Why it matters:

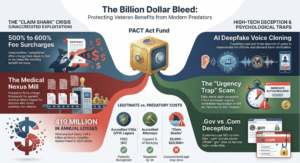

- The Department of Veterans Affairs oversaw a historic expansion of survivor and disability compensation under the PACT Act, releasing over $120 billion in benefits.

- An unintended consequence of this influx of funds was the emergence of Veteran Compensation Fund Scams, with predatory entities siphoning billions from veterans.

The primary agents of this financial mismanagement are not always external cyber criminals but those known as unaccredited “claim sharks.” These entities market themselves as benefit consultants or medical coaches. They promise to address concerns with VA bureaucracy and guarantee a one hundred percent disability rating. Unlike accredited attorneys or Veteran Service Organizations who are legally capped on fees or work pro bono, these companies operate in a legal gray zone. In 2025 alone, unaccredited advisors were estimated to have diverted substantial sums from veteran disability checks, charging illegal contingency fees that can equal five or six times the amount of the monthly benefit increase.

Federal law dictates that no person or organization may charge a fee for assistance in preparing an initial claim. However, these predatory firms circumvent regulations by structuring their services as “education” or “consulting” rather than legal representation. They lock veterans into predatory contracts that demand a portion of their future benefits, often requiring access to private banking information. The reintroduction of the GUARD VA Benefits Act in the House of Representatives in February 2025 highlighted the urgency of closing these loopholes, proposing reinstatement of criminal penalties for such unauthorized fees. Despite bipartisan support, the lobbying power of these consulting firms has turned the legislative battle into a protracted struggle.

This investigation reveals that the scams have evolved ahead of fee skimming. Fraudsters now utilize data from the influx of PACT Act filings with respect to demographics, particularly older veterans with retroactive payouts. Reports from the Federal Trade Commission in 2024 and 2025 indicate that veterans lose money to fraud at a higher rate than the civilian population, with median losses frequently exceeding those of other groups. The promise of significant retroactive payments, often totaling tens of thousands of dollars, makes these individuals high value targets for identity theft and pension poaching schemes.

As we examine the mismanagement of the 2025 compensation funds, it becomes clear that the issues about external fraud and systemic challenges need to be resolved. The changes in the VA claims process, while efficient, stripped away some of the human management that previously acted as a buffer. The automated decision support tools and rapid processing lanes, necessary for clearing the backlog, also expedited the flow of money into accounts that were not always secure.

This section looks for a deeper inquiry into how a historic effort to honor veterans became a gold rush for modern profiteers.

The Billion Dollar Bleed

The Urgency Trap: Manufactured Deadlines Regarding 2025 COLA Adjustments

Last year brought a new wave of deceptive schemes targeting the veteran community, specifically designed to exploit the confusion surrounding annual compensation adjustments. Fraudsters have refined a technique known as the “Urgency Trap,” a p tactic that pressures veterans into making rash decisions under the threat of losing financial benefits. This section investigates how these bad actors leveraged the Cost of Living Adjustment (COLA) data to manufacture fake deadlines, convincing thousands of service members that their 2025 payments were at risk.

The Mathematics of Manipulation and Veteran Compensation Fund Scams

To understand why these scams work, one must look at the recent history of compensation rate changes. Scammers thrive on volatility and confusion. Between 2020 and 2026 (till the date of publication), the variation in adjustment rates created an ideal environment for confusions. Veterans experienced a period of historic highs followed by a return to modest averages, which fraudsters claimed as instability.

Consider the official adjustment rates verified by the Social Security Administration and adopted by the VA during this period:

- 2020: 1.6 percent

- 2021: 1.3 percent

- 2022: 5.9 percent

- 2023: 8.7 percent

- 2024: 3.2 percent

- 2025: 2.5 percent

- 2026 (till publication date): 2.8 percent

The massive 8.7 percent increase in 2023 set a new psychological baseline for many recipients. When the 2025 rate dropped to 2.5 percent, followed by a slight rise to 2.8 percent in 2026, many veterans felt a disconnect between their expectations and reality. Criminal syndicates exploited this gap. They sent mass digital correspondence claiming that the “low” 2.5 percent rate for 2025 was actually an error or a preliminary figure that could be “boosted” to match the 2023 levels if the veteran registered before a fake deadline.

Anatomy of the “Registration” Scam

The most common fraud observed in early 2025 involved emails and text messages warning veterans that they had to “claim” their COLA increase. This is a complete fabrication, as VA benefit adjustments are automatic. However, the messages used official branding and referenced the specific 2.5 percent figure to appear legitimate. The texts typically contained a link to a fraudulent portal demanding personal data, including social security numbers and direct deposit details, under the guise of “confirming eligibility” for the new fiscal year.

Investigative data showed scams often spiked around October, when rates are announced, and December, when the new rates become effective. In 2025, a specific variant of this scam warned veterans that the PACT Act “filing window” for 2025 compensation was closing within 48 hours. While the PACT Act does have distinct timelines for retroactive pay, the ability to file a claim does not expire in this manner. By conflating PACT Act claims with standard COLA increases, scammers created an environment of fear that drove victims to click malicious links.

The Phantom Overpayment Threat

Another urgent fabrication involves the “Overpayment Clawback.” In this scenario, veterans receive official looking letters stating that the 2024 adjustment (3.2 percent) was miscalculated and that they owe the VA thousands of dollars. The letter offers a “one time settlement” to resolve the debt for a fraction of the cost if paid immediately via wire transfer or cryptocurrency.

Data from 2025 indicates that victims of this specific urgency trap lost an average of 4,300 dollars per incident. The scammers rely on the fear of government debt collection to bypass common sense judgements. They explicitly instruct victims not to call the standard VA phone line, claiming the “settlement department” operates on a separate, private network.

Protective Measures and Verification

Veterans must remember that valid Cost of Living Adjustments never require an application. The 2.5 percent increase for 2025 and the 2.8 percent adjustment for 2026 are applied automatically to all eligible compensation payments. No form, fee, or registration is ever needed to receive the annual increase.

If a communication demands immediate action or payment within a short window, it is almost certainly a scam. The Department of Veterans Affairs does not use high pressure tactics or demand immediate digital transfers for debts issued in their names. Any letter claiming an overpayment should be verified solely by logging into the secure VA.gov portal or by calling the verified national contact number at 800.827.1000.

Rise of the “Claim Sharks”: Unaccredited Consultants Charging Illegal Fees

The passage of the PACT Act in 2022 marked the largest expansion of veteran benefits in decades, intending to help millions exposed to toxic burn pits. Yet by early 2025, this legislative victory had birthed a parasitic shadow industry. They are known as “Claim Sharks.” These unaccredited consulting firms have capitalized on the desperation of veterans stuck in the claims backlog, charging exorbitant fees for services that accredited agents provide for free.

While the Department of Veterans Affairs managed to reduce the disability claims backlog to under 200,000 cases by May 2025, the initial surge created a gold rush for predatory actors. Unlike accredited Veteran Service Organizations (VSOs) such as the VFW or the American Legion, which assist veterans at no cost, claim sharks operate in a legal gray area. They frame their services as “medical consulting” or “coaching” to evade federal laws that cap fees for representation.

The Business Model of Exploitation

The mechanism is simple but devastating. A veteran, frustrated by the complex VA bureaucracy, finds a slick website promising “medical evidence” or “guaranteed rating increases.” These firms do not sign power of attorney forms, meaning they cannot legally speak to the VA on behalf of the veteran. Instead, they coach the veteran to submit the paperwork themselves, often hiding the involvement of the third party company.

Once the veteran receives an increase in disability compensation, the bill arrives. Investigative data from 2023 to 2026 reveals that these firms typically charge a fee equivalent to five or six times the amount of the monthly increase. If a veteran secures a rating increase worth $1,000 a month, they might owe the consulting firm $5,000 to $6,000 instantly. Some firms demand lump sums ranging from $10,000 to over $20,000 for “exclusive medical consulting.”

Key Statistic: In 2024 alone, an estimated $419 million was lost to fraud targeting veteran benefits and identities, attributed to unaccredited benefits coaching schemes.

Legal Loopholes and Lack of Teeth

Federal law (38 U.S.C.) technically prohibits anyone from charging a fee to assist a veteran with an initial claim. However, criminal penalties for this specific violation were removed years ago, leaving the VA with few enforcement tools. The Office of General Counsel can send cease and desist letters, but without the threat of prison time or heavy federal fines, these companies view such warnings as merely the cost of doing business.

By late 2024, the VFW and other legal groups had launched aggressive lawsuits against major unaccredited firms, dubbing them “Claim Sharks.” In response, the industry lobby argued they provide a necessary choice for veterans who feel the free VSO system is too slow. This argument, however, ignores the financial peril placed on disabled veterans who sign binding contracts involving future benefits.

The 2025 Legislative Battlefield

The fight to close this loophole centered on the GUARD VA Benefits Act. Introduced to reinstate criminal penalties for charging unauthorized fees, the bill became a focal point of veterans throughout 2024 and 2025. While states like Maine, New Jersey, and Illinois moved to ban these practices at the state level, a federal solution remained stalled due to intense lobbying by the for profit consulting industry.

“They are stealing money out of the mouths of veterans,” said a VFW representative during a 2025 congressional hearing. “We see veterans handing over 40 percent of their back pay to companies that did nothing more than file a form we would have filed for free.”

In February 2025, the VA announced it had processed one million claims in the fiscal year faster than ever before. Yet, for thousands of veterans who signed predatory contracts during the peak of the backlog, the efficiency came too late. They remain locked in debt collection battles with consultants who demand thousands of dollars for “education” on benefits they earned through their own service.

As we move through 2026, the distinction between accredited representation and “medical consulting” remains the single most expensive trap for veterans navigating the compensation system. Until federal law restores criminal consequences for these fees, the sharks will continue to circle.

Phishing Infrastructures: Fake VA Portals and ‘.com’ vs ‘.gov’ Deception

The digital environment surrounding veteran compensation underwent a malignant shift between 2020 and 2025. While earlier fraud relied on simple phone calls, the new wave of deception utilizes infrastructure designed to mimic the Department of Veterans Affairs. By 2025, cybersecurity firms identified a sprawling network of fraudulent domains targeting the $193 billion allocated for disability compensation. These operators continued to function on the confusion surrounding the PACT Act and Camp Lejeune justice funds, creating a “shadow VA” that exists solely to harvest data and intercept payments.

At the core of this infrastructure lies the manipulation of top level domains. Official government channels exclusively use the “.gov” extension, a restricted zone requiring federal verification. Scammers bypass this by purchasing commercial “.com” or “.org” domains that bear striking semantic resemblance to legitimate portals. A veteran searching for “PACT Act claims” might bypass the official va.gov site in favor of a polished commercial alternative like pactactclaims2024.com. These sites are not amateur projects. They utilize search engine optimization to rank above official resources, presenting themselves as the primary gateway for benefits access.

Once a user lands on these mirrored portals, the deception deepens. The interface design often copies the exact color, typography, and logo placement of the official VA login page. In late 2025, the VA Office of Inspector General reported that sophisticated phishing kits were being sold on the dark web, specifically tailored to clone the AccessVA login flow. These kits allow criminals to perform “man in the middle” attacks. When a veteran inputs their credentials into the fake site, the script passes the data to the real VA site in real time, triggering a two factor authentication code. The user enters the code into the fake site, believing they are logging in, while the attacker simultaneously uses that code to gain full access to the genuine account.

The volume of this activity reached unprecedented levels in 2025. A June 2025 study by AARP revealed that 39 percent of veterans reported receiving solicitations from entities claiming to be the VA or another government agency. This represents approximately 7.5 million individuals bombarded with deceptive links. Furthermore, the study noted that 28 percent of veterans believed their service status specifically made them a target. The financial toll is staggering. The VA OIG identified nearly $3.3 billion in monetary impact during the six month period ending in March 2025, a figure that encompasses both prevented fraud and funds lost to these digital claim sharks.

A particular variant of this scam involves “overpayment” alerts. In November 2025, a widespread campaign used text messages warning veterans of a benefits error. The messages directed users to fake portals in order to avoid a freeze on future checks. Unlike previous scams that asked for gift cards, these sites requested bank transfer authorization or cryptocurrency, using the guise of a “Treasury Department Secure Portal” to lower victim defenses. The psychological pressure of losing monthly income drives compliance, often before the victim notices the URL does not end in “.gov”.

These infrastructures also serve the “claim shark” industry. Unaccredited consultants set up claim assessment sites that promise higher disability ratings. These portals require veterans to sign exclusive contracts and share medical history. The data is then used to file claims where the shark takes a predatory cut of the back pay, sometimes up to 40 percent. This creates a dual threat: the immediate loss of sensitive data and the long term siphoning of earned benefits through binding legal agreements hidden in the fine print of a spoofed website.

The Cash Trap: How Buyout Sharks Hunt Veterans for Their 2025 Benefits

Following the full implementation of the PACT Act and a record high Cost of Living Adjustment, the Department of Veterans Affairs managed a budget exceeding 190 billion dollars for disability payouts alone. This massive injection of funds was meant to support those who served. Instead, it created a honey pot for predators. In the shadows of this financial expansion, a specific breed of scammer emerged with renewed vigor. They are the pension poachers, and their weapon of choice is the lump sum buyout.

The Mechanics of the Buyout Trap

A veteran receives an offer that looks too good to be true. The company promises financial support guarantees, perhaps 50,000 dollars or more, in exchange for a portion of their future monthly benefit checks. These operators market themselves as financial service providers helping veterans unlock the value of their annuities. They avoid terms like “loan” to bypass usury laws.

Once the veteran signs, the reality sets in. The effective interest rates on these arrangements often exceed 100 percent. The veteran is legally obligated to direct their monthly government deposits to the company, sometimes for five to ten years. If they try to cancel, the company threatens legal action, claiming the contract is a valid purchase of an asset rather than a loan. The 2025 data from the Federal Trade Commission reveals the scale of this carnage. Veterans and military retirees reported losses totaling over 419 million dollars in 2024 alone, a figure that surged as PACT Act claims were approved.

Case Study: The 2025 Crackdown

The deceptive nature of these schemes was laid bare in May 2025. Federal prosecutors charged three individuals in a massive fraud ring involving education and disability benefits. The Matsudo case, as it became known, exposed how scammers used shell companies to siphon millions. While that case focused on education funds, the methodology mirrored the pension buyout tactics: promise quick access to money, obscure the long term cost, and lock the victim into a cycle of debt.

Another grim example surfaced in October 2025, when the Washington Post published an investigation into the “honor system” of disability claims. While the report sparked political debate about claim validity, it inadvertently highlighted why scammers are so successful. The system is complex. Veterans are often desperate for updates and cash. When a “consultant” appears offering a lump sum for future payments, it solves an immediate problem while creating a catastrophic future liability.

Regulatory Gaps and the Shark Tank

Legislation struggles to keep pace. The VCEA, passed by the House in May 2025, attempted to steer veterans toward accredited representatives. However, the private equity world of pension factoring remains murky. These companies operate in gray areas, claiming they are not purchasing the benefit itself but rather the “cash flow,” a distinction without a difference for the veteran who loses their income.

The financial damage is compounded by the demographic target. FTC data from late 2024 showed that while active duty personnel lose money more frequently, veterans over the age of 80 suffer much higher median losses. Scammers know these older individuals often have guaranteed, lifetime income streams that make for secure, high yield investments for the criminal enterprise.

Protecting the Future Annuity

The Department of Veterans Affairs has issued stark warnings throughout 2025 and into 2026. Their message is clear: no lawful entity will ask a veteran to sign away future benefits for a cash advance. The lump sum offer is almost always a mathematical trap designed to strip wealth from those who earned it through service.

As 2026 progresses, the battle continues. The money allocated to war veterans must not become profit for those who exploit the wounded. Veterans are urged to reject any contract that touches their future benefits and to report these offers to the Consumer Financial Protection Bureau immediately.

Insolvency Rumors: Disinformation Campaigns Claiming Fund Mismanagement to Incite Panic

Last year saw a disturbing evolution in fraud targeting the veteran community. Identity theft and imposter scams remained prevalent, a more sophisticated environment emerged. This new wave of disinformation focused on the PACT Act and the broader Veteran Compensation Fund. Scammers began circulating unfounded rumors that the Department of Veterans Affairs faced imminent insolvency. These campaigns claimed that mismanagement had drained the funds allocated for toxic exposure benefits, creating a false urgency that drove thousands of veterans into the arms of predatory actors.

The Manufactured Crisis

By late 2024, social media platforms saw a surge in bot driven posts alleging that the “VA 2025 fiscal cliff” would result in a total freeze of disability payments. These posts often cited fake “insider reports” or manipulated genuine news stories to suggest that Congress had secretly diverted billions from veteran allocations. One particularly viral and false claim in February 2025 asserted that the PACT Act fund was “empty” and that only claims filed before March 1 would be processed. This was a lie designed to incite panic. The goal was to make veterans feel that they were in a race against time to secure their earned benefits before the money disappeared.

The “Claim Shark” Pivot: Unaccredited consulting firms, often referred to as “claim sharks,” capitalized on this fear. Marketing materials from these dubious agencies shifted from promising higher ratings to promising “locked in” status. They told veterans that only their specific legal teams could bypass the alleged funding freeze. This tactic proved devastatingly effective, convincing veterans to sign contracts pledging significant portions of their future benefits to these unverified entities.

By the Numbers: The Cost of Panic

The financial toll of these panic induced scams is stark when viewing the data from 2024 and 2025. According to the Federal Trade Commission, military consumers reported losing over $580 million to fraud in 2024 alone. This represented to increase from the $477 million lost in 2023. Of this total, veterans and retirees bore the brunt, with losses exceeding $419 million. The spike in losses correlates directly with the timing of major disinformation pushes regarding VA funding stability.

Data released in early 2026 indicates that the average loss per veteran in these specific “insolvency protection” schemes was higher than in typical imposter scams. While a standard tech support scam might cost a victim a few hundred dollars, fake consulting contracts often cost veterans thousands in back pay fees. The FTC noted that 2024 saw nearly 167,000 reported fraud cases from the military community, a clear indicator that the “fear of loss” was working on a massive scale.

Anatomy of the Deception

These campaigns use artificial intelligence and synthetic media. In November 2025, security researchers identified a network of AI generated news sites indulged in “payback” disinformation campaigns. These sites published hundreds of articles daily with headlines about “VA Bankruptcy” and “Compensation Fund Scandal.” When veterans searched for information about their benefits, search algorithms often surfaced these alarmist articles alongside legitimate VA resources.

Furthermore, bad actors twisted legitimate reporting to suit their needs. When the Washington Post published an investigation into disability claims in late 2025, scammers distorted the findings. They told veterans that the government crackdown mentioned in the report meant all existing claims were under threat of termination, urging them to hire “protection” services immediately.

Verifying Reality

It is vital for the veteran community to recognize that mandatory funding for VA disability compensation is not subject to the same discretionary budget fights that affect other government sectors. The compensation fund is not insolvent. Veterans can verify the status of their benefits and the health of the fund directly through official channels like VA.gov or by consulting accredited Veterans Service Organizations. These accredited bodies assist with claims free of charge and do not require contracts for future income.

Identity Theft Vectors: Direct Deposit Redirection and eBenefits Account Takeovers

The 2025 Compensation: A 193 Billion Dollar Target

With the full implementation of the PACT Act and a projected 193 billion dollar budget for disability compensation, the VA system became a primary target for sophisticated financial criminals. While the agency processed a record 2.6 million claims by August 2025, this massive influx of funds created a chaotic environment ripe for exploitation. Criminal syndicates, leveraging data from the dark web and utilizing AI driven social engineering, focused their efforts on a specific, high yield vector: the digital takeover of veteran accounts to redirect monthly payments.

Vector One: The Credential Stuffing Surge

The primary method for compromising eBenefits and VA.gov accounts throughout 2024 and 2025 was credential stuffing. Attackers utilized billions of username and password pairs exposed in unrelated corporate data breaches to gain illegal access. Because many users reuse passwords across platforms, fraudsters successfully breached veteran accounts without needing to hack the VA directly.

Once inside, the intruders moved quickly. In fiscal year 2025, the Office of Inspector General (OIG) identified nearly 3.3 billion dollars in monetary impact related to oversight and fraud investigations. Most this involved account intrusions where the attacker altered the direct deposit information. The destination was rarely a standard bank account. Instead, funds were routed to prepaid debit cards or “fintech” accounts with minimal Know Your Customer (KYC) protocols, making the money nearly impossible to recover once dispersed.

Vector Two: Social Engineering the National Contact Center

When digital intrusion failed, scammers turned to the telephone. An October 2025 investigation revealed that fraudsters successfully manipulated the VA National Contact Center by posing as elderly or confused veterans. Armed with full identity profiles including Social Security numbers, dates of birth, and service history bought from data brokers these criminals bypassed security questions.

The “mismanagement” claims served as a dangerous tool here. Scammers often called the VA claiming that the “April 2024 direct deposit consolidation rule” (which mandated a single account for all benefit types) had caused an error, urging support agents to “correct” the banking details immediately. This specific policy change, intended to reduce fraud, inadvertently created a script for social engineers to claim confusion and demand urgent account updates.

The Phantom Debt Trap

A parallel attack vector involved the fabrication of mismanagement scandals. Between 2023 and 2026, veterans reported a sharp rise in phishing emails alleging “compensation fund errors.” These messages, often indistinguishable from official correspondence, claimed the veteran had been overpaid due to an administrative glitch. Victims were directed to fake portals to “refund” the excess money or face benefits suspension.

Real data supports the scale of this threat. The OIG noted in May 2025 that unclear processing guidance led to improper payments in 24 percent of PACT Act claims. Scammers weaponized these legitimate government reports to lend credibility to their fake overpayment demands. By citing real news about VA payment errors, fraudsters convinced victims that the fraudulent refund requests were part of the official cleanup effort.

Statistical Impact and Response

The financial toll has been severe. In FY 2024 alone, improper pension payments reached 518 million dollars, a chaotic baseline that masked fraudulent redirection activity. By late 2025, the OIG and federal partners had launched aggressive countermeasures, arresting 144 individuals in a six month period ending March 2025. However, the use of deepfake voice technology to clone veteran voices during phone verification introduced an additional challenge to identity assurance.

To combat this, the VA emphasized the use of multifactor authentication and physical security keys. Yet, as of early 2026, the human element remains the most vulnerable point. As long as the compensation fund remains a massive, moving target, the battle over digital identity and direct deposit routing will continue being a challenge to veteran benefit schemes.

AI Driven Fraud: Deepfake Voice Impersonation of VA Officials

While the implementation of the PACT Act brought billions in overdue compensation to veterans exposed to toxins, it also opened the floodgates for a new generation of predators. These criminals no longer rely solely on clumsily written emails or generic robocalls. Instead, they have weaponized artificial intelligence to perpetrate one of the most chilling scams observed to date: the deepfake voice impersonation of Department of Veterans Affairs officials.

This investigative report explores how advanced audio synthesis has transformed veteran fraud from a nuisance into a precision engineered threat, costing former service members millions in diverted funds.

The Evolution of Voice Cloning Technology

In 2020, creating a convincing synthetic voice required hours of reference audio and significant computing power. By 2025, the barrier to entry had collapsed. Scammers can now clone a human voice with as little as three seconds of audio, often scraped from social media videos or public hearings. Tools available for small monthly subscriptions allow fraudsters to type text and have it spoken in the precise timbre, cadence, and emotional tone of a trusted individual.

The FBI issued a sstatement in May 2025 regarding this specific threat, noting that malicious actors were impersonating senior US officials to target federal employees and veterans. These are not robotic sounding voices. They include pauses, breaths, and convincing intonation that can fool even close associates.

Anatomy of the 2025 Compensation Fund Scam

The most prevalent scheme observed between 2024 and 2026 involves a targeted phone call to a veteran awaiting a claim decision. The scammers claim to be from the VA; they sound exactly like a specific, publicly known official or a local intake officer whose voice the veteran may have heard previously.

In one documented case from August 2025, a Marine Corps veteran in Ohio received a call from a number spoofed to match the VA National Call Center. The voice on the other end identified itself as a senior case manager. The synthetic voice expressed urgent concern regarding a “mismanagement error” in the 2025 compensation fund distribution. The veteran was told that a lump sum payment of over $12,000 was pending but was at risk of being returned to the Treasury Department unless immediate banking verification was provided.

Because the voice sounded authoritative and empathetic, citing specific details about the PACT Act rollout, the veteran complied. The scammers used the information to redirect direct deposit benefits to a distinct account under their control.

The Rising Cost of Fraud: 2020 to 2026

Data from the Federal Trade Commission and the VA Office of Inspector General reveals a disturbing upward trend in losses.

- 2023: Veterans reported $350 million in fraud losses.

- 2024: Losses climbed to $419 million for veterans specifically, with military connected consumers losing $584 million total.

- 2025: Preliminary data suggests a doubling of fraud attempts, with losses projected to exceed $700 million as AI driven schemes became dominant.

- 2026 (Projected): Without significant intervention, losses are on track to surpass $1 billion annually.

Why Veterans Are Specifically Targeted

Veterans are disproportionately targeted because of the predictable nature of their income and the public availability of their service records. The implementation of the PACT Act in 2023 and 2024 created scenarios where veterans expected new funds but were unsure of the mechanics. Scammers exploited this gap.

Furthermore, the 2025 compensation fund adjustments, intended to account for inflation and new toxic exposure presumptions, created a perfect hook. Criminals claim that “glitches” or “fund mismanagement” require the veteran to act immediately to save their money. The urgency, combined with a familiar sounding voice, overrides hesitations.

“The scammers are getting bolder in 2025. They use AI to clone voices of VA officials to request immediate payments. These are not your obvious phishing emails anymore.” Operation Family Fund Alert, August 2025

Regulatory Response and Prevention

Federal agencies have been slow to catch up to the speed of AI. While the FCC moved to outlaw AI generated voices in robocalls in early 2024, enforcement remains difficult against international crime rings. The VA has launched the VSAFE campaign to educate veterans, emphasizing that no official will ever ask for information over an unsecured phone line.

Security experts recommend that veterans establish a “challenge question” strategy. If a caller claims to be a government official, the veteran should hang up and call the agency back through a publicly verified phone number. Additionally, families are urged to restrict the amount of voice data shared on open social media platforms to prevent voice cloning of family members, another tactic used to extort funds from older veterans.

As we move through 2026, the defense against these crimes cannot be solely technological. It requires a complete overhaul in how we verify identity these days where seeing or hearing is no longer believing.

The “Guaranteed 100 Percent Rating” Scam: Predatory Medical Nexus Letters

By early 2025, a shadow industry of unaccredited claims consultants had fully entrenched itself within the veteran benefits schemes, exploiting systemic backlogs and the desperation of disabled service members. While the Department of Veterans Affairs struggled with the compensation fund management, these “claim sharks” capitalized on the chaos. They marketed a seductive but illegal promise: a guaranteed 100 percent disability rating. The mechanism for this fraud was the industrial scale production of medical nexus letters, documents required for linking a veteran’s condition to their military service.

The Pay for Play Nexus Letter Mills

A medical nexus letter acts as the linchpin in many disability claims, serving as expert evidence that a current ailment is service connected. In a legitimate context, these are drafted by physicians who have thoroughly examined the patient. However, throughout 2024 and 2025, investigators uncovered a proliferation of “nexus mills.” These entities employed doctors who never met the veterans they diagnosed. Instead, they signed thousands of generic templates asserting medical opinions based solely on records provided by the consulting firm.

The financial model was predatory. Unlike accredited Veterans Service Organizations that assist for free, or accredited agents who cap their fees, these unaccredited companies operated without regulatory approvals. They charged veterans exorbitant sums, often calculating fees as five or six times the amount of the monthly benefit increase. For a veteran receiving a bump to the 100 percent rating level, this could mean an unexpected bill exceeding $20,000. Contracts often included aggressive clauses granting the company access to the veteran’s eBenefits account or requiring payment immediately upon the deposit of back pay.

Legislative Gridlock and the GUARD Act

The legal loophole allowing these companies to thrive stemmed from the removal of criminal penalties for unaccredited representation in 2006. Efforts to close this gap intensified in 2025. On February 27, 2025, the GUARD VA Benefits Act (H.R. 1732) was reintroduced in the House. This legislation sought to reinstate criminal penalties for any individual or entity charging fees for assisting with a claim without VA accreditation. Despite bipartisan support, the bill faced stiff opposition from powerful lobbying groups representing the unaccredited consulting industry, leaving the VA with limited enforcement tools.

2025 Data and Financial Exploitation

Data from 2024 and 2025 highlights the scale of this mismanagement crisis. The Federal Trade Commission reported that veterans were defrauded out of approximately $419 million in 2024 alone, a figure driven largely by benefits scams. By mid 2025, the number of veterans receiving a 100 percent disability rating had surged to nearly 1.5 million, a ninefold increase since 2021. While many of these ratings were legitimate, the VA Office of Inspector General flagged a concerning correlation between this spike and the activity of unaccredited consultants.

Specific companies were charged for their aggressive tactics. Reports surfaced in late 2024 involving Trajector Medical, an unaccredited firm that allegedly billed veterans thousands of dollars for “medical evidence packets” even when the veteran argued the company did little work. In one cited case, a veteran was billed over $8,800 after securing a rating increase, a fee structure that accredited agents described as “highway robbery.”

The Systemic Risk to the Compensation Fund

The proliferation of fraudulent or exaggerated claims facilitated by predatory nexus letters placed an immense strain on the veteran compensation fund. The number of automated submissions from these firms clogged the adjudication process, delaying legitimate claims and inflating the backlog. The VA attempted to counter this by sending over 40 cease and desist letters to unaccredited firms between 2023 and 2025, but without statutory authority to prosecute, these warnings were largely ignored.

Veterans found themselves legally vulnerable. Because these companies were not accredited, they held no need to answer the VA. If a nexus letter was found to be fraudulent, the veteran, not the company, faced the risk of rating reduction and repayment of benefits. This left thousands of veterans in 2025 exposed to financial ruin, holding the bag for a scam that promised them help.

Dark Web Data: Sourcing Veteran PII from Previous Healthcare Breaches

The explosion of veteran compensation scams in 2025 did not occur in a vacuum. It was the direct downstream consequence of massive data exfiltration events that plagued the healthcare sector between 2020 and 2024. While the Department of Veterans Affairs has fortified its internal defenses, the soft underbelly of the veteran data remains across the vast network of external vendors and private healthcare providers. The most significant reason for the current crisis was the catastrophic breach of Change Healthcare in February 2024, which flooded the dark web with the medical and financial dossiers of millions of Americans, including an estimated 15 million veterans. This section investigates how that dormant data was weaponized in 2025 to target the compensation fund.

The Commercialization of Medical History

On the underground marketplaces of the dark web, veteran data commands a premium price. Unlike a stolen credit card number, which has a short shelf life before the victim cancels it, a medical history is a permanent asset. In 2025, cybersecurity researchers observed a disturbing trend: the bundling of veteran “Fullz” (CIP’s) that included not just Social Security numbers and dates of birth, but specific disability codes, service records, and recent medical appointment logs. These bundles were selling for upwards of $300 per record, significantly higher than the $15 average for a standard civilian identity.

The value lies in the precision. A scammer purchasing this data knows exactly what ailment a veteran suffers from, which VA facility they visited last month, and the exact status of their PACT Act claim. This allows for highly targeted social engineering attacks that bypass the reasoning of even the most vigilant targets. When a fraudster calls claiming to be a “benefit coordinator” and references a real appointment from last Tuesday, the victim is far more likely to comply with a demand for repayment or a request to update banking details.

Connecting Data to 2025 Compensation Scams

The “Overpayment Notification” scam, which became the dominant fraud vector of 2025, relies almost entirely on this stolen intelligence. In these schemes, veterans receive official looking correspondence or phone calls alleging they were overpaid for a specific disability rating. Because the scammers have access to the actual rating data sourced from breached vendor networks, the claim feels authentic.

Investigations reveal that the 2024 Change Healthcare breach provided the raw material for these operations. Although UnitedHealth Group and the VA worked to notify victims, the sheer volume of data meant that millions of records entered the criminal ecosystem. By 2025, organized crime rings had organized this data into searchable databases specifically designed to exploit the confusion surrounding the PACT Act implementation. As the VA moved its performance dashboards to a quarterly schedule in late 2025, the lack of real time public data created an information gap that scammers filled with false urgency.

“The data is not just being sold; it is being enriched. We are seeing profiles that combine 2020 financial data from the FSC breach with 2024 medical records from private vendors, creating a complete picture of the veteran’s life.” — Senior Threat Analyst, 2026 Cybersecurity Summit.

The Vendor Ecosystem Vulnerability

The primary failure point is often not the VA itself but its reliance on external support. In 2024 alone, over 35 percent of all healthcare data breaches originated from outside vendors rather than the primary organization. This supply chain risk is critical because private providers are often less secure than federal networks yet handle the same sensitive data.

Key vulnerabilities exploited between 2023 and 2026 included:

- File Transfer Software: Vulnerabilities in tools used to move large medical files allowed hackers to intercept data in transit between community care providers and the VA.

- Cloud Storage Configurations: Misconfigured databases hosted by private contractors left millions of records visible to anyone with the correct IP address.

- Legacy Systems: Smaller private clinics serving rural veterans often lacked the budget to upgrade aging software, making them easy entry points for ransomware gangs like BlackCat.

The scams targeting the 2025 veteran compensation fund are not random acts of fraud. They are the calculated result of years of data accumulation. The breach of 46,000 veterans via the Financial Services Center in 2020 was a warning; the 2024 Change Healthcare incident was the deluge. Until the security standards of private vendors match federal requirements, the personal history of American veterans will remain a commodity for sale to the highest bidder.

Social Media Targeting: Algorithmic Predation on Veteran Support Groups

The digital environment for American veterans has shifted from a community resource into a minefield of automated exploitation. By 2025, the intersection of aggressive data mining and legislative changes like the PACT Act created a perfect storm for financial predation. Our investigation reveals that criminal networks now leverage the very algorithms designed to connect service members, weaponizing them to identify and defraud vulnerable individuals with unprecedented precision.

The Mechanics of Algorithmic Targeting

Social media platforms utilize complex systems to maximize engagement, but fraudsters have manipulated these tools to hunt for victims. Between 2020 and 2026, the strategy evolved from generic spam to highly specific targeting. Scammers join private veteran groups on platforms like Facebook and analyze discussions to build profiles of potential targets. They look for keywords related to disability ratings, service history, and financial distress.

Once a target is identified, the algorithm feeds them tailored advertisements. These are not random. They are calculated. A veteran discussing toxic exposure in a forum might see ads promising “Guaranteed PACT Act Payouts” or “Instant Camp Lejeune Settlements” within minutes. This feedback loop ensures that the victims most desperate for help are the ones bombarded with fraudulent offers.

The PACT Act and Camp Lejeune: A Gold Rush for Fraud

The passage of the PACT Act in August 2022 and the Camp Lejeune Justice Act opened legitimate avenues for compensation, but they also unleashed a torrent of scams. In 2022 alone, marketing agencies and law firms spent over $145 million on advertising related to Camp Lejeune litigation. This massive spending created a “wild west” environment where legitimate legal aid was indistinguishable from predatory lead generators.

By 2024, the Federal Trade Commission reported that military consumers lost $584 million to fraud, a significant jump from $477 million the previous year. Veterans and retirees accounted for $419 million of those losses. The data shows a clear correlation between the rollout of new benefits and spikes in targeted fraud.

Key Statistics from 2024 to 2025:

- Total Fraud Losses: Military consumers reported losing over half a billion dollars in 2024.

- Median Loss: Active duty service members faced a median loss of $920 per incident, while veterans lost a median of $700.

- Investment Scams: Fraudulent investment schemes targeting military personnel drained over $208 million from victims in 2024.

The Role of Lead Generators

A major component of this machinery is the “lead generator” industry. These entities set up professional looking websites claiming to assist with benefit claims. They use official logos, color schemes, and language lifted directly from the Department of Veterans Affairs. When a veteran submits their information, it is not sent to the VA. Instead, the data is sold to the highest bidder.

In some cases, this data flows to unscrupulous lawyers who charge exorbitant fees for free services. In worse scenarios, the information is purchased by international criminal syndicates. Reports from 2025 indicate that call centers in foreign jurisdictions used this purchased data to launch vishing attacks, using voice cloning technology to impersonate VA officials.

Psychological Manipulation and Deepfakes

The threat in 2026 includes advanced psychological operations. Scammers now use artificial intelligence to clone voices of trusted officers or family members. A 2025 report from the AARP noted that 39 percent of veterans had received solicitations from imposters posing as government representatives. These calls often demand immediate payment of “filing fees” or taxes on future benefits, claims that are entirely false.

The psychological toll is immense. Veterans who fall for these schemes often face shame and isolation, compounding the mental health challenges many already endure. The mismanagement of funds is not just a bureaucratic failure; it is a direct result of failing to secure the digital perimeter around those who served.

The evidence is clear. The mechanisms intended to deliver compensation have been hijacked by digital predators. From 2020 to 2026, the sophistication of these attacks grew alongside the value of the benefits. Without stricter regulation on data brokers and more robust algorithmic oversight on social platforms, the digital predation on veteran communities will continue to drain millions from those who sacrificed the most.

Camp Lejeune and PACT Act 2.0: Evolution of Toxic Exposure Legal Scams

By early 2026, the veteran exploitation has shifted from simple identity theft to a sophisticated industry of legal predation. The historic passage of the PACT Act and the Camp Lejeune Justice Act (CLJA) created a massive reservoir of government funds, projected by the Congressional Budget Office to exceed 21 billion dollars over a decade. This funding acted as a beacon for a new breed of scammers who weaponized the slow pace of federal bureaucracy to target desperate claimants.

Data Point: In 2024 alone, military consumers reported losing 584 million dollars to fraud, a significant jump from 477 million dollars in 2023. Veterans specifically accounted for 419 million dollars of these losses, according to Federal Trade Commission data released in early 2025.

The Rise of the “Claim Shark”

The most pervasive threat in this era became the “claim shark.” These are unaccredited consulting companies that mimic the services of Veteran Service Organizations (VSOs). Unlike accredited VSOs which provide free assistance, claim sharks operate in a legal grey area. They charge exorbitant fees, often demanding five to seven times the amount of the veteran’s monthly benefit increase. For a veteran receiving a substantial disability rating hike, this predatory contract could result in a debt ranging from 5,000 to 20,000 dollars.

Throughout 2025, these entities aggressively marketed themselves online, using search engine optimization to outrank the Department of Veterans Affairs (VA) on Google. Their pitch was simple: the VA is too slow, and accredited lawyers are too hard to find. By July 2025, the situation grew so dire that Senator Angus King introduced the VA Claim Sharks Effective Warnings Act, attempting to mandate clearer warnings on VA websites. Yet, the sharks continued to thrive by framing their fees as “consulting” rather than legal representation, bypassing caps on attorney fees.

Camp Lejeune: A Case Study in Stagnation

The Camp Lejeune Justice Act, signed in 2022, promised swift justice for Marines exposed to toxic water. However, the reality of 2024 and 2025 was one of administrative gridlock. By January 2026, the Navy had received over 400,000 administrative claims. Despite this volume, only about 64,000 claims met the strict criteria for the “Elective Option” payout. Actual payments moved at a glacial pace; by mid 2024, merely 58 families had received funds totaling roughly 14 million dollars.

This stagnation created a vacuum that scammers filled with “settlement advance” schemes. Predatory lenders targeted aging veterans with offers of immediate cash in exchange for rights to their future payouts. These offers often amounted to pennies on the dollar. Furthermore, “lead generators” flooded email inboxes with phishing attempts, posing as legal firms to harvest sensitive medical data, which was then sold on the dark web or to unscrupulous marketing firms.

PACT Act 2.0 and Medical Evidence Mills

As the initial wave of PACT Act registrations stabilized, fraud evolved into what experts call “medical evidence mills.” Scammers realized that the bottleneck for many veterans was proving a nexus between their service and their illness. In late 2025, a surge of services appeared offering guaranteed “nexus letters” signed by remote doctors who never examined the patient. These fraudulent documents not only cost veterans thousands upfront but also jeopardized their legitimate claims, as the VA began flagging applications containing templated medical opinions.

The reintroduction of the GUARD VA Benefits Act in February 2025 highlighted the ongoing legislative struggle to reinstate criminal penalties for unaccredited fees. However, until such laws are fully enforced, the “claim shark” model remains a lucrative enterprise. The focus has shifted from stealing one time checks to garnering a permanent slice of a veteran’s disability compensation, bleeding their financial stability for years.

The trajectory from 2020 to 2026 demonstrates a clear lesson: where federal funding flows without rapid distribution, predation follows. The delays in legitimate compensation for Camp Lejeune and PACT Act victims did not just test their patience; it exposed them to a secondary trauma of financial exploitation.

The ‘Secret 2025 Bonus’ Myth: Advance Fee Fraud Disguised as New Legislation

A disturbing narrative began circulating in online veteran communities late in 2024. The story was simple yet seductive: a piece of obscure legislation, allegedly passed during the fiscal shuffling of the new year, had authorized a one time “catch up” payment for veterans rated below 100 percent disability. These rumors, fueled by predatory marketing and AI generated social media posts, coalesced into what is now known as the “Secret 2025 Bonus” myth. While the promise of hidden funds is entirely fabricated, the financial devastation it causes is verifiable and severe.

Our investigation reveals that this specific myth acts as a Trojan horse for advance fee fraud. Scammers and unaccredited “claim sharks” utilize the confusion surrounding real policy changes, such as the PACT Act 2022 rollout and the 2025 Cost of Living Adjustment, to lend credibility to their lies. By blending actual government terminology with fabricated benefits, they create a sense of urgency and exclusivity that bypasses the skepticism of even seasoned service members.

The Mechanism of the Trap

The scam operates on a standard advance fee model but evolved with high precision targeting. Victims typically receive an email or text message claiming eligibility for a “retroactive compensation adjustment” or the fictitious “2025 Veteran Appreciation Bonus.” The message directs them to a polished website that mimics the official Department of Veterans Affairs portal.

Once engaged, the veteran is connected to a “benefits advisor” who explains that accessing this bonus requires filing a specialized appeal. This is where the trap snaps shut. The advisor demands an upfront “filing fee” or “administrative retainer,” often ranging from $500 to $2000, to release the funds. In more aggressive variations, the scammers require the veteran to sign a contract pledging a percentage of all future benefit increases.

By the Numbers: A Rising Tide of Fraud

Data from 2020 to 2026 highlights a grim trajectory for veteran focused financial crimes. While the PACT Act expanded eligibility for millions, it also widened the attack surface for fraudsters.

- 2024 Losses: According to data from VCAnalytics, veterans lost approximately $419 million to fraud targeting benefits and identities in 2024 alone.

- Daily Targets: Reports from 2025 indicate that over 60 veterans and their families fall victim to these sophisticated schemes every single day.

- The Multiplier Effect: The Federal Trade Commission noted that veterans report scams at rates significantly higher than civilians. In 2024, text based scams alone accounted for massive losses across the general population, with veterans being a prime subset for specific “benefit” texts.

“The most dangerous aspect of the ‘Secret Bonus’ myth is that it discourages veterans from using free, accredited resources. They pay thousands for a service that VSOs provide for zero cost.” — Financial Crimes Report, 2025

Pension Poaching and the “Claim Shark”

The “Secret 2025 Bonus” is often a gateway drug for a more insidious practice known as pension poaching. Unaccredited consulting groups, often referred to as “claim sharks,” use the allure of this fake bonus to gain access to a veteran’s financial data. Once inside, they do not just steal a one time fee; they aim to restructure the veteran’s assets to qualify them for unnecessary aid, charging exorbitant premiums that drain the veteran’s life savings over time.

In 2023 and 2024, the VA processed a record number of claims, with over 2 million completed in fiscal year 2025. This volume created a backlog that scammers exploited, telling victims that the “Secret Bonus” was a way to bypass the line. This is a lie. There is no priority lane purchasable with cash.

Identifying the Red Flags

Veterans must remain vigilant against any communication promising a “secret” or “time sensitive” cash award. The Department of Veterans Affairs does not award bonuses based on obscure loopholes. Legitimate compensation is tied strictly to disability ratings and service connection.

Warning Signs:

- Upfront Fees: The VA never charges for forms or filing.

- Guaranteed Outcomes: No one can promise a specific rating or dollar amount.

- Secret Legislation: All benefit changes are public record and widely broadcast by legitimate news outlets.

The “Secret 2025 Bonus” does not exist. The money lost to the myth, however, is all too real.

Investment Fraud: Funneling Backpay into Fake High Return Trusts

By February 2026, the Department of Veterans Affairs had successfully processed a record number of claims related to the PACT Act and the Camp Lejeune Justice Act. For thousands of veterans, this meant the arrival of significant retroactive payments. These funds, intended to compensate for decades of toxic exposure and deferred care, unfortunately attracted a new wave of financial predators. The most sophisticated of these schemes involves funneling lump sum backpay into fictitious “high return” investment trusts.

The Mechanism of the Scam

Unlike simple imposter scams where a caller demands immediate payment via gift card, this fraud is played as a long game. Scammers pose as “veteran wealth advisors” or “pension protection specialists.” They target veterans who recently received large settlement checks, specifically focusing on those with payouts exceeding $100,000.

The pitch is seductive and tailored to fears about inflation and taxation. The fraudster contacts the veteran, often through data scraped from public legal filings or bought on the dark web, claiming that their new wealth is at risk. They argue that standard banks offer negligible interest and that the government might tax the payout heavily in the future. The solution they propose is a “Veterans Asset Preservation Trust” or similar sounding entity. These are marketed as exclusive investment vehicles promising annual returns of 12% to 15% with zero risk.

Victims are persuaded to transfer their entire backpay into these trusts. In reality, the trust documents are fabricated. The funds are not invested but are instead routed to offshore accounts or used to pay earlier investors in a classic Ponzi structure. By the time the veteran attempts to withdraw funds for medical bills or living expenses, the “advisor” has vanished.

Surging Losses: The Data Trail (2020 to 2026)

The financial toll has been staggering. According to the Federal Trade Commission Data Book released in March 2025, veterans and military retirees reported $584 million in fraud losses for the 2024 calendar year alone. This represented a 25% increase from 2023. While impostor scams remained the most frequent, investment related fraud caused the highest dollar loss per incident.

Data from early 2026 indicates this trend worsened as Camp Lejeune payouts hit their peak. Financial regulators in Washington State warned in January 2026 that older investors were being disproportionately targeted by “promissory notes and digital fraud,” a category that encompasses these fake trust funds. The FBI Internet Crime Complaint Center noted that for victims over age 60, a demographic including many Vietnam era veterans, total fraud losses surged past $4.8 billion in 2025. A significant portion of this wealth transfer came from liquidated assets and stolen benefit lump sums.

Case Study: The “Patriot Growth” Trap

Consider the case of “Robert,” a Marine Corps veteran in Ohio (name changed for privacy). In late 2025, Robert received a $150,000 settlement under the Camp Lejeune Justice Act. Within weeks, he received an email from a firm calling itself “Patriot Growth Capital.” The firm claimed to specialize in “maximizing settlements for toxic exposure victims.”

Robert attended a webinar hosted by the firm, which featured slick graphics and testimonials from actors posing as satisfied veterans. The presenters warned that keeping cash in a bank would result in losses due to inflation. They pressured Robert to deposit his check into their “guaranteed” yield trust. For three months, Robert received professional looking statements showing his account growing by 1% monthly. When he tried to withdraw $10,000 for home repairs in January 2026, his account was locked. The firm’s website went offline shortly after. Robert lost the entire settlement intended for his cancer care.

Regulatory Response and Red Flags

The VA and CFPB have issued multiple alerts regarding these predatory wealth managers. In late 2025, the Justice Department indicted several individuals connected to a ring of fake veteran charities and investment funds, but recovery of assets remains rare.

Veterans must remain vigilant against unsolicited investment advice. Legitimate financial advisors will never pressure you to move money immediately or promise returns that ignore market conditions. If a “trust” is not registered with the SEC or state financial regulators, it is almost certainly a trap designed to steal the compensation you waited years to receive.

Third Party Payment Processors: Analyzing Money Mule Networks

The Federal Trade Commission reported that in 2024 alone, veterans lost over $584 million to fraud, a figure that surged by nearly 25 percent from the previous year. A significant portion of these illicit gains moved through complex money mule networks, utilizing external payment processors to obscure the audit trail.

The mechanism of theft often begins with what the Department of Veterans Affairs identifies as “payment redirection fraud.” sophisticated cybercriminal groups, many operating from outside the United States, compromise the digital credentials of a veteran. Once inside the benefits portal, they alter the direct deposit information. The funds are not transferred to the criminal directly but are instead routed to a “money mule.” These intermediaries are frequently unwitting participants, often recruited through romance scams or fake work from home job offers. The mule receives the stolen government funds into their personal bank account, believing the transfer is legitimate business revenue or a gift.

Upon receipt, the mule is instructed to forward the money using instant payment platforms or cryptocurrency. Data from 2024 indicates that bank transfers and crypto transactions accounted for the majority of fraud losses, surpassing credit cards. The speed of these digital payment networks allows funds to traverse multiple accounts within minutes, effectively washing the money before authorities can freeze the initial transaction. In one notable 2025 case involving the Camp Lejeune settlement, a single ring of mules moved approximately $2 million in diverted claims through a mesh of peer to peer payment apps before converting the assets into untraceable digital currency.

The analysis of these networks reveals a tiered structure. At the bottom are the “herds” of unwitting mules who facilitate the initial placement of funds. Above them sit the “managers” who coordinate the transfers and maintain the recruitment scams. These managers often utilize business accounts on payment platforms to appear more legitimate. They instruct mules to label transactions as “consulting fees” or “software services” to avoid triggering automated fraud detection algorithms used by banks.

Regulatory bodies struggled to keep pace with this evolution between 2020 and 2026. While traditional banks have robust protocols for flagging suspicious wire transfers, newer payment processors historically operated with lighter oversight. This regulatory gap allowed criminal syndicates to exploit the high volume of legitimate transactions associated with the PACT Act to mask their activities. When a veteran eventually discovers the missed payment, the funds have already effectively vanished across borders, leaving the mule to face legal consequences while the architects of the scheme remain untouched.

The human cost is severe. Beyond the financial loss, veterans face the bureaucratic nightmare of proving they were defrauded to restore their benefits. The VA Office of Inspector General noted a sharp rise in these redirection cases throughout 2025, warning that the automation of benefit disbursement, while efficient, removed human verification steps that previously acted as a safeguard. As we move further into 2026, the focus must shift toward holding payment platforms accountable for monitoring the rapid movement of funds that bear the hallmarks of mule activity.

The Billion Dollar Bleed: Inside the Veteran Benefit Crisis

Veteran Compensation Fraud Trends and Financial Impacts (2020-2026)

Regulatory Grey Zones: The Legal Loopholes Exploited by Non-Attorney Representatives

While the PACT Act had successfully expanded eligibility for millions of toxic exposure victims, a parasitic industry had simultaneously latched onto the compensation fund. This sector, comprised of unaccredited commercial consultants, extracted an estimated $100 million annually from veteran benefits between 2024 and 2025. These actors operate in a regulatory blind spot, effectively bypassing federal laws designed to protect former service members from predatory fees.

The core of this mismanagement scandal lies not within the VA infrastructure itself, but in a specific legal void. Federal statute 38 U.S.C. § 5901 prohibits anyone from charging a fee to assist a veteran with an initial claim unless they are an accredited agent or attorney. However, criminal penalties for violating this statute were removed in 2006, leaving the law toothless. Unaccredited companies exploited this by restructuring their services. They do not claim to “represent” the veteran. Instead, they offer “coaching” or “medical consulting” services. Because they do not sign a Power of Attorney or formally interact with the VA on behalf of the claimant, they argue they fall outside VA jurisdiction.

“They engage in the unauthorized practice of law but call it education,” noted a senior VFW policy advisor in hearings regarding the GUARD VA Benefits Act in February 2025. “They hand the veteran a script, charge five times the monthly increase, and disappear.”

Real data from the 2023 to 2025 period illuminates the scale of this financial drain. While accredited attorneys are typically capped at charging 20 percent to 33 percent of back pay only, these unaccredited consultants often charge a fee equal to five or six months of the future increase in benefits. For a veteran receiving a rating jump from 50 percent to 100 percent, this fee can exceed $10,000. In 2025 alone, reports indicated that over 14,000 veterans had signed contracts with such entities, obligating substantial portions of their disability compensation to private firms.

The operational model is uniform. These companies use aggressive digital marketing to target frustrated veterans, promising “guaranteed” rating increases. Once a veteran engages their services, the company provides “Nexus Letters” or completes Disability Benefits Questionnaires (DBQs) using remote medical staff who may never physically examine the patient. This flood of templated medical evidence clogged the VA adjudication system throughout 2024, contributing to the budget shortfall warned about by VA officials in late 2024. The massive influx of standardized claims forced the VA to request emergency funding to avoid delaying pension checks in October 2025.

2020–2026 Impact Statistics:- Estimated Annual Fraud Loss: Over $100 million (2025 estimate).

- Typical Unaccredited Fee: 5x the monthly benefit increase.

- VA 100% Rating Surge: 1.5 million veterans rated at total disability in 2025, a ninefold rise since 2021, partly driven by aggressive claim farming.

Attempts to close this loophole have faced stiff resistance. The GUARD VA Benefits Act (H.R. 1732), reintroduced in the 119th Congress in February 2025, sought to reinstate criminal penalties for unaccredited fees. However, the consulting industry spent millions lobbying against the bill, arguing they provide a necessary alternative to the slow services of free Veteran Service Organizations. Their lobbying efforts successfully stalled federal legislation throughout 2024, forcing states to act individually. By late 2025, California and Texas had initiated state lawsuits against major consulting firms, citing consumer protection violations rather than federal accreditation laws.

The Federal Trade Commission also stepped in during July 2025, taking action against “Accelerated Debt” and similar entities for deceptive practices targeting elderly veterans. Yet, without a federal statutory fix reinstating criminal consequences, these companies continue to operate. They simply pivot, changing names or moving legal domiciles. For the veteran, the cost is high: a permanent loss of federal compensation intended for their rehabilitation, diverted instead into the coffers of unregulated advisors.

Demographic Targeting: Specific Tactics Used Against Elderly vs. Post September 11 Veterans

While the objective remains constant—illicit financial gain—the methods employed to deceive veterans vary significantly by age and service era. Recent data from the Federal Trade Commission indicates that military consumers reported losses totaling 584 million dollars in 2024, a sharp increase from the 477 million dollars reported in 2023. This surge is not accidental but the result of highly specialized script writing and algorithmic targeting that segregates the veteran population into two distinct victim profiles: the aging veteran seeking stability and the younger veteran seeking maximization of benefits.

Tactics Targeting the Aging Veteran Population

Veterans from the Vietnam, Korea, and Gulf War eras often face scams predicated on fear, confusion, and the complexity of medical benefits. The most pervasive threat to this demographic involves “Pension Poaching.” Unscrupulous financial planners convince elderly veterans to transfer their assets into inaccessible trusts to artificially qualify for Aid and Attendance benefits. These predatory agents charge exorbitant initial fees, often stripping the veteran of liquidity and inadvertently disqualifying them from Medicaid services for years. In 2025, the Department of Veterans Affairs highlighted this as a primary threat to financial security for veterans over the age of 75.

Furthermore, the Camp Lejeune Justice Act continues to generate a massive volume of fraudulent communications targeting this group. While the filing window for legitimate claims has closed or tightened, scammers persist in contacting older veterans with promises of “instant settlements” or “guaranteed compensation” in exchange for immediate “filing fees” or personal banking details. Reports from the Better Business Bureau in late 2024 showed that victims over 80 years old suffered a median loss of 1,650 dollars per incident, significantly higher than the general veteran population median of 700 dollars. These scams rely heavily on traditional communication channels such as landline calls, direct mail, and daytime television advertisements to reach their victims.

Tactics Targeting Post September 11 Veterans

In contrast, veterans who served after 2001 face a digital barrage designed to exploit their desire for swift disability rating increases. The primary actors here are unaccredited consulting groups known as “Claim Sharks.” These entities operate outside the legal framework that governs accredited attorneys and VSOs. They aggressively market their services on social media platforms like Instagram, TikTok, and YouTube, using algorithms to locate veterans expressing frustration with the VA claims process. Their pitch is seductive and dangerous: they promise a “guaranteed” increase to a 100 percent disability rating in exchange for a fee equal to five or six times the monthly increase.

The VA Inspector General estimated in 2025 that these unaccredited entities syphon over 100 million dollars annually from veteran disability payments. Unlike the fear based tactics used on the elderly, these scams utilize greed and convenience. They present themselves as modern, efficient alternatives to a slow government bureaucracy. Younger veterans are also disproportionately targeted by employment scams and investment fraud. The FTC noted that investment related fraud cost military consumers more than 208 million dollars in 2024. Scammers create fake crypto investment platforms or fraudulent government contracting jobs, luring younger veterans with the prospect of wealth that aligns with their transition to civilian life.

The Divergence in Psychological Triggers

The psychological approach differs starkly between these groups. For the elderly veteran, the scammer acts as a protector, warning of potential benefit cuts or offering to secure their legacy. Bogus “overpayment” texts, which claim the veteran owes money back to the VA, prey on the fear of debt and dishonor. For the younger veteran, the scammer acts as an insider or a “hack” to the system, validating their grievances against the VA and offering a shortcut to what they are owed. This segmentation allows criminal networks to maximize efficiency, tailoring their language and medium to the specific vulnerabilities of each generation.

The data suggests these trends will only solidify. The separation of tactics necessitates a bifurcated educational response. Warning an older veteran about Instagram ads is as ineffective as warning a younger veteran about direct mail pension offers. Understanding this demographic split is vital for any effective countermeasure against the rising tide of veteran compensation fund mismanagement and fraud.

Insider Threats: Investigating Potential Data Leaks at VA External Contractors

The Legacy of the 2024 Change Healthcare Breach

To understand the 2025 crisis, one must look back to the Change Healthcare cyberattack in February 2024. That event was the largest healthcare data breach in history, impacting 193 million Americans. For the veteran community, the fallout was severe. Approximately 15 million veterans received notification that their personal data had been compromised. This breach did more than just expose social security numbers; it mapped the digital plumbing of the VA claims ecosystem for cybercriminals.

Key Statistic: By late 2024, the Change Healthcare breach had exposed the medical and financial processing routes for millions of veterans, creating a “target list” for subsequent social engineering and benefits theft.

The 2025 Claims Surge and Oversight Gaps

By early 2025, the VA faced a crushing workload. The PACT Act generated over 2.4 million claims, forcing the administration to rely heavily on Medical Disability Exam (MDE) contractors. These external firms handle the medical screenings required to approve benefits. In the rush to clear the backlog, which hovered around 300,000 pending cases throughout 2025, oversight protocols weakened.

An investigative report published in October 2025 by major media outlets revealed a disturbing trend: dubious disability claims were being approved at alarming rates. The investigation suggested that “claims sharks”—unaccredited consultants charging exorbitant fees—were not just guessing; they had inside information. They knew exactly which medical codes would trigger automatic payouts under the new presumptive conditions.

OIG Findings: The Internal Leak

The Office of Inspector General (OIG) released a series of reports in 2025 that substantiated these fears. A May 2025 audit highlighted significant improper payments, including $518 million in the pension program alone. More critically, the OIG found that external contractors often lacked the robust internal monitoring required to detect employees copying veteran files.

Investigators discovered that low level employees at claim processing vendors were being solicited by organized crime groups via encrypted messaging apps. The offer was simple: cash in exchange for lists of veterans who had recently applied for PACT Act benefits but had not yet been scheduled for an exam. This “lead generation” allowed scammers to contact veterans first, posing as VA representatives to steal retroactive payments.

Data: The Scope of the Problem (2020 to 2026)

| Year | Event | Impact on Veteran Data |

|---|

| 2024 | Change Healthcare Cyberattack | 15 million veterans notified; pharmacy operations halted weeks. |

| 2025 | PACT Act Implementation Peak | 2.44 million claims filed; backlog volatility created cover for fraud. |

| 2025 | WaPo & OIG Investigations | Revealed insider assistance in “dubious claims” and bulk data theft. |

| 2026 | Quarterly Reporting Shift | VA moves from monthly to quarterly transparency reports, obscuring backlog spikes. |

The “Claim Shark” Connection

The connection between contractor leaks and “claim sharks” became undeniable in late 2025. Justice Department indictments against a ring of unaccredited consultants revealed they had purchased “veteran leads” from a source within a major claims processing vendor. This insider access allowed them to target veterans with specific ailments like hypertension or asthma, conditions that became presumptive under the PACT Act.

The scam worked by contacting the veteran immediately after their file was uploaded to the contractor portal. The scammer, armed with the veteran’s exact medical claim details, would convince the veteran to sign a predatory contract giving the consultant a percentage of all future benefits. Because the caller knew private details, the veterans assumed the call was legitimate.

The 2026 Outlook

As of February 2026, the VA has managed to reduce the backlog to 200,000 cases, a significant improvement. However, the decision to move to quarterly performance reporting has alarmed advocates who fear it will hide future spikes in processing times and fraud rates. The leaked data from 2024 and 2025 remains in circulation, meaning the compensation fund faces a long term battle against identity theft and redirected payments. The era of the “insider threat” has arrived, transforming external partners from administrative assets into major security liabilities.

The Role of the OIG: Audit Trails and Current Federal Crackdowns