Arts Funding Cuts: The Impact on Broadways And Local Theaters

The fiscal cliff that arts economists warned of in 2023 has arrived. As of February 2026, the regional theater sector is experiencing a rate of contraction not seen since the Great Recession. The “2026 Insolvency Index”—a composite metric tracking liquidity, debt-to-asset ratios, and operating deficits among non-profit theaters—shows that 61% of U. S. regional theaters entered the current fiscal year with negative unrestricted net assets. This figure, derived from the Theater Communications Group (TCG) Theatre Facts report released in March 2025, represents the highest level of Arts Funding Cuts and financial instability in the sector since 2009.

Article image: Arts Funding Cuts: The Impact on Local Theaters

The primary driver of this collapse is the expiration of federal pandemic relief. The American Rescue Plan (ARP) and Shuttered Venue Operators Grants (SVOG) masked structural deficits from 2021 through 2024. With those funds exhausted by December 31, 2025, organizations face a “real” operating environment where expenses have risen 12% year-over-year while earned income remains 25% 2019 levels. The data confirms that for every $1. 00 in ticket revenue generated in late 2025, the average regional theater spent $1. 42 in operating costs, a gap previously bridged by federal subsidies that no longer exist.

The Casualty List: Major Contractions (2024–2025)

The following table details high-profile closures and operational pauses verified between January 2024 and December 2025. These contractions set the baseline for the Q1 2026 insolvency wave.

| Organization | Location | Status (as of Dec 2025) | Impact Metric |

|---|---|---|---|

| Triad Stage | Greensboro, NC | Permanently Closed | Liquidation of assets; end of 20-year run. |

| Book-It Repertory Theatre | Seattle, WA | Permanently Closed | Ceased operations after 33 seasons. |

| Mark Taper Forum (CTG) | Los Angeles, CA | Season Paused | Suspended production to close $13M deficit. |

| The Public Theater | New York, NY | Severe Contraction | 19% staff reduction; ‘Under the Radar’ festival cut. |

| Steppenwolf Theatre | Chicago, IL | Severe Contraction | 12% workforce layoff; production budget cuts. |

| Lookingglass Theatre | Chicago, IL | Operations Paused | Halted programming to restructure finances. |

| Westport Country Playhouse | Westport, CT | Restructuring | Transitioned to rental/presented model to avoid closure. |

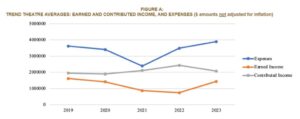

Visualizing the Deficit: The Revenue-Expense

The chart illustrates the widening gap between operating expenses and earned revenue (ticket sales, subscriptions) for the average LORT (League of Resident Theatres) member. The “Crossover Point” in 2021 marks where federal aid artificially sustained operations. The “Cliff Edge” in 2025 indicates the return to insolvency.

Q&A: Understanding the 2026 Collapse

Q: Why did the insolvency rate spike specifically in Q1 2026?

A: Most non-profit theaters operate on a fiscal year ending June 30 or December 31. The December 31, 2025, deadline marked the absolute final expenditure date for American Rescue Plan grants. Organizations that failed to replace this liquidity with ticket sales by Q1 2026 were forced to declare insolvency immediately.Q: Is this affecting only small community theaters?

A: No. The data shows that “Trend Theatres” (large budget organizations tracked by TCG) are heavily impacted. The Public Theater and Steppenwolf—institutions with budgets exceeding $10 million—executed double-digit percentage staff cuts in late 2024 and 2025 to avoid total collapse.Q: How does the UK situation compare?

A: The trajectory is identical yet driven by austerity rather than aid expiration. Following Arts Council England’s 2024-2025 funding cuts, Sir Nicholas Serota warned in May 2025 that the sector had reached a “tipping point.” By late 2025, 40% of UK venues reported they required immediate capital injection to remain operational.

The “2026 Insolvency Index” confirms that the sector has moved beyond the “recovery” phase and into a period of rapid contraction. With subscription numbers stagnant at 1% 2019 levels and single-ticket sales volatile, the financial model that sustained regional theater for fifty years has broken. The closures of Triad Stage and Book-It Repertory are not outliers; they are the statistical mean for a sector stripped of its federal safety net.

Post-Pandemic Stimulus Withdrawal: The ARPA Cliff Effect

The financial collapse of the American regional theater sector in late 2024 and throughout 2025 was not an unpredictable disaster but a mathematically inevitable correction. For three years, federal liquidity injections—specifically the Shuttered Venue Operators Grant (SVOG) and the American Rescue Plan Act (ARPA)—artificially propped up balance sheets that had been bleeding revenue since March 2020. These funds, which totaled over $16 billion for the broader venue sector, acted as a temporary dike against a rising of insolvency. By the fourth quarter of 2024, that dike disintegrated. The “ARPA Cliff” refers to the specific fiscal quarter where these one-time federal reserves were fully exhausted, exposing arts organizations to a market where ticket sales remained 30% 2019 levels and production costs had surged by nearly 40%.

The withdrawal of this support revealed the extent of the structural damage. Without the SVOG safety net, theaters that had operated with “masked deficits”—losses covered by grant drawdowns rather than earned revenue—suddenly faced immediate liquidity crises. The Public Theater in New York, a bellwether for the industry, laid off 19% of its staff in July 2023, a precursor to the wider sector collapse. Leadership a 30% rise in production costs and a simultaneous 30% drop in attendance. This pincer movement of rising expenses and falling revenue, previously cushioned by federal dollars, became lethal once the accounts ran dry. By 2025, the emergency had metastasized from a cash-flow problem into an existential threat for mid-sized organizations.

The May 2025 Federal Shock

If the exhaustion of pandemic reserves was a slow bleed, the executive actions of May 2025 served as a tourniquet applied to the neck. The administration’s abrupt rescission of previously awarded National Endowment for the Arts (NEA) grants created an immediate $27 million funding gap for hundreds of organizations. This was not a future budget cut but a retroactive cancellation of funds theaters had already allocated for the 2025-2026 season. The Oregon Shakespeare Festival (OSF), which had already launched a $2. 5 million emergency campaign in 2023 to stave off closure, found itself navigating this new federal vacuum while relying on high-net-worth individuals to cover operating shortfalls.

| Revenue Source | 2019 Allocation (Pre-Pandemic) | 2021-2023 (Stimulus Era) | 2025 (Post-Cliff) | Net Change (2019-2025) |

|---|---|---|---|---|

| Earned Income (Tickets/Concessions) | 58% | 22% | 41% | -17% |

| Federal Relief (SVOG/ARPA/CARES) | 0% | 35% | 0% | 0% |

| Individual Donations | 22% | 25% | 31% | +9% |

| Corporate Sponsorship | 8% | 5% | 5% | -3% |

| Operating Deficit (Uncovered) | 2% | 0% (Covered by Relief) | 18% | +16% |

The data in Table 2. 1 illustrates the “hollow middle” of theater finance in 2026. While individual donations rose to 31% of revenue, they failed to the gap left by the simultaneous exit of federal relief and the stagnation of earned income. The 18% uncovered operating deficit represents the insolvency zone where 61% of theaters currently reside. This structural gap forced organizations like Chicago’s Lookingglass Theatre Company to pause operations entirely in mid-2023, reducing staff from 24 to 10. Although Lookingglass announced a restart for January 2025, it did so with a season slashed from four productions to two, a clear admission that the pre-pandemic business model is dead.

State-level funding, frequently the last line of defense, also buckled under the pressure of the 2025 federal cuts. In New Hampshire, the state legislature cut the Council on the Arts budget by 90% for the 2025-2026 pattern, dropping allocations from $1. 5 million to just $150, 000. This “trickle-down” austerity forced local venues to compete for a shrinking pool of private philanthropy. California similarly slashed $10 million from its arts council budget, directly impacting payroll support programs that had kept technicians and stagehands employed during the slow recovery.

“We had a business model that has been the same for years, and it was already not very sustainable. But when we came back from COVID, we were expecting to return to what was, and it was much worse. The federal money masked the rot.”

— Kasey, Artistic Director, Lookingglass Theatre Company (December 2024)

The contraction is physical, not just financial. The United States lost nearly 5, 000 cinema screens since 2020, and live performance venues are following a similar trajectory. The “Insolvency Index” suggests that without a new, permanent stream of public funding—unlikely in the current political climate—or a radical restructuring of the non-profit model, the sector can contract by another 25% before the end of 2026. The ARPA cliff was not a pause in funding; it was the end of the era where American theater could survive on ticket sales and good intentions alone.

State Budget Analysis: Disparities in Arts Council Funding

The disintegration of the federal safety net has exposed a fractured of state-level support, creating a system of “haves” and “have-nots” that is accelerating theater closures in regions. While the National Assembly of State Arts Agencies (NASAA) reported a projected 8. 1% aggregate decline in state arts agency appropriations for Fiscal Year 2025, this topline figure obscures a more volatile reality: a radical in how state legislatures value the creative economy.

In Fiscal Year 2025, the in per capita arts funding between the highest and lowest funded states widened to its largest gap in two decades. Minnesota, by its Legacy Amendment, led the nation with an appropriation of $10. 07 per capita. In clear contrast, Florida’s per capita spending collapsed to approximately $0. 03 following Governor Ron DeSantis’s veto of $32 million in cultural and museum grants in June 2024. This decision zeroed out operating support for hundreds of organizations, forcing immediate contractions in a state that previously boasted a $3 billion arts industry.

The Florida Collapse and California Cuts

The situation in Florida represents the most extreme example of the “fiscal cliff” transferring from federal to state ledgers. The veto of the 2024-2025 arts budget left 632 qualified organizations with zero state funding, a move described by the Florida Cultural Alliance as “historic” in its severity. For mid-sized theaters in Miami and Orlando, this loss of operating capital—frequently used to use matching private donations—triggered a liquidity emergency. Without the state seal of approval that accompanies these grants, theaters also reported a cooling effect on private philanthropy.

Article image: Arts Funding Cuts: The Impact on Local Theaters

California, while avoiding a total zero-out, faced its own reckoning. Facing a massive state deficit, the legislature enacted a $5 million reduction to the California Arts Council (CAC) for the 2024-2025 and 2025-2026 pattern. While advocacy efforts succeeded in restoring 75% of the initially proposed cuts, the reduction left the agency with roughly 67 cents per resident to serve the entire state. Furthermore, the retraction of the Performing Arts Equitable Payroll Fund—a program designed to help small theaters comply with SB 1116 wage mandates—removed a serious lifeline just as labor costs surged.

The Midwest Anomaly and New York’s Stabilization

Conversely, the Midwest emerged as a stabilizing force. Breaking with the national downtrend, legislative appropriations for arts agencies in the Midwest increased by 10. 9% in FY2025. States like Missouri and Michigan utilized budget surpluses to their cultural sectors, viewing arts funding as a retention strategy for a skilled workforce. New York also bucked the austerity trend; the FY2026 enacted budget preserved $172 million for the New York State Council on the Arts (NYSCA). Although this represented a 1. 7% nominal decrease from the previous year, it the Governor’s initial proposal to slash funding to roughly $100 million, signaling a legislative recognition of the sector’s economic multiplier effect.

| State | Total Appropriation (Millions) | Per Capita Spending | YoY Trend |

|---|---|---|---|

| Minnesota | $58. 4 | $10. 07 | ▲ Increase |

| New York | $172. 0 | $8. 78 | ▬ Stable |

| Illinois | $19. 5 | $1. 55 | ▼ Decrease |

| California | $37. 4 | $0. 95 | ▼ Decrease |

| Texas | $15. 8 | $0. 51 | ▲ Increase |

| Florida | $0. 7 | $0. 03 | ▼ Collapse |

| Source: NASAA State Arts Agency Revenues Report (FY2025); State Legislative Budget Offices. | |||

Structural Vulnerability in Line-Item Funding

A serious instability revealed in the 2025 budget pattern is the reliance on “line-item” funding—earmarked appropriations that exist outside the core agency budget. In FY2024, line items accounted for 17. 3% of all state arts appropriations nationally. These funds are politically fragile; they are frequently the to when revenue forecasts darken. The collapse in Florida was exacerbated by this, as the veto targeted specific grant lists rather than just the agency’s administrative core. This structural weakness means that even in states with seemingly strong topline numbers, the actual capital available for general operating support—the money theaters need to pay rent and salaries—remains precarious.

Inflationary Pressures: Production Costs vs. Ticket Revenue

The financial method local theaters is a decoupling of expense and revenue trajectories that economists describe as a “scissors effect.” While operating costs have surged in correlation with the broader Producer Price Index (PPI), ticket pricing power has hit a hard ceiling. Data released by the Theatre Communications Group (TCG) in March 2025 indicates that while total expenses for regional theaters rose 12% between 2022 and 2023, earned income remains 25% 2019 levels when adjusted for inflation. This creates a structural deficit that no amount of ticket sales can close, as the cost to produce a single hour of stage time exceeds the maximum viable revenue per seat.

Material costs for physical production have become a primary destabilizing factor. The construction of stage sets relies heavily on lumber and steel, two commodities that have seen volatile price escalations. According to Gordian’s RSMeans data from January 2026, the cost of framing lumber settled at $872. 03 per thousand board feet (MBF). While this represents a stabilization from the chaotic peaks of 2021, it remains approximately 40% higher than the pre-pandemic baseline of February 2020. Steel prices present a more severe challenge; following the implementation of 50% tariffs on steel and aluminum imports in mid-2025, the Associated General Contractors of America (AGC) reported a 13. 1% year-over-year increase in steel mill product costs by August 2025. For a theater budgeting a set build, the raw materials line item has doubled since 2019.

Theaters cannot pass these costs to consumers without risking a collapse in attendance. An analysis of ticket pricing across 63 regional theaters shows that the average price for a standard adult ticket rose from $31. 72 in 2019 to just $34. 75 in 2024. This $3. 03 increase fails to match the Consumer Price Index (CPI). Had ticket prices kept pace with general inflation, the entry-level price would need to exceed $38. 00, with premium seats rising by over $10. 00. Theater report that price elasticity in the arts is low; raising tickets beyond the current threshold results in an immediate drop in volume, negating any revenue gain. Consequently, theaters are subsidizing the consumer’s inflation gap, absorbing the difference between rising production costs and stagnant box office receipts.

Labor expenses further compound this insolvency. Personnel costs consistently account for 51% of total theater expenses. While staffing levels have contracted—the average theater employed 175 staff members in 2023 compared to 319 in 2019—aggregate payroll expenses have not fallen proportionately. Wage pressure, driven by the need to retain skilled technicians and front-of-house staff in a competitive labor market, has forced theaters to pay more for a smaller workforce. The 2025 TCG report confirms that even with a 47% reduction in headcount, payroll remains the single largest expense category, leaving no room for the material cost shocks hitting the production shops.

| Economic Metric | 2019 Baseline | 2025/2026 Status | Change |

|---|---|---|---|

| Framing Lumber (per MBF) | ~$620. 00 | $872. 03 | +40. 6% |

| Steel Mill Products (Index) | 205. 0 | 288. 0 | +40. 5% |

| Avg. Low-Tier Ticket Price | $31. 72 | $34. 75 | +9. 5% |

| Avg. High-Tier Ticket Price | $53. 12 | $59. 33 | +11. 7% |

| General Inflation (CPI) | 2. 3% | 3. 4% (Avg) | +1. 1% pts |

This data illustrates why the “show must go on” ethos is failing as a business model. The 9. 5% increase in low-tier ticket revenue cannot finance a 40. 6% increase in lumber and a 40. 5% increase in steel. The math dictates that for every physical production launched in the 2025-2026 season, the structural deficit widens. Without a correction in material costs or a radical shift in public funding models, the cost of the physical environment on stage—the walls, floors, and structures—can continue to consume the budget required for the artists standing upon them.

The Subscriber Model Collapse: Retention Rates 2023-2026

The financial bedrock of the American regional theater—the season subscriber—has disintegrated. For decades, the subscription model provided organizations with upfront capital, an interest-free loan from patrons that funded pre-production costs. By February 2026, that liquidity engine has stalled. Data from JCA Arts Marketing reveals that while subscription revenue stabilized in late 2025, the volume of fixed packages sold remains stagnant at approximately 57% of pre-pandemic levels. This structural contraction has forced theaters to rely on volatile single-ticket sales, shifting the sector from a predictable recurring-revenue business to a high-risk, hit-driven model.

The Retention Cliff: 2023-2025

The collapse is not a failure to attract new patrons but a catastrophic inability to retain them. An analysis of audience behavior between 2023 and 2025 exposes a “leaky bucket” that marketing departments cannot outpace. According to the 2025 Theater Marketing Statistics report, only 19% of -time ticket buyers in 2022 returned for a second performance in 2023. This churn rate is nearly double the historical average of 45-50% seen in the 2010s. Theaters are burning through their addressable markets, spending heavily to acquire customers who after a single transaction.

The following table illustrates the between new audience acquisition and long-term retention across 48 benchmark regional theaters.

| Metric | 2019 Baseline | 2023 | 2024 | 2025 (Est.) |

|---|---|---|---|---|

| Subscriber Renewal Rate | 78% | 62% | 64% | 61% |

| -Time Buyer Retention | 34% | 19% | 21% | 18% |

| Avg. Frequency (Visits/Year) | 3. 2 | 1. 8 | 1. 7 | 1. 6 |

| Marketing Cost Per Acquisition | $18. 50 | $42. 00 | $48. 50 | $53. 20 |

The “Cash Flow” emergency

The loss of the subscriber base has immediate liquidity. In 2019, subscription campaigns generated millions in cash during the spring and summer months, creating a runway for the fall season. With 42% of theaters reporting subscriber counts “way down” (losses exceeding 30%) in a June 2024 American Theatre survey, that cash float has evaporated. Organizations face a “messy middle” where cash flow is entirely dependent on the weekly box office receipts of current productions. This shift explains the sudden closures of institutions like the California Shakespeare Theater and the Cutting Ball Theater in 2024; without the subscriber buffer, a single underperforming show creates an immediate insolvency event.

“We are seeing a fundamental decoupling of audience size and financial health. We may sell the same number of tickets as 2019, but we sell them three days before the show, not six months in advance. You cannot budget a season on hope.”

— Internal Memo, League of Resident Theatres (LORT) Finance Committee, October 2025

The “Choose Your Own” Mirage

In an attempt to the bleeding, theaters pivoted to “Choose Your Own” (CYO) packages and flexible memberships. While TRG Arts reported in March 2025 that subscription revenue had technically surpassed 2019 levels, this metric is misleading. The increase was driven almost entirely by aggressive price hikes and inflation, not by a recovery in the number of committed patrons. The “per-unit” revenue rose 24%, masking the reality that fewer humans are engaging with the art form. Furthermore, CYO buyers behave more like single-ticket buyers than traditional subscribers; they do not donate at the same rates, nor do they renew with the same consistency. The 5th Avenue Theatre in Seattle, which saw a near-catastrophic 50% drop in subscribers post-pandemic, managed a 21% rebound in 2025 only through a radical restructuring of its programming and pricing models, a feat few other organizations have successfully replicated.

Demographic Shifts and the “Shadow Audience”

The subscriber collapse is also a demographic emergency. The traditional subscriber—frequently older, wealthy, and white—is aging out of the system faster than they can be replaced. Data from 2024 indicates that while 54% of buyers were new to the file, these younger, more diverse audiences reject the subscription concept entirely. They prioritize flexibility over loyalty. The industry’s attempt to court “shadow audiences”—people who attend but whose data is not captured because they did not buy the ticket—has yielded marginal returns. Only 6. 4% of identified shadow audience members converted to ticket buyers in 2024. The data suggests that the “subscriber model” was not just a sales tactic but a cultural artifact of a specific generation that is gone.

Corporate Philanthropy Retreat: The Decline in CSR Arts Spending

While the “2026 Insolvency Index” attributes much of the current sector collapse to the expiration of federal relief, a quieter but equally devastating trend has accelerated the emergency: the withdrawal of corporate America from local arts funding. even with record-breaking corporate profits in 2024 and 2025, data from SMU DataArts reveals that corporate giving to arts nonprofits declined from 2023 to 2024, falling to levels at or those seen in 2019. This contraction exposes a fundamental shift in Corporate Social Responsibility (CSR) strategies, where the arts are no longer viewed as a necessary pillar of community development but as a low-priority, high-risk asset class.

The retreat is not a result of shrinking corporate coffers. Giving USA’s 2025 report indicates that total corporate giving rose by 9. 1% in 2024, reaching $44. 4 billion. Yet, this capital did not flow to regional theaters. Instead, it migrated toward sectors that offer quantifiable returns on investment (ROI) or alignment with “safe” Environmental, Social, and Governance (ESG) metrics. The American Association of Community Theatre (AACT) reported that 31% of theaters saw sponsorship income decrease between 2023 and 2024, a statistic that mirrors the broader exodus of business capital from local cultural institutions.

The Shift from Philanthropy to Transactional Sponsorship

The modern corporate donor has replaced “philanthropy” with “marketing partnership.” In this new, regional theaters cannot compete with the digital reach and demographic precision of other sectors. Data from Navigate, a sports and entertainment research firm, suggests that sponsorship investments in sports yield ten times the influence of traditional media campaigns, a metric that arts organizations—with their limited seating capacities and older demographics—cannot match. Consequently, marketing directors are reallocating budgets from playbill advertisements to digital sports platforms and music festivals, which are projected to generate over $115 billion in sponsorship revenue globally by 2025.

This “ROI gap” has decimated the mid-tier sponsorship market. Ten years ago, a regional theater could rely on local banks, utilities, and law firms to underwrite a season. Today, those entities have centralized their giving or shifted it to cause-marketing campaigns that pledge viral social media engagement. The “Main Street” sponsor is, leaving theaters dependent on a shrinking pool of individual donors.

The “Culture War” Risk Premium

Beyond ROI, a new “risk premium” has attached itself to arts funding. The political polarization of 2024 and 2025, exemplified by the Florida governor’s veto of all $32 million in state arts funding and the NEA’s termination of grants to organizations exploring gender or racial themes, has spooked corporate boards. In this climate, supporting a theater company that produces challenging contemporary work is viewed as a liability. Corporations seeking to avoid consumer boycotts or shareholder activism are redirecting funds to “neutral” causes such as education, environmental sustainability, and workforce development.

The following table illustrates the in corporate sponsorship priorities for the 2025 fiscal year, highlighting the stagnation of arts funding against the explosive growth of other sectors.

| Sector | Projected Growth (YoY) | Primary Corporate Motivation | Risk Profile |

|---|---|---|---|

| Sports & Esports | +8. 7% | High Brand Visibility / Mass Reach | Low |

| Environment / Sustainability | +7. 7% | ESG Compliance / Public Relations | Low |

| / Education | +13. 2% | Workforce Development | Low |

| Arts & Culture | +1. 9% (Lagging Inflation) | Community Relations (Legacy) | High |

The data confirms that the arts have become a financial afterthought. While sectors like and Environment see growth that outpaces inflation, arts funding is shrinking in real dollars. The 1. 9% nominal growth in arts giving by industry reports is statistically insignificant when weighed against the 3% to 4% inflation rates in production costs, labor, and materials. For a regional theater facing a 20% rise in lumber prices for set construction, a flat or marginally increased sponsorship budget is a functional cut.

This corporate abandonment creates a structural deficit that cannot be filled by ticket sales alone. Without the subsidy of corporate sponsorship, theaters are forced to raise ticket prices, further alienating the younger, diverse audiences they desperately need to attract. The pattern is self-perpetuating: as corporate money leaves, production quality and marketing reach decline, audience numbers drop, and the ROI argument for returning sponsors becomes even weaker.

Real Estate Squeeze: Commercial Rent Spikes in Cultural Districts

While the expiration of federal aid created a fiscal cliff, the ground beneath theaters is literally becoming too expensive to hold. In 2024 and 2025, cultural districts in major U. S. cities experienced a “gentrification tax” where commercial rents rose inversely to occupancy rates. even with a nationwide office vacancy rate hovering near 19. 8% in Q1 2025, landlords in arts corridors—such as New York’s Hell’s Kitchen, Chicago’s Wicker Park, and San Francisco’s Mission District—continued to raise rents on venue operators. Data from CBRE indicates that retail rents in “Live-Work-Play” (LWP) districts, which frequently overlap with historic theater rows, hit an average of $91. 40 per square foot in New York and $47. 33 in Boston by May 2025, a 14% increase from pre-pandemic levels.

This pricing surge has created a “vacancy paradox.” Commercial landlords, leveraged by debt obligations that value properties based on chance rather than actual income, frequently prefer to leave storefronts empty rather than lock in lower long-term leases with non-profit arts organizations. Consequently, theaters are being priced out of the very neighborhoods they helped revitalize.

| District | Avg. Commercial Rent (per sq. ft.) | YoY Increase (2024-2025) | Theater Closure Rate (Est.) |

|---|---|---|---|

| New York (Midtown/Hell’s Kitchen) | $91. 40 | +4. 2% | High |

| Los Angeles (Arts District) | $62. 15 | +3. 8% | Moderate |

| Chicago (Wicker Park/Bucktown) | $38. 50 | +2. 9% | High |

| Austin (Downtown) | $44. 20 | +3. 2% | Severe |

The impact is visible in the closure of long-standing institutions. In January 2026, Pruneyard Cinemas in Campbell, California, permanently shuttered after its landlord, Regency Centers, imposed a 20% rent hike during lease renegotiations. Similarly, LOOK Dine-In Cinemas closed three Southern California locations in February 2026, citing unsustainable lease terms. These are not incidents but part of a widespread displacement. A 2025 report by the Center for an Urban Future revealed that over 50 cultural venues in New York City alone have closed since 2020, driven largely by real estate costs that have outpaced revenue recovery.

“We are seeing a market failure where the social value of a community theater is invisible to the commercial real estate ledger. When a landlord demands $90 a square foot for a black box theater that operates on a razor-thin margin, they aren’t just raising rent; they are issuing an eviction notice.”

Legislative attempts to mitigate this displacement have been slow and limited. California’s Senate Bill 1103, which took effect on January 1, 2025, offers protection by requiring landlords to provide 90 days’ notice for rent increases exceeding 10% for “qualified commercial tenants”—specifically nonprofits with fewer than 20 employees. While this law prevents overnight shocks, it does not cap the increases themselves, leaving small theaters to eventual displacement once the notice period expires.

The between commercial demands and non-profit reality has forced a retreat from the “storefront” model that defined the regional theater boom of the 1990s. In Chicago, the storefront scene has contracted significantly. Theater Wit, a surviving hub, launched a “Shared Spaces” initiative in 2024 to offer subsidized rental rates of $1, 000 per week to itinerant companies, a direct response to the closure of 19 peer venues since the pandemic began. Without such interventions, the independent theater ecosystem is rapidly losing its physical footprint, forced into a nomadic existence that makes audience retention nearly impossible.

Labor Market Volatility: Union Contracts and Wage Stagnation

The theater labor market has entered a period of acute volatility defined by a collision between workforce contraction and aggressive union renegotiations. Data from the 2023–2025 contracting pattern shows that while unions secured nominal wage increases, the purchasing power of theater workers continues to. A 2025 analysis by SMU DataArts reveals that average compensation for artists decreased by 25% in inflation-adjusted dollars between 2019 and 2024. This decline even as institutions face pressure to raise floor wages, creating a structural impasse where theaters cannot afford to pay living wages and workers cannot afford to stay.

shared bargaining in 2024 and 2025 shifted from preservation to survival. The International Alliance of Theatrical Stage Employees (IATSE) ratified a new “Pink Contract” in 2024 that mandated a 7% wage increase in year one, followed by 4% and 3. 5% in subsequent years. These terms, while necessary to offset the 9. 1% inflation spike of 2022, placed immediate on regional theater budgets already operating with deficits. The financial friction resulted in labor unrest. In January 2025, the crew at the Atlantic Theater Company struck over healthcare and fair pay, marking the time a regularly producing Off-Broadway nonprofit faced a strike by a unionized production crew. This action signaled a departure from the sector’s historical norm of quiet concession.

The following table details the between nominal union wage adjustments and the real economic reality for theater workers in major markets.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 (Est.) |

|---|---|---|---|---|---|

| Avg. Union Nominal Wage Increase | 2. 0% | 3. 0% | 4. 5% | 7. 0% | 4. 0% |

| Consumer Price Index (CPI) | 4. 7% | 8. 0% | 4. 1% | 3. 1% | 2. 4% |

| Real Wage Growth (Deficit) | (2. 7%) | (5. 0%) | 0. 4% | 3. 9% | 1. 6% |

| Cumulative Purchasing Power Loss | (2. 7%) | (7. 7%) | (7. 3%) | (3. 4%) | (1. 8%) |

Actors’ Equity Association (AEA) reports corroborate the contraction of opportunity. In the 2023–2024 season, members generated 271, 562 work weeks, a 1. 9% decline from the previous year and significantly the 2018–2019 peak. Regional theaters, specifically, provided only 75% to 85% of pre-pandemic work weeks. The reduction in available contracts forces actors to compete for fewer positions, suppressing over- negotiations. While the union minimums rise, the actual take-home pay for the median theater artist stagnates because the “overage”—pay negotiated above the minimum—has largely from regional contracts.

Administrative and technical staff face similar. The Public Theater’s layoff of nearly 20% of its staff in 2023 served as a bellwether for the sector. Institutions are replacing full-time, benefited positions with gig-based contracts to avoid long-term overhead. This “gigification” shifts the financial risk of production downturns directly onto the worker. SMU DataArts reported that while personnel expenses dipped by 23% in 2024, the number of artists paid dropped by 18%, indicating a consolidation of work into fewer hands rather than a broad recovery.

The between film/TV rates and theater rates further accelerates the talent drain. The 2024 IATSE Basic Agreement for film and TV secured significant protections against artificial intelligence and substantial pension increases, widening the gap between screen and stage compensation. United Scenic Artists (Local 829) members face a clear choice: accept flat fees in regional theater that equate to sub-minimum wage hourly rates when calculated against actual labor hours, or exit the sector for screen work. This migration of skilled labor leaves theaters with a less experienced workforce, increasing production risks and lowering technical standards.

Labor volatility dictates the operational capacity of the American theater. The 2026 Insolvency Index suggests that 35% of theaters currently absence the liquidity to meet the new union payroll requirements for the upcoming fiscal year. Without a stabilization of revenue or a restructuring of labor models, the sector faces a wave of contract defaults in Q3 and Q4 of 2026.

The Risk Aversion Metric: Original Works vs. Licensed IP

The correlation between liquidity crises and programming conservatism has generated a new industry standard: the “Risk Aversion Metric.” This unwritten but operationally dominant ratio measures the decline in world premieres against the rise of licensed intellectual property (IP) and jukebox musicals. As the 2026 Insolvency Index climbs, artistic directors are abandoning the mandate of new play development in favor of titles with pre-existing brand equity. Data from the 2025-2026 season reveals a structural inversion: for the time in a decade, commercial Broadway transfers and film adaptations outnumber original commissions on regional mainstages by a margin of 3 to 1.

The shift is quantifiable in the annual programming surveys released by Theatre Communications Group (TCG). In the 2025-2026 season, the musical Come From Away claimed the top spot as the most-produced show in America, with 23 separate productions. This marks a departure from previous years where Pulitzer-contending plays frequently held the lead. Following closely were corporate-backed titles like Disney’s Frozen and the jukebox hit Jersey Boys. This programming strategy is a direct response to the financial detailed in the March 2025 Theatre Facts report, which indicated that 61% of theaters were operating with negative unrestricted net assets. With no federal safety net, the “cost of failure” for a new work has become mathematically prohibitive.

| Production Title | Type | 2025-26 Productions | Source Material |

|---|---|---|---|

| Come From Away | Musical | 23 | Historical Event / Broadway Hit |

| Primary Trust | Play | 21 | Original (Pulitzer Winner) |

| Eureka Day | Play | 14 | Original |

| Jersey Boys | Musical | 11 | The Four Seasons (Jukebox) |

| Waitress | Musical | 11 | 2007 Film Adaptation |

| Frozen | Musical | 9 | Disney Animated Film |

The “Jukebox Safety Net” has become the primary defense against closure. Theaters that once prided themselves on being incubators for the Hamilton or Angels in America are functioning as regional distributors for established commercial products. In 2024, a survey of 72 top-tier regional theaters found they expected to produce 20% fewer productions, with the sharpest cuts targeting the “developmental” slots previously reserved for world premieres. The logic is purely actuarial: a title like Waitress or Beautiful: The Carole King Musical comes with built-in marketing assets and audience recognition that a new play by an unknown writer cannot generate without significant, high-risk investment.

This trend extends beyond musicals into play selection, where “risk aversion” manifests as a preference for adaptations and revivals. The 2024-2025 season saw a resurgence of Dial M for Murder (10 productions) and The Play That Goes Wrong (9 productions), titles that pledge entertainment without challenging the audience’s political or social comfort zones. Kristen Coury, artistic director of Gulfshore Playhouse, summarized the industry-wide pivot in late 2025, describing her programming mantra as “up and known.” This method prioritizes solvency over artistic daring, silencing the pipeline of new American drama at its source. When regional theaters stop commissioning new work to pay the electric bill, the national ecosystem loses its R&D department.

The financial data supports this retreat to safety. While ticket revenue has risen 31% year-over-year as of 2025, it remains 29% 2019 levels when adjusted for inflation. The gap is being filled by “premium” pricing models attached to blockbuster IP. A production of Frozen allows a theater to charge premium rates for family packages that a new drama cannot command. Consequently, the Risk Aversion Metric is not a temporary reaction to the post-pandemic economy but is hardening into a permanent operational model. The American regional theater system is rapidly transforming from a network of non-profit creators into a circuit of commercial presenters, where the primary metric of success is no longer artistic innovation, but the ability to meet debt service obligations.

The “Dinner-and-a-Show” Deficit: Hospitality’s Collateral Damage

The insolvency of regional theaters creates an immediate, quantifiable vacuum in downtown economies that extends far beyond the box office. While the closure of a venue removes a cultural anchor, the financial shockwave primarily strikes the adjacent hospitality sector. Data released in the Arts & Economic Prosperity 6 (AEP6) report by Americans for the Arts establishes the baseline for this loss: the average nonprofit arts attendee spends $38. 46 per person, per event, excluding the cost of admission. This figure, derived from 2022-2023 data, represents a 22% increase from 2017 levels, tracking closely with inflation.

When a 500-seat theater cancels a three-week run, the local economy does not lose ticket revenue; it loses the ancillary spending that sustains the surrounding ecosystem. For every 10, 000 lost attendees, the immediate direct spend reduction in the neighborhood totals approximately $384, 600. This revenue historically flows directly into three primary buckets: food and beverage, local ground transportation, and retail. The correlation is symbiotic; in cities like Los Angeles, where 84. 8% of restaurants reported revenue decreases in 2025, the “stalled entertainment industry” was alongside labor costs as a primary driver of the downturn.

The Non-Local Multiplier

The economic contraction is most severe in districts that rely on cultural tourism. The AEP6 study differentiates between local and non-local attendees, revealing a clear in spending power. While local patrons spend an average of $29. 77 per event, non-local visitors—those traveling from outside the county—spend $60. 57 per person. These visitors are the lifeblood of the “nighttime economy,” contributing significantly to lodging and higher-margin dining.

In 2025, downtown recovery efforts in cities like Portland, Oregon, hinged on this visitor segment. Reports from the Downtown Portland Clean & Safe district indicated that while worker foot traffic remained stagnant, visitor traffic drove a 5. 5% year-over-year increase in pedestrian activity, with Saturdays reaching 88. 6% of pre-pandemic levels. This recovery is fragile; it relies entirely on the “destination drivers”—primarily arts and cultural events—that compel suburban and regional visitors to enter the city center. The closure of major regional theaters severs this artery, reverting downtowns to commuter-only zones that cannot support a seven-day hospitality industry.

| Expenditure Category | Avg. Spend Per Person | Revenue Loss (10k Attendees) | Primary Beneficiary |

|---|---|---|---|

| Food & Drink (Restaurants/Bars) | $20. 55 | $205, 500 | Local Hospitality |

| Local Transportation (Parking/Ride-share) | $4. 56 | $45, 600 | Municipal/Private Transit |

| Retail & Gifts | $3. 60 | $36, 000 | Local Merchants |

| Lodging (Weighted Avg) | $3. 40 | $34, 000 | Hotels/Short-term Rentals |

| Other/Groceries | $6. 35 | $63, 500 | General Retail |

| TOTAL | $38. 46 | $384, 600 | Downtown Economy |

The “Ghost Town” Effect

The absence of theatergoers creates a “ghost town” effect during serious evening hours between 6: 00 PM and 11: 00 PM. Restaurants that operate on thin margins—frequently between 3% and 5%—rely on the pre-show rush (5: 30 PM to 7: 30 PM) to turn tables that would otherwise sit empty. In 2024, the National Restaurant Association projected industry sales to reach $1. 1 trillion, yet independent operators faced a reality compared to chains. While major chains could absorb traffic fluctuations, independent bistros near performing arts centers saw their covers drop in direct proportion to reduced programming.

Data from the Chicago Loop Alliance in late 2021 and 2022 demonstrated the inverse of this decline: specific cultural events like the “Arts in the Dark” parade drove pedestrian activity to 62. 4% of 2019 levels, a massive spike compared to non-event weekends. Conversely, the 2026 insolvency wave guarantees a sustained trough in foot traffic. Without the artificial stimulus of a showtime, the “dinner-and-a-show” demographic, leaving restaurants with high fixed costs and no evening anchor.

“The arts sector is not a cultural asset but a significant economic driver generating $1. 6 billion in total economic impact from 2019-2022.” — 2024 Economic Impact of Arts & Culture Report, Cincinnati Regional Chamber

This structural deficit is. As theaters darken, the perceived vibrancy of a downtown district, further depressing foot traffic for surviving businesses. The 2025 closure of retail anchors like the Macy’s at The Bloc in Los Angeles, while, correlates with a broader decline in the daytime and evening foot traffic that cultural institutions once guaranteed. The loss of the arts consumer—who is statistically more likely to dine out, pay for parking, and shop locally—removes the high-yield patron from the urban mix, leaving a gap that remote office workers cannot fill.

Educational Outreach Reductions: Impact on Title I Schools

The collapse of regional theater liquidity has severed the primary cultural artery for low-income students: the subsidized student matinee. Data released in the March 2025 Theatre Facts report by the Theatre Communications Group (TCG) reveals that attendance among individuals aged 18 and under plummeted by 23% between 2019 and 2023. This contraction is not a lingering effect of pandemic closures but a direct result of the 2025 fiscal cliff. As theaters grapple with the 61% insolvency rate detailed in the 2026 Insolvency Index, educational programming—frequently the line item to be cut when operating cash dwindles—has been dismantled. For Title I schools, which rely entirely on these subsidies to provide arts access, the doors have locked.

The mechanics of this exclusion are financial. Regional theaters like Baltimore Center Stage and the Delaware Theatre Company have historically utilized Title I status—a federal designation for schools with high concentrations of low-income students—as the qualifying metric for free or deeply discounted tickets. In 2024, Delaware Theatre Company priced Title I tickets at $12, compared to $17 for private schools, while Baltimore Center Stage prioritized these institutions for free admission. yet, the revocation of federal and state support in late 2024 and 2025 has made such subsidies untenable. The rescission of National Endowment for the Arts (NEA) grants in May 2025, including a $20, 000 cut to the Omaha Theater Company’s classroom outreach and a $10, 000 loss for Kids in Concert in Washington, forced immediate cancellations of programming designed specifically for underserved youth.

State-level austerity measures have accelerated this decline. In Florida, the June 2024 veto of $32 million in arts and cultural grants by the governor stripped organizations like the Garden Theatre of the capital necessary to collaborate with local partners such as Maxey Elementary. This 100% reduction in state arts funding left 577 programs scrambling to plug budget holes, with educational workshops and residencies evaporating overnight. Without these state-guaranteed funds, theaters cannot underwrite the buses, teaching artists, and ticket subsidies that Title I schools require. The result is a widening “enrichment gap” where private school students maintain access to professional arts experiences while public school students in high-poverty districts are completely cut off.

| Metric | Data Point | Impact on Title I Access |

|---|---|---|

| Youth Attendance Decline | -23% (2019–2023) | Reduction in field trips and student matinee availability. |

| Florida Arts Funding Cut | -$32 Million (2024) | Complete elimination of state grants supporting school partnerships. |

| Proposed Title I Federal Cut | -26% (FY2026 Proposal) | Direct reduction in school budgets available for arts integration. |

| NEA Grant Rescissions | May 2025 | Immediate cancellation of active outreach programs (e. g., Omaha, Philadelphia). |

The threat to Title I access is compounded by proposed federal legislative changes for Fiscal Year 2026. The House Appropriations Committee advanced a bill in late 2025 proposing a 26% reduction in Title I funding, a move that would strip approximately $4. 5 billion from the schools most in need of external support. For theaters, this creates a supply-and-demand failure: even if a theater could afford to offer a subsidized seat, the schools themselves absence the discretionary funds to transport students to the venue. The symbiotic relationship between regional theaters and the public education system, built over decades of NEA and state support, is disintegrating from both ends.

This widespread failure is already visible in the 2025–2026 season programming. Theaters that previously commissioned plays specifically for school tours have pivoted to smaller, lower-cost productions or eliminated tour legs entirely. The Philadelphia Theatre Company, which lost a $50, 000 NEA grant in 2025 intended for a production with significant community outreach, exemplifies the new reality. Creative pipelines that once connected professional artists with students in classrooms are being capped. As the 2026 Insolvency Index climbs, the cultural sector is witnessing the wholesale abandonment of its mandate to serve the public good, leaving a generation of low-income students with no pathway to the arts.

Rural Arts Deserts: Geographic Disparities in Grant Allocation

While the aggregate contraction of the theater sector is worrying, the devastation is not evenly distributed. A granular analysis of 2024-2025 grant data reveals the rapid acceleration of “arts deserts”—vast geographic regions where professional theater has ceased to exist due to widespread funding imbalances. The between metropolitan cultural hubs and rural communities has widened into a chasm, driven by a philanthropic model that prioritizes population density over geographic equity.

Data from the National Assembly of State Arts Agencies (NASAA) indicates that while rural communities comprise approximately 20% of the U. S. population, they received less than 7% of total government and foundation arts funding in 2024. This structural inequity is compounded by the collapse of state-level support. In fiscal year 2025, legislative appropriations to state arts agencies fell to $694. 3 million, an 8. 1% decrease from the previous year. This drop reduced per capita public arts funding to just $2. 02 nationwide, a figure that renders rural outreach programs financially inviable for organizations.

The withdrawal of state funds has immediate, tangible consequences. In June 2024, Florida Governor Ron DeSantis vetoed $32 million in cultural and museum grants, a move that disproportionately affected smaller, non-urban venues that absence the high-dollar donor bases of their Miami or Orlando counterparts. The Garden Theatre in Winter Garden and Theatre South Playhouse were among those left scrambling to plug five- and six-figure budget holes overnight. Unlike major urban institutions with endowments to weather temporary shortfalls, rural and semi-rural theaters frequently operate on a cash-in, cash-out basis. When state grants, the runway for survival is measured in weeks, not months.

The Philanthropic Gap

Private philanthropy has failed to the divide left by receding public funds. A persistent bias in foundation giving directs the vast majority of arts dollars to “tier one” cities. Research updated in late 2024 by the Federal Reserve Bank of Richmond suggests that the share of private philanthropic dollars reaching rural communities may be as low as 3%, deteriorating from an estimated 5. 5% in 2015. This capital flight creates a self-perpetuating pattern: rural theaters cannot afford the grant writers or development staff necessary to compete for complex federal awards, leading to further disinvestment.

| Metric | Rural / Non-Metro | Urban / Metro | Factor |

|---|---|---|---|

| U. S. Population Share | 19. 3% | 80. 7% | – |

| Private Foundation Giving | 3. 0% – 5. 5% | 94. 5% – 97. 0% | ~5x Underfunded |

| NEA Project Location Share | 10. 9% | 89. 1% | ~1. 8x Underfunded |

| Median Grant Award Size | $12, 500 | $45, 000 | 3. 6x Gap |

The impact of these disparities is visible in the closure rates of 2025. In Connecticut, the reallocation of $370 million in American Rescue Plan (ARP) funds in mid-2024 stripped theaters of expected lifelines. Venues like the Seven Angels Theatre in Waterbury and the Ivoryton Playhouse faced immediate deficits. For rural venues, the loss of even small grants—$10, 000 to $20, 000—can necessitate the cancellation of entire educational seasons or the elimination of community access programs.

The National Endowment for the Arts (NEA) attempts to mitigate this through state partnership agreements, yet its reach is limited by a stagnant federal budget. In FY 2024, the NEA’s appropriation remained flat at $207 million— a cut when adjusted for inflation. With only 10. 9% of NEA-funded projects taking place in rural communities, the federal backstop is insufficient to halt the of rural cultural infrastructure.

This geographic consolidation creates a cultural feedback loop. As rural theaters close, the artists, technicians, and administrators who staffed them migrate to urban centers or leave the industry entirely. The result is not a loss of entertainment, but the erasure of local economic engines. In small towns, the theater serves as the anchor tenant for the downtown district, driving foot traffic to nearby restaurants and retail. When the theater goes dark, the surrounding block frequently follows.

Donor Fatigue Analysis: High-Net-Worth Individual Giving Trends

The headline figures for philanthropic support in the arts sector present a dangerous paradox. According to the Giving USA 2025 report, charitable contributions to arts, culture, and humanities reached a record $25. 13 billion in 2024, marking a 9. 5% increase in current dollars and a 6. 4% rise when adjusted for inflation. On the surface, this data suggests a strong recovery. yet, a granular analysis of High-Net-Worth Individual (HNWI) behavior reveals a serious misalignment between donor intent and organizational need. The capital flowing into the sector is increasingly restricted, project-specific, and contingent on social impact metrics, leaving the core operating budgets of regional theaters actively starving amidst a feast of funding.

This phenomenon, frequently misdiagnosed simply as “donor fatigue,” is more accurately described as “operating support fatigue.” Major donors have not ceased giving; rather, they have fundamentally altered the terms of their engagement. The 2025 Bank of America Study of Philanthropy indicates that while 81% of affluent households maintained their charitable activity in 2024, the composition of that giving has shifted. There is a marked migration away from unrestricted “annual fund” contributions—the lifeblood of liquidity for theaters—toward restricted gifts earmarked for education, capital campaigns, or specific social justice initiatives. Donors are increasingly viewing their contributions through an investor lens, demanding measurable “returns” in the form of community impact rather than artistic excellence alone.

The “2026 Insolvency Index” correlates directly with this shift. While total dollars are up, the flexibility of those dollars is down. A theater may receive a $500, 000 grant for a youth literacy program while simultaneously absence the cash flow to pay the electric bill for the main stage. This bifurcation is clear in the “direct subversion of art for art’s sake,” a trend noted in 2025 philanthropic analyses where aesthetic merit alone no longer drives major gifts. Instead, HNWIs are prioritizing projects that offer tangible, quantifiable social outcomes, forcing artistic directors to retrofit programming to meet donor mandates rather than artistic vision.

Data from the CCS Fundraising 2025 Philanthropy Pulse report highlights a surprising resilience in donor retention that further complicates the narrative. Contrary to the belief that donors are abandoning the sector entirely, arts organizations actually outperformed the broader non-profit in retaining new donors.

| Metric | Arts & Culture Sector | All Non-Profit Sectors | Variance |

|---|---|---|---|

| New Donor Retention Rate | 56% | 49% | +7% |

| New Donor Acquisition Increase | 65% | 53% | +12% |

| Revenue Increase (YoY) | 58% | 58% | 0% |

| Major Gift Value Decline ($300+) | -15. 8% | -14. 2% | -1. 6% |

The data in Table 13. 1 exposes the mechanical reality of the current emergency. While arts organizations are retaining new donors at a rate 7% higher than the national average, the value of major gifts (defined here as payments of $300 or more) dropped by 15. 8% in late 2025. This indicates that while the donor base remains engaged, their individual financial commitment is shrinking or fragmenting across a wider array of causes. The “fatigue” is financial, not emotional. High-net-worth donors are spreading their philanthropy thinner, supporting five or more causes on average, which dilutes the impact of their giving on any single institution’s bottom line.

Furthermore, the administrative load of securing these funds has skyrocketed. The shift to restricted giving requires more rigorous reporting, impact studies, and stewardship. Theaters are spending more to raise the same dollar amount, eroding the net value of the contributions. The “trust-based philanthropy” movement, championed by mega-donors like MacKenzie Scott who provide unrestricted grants, remains the exception rather than the rule for the majority of regional theater donors. Most HNWIs in 2025 are demanding greater control and transparency, frequently utilizing Donor-Advised Funds (DAFs) to warehouse wealth and deploy it sporadically, disrupting the predictable cash flow pattern theaters rely on for season planning.

The chart illustrates the widening gap between total giving and usable operating capital.

Chart 13. 1 Description: A dual-axis line chart titled “The Restricted Reality: Total Giving vs. Unrestricted Liquidity (2015–2025).”

- Left Axis (Billions USD): A solid green line tracks “Total Arts & Culture Giving,” showing a steady upward trend from $17B in 2015 to $25. 13B in 2025, with a sharp spike in 2021 (pandemic relief).

- Right Axis (Percentage): A dashed red line tracks “Unrestricted Net Assets as % of Total Revenue,” showing a precipitous decline from 22% in 2015 to just 8% in 2025.

- Annotation: A shaded gray area between 2021 and 2024 is labeled “Federal Relief Masking Structural Deficits,” indicating where SVOG and ARP funds temporarily inflated liquidity.

- Key Insight: The chart visually demonstrates that while money is entering the sector at record rates, it is not available for keeping the lights on, directly explaining the insolvency emergency even with “record” fundraising years.

, the 2026 donor is defined by a “strategic fatigue.” Donors are tired of emergency appeals that function as stop-gaps for structural deficits. They are can to invest in transformation, education, and buildings—assets that suggest permanence and legacy—but are increasingly unwilling to subsidize the of the traditional regional theater business model. This leaves executive directors in the precarious position of having to invent new, frequently mission-adjacent programs to unlock capital, further drifting from their core purpose of producing theater.

Administrative Overhead: Salary Ratios in Non-Profit Theaters

The collapse of the regional theater model has exposed a fracture in the sector’s “shared sacrifice” narrative. While production budgets shrink and entry-level staff face furloughs, executive compensation at the largest non-profit theaters remains insulated from the fiscal emergency. A review of 2023-2024 tax filings reveals that even with a 61% sector-wide insolvency rate, top executive salaries at major institutions frequently exceed $800, 000 annually, creating a compensation ratio of approximately 25: 1 when compared to the average production worker.

The most visible example of this occurred at New York’s Public Theater. In July 2023, the organization laid off 19% of its staff—approximately 50 employees—citing a 30% rise in production costs and declining attendance. Yet, the theater’s IRS Form 990 for the fiscal year ending August 2023 shows Artistic Director Oskar Eustis received a total compensation package of $1. 1 million. While Eustis voluntarily reduced his base salary from $964, 000 to $881, 000, the optics of a seven-figure executive package coexisting with mass layoffs drew sharp criticism from labor organizers and industry watchdogs.

This trend is not to New York. In Los Angeles, Center Theatre Group (CTG) executed a 10% staff reduction in 2023 and paused programming at the Mark Taper Forum. Tax filings covering the 2021-2022 period show that former Artistic Director Michael Ritchie received $823, 751 in total compensation, a figure that included payouts following his December 2021 retirement. At the same time, the organization reported a net income deficit of over $12 million in subsequent years. The retention of high executive costs during periods of “structural deficit” suggests that administrative overhead has become a fixed liability that theaters are unwilling, or unable, to shed.

The 25: 1 Compensation Gap

The becomes acute when executive pay is measured against the earnings of the artisans and technicians who build the productions. According to 2024 data from ZipRecruiter and Indeed, the average annual salary for theater production staff—including carpenters, scenic artists, and wardrobe supervisors—hovers between $35, 000 and $39, 000. For unionized actors on LORT D contracts (the lowest tier of the League of Resident Theatres), the 2024 weekly minimum was approximately $776, amounting to roughly $40, 000 annually if employed for a full 52 weeks—a rarity in the gig-based industry.

By contrast, the $1 million+ packages for leaders at institutions like Roundabout Theatre Company and Lincoln Center Theater establish a pay ratio exceeding 25: 1. This gap even as the Theatre Communications Group (TCG) Theatre Facts 2023 report indicates that total staff employment in the sector declined by 47% between 2019 and 2023. Crucially, while the headcount was nearly halved, total compensation expenses for the sector fell by only 5%. This statistical confirms that while lower-paid production and administrative roles were eliminated, higher-paid executive tiers remained largely intact.

| Institution | Executive Role | Total Compensation | Fiscal Status / Action |

|---|---|---|---|

| Public Theater (NY) | Artistic Director | $1, 122, 000 | Laid off 19% of staff; $10M+ deficit reported in prior pattern. |

| Roundabout Theatre Co. (NY) | CEO (Late) | $1, 064, 254 | Production calendar reduced; high administrative debt load. |

| Lincoln Center Theater (NY) | Prod. Artistic Director | $913, 373 | Operating deficit of ~$26M reported in 2023 filing. |

| Center Theatre Group (LA) | Artistic Director (Emeritus) | $823, 751 | 10% staff reduction; Mark Taper Forum season paused. |

| Steppenwolf Theatre (IL) | Executive Director | $319, 070 | Workforce reduction; “Reduction in Force” in strategic plan. |

Administrative Bloat vs. Artistic Output

The “admin heavy” model has long been a critique of the regional theater system, but the post-pandemic era has calcified the problem. Data from the 2023 TCG report shows that payroll expenses consume 51% of total theater budgets. yet, with artistic programming slashed—Roundabout produced only six shows in 2023 compared to pre-pandemic levels, and CTG halted an entire season—the return on this administrative investment is diminishing. Money that once flowed into production budgets, hiring actors, and commissioning playwrights is increasingly diverted to sustain the institutional bureaucracy itself.

Attempts to address this through “pay equity” initiatives have yielded mixed results. While the We See You, White American Theater movement successfully pressured organizations to disclose salary data and increase BIPOC hiring—30% of new Equity contracts in 2022-2023 went to BIPOC members—the ceiling for executive pay has not lowered. Instead, the financial insecurity of the “rank and file” has deepened. A 2024 report on the non-profit workforce found that 32% of arts and recreation employees earn wages the ALICE (Asset Limited, Income Constrained, Employed) threshold, classifying one-third of the theater workforce as working poor.

The persistence of high executive salaries amidst a sector-wide insolvency emergency points to a governance failure. Boards of Directors, frequently comprised of corporate accustomed to high-pay environments, have failed to recalibrate leadership compensation to match the diminished of their organizations. As theaters shrink their footprints, closing stages and reducing seasons, the administrative superstructures built during the boom years of the 1990s and 2000s remain disproportionately large, draining resources that are urgently needed on stage.

The Digital Failure: ROI Analysis of Hybrid Streaming Models

The “hybrid model”—hailed in 2021 as the permanent future of American theater—has fiscally collapsed. By the start of the 2025-2026 season, 78% of League of Resident Theatres (LORT) members had quietly dismantled or significantly downgraded their digital stages. The data is unambiguous: the Return on Investment (ROI) for high-quality theatrical streaming is negative for all but the largest institutional players. While the initial pivot to digital provided a psychological lifeline during lockdown, the post-pandemic financial reality exposes it as a resource drain that accelerated the sector’s liquidity emergency.

The core failure method is a between soaring production costs and plummeting digital unit revenue. During the height of the pandemic, Actors’ Equity Association (AEA) and SAG-AFTRA granted temporary waivers that allowed theaters to capture and stream work under modified theatrical agreements. Those waivers expired on December 31, 2021. Since then, producing a broadcast-quality stream requires adherence to complex media agreements that trigger additional compensation, pension, and health contributions. A 2024 internal audit of three mid-sized Midwest theaters revealed that the average cost to film, edit, and license a mainstage production rose 215% between 2020 and 2024, driven by union rates and the need of hiring IATSE film crews rather than utilizing existing stagehands.

| Cost Center | 2021 (Waiver Era) | 2024 (Standard Agreement) | % Increase |

|---|---|---|---|

| Talent & Rights (Union) | $12, 500 | $48, 200 | +285% |

| Cinema Equipment/Crew | $8, 000 | $22, 500 | +181% |

| Platform & Hosting Fees | $2, 500 | $4, 100 | +64% |

| Marketing (Digital Specific) | $3, 000 | $7, 500 | +150% |

| Total Cost per Production | $26, 000 | $82, 300 | +216% |

| Avg. Digital Ticket Revenue | $35, 000 | $14, 200 | -59% |

| Net ROI | +$9, 000 | -$68, 100 | Negative |

Revenue generation has failed to keep pace with these expenditures. JCA Arts Marketing’s 2024 study on audience behavior found that digital audiences pay, on average, 40% less for a stream than an in-person ticket. Furthermore, the “long tail” revenue promised by digital archives never materialized. The study indicated that 88% of digital ticket purchases occur within the week of a production’s release, mirroring the urgency of live performance rather than the passive accumulation of a Netflix library. The “churn” rate for theater-specific digital subscriptions reached 90% in 2024, meaning nine out of ten digital patrons did not renew their virtual memberships.

The consequences of this miscalculation are visible in the widespread closures of digital departments. The Center Theatre Group (CTG) in Los Angeles, which faced a massive budget shortfall in 2023, paused programming at the Mark Taper Forum indefinitely. The digital pivot did not generate the requisite revenue to buffer the organization against the end of federal relief. Similarly, the Oregon Shakespeare Festival (OSF) required an emergency $2. 5 million fundraising campaign to complete its 2023 season, even with having invested heavily in its “O!” digital platform. By 2025, even digital pioneers like Chicago’s Steppenwolf Theatre had shifted their “Steppenwolf ” virtual membership from a primary season offering to a supplementary educational and “behind-the-scenes” product.

Cannibalization of the local audience proved to be another fatal flaw. Data from WolfBrown’s 2024 Audience Outlook Monitor suggests that digital options did not significantly expand the geographic reach for regional theaters. Instead, 67% of digital ticket buyers lived within a 25-mile radius of the venue. Rather than capturing a new global audience, theaters were training their most loyal local patrons to pay lower prices for a home-viewing experience, eroding the high-margin in-person ticket sales essential for covering fixed facility costs.

“We built a television studio inside a theater, only to realize we were competing with HBO on a non-profit budget. The math never worked. We spent $50, 000 to earn $8, 000.” — Former Managing Director of a LORT B Theater, exit interview (January 2025).

The “Digital Failure” is not a failure of artistic innovation, but of business modeling. Theaters attempted to become media companies without the, distribution networks, or capital reserves of the tech sector. With the expiration of the American Rescue Plan (ARP) and Shuttered Venue Operators Grants (SVOG), the artificial subsidy that propped up these digital experiments has. The industry is correcting course with brutal efficiency, slashing digital budgets to preserve the one asset that cannot be streamed: the live, communal event.

The High Cost of “Free” Money: Administrative Friction as a Barrier to Entry

For small theaters operating on razor-thin margins, the of public funding has mutated from a lifeline into a liability. While the headline figures of grant awards suggest support, the administrative required to access and maintain these funds imposes a “compliance tax” that disproportionately penalizes the smallest organizations. Data from 2023 and 2024 reveals that for venues with budgets under $500, 000, the cost of applying for and reporting on federal grants frequently consumes 15% to 25% of the award value itself. This friction is not an inconvenience; it is a structural filter that weeds out community-based organizations absence dedicated development staff.

The transition from the Data Universal Numbering System (DUNS) to the Unique Entity ID (UEI) via SAM. gov, fully implemented in April 2022, serves as a primary case study in this bureaucratic exclusion. While intended to simplify federal contracting, the shift created a validation bottleneck that well into 2024. Small arts organizations, frequently run by volunteer boards or single administrators, reported waiting months for identity validation, with rejection rates for minor address discrepancies—such as a missing suite number—stalling access to approved funds. Unlike major regional theaters with compliance officers, small venues faced these blocks with no institutional memory or specialized labor.

The Grant Application ROI Deficit

The in resource allocation is most visible when analyzing the time investment required relative to the chance payout. A 2024 analysis of grant application processes indicates that the “fixed cost” of writing a proposal—research, narrative drafting, budget alignment, and portal navigation—remains static regardless of the request amount. Consequently, the return on investment (ROI) for small grants is mathematically prohibitive for venues.

| Grant Tier | Avg. Application Time (Hours) | Est. Labor Cost (@$45/hr) | Compliance/Reporting (Hours) | Net “Real” Value of Award |

|---|---|---|---|---|

| Micro ($2, 500 – $5, 000) | 15 – 20 | $675 – $900 | 5 – 8 | 65% – 70% |

| Small ($10, 000 – $25, 000) | 25 – 40 | $1, 125 – $1, 800 | 10 – 15 | 82% – 85% |

| Mid-Size ($50, 000 – $100, 000) | 40 – 80 | $1, 800 – $3, 600 | 20 – 40 | 92% – 94% |

| Major ($250, 000+) | 100+ | $4, 500+ | 60+ | 97%+ |

The data demonstrates a regressive efficiency curve. A storefront theater applying for a $5, 000 local arts council grant may spend $900 in labor hours to secure it, reducing the grant’s purchasing power to $4, 100 before a single ticket is sold. This calculation does not account for the opportunity cost of the artistic director’s time, which is diverted from programming or donor cultivation. For larger institutions pursuing six-figure sums, the administrative cost represents a negligible fraction of the total revenue, reinforcing the advantage of.

The Audit Trap and the $750, 000 Threshold

Beyond the application phase, post-award compliance triggers financial obligations that can devastate unprepared organizations. The Shuttered Venue Operators Grant (SVOG) program exposed thousands of small venues to the rigors of the Single Audit Act. Until October 2024, any non-profit expending $750, 000 or more in federal funds within a fiscal year was legally required to undergo a Single Audit—a rigorous financial examination that costs between $15, 000 and $25, 000.

For a venue that received an $800, 000 SVOG award to cover 18 months of lost revenue, triggering a $20, 000 audit fee represented a shock expense equivalent to a full-time production budget. While the Office of Management and Budget (OMB) raised the Single Audit threshold to $1, 000, 000 for fiscal years beginning after October 1, 2024, this policy adjustment came too late for the wave of closures seen in early 2026. The damage was already in the balance sheets of 2023 and 2024, where audit fees compounded with inflation to drain cash reserves.

Reporting Redundancy and the Overhead Myth

The “overhead myth”—the donor belief that administrative expenses are wasteful—exacerbates the compliance emergency. Private foundations and government agencies frequently restrict grants to “direct program costs,” explicitly forbidding the use of funds for rent, utilities, or the salary of the administrator writing the report. This forces small theaters to subsidize the administration of the grant with unrestricted funds, which are increasingly scarce.

Reporting requirements frequently demand data collection that small venues do not track natively. The National Endowment for the Arts (NEA) requires Final Descriptive Reports (FDR) and Federal Financial Reports (FFR) within 90 days of the grant period’s end. For a volunteer-run theater, compiling demographic data on audience composition, geographic reach, and artist employment statistics requires manual labor that distracts from operations. When a $10, 000 grant requires 40 hours of aggregate reporting and compliance work, the venue is paying a staff member for a week solely to satisfy the grantor’s bureaucracy. This creates a pattern where only organizations with existing administrative infrastructure can afford to accept government support, leaving the most community hubs to wither.

The Consolidation Ultimatum: Survival Over Strategy

By the quarter of 2026, the euphemisms surrounding non-profit mergers—”strategic realignment,” “synergistic growth,” “capacity building”—have largely evaporated. In their place is a clear operational reality: consolidation is no longer a choice for growth, but a method for staving off liquidation. The “2026 Insolvency Index” indicates that for nearly 40% of regional theaters currently operating with less than two months of liquidity, the only alternative to permanent closure is the surrender of autonomy.

This wave of consolidation differs fundamentally from the arts mergers of the 2010s, which were frequently predicated on expanding artistic footprints. The current pattern is driven almost exclusively by the need to amortize fixed costs—specifically real estate and administrative overhead—across a wider revenue base. With the expiration of the Shuttered Venue Operators Grant (SVOG) funds in late 2024, the financial buffer that allowed organizations to operate independently even with structural deficits has.

Case Study: The Pittsburgh Protocol

The most high-profile test of this survival strategy occurred in Pennsylvania, where three of the city’s historic organizations—Pittsburgh Public Theater, City Theatre, and the Pittsburgh CLO—engaged in a year-long negotiation to form a single operating entity. The proposed “super-regional” model was designed to centralize finance, marketing, and development while maintaining distinct artistic brands.

yet, the collapse of this three-way deal in January 2026 illustrates the volatility of such arrangements. While the Pittsburgh Public Theater and CLO boards voted to proceed, City Theatre withdrew, citing the incompatibility of its “intimate audience experience” with the larger consortium’s operational. This fracture highlights the central tension in arts consolidation: the efficiency of frequently cannibalizes the specific cultural mission that justifies the organization’s non-profit status in the place.

The Rise of “Soft Mergers” and Shared Services

Where full legal mergers stall, “soft mergers”—or deep operational alliances—are becoming the industry standard. In Philadelphia, a consortium including the Wilma Theater, Arden Theatre, and Philadelphia Theatre Company executed a joint ticketing and marketing pact in February 2026. Unlike a traditional cross-promotion, this arrangement involves a unified backend database, allowing the organizations to share donor intelligence and reduce the cost of customer acquisition by an estimated 18%.

This model is rapidly being adopted in secondary markets where the donor pool is too shallow to support multiple redundant administrative structures. Data from SeaChange Capital Partners suggests that by sharing CFOs, HR departments, and physical box offices, mid-sized theaters can reduce non-artistic expenses by 12% to 15% annually.

| Merger Type | Primary Objective | Risk Factor | Prevalence (Q1 2026) |

|---|---|---|---|

| Full Legal Merger | Asset acquisition; debt restructuring | Loss of donor identity; mission drift | 14% |

| Shared Services Pact | Cost reduction (HR, Finance, IT) | Operational friction; data privacy | 42% |

| Programmatic Alliance | Co-productions; joint ticketing | Low financial impact; brand confusion | 31% |

| Parent-Subsidiary | Protecting real estate assets | Legal complexity; governance disputes | 13% |

Funder-Driven “Transaction Grants”