period illustrates the sheer scale of the incentive. In 2021, the premium for operating a short term rental compared to a standard annual lease hit a staggering 170 percent. For a property owner, the choice was binary and obvious. Why collect 2,000 dollars a month from a local tenant when the same unit could generate 5,400 dollars as a vacation hub? This disparity effectively demonetized the social function of housing, prioritizing high velocity tourist dollars over stable community residency.

By 2023, the rush of new investors seeking these returns began to saturate the market, yet the fundamental economics remained broken in favor of tourism. While the arbitrage premium compressed from its 2021 peak, it settled at a robust 124 percent in 2024. Even with this reduction, the financial logic holds firm. An investor in a popular market like Charleston, South Carolina, faced a stark reality at the end of 2023. A long term tenant would offer a net return on investment of roughly 3.5 percent. Converting that same home into a short term stay product yielded 9.1 percent. In this environment, a landlord opting for a traditional lease is essentially donating nearly two thirds of their potential profit to social stability, a charitable act that few private equity firms or individual investors are willing to perform.

The impact of this yield chasing is visible in global data trends. In tourist heavy zones, vacation rentals consistently generate two to three times the revenue of residential leases. This multiple allows owners to tolerate significant vacancy periods while still outperforming the residential market. Occupancy rates for short term units are projected to stabilize around 55 percent through 2025 and 2026. This figure is critical because it reveals a disturbing efficiency: a home can stand empty for nearly half the year and still earn more than one occupied by a local teacher or nurse for the entire twelve months. The “ghost town” effect observed in city centers is not a sign of market failure but rather a sign of market success for the asset owners.

As we move into 2026, the market is maturing, but the damage to housing stock is largely baked in. The explosive growth phase has slowed, with supply growth tapping the brakes to roughly 7 percent in 2024 compared to over 22 percent in 2022. However, this slowdown does not signal a return of units to the residential sector. Instead, it marks the entrenchment of a new asset class. The projected valuation of the short term rental market is expected to approach 9 billion dollars by 2026 in key regions alone. This capitalization represents a permanent transfer of real estate utility. The housing units lost to this arbitrage are not merely temporarily unavailable; they have been revalued based on hospitality metrics, making them too expensive to ever return to the local rental market without a catastrophic collapse in asset prices.

The economic reality is that local wage growth cannot compete with global travel budgets. When a housing market competes with a tourism market, the local resident loses every time. A 2024 report indicated that for every 1 percent increase in Airbnb listings, local rents tick upward, independent of other inflationary pressures. The arbitrage economy does not just displace tenants; it resets the baseline cost of shelter for everyone who remains, forcing communities to subsidize the profits of an industry that views their homes as nothing more than yield generating inventory.

Inventory Collapse: Quantifying the Removal of Residential Housing Stock

The transformation of residential infrastructure into tourist accommodation is no longer a fringe economic activity. It has become a dominant force reshaping cities globally. Between 2020 and 2026, the data reveals a systematic diversion of housing units from permanent residents to transient visitors. This shift has created an inventory vacuum, directly fueling the affordability crisis plaguing urban centers from Vancouver to Barcelona.

From Spare Rooms to Corporate Assets

The original promise of the sharing economy was simple: monetization of excess capacity. A homeowner renting a spare room for a weekend did not impact the broader housing supply. However, by 2024, that narrative had collapsed under the weight of professionalization. Data from AirDNA indicates that by early 2025, the majority of revenue on major platforms was generated not by casual hosts, but by operators managing multiple properties. In British Columbia, prior to the 2024 crackdown, the top 10% of hosts earned nearly half of all sector revenue. These were not neighbors sharing homes; they were commercial entities operating distributed hotels without zoning oversight.

This structural change turned potential permanent homes into dedicated vacation rentals. In popular markets, investors purchased entry level condos explicitly for the tourist trade, outbidding local families. By late 2023, vacancies for standard yearly leases in cities like Lisbon and New York City hovered near historic lows, often under 2%, while listings for temporary stays numbered in the tens of thousands.

The Regulatory backlash: 2024 and 2025

Two major case studies from the past two years highlight the scale of this inventory loss. New York City and British Columbia both implemented aggressive restrictions to reclaim housing stock, providing a clear view of exactly how many units had been lost to the tourism sector.

New York City enforced Local Law 18 in September 2023, effectively banning most entire apartment rentals for less than 30 days. The impact was immediate and quantifiable. By January 2025, the number of listings on major platforms had plummeted from over 22,000 to fewer than 5,000 legal registrations. This difference represents approximately 17,000 units that were theoretically unavailable to local workers. However, the transition back to the residential market was complex. While some units returned to the long lease market, others shifted to underground channels or remained vacant as owners waited for legal challenges to resolve. Despite the ban, median rents in Manhattan remained stubbornly high through 2025, proving that while tourism is a key factor, it is not the sole driver of housing inflation.

On the West Coast of Canada, the outcome was more direct. The Short Term Rental Accommodations Act, enacted in May 2024, restricted rentals to the principal residence of the host. By February 2025, listings in Vancouver had dropped by 22%, and in Kelowna by 31%. Unlike New York, British Columbia saw a slight but measurable uptick in vacancy rates for permanent housing in 2025, suggesting that strict enforcement can successfully return units to the local market.

The European Surge

While North America tightened rules, Europe faced a different trajectory. In the third quarter of 2025, the EU recorded a record 398 million overnight stays in tourist accommodations, an 8.7% annual increase. This demand continued to pressure housing stock. In Spain, the government launched a national registry in July 2025 to purge illegal listings. Authorities estimated that 30,000 units would be removed from platforms for failing to meet local zoning laws. These were apartments that, for years, had been illegal hotels operating in plain sight, removing tens of thousands of bedrooms from the reach of local students and families.

The Permanent Cost of Transient Profit

The cumulative effect of these trends is a fractured housing market. As we move through 2026, the data is clear: for every dedicated vacation unit in a city, there is one less home for a nurse, a teacher, or a service worker. The “ghost hotel” phenomenon has successfully monetized residential zoning, but the cost is paid by the community in the form of higher rents and displaced neighbors. While 2025 showed that regulation can stem the bleeding, the inventory lost since 2020 has left a deficit that will take years of dedicated construction to refill.

The Gentrification Accelerator: How Temporary Stays Drive Up Neighborhood Rents

The mechanism by which vacation platforms distort housing costs is neither accidental nor subtle. It is a direct function of yield. When a landlord can extract the same revenue in ten nights of tourism that a permanent tenant pays in a full month, the economic incentive effectively evicts the local workforce. By 2024, this yield gap had crystallized into a global engine of displacement, transforming residential infrastructure into a distributed hotel network.

“We are witnessing the financialization of the spare room, where global capital outbids local labor for the right to shelter.” — Housing Justice Consortium, 2025 Report

The Inventory Shock

The most immediate impact is the physical removal of supply. Every unit converted to a transient lodging listing is one fewer home available for a nurse, a teacher, or a service worker. In Lisbon, data from 2024 revealed that the density of vacation listings relative to the population was six times higher than in Barcelona and over three times that of London. In the historic center of Lisbon, nearly 70 out of every 100 homes held a license for tourist accommodation. The result was a rent increase of over 33 percent between 2019 and 2024, forcing traditional residents to the urban periphery.

This removal of stock creates an artificial scarcity. When supply contracts while demand for housing remains constant, prices inevitably rise. A 2025 analysis of European markets indicated that for every 1 percent increase in vacation listings within a neighborhood, asking rents for permanent housing climbed by 0.5 percent within two years. In tight markets, this seemingly small margin often pushed rents past the affordability threshold for median income earners.

The Professionalization of Displacement

The myth of the “host” sharing a spare bedroom has largely evaporated. By 2026, the market was dominated by corporate operators and investment syndicates. In New York City, prior to the enforcement of Local Law 18 in late 2023, a fraction of hosts controlled a vast majority of the inventory. These were not neighbors earning extra cash; they were hospitality businesses operating in residential zones without the regulatory overhead of hotels.

This professionalization drives gentrification by altering the amenity landscape. As investors buy properties to convert them, neighborhood services shift. Laundromats and grocers are replaced by luxury cafes and experience boutiques catering to transient visitors. This process, often called “tourism gentrification,” signals to other landlords that the area is ripe for rent hikes, causing a ripple effect that destabilizes the entire community.

The Regulatory Paradox: Lessons from New York

The attempt to curb this trend through regulation has produced mixed results, highlighting the complexity of the crisis. New York City enforced strict bans on unregistered listings in September 2023, removing over 15,000 units from platforms like Airbnb. Yet, data from 2024 and 2025 showed that median rents in Manhattan continued to rise, surpassing $4,000 per month.

Why did rents not fall immediately? The answer lies in the deep damage already done to the market and the emergence of new loopholes. Landlords, addicted to the higher yields of corporate travel, shifted inventory to “medium duration” rentals of 30 days or more, bypassing the ban on stays under 30 days. Additionally, a shadow market emerged on private social media channels, where illicit rentals continued underground. The supply did not return to the affordable permanent housing pool; it merely shifted to a different tier of exclusivity.

The Future of Neighborhoods

As we look toward 2026, the data suggests that without aggressive intervention that targets ownership structures rather than just stay duration, the accelerator will continue to function. Cities like Barcelona have pledged to eliminate all tourist apartment licenses by 2028, a bold experiment to reclaim 10,000 homes. Whether this will reverse the price surges of the last decade remains the defining question for the survival of local communities.

The Short Term Rental Crisis: How Tourism Is Killing Local Housing Markets

Displacement Dynamics: No Fault Evictions and Lease Non Renewals

The eviction notice rarely arrives with a bang. For António Melo, a 71 year old resident of Lisbon’s Alfama district, it arrived as a quiet bureaucratic shuffle. After the building he had called home for decades was sold to a tourist accommodation company in late 2023, his lease was simply not renewed. There was no rent dispute, no damage to the property, and no violation of terms. There was only a new owner with a calculator who realized that a nightly tourist rate of 150 euros far outstripped a monthly local rent of 800 euros. Melo is now one of thousands across Southern Europe caught in the “warm bed” cycle, where residential stability is sacrificed for visitor turnover. Data from 2024 indicates that over 70% of short stay revenue in Lisbon flows to hosts with multiple listings, effectively turning housing stock into distributed hotel chains.

This phenomenon is not unique to Portugal. It represents a global shift in property usage that housing advocates call “displacement by algorithm.” In Los Angeles, the mechanism is legal but devastating. The Ellis Act allows landlords to evict tenants from rent controlled units if they intend to “go out of business.” In practice, this often means clearing a building to convert it into boutique lodging or luxury condos. Between 2001 and 2025, the Ellis Act removed more than 29,000 rent stabilized units from the Los Angeles market. The human cost is visible in Koreatown, where Jovita Cuevas and her son Leonardo spent 2024 as the sole remaining residents of their historic building. While their neighbors accepted buyouts or fled, the Cuevas family fought the eviction in court, arguing the owner’s intent was not a genuine exit from the market but a strategy to pivot toward higher yield transient occupancy.

Further north, in Canada, the displacement tactic differs but the result remains the same. The “renoviction” serves as the primary tool for landlords seeking to reset rents to market rates or convert to short stay models. A particularly egregious case in Surrey, British Columbia, surfaced in 2025. A tenant was evicted under the “landlord’s use” provision, ostensibly so the owner’s son could move in. Months later, the tenant discovered their former home listed on a popular vacation platform. The “son” was nowhere to be found; instead, the listing featured photos of the owners vacationing at Devils Tower in Wyoming. A tribunal awarded the tenant 17,000 dollars, a rare victory in a landscape where bad faith evictions often go unpunished due to the burden of proof placed on the displaced.

The situation in Barcelona reveals the sheer scale of this market distortion. By 2024, rents in the Catalan capital had risen 68% over a decade. Josep Torrent, a 49 year old teacher, became the face of the resistance at Casa Orsola, an Art Nouveau building acquired by Lioness Investments. Like Melo in Lisbon, Torrent faced lease non renewal rather than for cause eviction. The strategy is clean and effective: wait for a contract to expire, refuse renewal, and release the unit into the lucrative temporary market. The backlash, however, has been fierce. In response to cases like Casa Orsola, Barcelona Mayor Jaume Collboni announced in mid 2024 a plan to eliminate all 10,101 tourist apartment licenses by November 2028. This total ban aims to return these units to the residential market, acknowledging that the city cannot survive if its workforce is pushed to the periphery.

These lease non renewals constitute a “silent eviction” crisis. Unlike formal evictions which leave a legal paper trail, non renewals simply disappear families from the data. They do not show up in court records or sheriff lockout statistics. They appear only as vacancies that are quickly filled not by new neighbors, but by weekend visitors. In New York City, before the enforcement of Local Law 18 in 2023 and 2024, this churn was rampant. While the city has since cracked down, reducing listings by over 90% by early 2025, the underground market persists. Tenant advocates report that landlords in the outer boroughs continue to withhold lease renewals, gambling that the fines for illegal short term rentals are merely a cost of doing business compared to the potential profits.

The trajectory for 2026 remains grim for renters in tourist heavy hubs. As global travel rebounds fully to pre pandemic levels, the incentive to displace long term tenants grows. The data is clear: for every unit converted to a short stay rental, a local family is pushed into an increasingly expensive and shrinking housing market. Whether through the Ellis Act in California, bad faith “family use” claims in British Columbia, or simple lease expirations in Lisbon, the mechanism varies but the outcome is identical. Housing is being consumed by tourism, and residents are being asked to pay the price with their homes.

The ‘Ghost Hotel’ Phenomenon: Hollowed Out Neighborhoods and Loss of Community

Walk through the historic Alfama district of Lisbon or the Gothic Quarter in Barcelona after sunset in 2025. You might expect the hum of domestic life, such as televisions glowing through curtains or residents chatting on balconies. Instead, you encounter a distinct silence. This quiet is occasionally broken by the rattle of suitcase wheels on cobblestones. You are standing in a “Ghost Hotel.” These are not traditional accommodations but rather residential buildings where permanent inhabitants have been systematically replaced by a revolving door of transient tourists. This shift represents the most aggressive phase of the housing crisis driven by vacation platforms.

The term describes entire apartment blocks dedicated solely to visitors. Unlike the early promise of the sharing economy, which pitched the idea of renting a spare room, the data from 2020 to 2026 reveals a starkly different reality. By 2024, Inside Airbnb reported that in major tourist capitals, the majority of listings were entire homes rather than private rooms. Professional hosts, often corporate management firms, controlled vast portfolios of twenty or more properties. The romantic notion of a local host earning extra pocket money has largely vanished.

The Data on Displacement

New York City provided the most definitive case study on this issue between 2023 and 2024. Officials implemented Local Law 18 in September 2023, which effectively banned unhosted rentals for stays under 30 days. The immediate aftermath exposed the scale of the Ghost Hotel issue. Before enforcement, the city hosted roughly 22,000 listings. By early 2024, the number of legal and registered hosts plummeted to roughly 3,000. This massive delta proved that tens of thousands of units had been withheld from the long duration rental market, acting instead as illegal hotel rooms scattered across residential zones.

Short Term rental Crisis Data

In Europe, the statistics are equally alarming. Data from 2023 showed that rents in Lisbon skyrocketed by over 30 percent compared to the previous year, a surge attributed to the scarcity of supply. Landlords found they could earn the equivalent of a month of residential rent in just four days of tourist occupancy. Consequently, evictions rose. Families who had lived in downtown cores for generations were pushed to the periphery, leaving behind sterile districts that lack the social fabric of a true community.

Erosion of Community Infrastructure

The transition from homes to Ghost Hotels dismantles the local ecosystem. When a building loses its permanent residents, the neighborhood loses its customer base for essential services. By 2025, cities like Florence and Athens saw a decline in butchers, bakers, and hardware stores. They were replaced by luggage storage facilities, souvenir shops, and cafes catering exclusively to brunch crowds. The demographic shift is palpable. Schools in central districts of Paris and Venice have faced closures and mergers throughout the early 2020s because there are simply not enough children living nearby to fill classrooms.

Security and safety also suffer. In a standard apartment complex, neighbors know one another. They notice when something is amiss. In a Ghost Hotel, anonymity is the rule. The constant churn of strangers accessing the building via lockboxes creates security vulnerabilities. Residents remaining in these mixed use buildings often report excessive noise, waste mismanagement, and a general sense of unease in their own hallways.

The 2026 Outlook

As we move through 2026, the battle lines have hardened. While cities like Barcelona have pledged to eliminate all tourist flats by 2028, the market has adapted. Corporate landlords are now pivoting to “mid length” stays of 31 days or more to bypass regulations while still charging premium rates that locals cannot afford. The Ghost Hotel has not disappeared; it has merely evolved. Without strict global regulation and aggressive tax disincentives for vacant homes, the heart of our most beloved cities will continue to beat only for those just passing through.

Corporate Consolidation: The Rise of Institutional Investors and Multiple Unit Hosts

By early 2026, the romantic notion of the “sharing economy” had effectively vanished from the global housing market. What began a decade prior as a way for homeowners to earn extra income from a spare room has mutated into a sophisticated, high yield asset class dominated by corporate entities. The period between 2020 and 2026 marked a definitive shift where the amateur host was systematically replaced by professional management companies, private equity firms, and “mega hosts” controlling vast portfolios of residential property.

Data from the past six years paints a stark picture of this consolidation. In 2020, single property owners still made up a significant portion of the market. However, the post pandemic travel boom of 2021 and 2022 accelerated a professionalization wave. By 2024, AirDNA data revealed that hosts with twenty or more listings generated the majority of revenue in key markets like New York, London, and Lisbon. These were not individuals renting out a second home; they were limited liability companies and property management firms operating distributed hotels without the regulatory oversight of traditional hospitality.

The impact on local housing supply was immediate and devastating. In Kissimmee, Florida, which consistently ranked as the US city with the highest concentration of vacation rentals, entire subdivisions were constructed solely for the purpose of transient lodging. This effectively removed thousands of units from the residential stock available to local workers. A similar pattern emerged in European capitals. In Lisbon, where real estate prices soared by 70% leading up to 2024, the displacement of residents became so acute that the municipality was forced to ban new registrations in historic districts. Yet, corporate operators simply moved their capital to emerging neighborhoods, continuing the cycle of gentrification and displacement.

The trend reached its apex in 2025, a year characterized by aggressive acquisition strategies from institutional investors. With interest rates stabilizing, private equity firms and hedge funds began purchasing single family homes at an unprecedented rate, explicitly for conversion into short stay rentals. In the first quarter of 2025 alone, investors purchased nearly 27% of all single family homes sold in the United States. This buying spree was most concentrated in the Sun Belt, where affordable housing stock was snapped up in bulk, repackaged as high yield rental portfolios, and managed by algorithmic pricing software that maximized revenue at the expense of community stability.

The sheer scale of this corporate takeover forced a historic federal intervention. On January 20, 2026, the US government signed an Executive Order aimed at “Stopping Wall Street from Competing with Main Street Homebuyers.” This directive sought to ban large institutional investors from acquiring single family homes for the purpose of rental conversion. While the long term effects of this 2026 policy remain to be seen, its very existence acknowledges the severity of the crisis. The housing market had been fundamentally broken by a model that prioritized transient tourism revenue over the basic need for shelter.

As we move further into 2026, the landscape of local housing is irrevocably altered. The “mom and pop” host is now a statistical anomaly, overshadowed by a mechanized industry of asset management. Cities are no longer just destinations; they are battlegrounds between the capital of global investors and the survival of local communities. The corporate consolidation of the short term rental market stands as the primary driver of this conflict, having successfully monetized the neighborhood unit into a tradable commodity.

Financializing Housing: STRs as Speculative Investment Assets

The romantic myth of the short term rental host offering a spare bedroom to a weary traveler has largely evaporated. By 2024, the sector had mutated into a sophisticated asset class, attracting wall street capital and turning residential neighborhoods into high yield trading floors. This process, often termed the financialization of housing, treats shelter not as a human necessity but as a speculative vehicle for maximizing returns. Between 2020 and 2026, this shift aggressively detached local housing prices from local wages, creating a crisis where homes are valued based on their potential global tourism revenue rather than their utility for residents.

Data from the first quarter of 2024 revealed that investors purchased nearly 15 percent of all homes sold in the United States. In specific vacation heavy markets, this figure was significantly higher. For instance, in parts of the Sun Belt and coastal regions, investor activity accounted for over a third of transactions. These buyers were not looking for primary residences; they were acquiring cash flow engines. The distinction between a home and a hotel blurred as entities like Saluda Grade partnered with management firms such as AvantStay to institutionalize the vacation rental market. This trend signaled a departure from individual ownership toward portfolio management, where algorithms determine pricing and acquisition strategies based on projected average daily rates rather than neighborhood comparable sales.

The impact of this speculation became evident in the housing inventory crunch of 2025. As institutional players and wealthy individuals aggregated properties, the supply available for long term residents plummeted. AirDNA reported in its 2026 outlook that short term rental supply was accelerating in coastal and urban markets, with supply growth in coastal areas hitting 4.5 percent in 2026, up from 3.7 percent the previous year. This growth occurred even as traditional housing inventory remained historically tight. Investors effectively removed these units from the residential market, converting them into dedicated tourist accommodation. The result was a scarcity premium that drove up rents and purchase prices for locals who could not compete with the purchasing power of corporate backed entities.

The “Airbnb arbitrage” phenomenon further exacerbated this dynamic. Speculators leveraged data analytics platforms like AirDNA and Mashvisor to identify neighborhoods where the gap between long term rental income and short term rental revenue was widest. In 2023 and 2024, the yield premium for short term rentals sat between 300 and 500 basis points above long term leases. This financial incentive spurred a rush of capital into affordable neighborhoods, gentrifying them at a pace that displaced long standing communities. The logic was simple: why rent to a local family for 2,000 dollars a month when a tourist will pay 200 dollars a night?

By early 2026, the market witnessed the consolidation of this asset class. Blackstone, having acquired Tricon Residential, and other private equity giants signaled a broader interest in residential real estate that, while often focused on long term rentals, created a pressure cooker effect on overall housing stock. MetLife Investment Management projected that institutional investors could control 40 percent of the single family rental market by 2030. While not all of these are short term rentals, the overlap in resort markets is undeniable. The commodification of housing stocks meant that a home in Nashville or Barcelona was no longer competing just with other homes in the city but with investment opportunities in stocks, bonds, and crypto. Housing became a line item on a balance sheet, optimized for extraction.

The consequences for local economies have been severe. In cities like New York, the enforcement of Local Law 18 in late 2023 attempted to curb this financialization by banning unregistered rentals. Yet, in many unregulated markets, the damage was already done. The influx of speculative capital created a price floor that local wages could not breach. When housing is priced for the global tourist economy, the local service worker, teacher, and artist are inevitably priced out. The years 2020 through 2026 demonstrated that without strict regulatory guardrails, the invisible hand of the market will naturally steer housing away from shelter and toward speculation, leaving hollowed out neighborhoods in its wake.

The Digital Nomad Factor: Remote Work and the Global Competition for Local Housing

The 2020 pandemic triggered a seismic shift in global travel, birthing a new demographic that operates unlike any tourist class before it. This is the era of the digital nomad, a group defined not by where they visit, but by where they choose to exist temporarily. By 2024, the United States alone saw its population of digital nomads swell to 17.3 million, a staggering increase from just 7.3 million in 2019. Unlike traditional vacationers who occupy hotels for a week, these remote workers embed themselves in residential neighborhoods for months, armed with strong currencies and a demand for high speed internet.

This migration has turned local housing markets into global bidding wars. Data from 2023 and 2024 reveals a distinct correlation between popular remote work hubs and skyrocketing rents. The core issue is the conversion of long stay residential inventory into “medium stay” units. Landlords, eyeing the lucrative nomad dollar, prefer renting to a remote worker for three months at $2,500 a month rather than a local family for twelve months at $1,000. In the first quarter of 2024, Airbnb reported that stays of 28 days or longer accounted for roughly 17 percent of its total gross nights booked, a structural shift from pre 2020 levels.

The Lisbon Effect: A Case Study in Displacement

Few cities illustrate this crisis as starkly as Lisbon. Once an affordable European capital, it became the poster child for nomad gentrification. Between 2021 and 2024, rents in central Lisbon surged by over 65 percent. The arrival of thousands of remote workers, incentivized by specific visa programs, created a dual market: one for locals earning Euro wages and another for transients earning dollars or pounds.

Real estate platform Flatio reported in mid 2024 that nomad reservations in Portugal were still climbing. While some rental prices on their specific platform dipped slightly, the broader market remained inaccessible to locals. A 2025 investigative report noted that foreign buyers in Lisbon were paying on average 82 percent more per property than domestic buyers. This disparity sparked intense public backlash. On April 20, 2024, protests erupted across tourist hotspots under the banner “The Canaries have a limit,” echoing sentiments in Lisbon where locals demanded an end to housing financialization.

Mexico City and the “Shadow Hotel” Economy

In the Americas, Mexico City faces a parallel emergency. The influx of remote workers into neighborhoods like La Condesa and Roma transformed them into what activists call “shadow hotels.” By late 2023, average monthly rents across the city had jumped from $880 in 2020 to $1,080, with premium districts seeing hikes of nearly 40 percent. In these areas, the local bakery becomes a laptop friendly cafe, and the family apartment becomes a corporate rental.

“We are not against immigrants. We are against a system that lets wealth dictate who belongs.” — Sentiment from the 2025 Anti Gentrification Front protests in CDMX.

The displacement mechanics are swift. In 2023 alone, the issuance of temporary resident permits to U.S. nationals in Mexico nearly doubled compared to 2019 figures. The market responded aggressively. Listings on rental platforms shifted en masse to accommodate these longer stays, effectively removing thousands of units from the permanent housing stock. By August 2024, the situation forced the local government to implement rent caps pegged to inflation, though enforcement remains a challenge in a market dominated by informal agreements.

The 2026 Outlook

Looking ahead, the pressure is projected to intensify. Global estimates suggest the digital nomad population could reach 60 million by 2030. Without robust policy intervention, the competition for “turnkey” housing will continue to push local residents to the periphery. The data from 2020 to 2026 paints a clear picture: when housing becomes a global asset class optimized for the mobile workforce, the local community loses its foothold.

Zoning Conflicts: The Legal Battle Over Residential vs Commercial Usage

The distinction between a home and a hotel was once clear. One was for living; the other was for visiting. By 2024, that line had vanished, erased by platforms that monetized every spare bedroom and vacant apartment. Now, cities globally are engaged in fierce legal conflicts to redraw that line. This section investigates the zoning battles defining the current era of housing policy, where municipal codes clash with property rights and platform capitalism.

At the heart of these conflicts lies a single question: Is a house used exclusively for transient visitors still a residence, or has it become a commercial enterprise? For years, operators argued that renting out a home for a few days was merely a modern property right. City planners and housing advocates now argue the opposite. They claim that when a unit is removed from the permanent housing market to serve tourists, it functionally becomes a hotel, violating residential zoning laws.

New York City: The Enforcer

New York City serves as the primary example of strict regulatory enforcement. In September 2023, the city implemented Local Law 18, a strict ordinance requiring hosts to register with the city and prohibiting stays of under 30 days unless the host is present. The impact was immediate and quantifiable.

Data Focus: By mid 2024, the number of transient listings in NYC plummeted by over 80 percent, dropping from roughly 22,000 to under 4,000. While hotel prices surged, the intent was to return units to the residential stock. However, rent prices in Manhattan still rose by 0.5 percent to 3 percent in the following year, suggesting that while the ban stopped tourist flow, it was not a silver bullet for affordability.

The legal fallout in New York established a massive precedent. In August 2023, a judge dismissed a lawsuit from a major booking platform, affirming the right of the city to regulate its housing stock. This victory empowered other municipalities to pursue similar aggressive bans. Yet, enforcement birthed a shadow market. By 2025, underground listings on social media groups like Facebook and WhatsApp surged, bypassing official platforms to evade detection.

The Southern Standoff: Dallas and New Orleans

While New York successfully purged listings, other cities faced prolonged litigation. In Dallas, Texas, a ban on tourist rentals in single family neighborhoods was approved in June 2023 but immediately blocked by legal injunctions. Operators sued, arguing that the city was infringing upon their vested property rights and that the ban was unconstitutionally vague.

In August 2025, a Texas appeals court dismissed a motion by the city to lift the injunction, allowing operators to continue business as usual while the case moved slowly toward the state Supreme Court. The Dallas conflict highlights the difficulty of retroactively applying zoning laws to activities that were previously tolerated.

Conversely, New Orleans secured a major victory in September 2025. A federal judge dismissed a lawsuit from a major platform, upholding strict new rules that limited licenses to one per square block. The court ruled that there is no fundamental right to rent out residential property on a transient basis. However, an appeals court later struck down a provision banning LLC ownership, complicating the enforcement landscape. Corporate entities could still hold permits, provided they followed the strict density limits.

The Nuclear Option: Barcelona

Across the Atlantic, Barcelona took the most extreme measure available. In June 2024, the mayor announced a plan to eliminate all tourist apartments by November 2028. The city intends to revoke all 10,000 existing licenses, effectively wiping out the sector to combat soaring rents and overtourism. In 2025, the Constitutional Court of Spain validated the authority of the city to prioritize residential use over commercial tourism, setting the stage for a total ban by 2029.

The era of the “wild west” rental market is over. From 2020 to 2026, the narrative shifted from innovation to regulation. Zoning laws, once dusty bureaucratic codes, are now the weapon of choice for cities desperate to protect their housing supply. Whether through total bans like in Barcelona or strict registration schemes like in New York, the legal consensus is solidifying: housing is for residents, not investors.

Enforcement Paralysis: Why Municipalities Struggle to Police Illegal Listings

For city officials across the globe, the battle against illegal vacation rentals has mutated into a digital game of whack a mole. As major metropolitan areas attempt to reclaim housing stock from the tourism sector, they face a sophisticated wall of data obfuscation, legal attrition, and resource exhaustion. While the headlines from 2020 to 2026 promised a crackdown, the reality on the ground reveals a systemic failure to enforce the rules effectively.

The Data Cloak

The primary weapon used by platforms to evade regulation is the obscuring of location data. Until a booking is confirmed, most platforms only display a vague circle indicating the general neighborhood of a property. For enforcement officers, this means they cannot easily match a listing to a specific physical address without booking the unit themselves. This “data cloak” prevents automated scraping tools from identifying illegal operators.

“In New York City, the implementation of Local Law 18 in late 2023 forced a massive drop in Airbnb listings, falling from over 21,000 to under 4,000 by the middle of 2024. Yet, a shadow market immediately surged on Craigslist and Facebook Marketplace, where data transparency is even lower.”

When cities demand raw user data, platforms often respond with litigation, citing user privacy or the Electronic Communications Privacy Act. This stalls enforcement for years. In 2024, officials in Florence found their ban on new tourist lets in the historic center overturned by a regional court, proving that even clear municipal intent can be dismantled by complex legal challenges.

The Resource Gap

Enforcement requires immense resources that few cities possess. New York City maintains a dedicated Office of Special Enforcement with a multimillion dollar budget, allowing them to verify registrations and penalize violators. In contrast, smaller destination towns lack the staff to audit thousands of listings. A 2025 report from the Spanish Ministry of Consumer Rights highlighted that while they successfully flagged 65,000 illegal listings, the administrative burden of processing these violations overwhelmed local courts.

Without advanced software to monitor compliance, inspectors are left to manually scour websites, a task that is mathematically impossible given the scale of the market. Platforms know this. They rely on the assumption that municipalities cannot afford the chase. When fines are issued, they are often viewed as merely the cost of doing business. In late 2025, Spain fined a major platform 64 million euros, a headline grabbing figure that nonetheless represented a fraction of the revenue generated by those listings over the previous decade.

The Black Market Pivot

The rigorous registration systems introduced between 2023 and 2025, such as the national CIN code in Italy, forced many hosts off the main platforms. However, this did not return units to the residential market as hoped. Instead, it pushed the trade underground. Data from 2026 suggests a rise in direct booking websites and private WhatsApp groups where hosts vet guests personally, bypassing municipal oversight entirely. These “ghost hotels” operate without paying tourist taxes or adhering to safety standards, yet they remain invisible to regulators.

A Broken Feedback Loop

The paralysis is compounded by a lack of reciprocity. Cities supply platforms with lists of prohibited buildings or unlicensed addresses, but the removal of these listings is often slow or incomplete. In Barcelona, which announced an ambitious plan to eliminate all tourist apartments by 2028, officials reported that listings removed one week would frequently reappear the next under slightly modified names or new host profiles. This endless cycle drains morale and public funds, leaving residents to wonder if the laws on the books are merely decorative.

As we move through 2026, the consensus among urban planners is clear: without direct access to platform databases and the legal authority to hold tech companies liable for every unverified listing, municipal enforcement will remain a costly, ineffective struggle. The laws are strict, but the digital loopholes are wider.

The Black Market: Data Obfuscation and Underground Rental Networks

The sleek interface of a vacation rental app offers a sanitized view of the housing market. Users see verified photos, star ratings, and cheerful host profiles. Yet below this glossy surface lies a vast, murky ocean of shadow inventory. As cities tighten regulations to save local housing stock, a sophisticated black market has emerged. Data from 2020 to 2026 reveals a systemic shift where thousands of illegal units have not disappeared but simply vanished from public view, moving into encrypted chats and private networks.

New York City provides the clearest case study of this migration. Following the strict enforcement of Local Law 18 in September 2023, the official number of short term rentals plummeted. By 2025, the Office of Special Enforcement reported only 3,000 active legal registrations, a fraction of the 38,000 listings active just two years prior. On paper, this looked like a victory for housing advocates. In reality, the market fractured. Investigations reveal that while Airbnb purged noncompliant listings, the demand did not evaporate. It moved underground.

The Great Data Vanishing Act

Platforms often claim cooperation with cities, but their data transparency is frequently an illusion. In March 2024, one major platform announced the removal of 100,000 “low quality” listings. While framed as a quality control measure, housing analysts suggest this purge conveniently scrubbed illegal inventory just ahead of tighter European Union reporting requirements. Inside Airbnb, a watchdog group, has long documented such anomalies. Their reports highlight how commercial operators control clusters of apartments, using multiple fake host profiles to evade detection.

A common obfuscation technique involves “listing cycling.” A host creates a listing, books it fully for a season, and then deletes it before regulators can scrape the data. The unit generates revenue without ever appearing in a quarterly government report. In Barcelona, where the mayor announced a total ban on tourist apartments by 2028, inspectors found that 43 percent of rentals lacked proper registration as of mid 2025. These ghost units exist in a digital limbo, visible only to those with the right link.

Social Media as the New Marketplace

The most significant development from 2023 to 2026 is the migration of illegal inventory to social media. Facebook groups and WhatsApp communities have replaced the open market for thousands of operators. In groups with innocuous names like “Travel Lovers NYC” or “Barcelona Stay,” hosts post photos of apartments that are illegal to rent on major platforms. Transactions happen via Venmo or PayPal, completely bypassing municipal tax collection and safety inspections.

Investigative scrapes of these private groups show a thriving economy. In 2024, a single private Facebook group for “Direct Holiday Rentals” grew by 200 percent. Hosts explicitly advertise “no service fees” and “no registration needed,” signaling their noncompliant status to savvy travelers. This peer to peer shadow economy creates a regulatory blind spot. City officials can scrape public websites, but they cannot easily infiltrate thousands of private, encrypted group chats.

Cybercrime and Digital Keys

The underground market has also attracted a darker element. A 2023 cybersecurity report by SlashNext exposed a marketplace for stolen host credentials. Cybercriminals purchase session cookies to hijack legitimate accounts, listing nonexistent properties to scam tourists. Furthermore, the lack of platform oversight in the shadow market means physical safety protocols are nonexistent. Without the digital trail provided by a central platform, guests in illegal units have no recourse if they encounter hidden cameras or unsafe conditions.

The Whack a Mole Reality

As 2026 approaches, the data suggests that enforcement is merely pruning the visible branches while the roots grow deeper. The 9,700 illegal apartments closed by Barcelona since 2016 represent only the units that were caught. For every unit returned to the residential market, another likely shifts to the shadow economy, rented out via direct message to a friend of a friend. The crisis is no longer just about tourism displacing residents; it is about a parallel housing market that operates entirely outside the law, invisible to the state and lucrative for the operators who know how to hide.

Case Study: New York City Local Law 18 and the Fight for Regulation

The battle for the soul of New York City housing entered a volatile new phase in September 2023. For years, housing advocates had argued that platforms like Airbnb were draining the supply of permanent homes, converting apartments into lucrative tourist lodgings. The solution proposed by city officials was Local Law 18, also known as the Short Term Rental Registration Law. This legislation was not merely a new set of rules; it was a total blockade designed to crush the illegal rental market. By 2026, the data from this aggressive experiment offers a stark lesson on the complexities of regulating the digital economy.

The Great Purge of 2023

The implementation of Local Law 18 triggered an immediate and massive contraction in the market. In August 2023, just before enforcement began, data showed approximately 22,000 short term listings across the five boroughs. By May 2024, that number had collapsed. Only about 4,000 listings remained, representing an 82 percent drop in less than a year. The Office of Special Enforcement, led by Christian Klossner, successfully pressured platforms to block unregistered hosts. The law required hosts to be present during stays and limited guest capacity to two people, effectively banning the “entire apartment” rentals that tourists preferred.

This purge was intended to return units to the long duration housing stock. However, the transition was far from smooth. While thousands of listings vanished from major platforms, they did not immediately flood the rental market for local tenants. Instead, a significant portion of the inventory entered a legal gray zone or shifted to underground channels.

Unintended Consequences: The Hotel Monopoly

With affordable vacation rentals wiped off the map, the hotel industry found itself in a position of unrivaled dominance. Travelers who once relied on cheaper Airbnb options were forced into the traditional hospitality sector. The economic impact was swift. By late 2024, the average daily rate for a hotel room in New York City had surged. Reports from May 2025 indicated that the 12 month average nightly rate had reached a record $320. During peak seasons, some data showed average daily rates climbing as high as $524, a staggeringly high figure that priced out many middle class visitors.

Critics argued that the legislation inadvertently gifted a monopoly to hotel operators without securing the promised relief for renters. The anticipated drop in housing costs failed to materialize in the way proponents had hoped.

The Rent Paradox

The core promise of Local Law 18 was that banning short term rentals would alleviate the housing crisis. Yet, data from 2024 and 2025 revealed a troubling paradox. Despite the eradication of nearly 20,000 tourist listings, rents in New York City continued to climb. In May 2025, the median rent in Manhattan surpassed $4,000 per month for the first time in history. Vacancy rates remained stubbornly low, showing little change from the period prior to regulation.

Housing analysts pointed out that short term rentals had constituted less than 1 percent of the total housing stock. The removal of these units was a drop in the bucket compared to the broader structural issues of supply and demand. The narrative that tourism was the primary driver of high rents began to crumble under the weight of the 2025 data, which showed rent growth in New York outpacing comparable cities that had not enacted such strict bans.

The Rise of the Black Market

By early 2026, a new challenge had emerged: the shadow market. While Airbnb and Vrbo complied with the registration system, the demand for short stays did not disappear. It merely moved underground. Listings migrated to platforms like Facebook Marketplace, Craigslist, and encrypted messaging apps, where verification was nonexistent. An investigation in 2025 found that nearly 20 percent of supposedly compliant hosts were finding ways to circumvent the rules, while completely unregulated operators thrived outside the view of the Office of Special Enforcement.

The New York experiment serves as a cautionary tale. While the city successfully reclaimed control over its housing inventory on paper, the tangible benefits for residents remain elusive. The legislation succeeded in curbing the platforms but failed to solve the affordability crisis, leaving New Yorkers with record high rents and a tourism economy dominated by expensive hotels.

Case Study: Barcelona and the Struggle Against Overtourism

The image was visceral and went viral instantly: diners on a sunny terrace in Barcelona being sprayed with water pistols by local protesters. It was July 2024, and the message from the residents was clear. They were not just annoyed; they were desperate. This moment marked a turning point in the global conversation about urban tourism, shifting the narrative from economic benefit to social survival. For Barcelona, a city of 1.6 million residents that hosted over 26 million visitors in the broader region during 2024, the situation had become untenable.

Mayor Jaume Collboni responded with a decree that sent shockwaves through the global vacation rental industry. In June 2024, he announced that the city would revoke the licenses of all 10,101 tourist apartments by November 2028. Unlike other cities attempting to cap or limit nights, Barcelona chose total elimination. The goal was simple: return that housing stock to the locals. The administration argued that the social contract had broken. With rents rising by 68% over the previous decade and purchase prices climbing 38% in the same period, the working class could no longer afford to live in their own city.

Data from 2020 to 2026 reveals the severity of the housing emergency that precipitated this ban. While the pandemic caused a temporary dip in visitor numbers, the rebound was aggressive. By September 2025, the average property price per square meter in central districts had surged to €4,661, marking a rise of nearly 50% since 2020. The rental market suffered an even more dramatic contraction. Between December 2020 and early 2025, the supply of available residential rentals in Barcelona plummeted by 84%, while rental prices soared by 62%. The proliferation of holiday lets meant that for every unit removed from the residential market for tourists, the remaining supply for locals became scarcer and more expensive.

The industry pushback was immediate. Apartur, the association representing tourist apartment owners, argued that their units comprised only 0.77% of the total housing stock and that banning them would not solve the crisis. They labeled the move as forced expropriation and warned of a black market explosion. However, local housing groups countered that in specific neighborhoods like the Gothic Quarter, the concentration of tourist lodgings was far higher, effectively hollowing out entire communities and turning historic districts into theme parks where no locals remained.

As 2025 progressed, the tension only heightened. Spain welcomed a record 44.5 million international tourists in just the first half of the year, a 14% increase from 2024. This influx brought undeniable wealth, contributing significantly to the GDP, yet the distribution of this wealth remained a point of contention. The “quality over quantity” tourism strategy touted by officials struggled to materialize on the streets, where congestion and noise continued to fuel resentment. The 2028 deadline now looms as a definitive experiment in urban planning. Cities from Lisbon to New York are watching closely. If Barcelona succeeds in reclaiming its housing inventory without crashing its economy, it may well set the blueprint for the future of urban travel. If it fails, it will serve as a stark warning that perhaps the genie of mass tourism cannot be put back in the bottle.

Case Study: Rural Towns and the Erasure of Workforce Housing

The narrative of the housing crisis often centers on dense urban cores, yet a more aggressive and invisible displacement is occurring in rural America. Between 2020 and 2026, small towns that once relied on a stable seasonal workforce saw their housing stock systematically converted into short term rental inventory. This process has not merely increased rents; it has erased the very category of workforce housing, forcing teachers, firefighters, and service workers to live in vehicles or commute across county lines. This section examines the mechanics of this erasure through two distinct archetypes: the mountain resort and the high desert boomtown.

The Hollow Mountain: Steamboat Springs, Colorado

Steamboat Springs serves as a grim warning of what happens when a community prioritizes tourism revenue over labor stability. By 2024, the town faced a paradox: record tourism numbers alongside a labor shortage so severe that businesses curtailed hours. The root cause was a housing market that had ceased to function for locals. Data from the Yampa Valley Housing Authority revealed that for decades, demand for workforce housing had outpaced supply, but the acceleration between 2020 and 2023 was unprecedented.

“There is not a day that goes by that I do not hear from someone that they have to move because they cannot afford rent. It is crushing our community.” — Heather Sloop, Steamboat Springs Council Member.

In a pivotal moment in March 2024, residents voted on the annexation of Brown Ranch, a project designed to add over 2,200 units of workforce housing. Despite the dire need, the measure failed. This rejection, fueled by concerns over density and infrastructure costs, effectively sealed the town’s fate as a luxury preserve. Meanwhile, the short term rental market continued to thrive. Although the city passed a ban on new short term rentals in most residential zones in 2022 and voters approved a 9% tax on them, the damage was already entrenched. The existing stock of affordable long term rentals had already been flipped. By 2025, reports indicated that the “hollowing out” of the middle class in Routt County was near total, with the 25 to 45 age demographic seeing the fastest decline.

The Desert Mirage: Joshua Tree, California

While Steamboat Springs represents a regulatory battleground, Joshua Tree illustrates the volatility of an unregulated boom. During the pandemic, this quiet desert community became a haven for remote workers and investors. By 2021, an estimated 33% of the entire local housing stock had been converted into short term rentals. This massive reallocation of shelter drove monthly rents from manageable levels to between $1,800 and $4,000, figures entirely disconnected from the local service economy wages.

The turning point arrived in 2025, but not in the way locals hoped. A market “bust” occurred as oversaturation led to a collapse in booking revenues for hosts. In April 2025, active listings for sale surged to historic highs as amateur investors tried to offload unprofitable properties. However, this did not result in a return to affordability. The data shows a “sticky” price floor; while median home prices dipped slightly to around $385,000, they remained far above the purchasing power of long term residents. The housing stock did not return to the workforce; it sat empty or was purchased by institutional buyers waiting for the next cycle. The community was left with the wreckage: a displaced population and neighborhoods comprising empty vacation homes.

The Mechanics of Erasure

The crisis in these towns is driven by a simple arbitrage mechanism that policymakers struggled to contain between 2020 and 2026:

- Yield Disparity: A property earning $2,500 a month as a long term rental could earn $6,000 as a short term rental. This gap made evicting long term tenants a rational financial decision for landlords.

- Regulatory Lag: In Lake Placid, New York, effective regulations capping permits did not arrive until 2023 and 2024. By then, the “gateway corridor” and commercial districts had already absorbed significant housing capacity, and unhosted permits in residential areas were grandfathered in, preserving the displacement.

- Shadow Inventory: Official counts often underreport the problem. In Park County, Colorado, 2025 assessments showed that short term rentals were tightening the market not just by their presence, but by inducing speculative pricing on all surrounding properties.

As we move through 2026, the data suggests that rural workforce housing is not merely expensive but extinct in prime tourism zones. The short term rental industry has successfully decoupled local housing costs from local wages, creating an economic environment where the only people who can afford to sleep in these towns are the ones visiting them.

The Service Economy Crisis: When Service Workers Can No Longer Afford to Live Near Work

The coffee shop on the main street of Steamboat Springs, Colorado, should be bustling. It is peak ski season in early 2025, and fresh powder has drawn thousands of visitors willing to pay premium rates for lift tickets and lodging. Yet the shop is closed. A handwritten sign taped to the glass offers a blunt explanation. It reads: “Closed due to staffing shortage. No one can afford to live here.”

This scene is not unique to the American West. It is playing out in Barcelona, Maui, and Cornwall. We are witnessing a paradox where the tourism industry is slowly cannibalizing the very infrastructure it relies upon. The service economy, the backbone of any tourist destination, is fracturing under the weight of housing costs driven by the explosive growth of vacation rentals.

The Math of Displacement

The numbers from 2020 to 2026 paint a stark picture of displacement. As property owners converted long term leases into nightly rentals on platforms like Airbnb and Vrbo, the inventory for local workers evaporated. In Steamboat Springs, the median monthly rent hit 4,000 dollars by 2024. For a service worker earning 20 dollars an hour, housing alone consumes nearly all their pretax income. The city manager even admitted to CBS News in 2024 that the town could not hire a human resources director despite offering a six figure salary because the candidate could not find housing.

Across the Atlantic, the situation in Barcelona reached a boiling point in 2024. Mayor Jaume Collboni announced that rents had surged 68 percent over the past decade. The average tenant in the Catalan capital was spending 40 percent of their income on rent by 2025. This is far above the European average of 27 percent. The culprit was clear to local officials. More than 10,000 apartments were removed from the residential market to serve tourists. In response, the city announced a plan to ban all tourist apartments by November 2028, a radical attempt to reclaim the city for its workforce.

The Rent Gap (2020 to 2025 Data):

- Steamboat Springs, USA: Home prices rose 71 percent from 2019 to 2022.

- Lake Tahoe, USA: 76 percent of locals pay over 30 percent of income on housing.

- Barcelona, Spain: Rents up 68 percent in ten years; 10,101 tourist flats targeted for closure.

- Hawaii, USA: 85 percent of residents in 2025 stated there are not enough affordable homes.

Living in the Shadows of Paradise

When workers cannot afford walls and a roof, they find other ways to survive. In Hawaii, the disparity between the luxury resort experience and the reality of the staff is jarring. A 2025 report revealed that hotel management companies on the islands were resorting to housing staff in shipping containers because traditional housing was nonexistent. These essential workers, who maintain the pristine image of paradise for guests paying 1,000 dollars a night, end the day in metal boxes.

The “ALICE” threshold (Asset Limited, Income Constrained, Employed) tracks households that earn above the poverty line but cannot afford basic necessities. In Hawaii, 38 percent of workers in the top twenty most common occupations lived below this threshold in 2024. Wait staff, housekeepers, and drivers are essentially financing the tourism industry with their own poverty.

The Ghost Town Effect

The economic feedback loop is vicious. When a town displaces its workforce, the quality of the visitor experience degrades. Restaurants reduce hours. Hotels leave rooms uncleaned. Ski lifts spin empty. This is the “Ghost Town” effect. Neighborhoods that once housed families and workers become hollow shells, occupied only by transient visitors or standing empty during the off season.

In 2026, we are seeing the first major wave of regulatory backlash. Spain introduced the NRUA code system in 2025 to crack down on illegal listings, while the European Union has noted that short term rentals nearly doubled between 2018 and 2024, prompting new legislation. The argument from the vacation rental lobby is that these rentals create jobs. Yet the data suggests they displace the workers needed to fill those jobs.

“We are killing the golden goose,” said one local planner in Aspen. “We built a playground for the wealthy but forgot to build a place for the people who keep the lights on.”

The crisis of the 2020s has proven that housing is not just a commodity; it is essential infrastructure. Without affordable homes for cooks, cleaners, nurses, and teachers, the most beautiful destinations on Earth are destined to become functional failures. The service economy cannot survive when the service worker has nowhere to sleep.

Platform Accountability: Section 230, Data Transparency, and Corporate Responsibility

For over a decade, the digital economy operated under a legal shield that allowed short term rental giants to evade consequence. The crux of this defense lay in Section 230 of the Communications Decency Act, a 1996 United States law originally designed to protect nascent internet companies from liability for user content. Platforms like Airbnb and Vrbo wielded this statute as absolute immunity. They argued that illegal listings, fraudulent hosts, and zoning violations were the sole responsibility of the user, not the marketplace profiting from the transaction. This legal gray zone fueled a multibillion dollar industry while local housing markets crumbled under the weight of commercialized residential stock.

The tide began to turn between 2020 and 2024. Cities realized that fighting individual hosts was a losing battle; they needed to regulate the gatekeepers. The legislative landscape shifted when municipalities stopped targeting the “content” of the listing and started targeting the “transaction” of the booking. This pivot proved lethal to the platform defense strategy. New York City provided the most aggressive case study with Local Law 18. By enforcing strict registration requirements in September 2023, the city effectively pierced the corporate veil. The impact was immediate and statistically staggering. Data from 2024 and early 2025 revealed that short term rental listings in New York City plummeted by over 90 percent, dropping from approximately 17,000 to just 1,400 in the outer boroughs alone.

However, the investigative lens reveals a complex aftermath that platforms are quick to highlight. While the inventory vanished, the promised relief for tenants was not immediate. Median asking rents in the city actually rose by 2.1 percent between October 2023 and October 2024, while hotel prices surged by 6 percent in 2024. This data suggests that while platform accountability is a prerequisite for housing stability, it is not a silver bullet for affordability crises decades in the making.

Corporate response to this regulatory pressure has largely been performative. In 2020 and again in 2024, Airbnb touted its “City Portal” as a tool for transparency, claiming it gave officials the data needed to enforce rules. Yet, independent analysis often contradicts these claims of cooperation. A devastating report published in December 2025 regarding the Los Angeles market exposed the gap between corporate PR and street level reality. Despite the existence of enforcement tools, the study found that nearly 45 percent of active listings on major platforms in LA were likely noncompliant with local ordinances. The city collected less than $40,000 in fines during a period where potential violations could have yielded $300 million. This discrepancy highlights a persistent strategy: provide just enough data to appear cooperative while maintaining a user interface that maximizes booking volume regardless of legality.

The true death knell for the era of opacity may come from the European Union rather than the United States. In April 2024, the EU adopted Regulation 2024/1028, a sweeping framework for data collection. Unlike the voluntary and fragmented agreements of the past, this law mandates a “Single Digital Entry Point” for data sharing across all member states. By the full implementation date in May 2026, platforms will no longer hold the keys to the data kingdom. They will be legally compelled to transmit granular activity data monthly, allowing authorities to match listings against local registration databases instantly. This shift represents the end of the “black box” algorithm. It transforms platform accountability from a corporate social responsibility initiative into a rigid legal obligation.

As we move through 2026, the era of Section 230 acting as a blanket shield for housing disruption is effectively over. The data shows that when cities force transparency, the inventory of illegal hotels evaporates. The challenge for the next decade will not be piercing the corporate shield, but managing the economic ripples that follow the sudden withdrawal of the shadow hospitality sector.

Proposed Solutions: Bans, Caps, Lotteries, and Principal Residence Requirements

By the middle of this decade, city leaders worldwide realized that a passive approach to platform tourism was no longer viable. Between 2020 and 2026, a regulatory wave crashed against the shores of the vacation rental market. Authorities moved from simple taxation to aggressive intervention, deploying bans, strict duration limits, and residency mandates to reclaim housing stock. The results of these experiments offer a stark lesson in the complexity of untangling tourism from residential real estate.

The Nuclear Option: Total Bans and Strict Prohibition