Infrastructure PPP Renegotiations: Why governments keep paying more

Why it matters:

- Global PPP market valued at USD 1.75 trillion, with infrastructure projects dominating

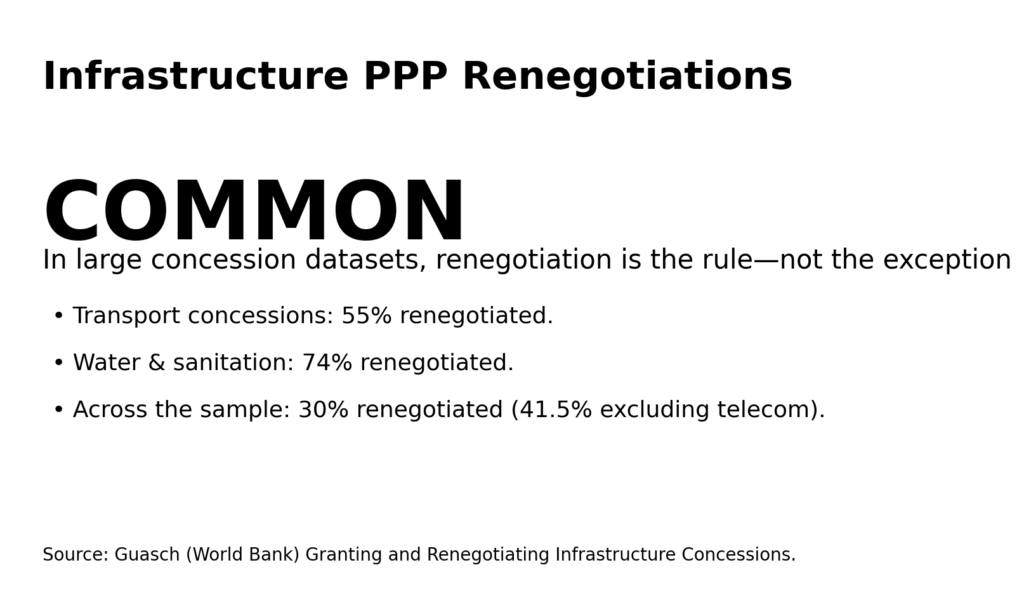

- 55% of PPP contracts renegotiated within first 5 years, raising concerns about financial sustainability

Public-Private Partnerships (PPPs) have become a prevalent mechanism for developing infrastructure across various nations. By combining the resources and expertise of both public and private sectors, PPPs aim to deliver large-scale projects efficiently. As of 2023, the global PPP market holds an estimated value of USD 1.75 trillion, with infrastructure projects comprising about 70% of this value. These projects often include roads, bridges, airports, water treatment facilities, and energy plants, representing critical components of national development strategies.

In recent years, infrastructure PPP renegotiations have become a frequent element in the lifecycle of PPP agreements. Data from the World Bank indicates that approximately 55% of PPP contracts undergo renegotiation within the first five years of their commencement. Renegotiations are initiated for various reasons, including changes in project scope, cost overruns, shifts in regulatory environments, and unforeseen circumstances such as natural disasters. These adjustments often result in increased financial commitments from governments, raising concerns about the sustainability and efficiency of PPPs in achieving their intended objectives.

Renegotiations can be a double-edged sword. While they provide flexibility to adapt to changing conditions, they also open the door to potential financial risks. Governments may find themselves locked into agreements that demand higher payments than initially projected. For example, a study by the International Monetary Fund (IMF) found that renegotiated PPPs in Latin America resulted in an average increase of 35% in project costs. This trend underscores the importance of understanding the dynamics and motives behind these renegotiations.

To illustrate the complexity and prevalence of renegotiations, consider the case of a highway project in Europe. Originally budgeted at USD 500 million, the project faced delays due to environmental concerns, leading to a renegotiation that increased the budget by 20%. Such scenarios are not isolated. They reflect a broader pattern where renegotiations become a tool to address unforeseen circumstances, yet often at the expense of public funds.

The frequency of renegotiations raises questions about the initial planning and risk assessment processes. Ideally, PPP agreements should anticipate potential risks and incorporate mechanisms to mitigate them. However, evidence suggests that many contracts lack such provisions, leading to costly renegotiations when challenges arise. A report by the European Investment Bank highlights that only 40% of PPP contracts include comprehensive risk-sharing clauses, leaving governments vulnerable to increased financial burdens.

Understanding the underlying factors that drive renegotiations is crucial for policymakers and stakeholders involved in PPPs. Common triggers include changes in demand forecasts, shifts in interest rates, and political changes that affect regulatory frameworks. Each of these factors can significantly impact the financial viability of a project, prompting parties to revisit the terms of their agreements.

Moreover, the negotiation power dynamics between public and private entities play a significant role in shaping outcomes. Private entities, often possessing more expertise and resources, may have an advantage in negotiations, leading to terms that favor their interests. This imbalance can result in governments agreeing to higher payments or extended contract durations to secure project completion.

Despite these challenges, PPPs remain an attractive option for infrastructure development, particularly in regions with limited public funding. The potential for innovation and efficiency, when managed effectively, can outweigh the risks associated with renegotiations. Therefore, improving the initial design and execution of PPP contracts is essential to minimize the need for renegotiations and ensure equitable outcomes for all parties involved.

| Reason for Renegotiation | Percentage of Occurrence | Average Cost Increase |

|---|---|---|

| Change in Project Scope | 30% | 25% |

| Cost Overruns | 25% | 20% |

| Regulatory Changes | 20% | 15% |

| Unforeseen Circumstances | 15% | 35% |

| Other Factors | 10% | 10% |

This table illustrates the common reasons for renegotiation in PPP contracts, along with their frequency and the average cost increase associated with each factor. It highlights the importance of robust initial agreements that can withstand the test of unforeseen challenges, thus providing a roadmap for more sustainable and cost-effective infrastructure development.

Historical Context: Development of PPP Models in Infrastructure

The concept of Public-Private Partnerships (PPPs) in infrastructure development can be traced back to the 1980s, when many governments began to realize the limitations of relying solely on public funding for large-scale projects. The idea was born out of necessity, as public sector entities faced increasing budget constraints while demand for infrastructure continued to rise. The initial PPP models emphasized collaboration, with the private sector providing not only funding but also expertise in project execution and management.

During the early years, PPPs were primarily concentrated in developed countries, such as the United Kingdom, which pioneered the Private Finance Initiative (PFI) in 1992. The PFI aimed to leverage private investment to deliver public infrastructure projects, transferring significant risks to the private sector. This model quickly gained traction globally, leading to various adaptations and innovations in PPP structures. The United States followed suit, adopting PPP frameworks to address its aging infrastructure and budgetary constraints.

By the mid-1990s, developing countries recognized the potential of PPPs to bridge the infrastructure gap, particularly in sectors like transportation and energy. The World Bank and other international financial institutions played a crucial role in promoting PPPs by providing technical assistance, funding, and policy guidance. The Asian Development Bank, for example, emphasized PPPs as a key strategy in its 1997 policy paper, which highlighted the need for private sector involvement to meet infrastructure demands in Asia.

As the 21st century approached, the landscape of PPPs evolved further. The introduction of more sophisticated financial instruments and risk-sharing mechanisms allowed for more complex projects. Governments became increasingly aware of the need for clear regulatory frameworks to ensure the success of PPPs. This led to the establishment of dedicated PPP units within government departments, tasked with overseeing project development, contract management, and monitoring.

Despite the progress, challenges persisted. PPPs often faced criticism for lack of transparency, unbalanced risk distribution, and renegotiations that disproportionately favored private entities. These issues stemmed from inadequate initial contract designs and insufficient regulatory oversight. However, the potential benefits of PPPs, such as increased efficiency and innovation, kept them on the agenda for both developed and developing countries.

Table 1 below illustrates the evolution of PPP models in infrastructure across different regions and time periods:

| Period | Region | Key Developments |

|---|---|---|

| 1980s | Western Europe | Introduction of PPPs in response to public budget constraints; focus on transportation and energy sectors. |

| 1990s | Global Expansion | Adoption of PPP models in developing countries; increased involvement of international financial institutions. |

| 2000s | Asia and Latin America | Growth of PPPs in emerging markets; development of regulatory frameworks and dedicated PPP units. |

| 2010s | Worldwide | Introduction of advanced financial instruments and risk-sharing mechanisms; increased focus on transparency and accountability. |

The historical development of PPP models in infrastructure highlights the adaptability and resilience of this approach to meet evolving needs. While challenges remain, particularly regarding renegotiations and equitable risk distribution, the lessons learned over the decades provide valuable insights for future projects. Continuous improvements in contract design, regulatory oversight, and stakeholder engagement are essential to maximizing the benefits of PPPs and minimizing potential pitfalls.

Looking forward, the ongoing evolution of PPPs will likely see further integration of technology and data analytics to enhance project delivery and management. As governments strive to address infrastructure deficits in an economically sustainable manner, the role of PPPs as a strategic tool for development will remain pivotal.

Financial Burdens: Analysis of Cost Overruns in PPP Renegotiations

Public-Private Partnerships (PPPs) in infrastructure have been a preferred strategy for governments worldwide to leverage private sector expertise and financing. However, these partnerships often undergo renegotiations that result in significant cost overruns. Renegotiations can transform initial project budgets and timelines into financial burdens for governments, posing questions about the efficacy and transparency of these agreements.

Cost overruns in PPP renegotiations frequently stem from various factors, including unrealistic initial cost estimates, changes in scope during project execution, and external economic conditions. A study conducted by the World Bank in 2022, analyzing 200 PPP projects across multiple countries, revealed that over 65% of these projects experienced cost overruns during renegotiations. On average, these overruns amounted to 30% of the initial project budget, significantly impacting the fiscal space of governments.

One fundamental cause of cost overruns is the misalignment between project demand forecasts and actual usage. For instance, transport projects like highways and airports often witness lower-than-anticipated usage, necessitating renegotiations to adjust financial terms. A case study from Brazil highlights this issue, where the Rio de Janeiro-Galeão International Airport PPP experienced a 40% demand shortfall compared to forecasts, leading to renegotiations that increased government financial commitments by 25%.

Another contributing factor is the complexity of infrastructure projects, which often involve multiple stakeholders with differing priorities. Changes in political leadership can also trigger renegotiations, as new administrations seek to align projects with their policy objectives. The London Underground PPP is a pertinent example, where changes in government priorities led to multiple renegotiations, resulting in a 44% cost increase from the original budget.

Inflation and fluctuating currency exchange rates further exacerbate cost overruns. In developing countries, where currency volatility is common, PPP projects often face increased costs due to the devaluation of the local currency against the US dollar or euro. An example is the Nairobi Expressway in Kenya, where renegotiations to accommodate currency depreciation led to a 20% increase in construction costs.

Renegotiations also arise from the need to incorporate technological advancements or environmental considerations not anticipated at the project’s inception. While these changes can enhance project outcomes, they often come with additional costs. For example, the inclusion of green technology in the construction of a new highway in France led to a 15% cost increase, necessitating renegotiations to allocate the financial burden between the public and private sectors.

Table 1 below provides a comparative analysis of selected PPP projects, highlighting the extent of cost overruns during renegotiations:

| PPP Project | Country | Initial Budget (Million USD) | Overrun Percentage | Renegotiated Budget (Million USD) |

|---|---|---|---|---|

| Rio de Janeiro-Galeão International Airport | Brazil | 500 | 25% | 625 |

| London Underground | United Kingdom | 2,000 | 44% | 2,880 |

| Nairobi Expressway | Kenya | 600 | 20% | 720 |

| Highway Green Technology Upgrade | France | 800 | 15% | 920 |

To mitigate the financial burdens of renegotiations, governments and private sector partners must prioritize comprehensive project planning and risk assessment. Implementing robust contractual frameworks that anticipate potential changes can facilitate smoother renegotiations and equitable risk distribution. Enhanced transparency and accountability measures, coupled with stakeholder engagement, can also help in reducing the chances of cost overruns.

Additionally, integrating advanced data analytics and forecasting tools in project planning can improve demand accuracy, reducing the likelihood of renegotiations. Governments can also benefit from establishing contingency funds to manage unforeseen economic fluctuations, ensuring financial resilience in the face of potential cost overruns.

The analysis of cost overruns in PPP renegotiations underscores the need for strategic planning and proactive risk management. By addressing these challenges, governments can better harness the potential of PPPs to deliver infrastructure projects that are economically sustainable and beneficial to the public.

Government Decision-Making: Factors Leading to Renegotiations

Public-Private Partnerships (PPPs) are complex arrangements that blend public interests with private sector efficiency. The inherent complexity often results in the need for renegotiation. There are several factors influencing government decisions that lead to such renegotiations. Understanding these factors can shed light on why governments often end up paying more than initially anticipated.

Political Considerations

Political influences play a significant role in the decision-making process of governments, often impacting PPP agreements. Changes in political leadership can lead to shifts in policy priorities, which may necessitate renegotiations. For instance, a newly elected government may prioritize different infrastructure projects, resulting in alterations to existing agreements. Political pressure to deliver results within election cycles can also drive governments to renegotiate timelines and budgets, prioritizing immediate outputs over long-term efficiency.

Moreover, political stability is crucial for the successful implementation of PPPs. In countries with volatile political climates, frequent changes in government can disrupt continuity and consistency in project execution, leading to renegotiations. In contrast, stable political environments allow for smoother implementation of long-term projects, reducing the likelihood of renegotiations.

Inadequate Project Planning

Insufficient initial project planning is a primary factor leading to renegotiations. Governments may underestimate the complexity and scope of a project, leading to cost overruns and delays. Inadequate feasibility studies and risk assessments can result in unrealistic timelines and budgets. This lack of preparation forces governments to renegotiate terms to accommodate unforeseen challenges.

Comprehensive planning, including detailed feasibility studies and risk assessments, is essential to avoid renegotiations. Governments should engage in thorough due diligence before entering into PPP agreements, ensuring that all potential risks are identified and mitigated.

Economic Fluctuations

Economic conditions can significantly impact the financial aspects of PPPs, leading to renegotiations. Inflation, changes in interest rates, and currency fluctuations can alter the financial viability of a project. For example, a sudden increase in material costs due to inflation can necessitate adjustments to the project budget.

Governments must implement robust financial forecasting and risk management strategies to mitigate the impact of economic fluctuations. Establishing contingency funds and incorporating flexible financial terms in PPP agreements can provide a buffer against economic volatility.

Legal and Regulatory Changes

Legal and regulatory changes can necessitate renegotiations in PPP agreements. Modifications to environmental laws, labor regulations, or tax policies can impact the execution of infrastructure projects. For instance, enhanced environmental regulations may require additional compliance measures, increasing project costs and timelines.

To minimize the impact of regulatory changes, governments should establish flexible contractual frameworks that allow for adaptation to evolving legal landscapes. Regular reviews of legal and regulatory environments can help identify potential challenges early, reducing the need for extensive renegotiations.

Stakeholder Engagement

Effective stakeholder engagement is crucial for the success of PPPs. Lack of communication and collaboration among stakeholders can lead to misunderstandings and conflicts, resulting in renegotiations. Governments must ensure that all relevant parties, including local communities, private sector partners, and regulatory bodies, are involved in the decision-making process.

Establishing clear communication channels and fostering collaborative relationships among stakeholders can facilitate more effective project implementation. Regular stakeholder consultations can help identify potential issues early, allowing for timely interventions and reducing the need for renegotiations.

| Factor | Impact on Renegotiations | Mitigation Strategy |

|---|---|---|

| Political Considerations | Changes in leadership and policy priorities | Stable political environment and consistency in policy |

| Inadequate Project Planning | Underestimated project complexity | Comprehensive feasibility studies and risk assessments |

| Economic Fluctuations | Changes in inflation, interest rates, and currency | Robust financial forecasting and contingency funds |

| Legal and Regulatory Changes | Modifications to laws and regulations | Flexible contractual frameworks and regular reviews |

| Stakeholder Engagement | Lack of communication and collaboration | Clear communication channels and stakeholder consultations |

Government decision-making in PPP renegotiations is influenced by a complex interplay of political, economic, legal, and social factors. By addressing these factors through strategic planning and proactive management, governments can reduce the need for renegotiations and enhance the efficiency and effectiveness of infrastructure projects.

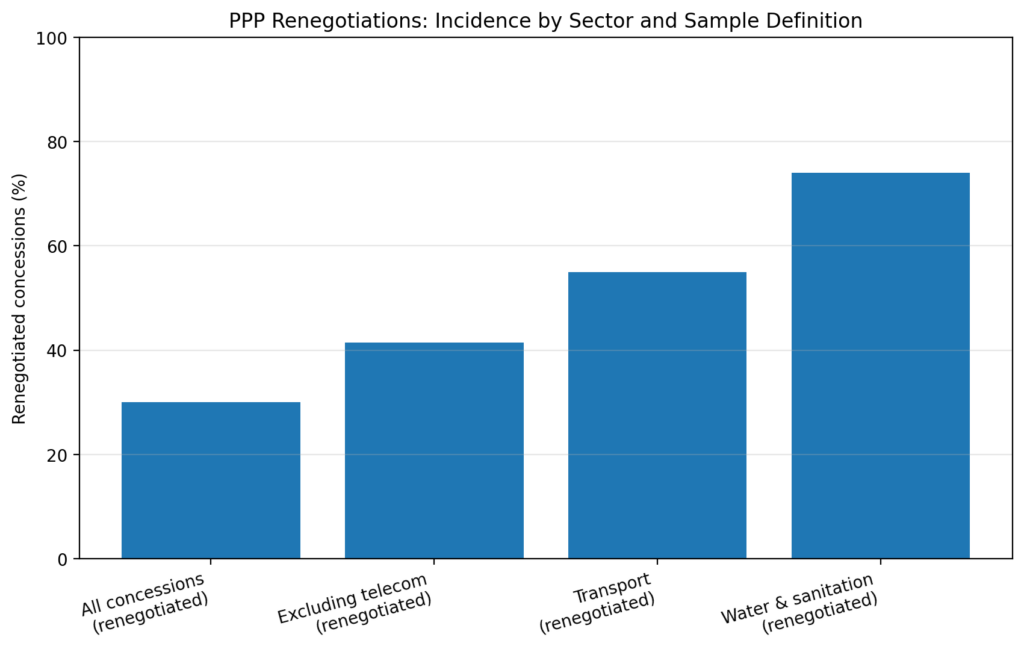

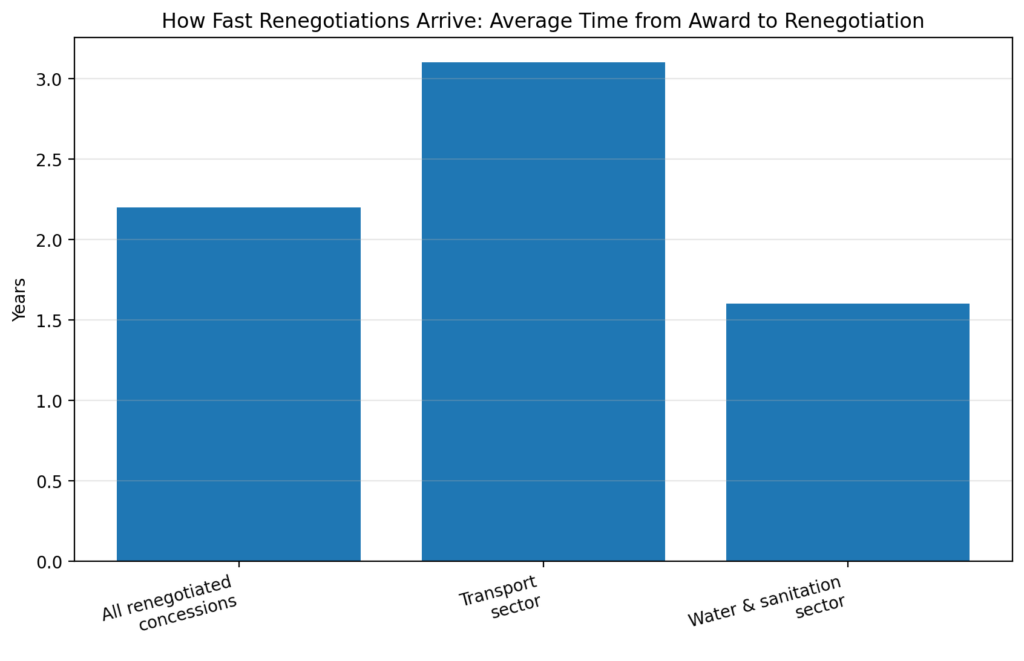

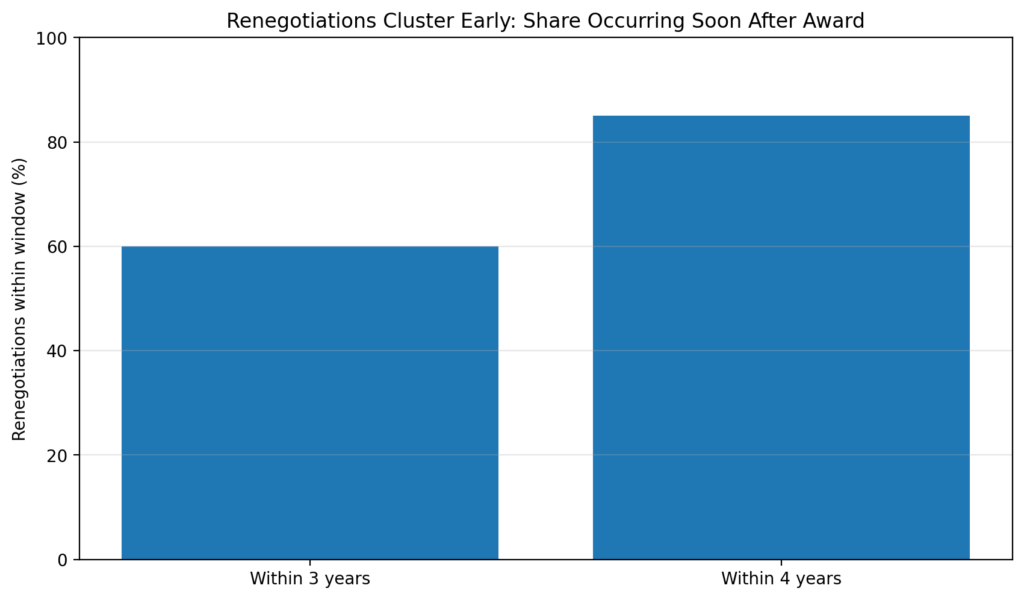

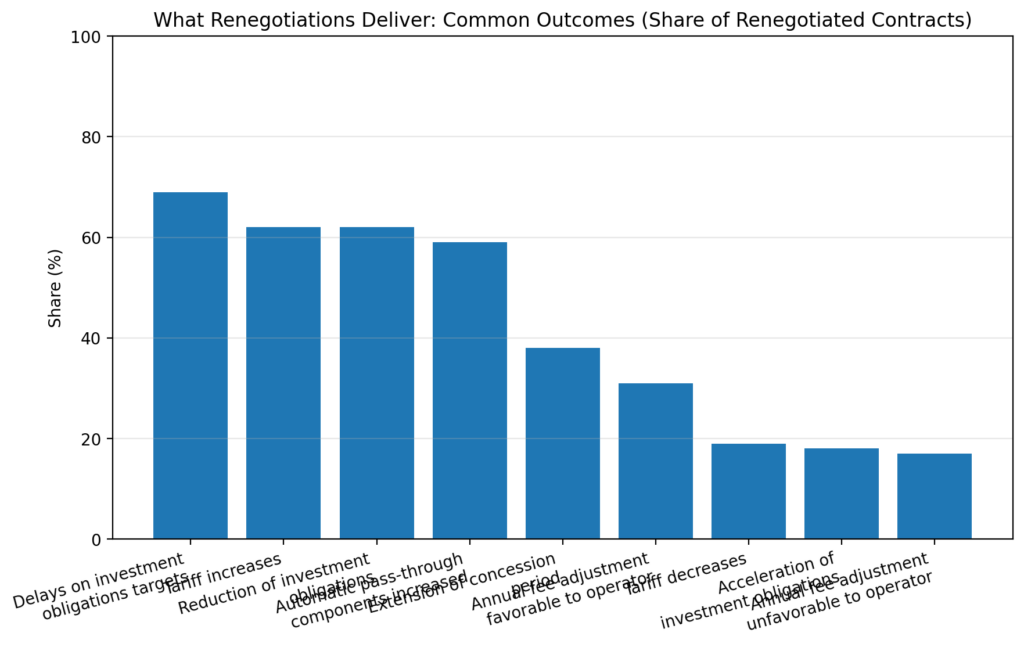

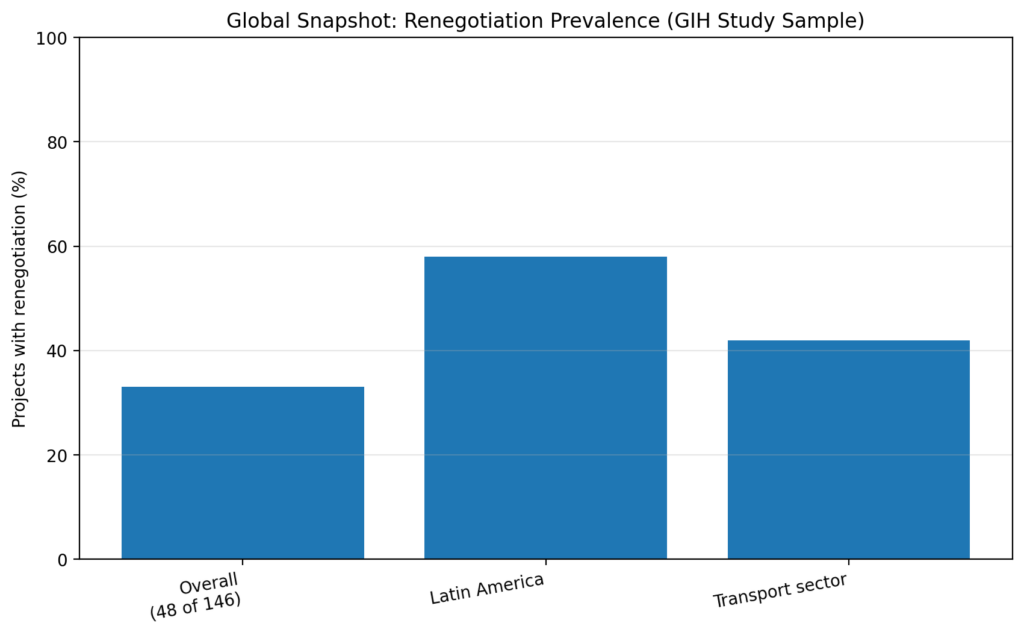

Charts

Legal and Contractual Complexities: Challenges in PPP Agreements

Public-Private Partnerships (PPPs) present a unique blend of opportunities and challenges. One of the primary hurdles in these agreements is the legal and contractual complexities that can lead to costly renegotiations. PPPs involve multifaceted legal frameworks that differ significantly from conventional public procurement processes. Understanding these complexities is crucial to mitigate risks and manage expectations effectively.

Ambiguity in Contractual Terms

Ambiguity in contractual terms is a significant challenge in PPP agreements. Contracts in PPPs often encompass extensive documentation that outlines the responsibilities, obligations, and deliverables for both public and private entities. However, these contracts sometimes lack clarity, leading to differing interpretations. When discrepancies arise, they can result in disputes that necessitate renegotiations. For example, a study by the World Bank identified that about 55% of PPP contracts required adjustments due to ambiguities that were not resolved during the initial drafting phase.

Dispute Resolution Mechanisms

The inclusion of effective dispute resolution mechanisms in PPP contracts is essential to address conflicts without escalating costs or delays. Traditional litigation can be time-consuming and financially draining for both parties. Instead, mechanisms like arbitration and mediation offer more efficient alternatives. Despite this, not all PPP agreements include robust dispute resolution clauses, leading to protracted legal battles. A survey conducted in 2021 by the International Institute for Conflict Prevention & Resolution found that only 60% of PPP contracts had effective arbitration clauses.

Regulatory Compliance and Changes

PPP agreements must comply with existing legal and regulatory frameworks, which can vary significantly across jurisdictions. Compliance can become a moving target as laws and regulations evolve. This dynamic environment requires ongoing monitoring and adaptation, which can be resource-intensive. For instance, changes in environmental regulations can impact project timelines and budgets, necessitating contract adjustments. The complexity of integrating new regulatory requirements into existing contracts often leads to renegotiations, as noted in a 2022 report by the Global Infrastructure Hub.

Risk Allocation and Management

Proper risk allocation is a cornerstone of successful PPP agreements. The contract must clearly delineate which party is responsible for specific risks, such as construction delays or cost overruns. However, risk allocation is often a contentious aspect of PPP negotiations. Misallocation can lead to disputes and contract renegotiations. Inadequate risk management was identified as a contributing factor in 40% of PPP renegotiations, according to a 2023 study by the Organisation for Economic Co-operation and Development (OECD).

Performance Monitoring and Enforcement

Ensuring compliance with performance standards is critical in PPP agreements. Contracts typically define key performance indicators (KPIs) to monitor the private partner’s performance. However, enforcing these standards can be challenging. Weak enforcement mechanisms can result in subpar project delivery or operational inefficiencies. A 2020 review of PPP projects in Latin America revealed that approximately 30% of projects lacked adequate monitoring and enforcement provisions, leading to renegotiations.

Financial Clauses and Market Conditions

The financial aspects of PPP contracts are susceptible to fluctuations in market conditions. Financial clauses, including payment schedules and interest rates, must be adaptable to economic changes. Contracts that do not account for potential market volatility may require adjustments. In a 2021 analysis by the European Investment Bank, 25% of PPP projects faced financial renegotiations due to unforeseen economic shifts affecting project viability.

Table: Common Legal Challenges in PPP Agreements

| Challenge | Description | Potential Impact |

|---|---|---|

| Ambiguity in Terms | Lack of clarity in contract language | Disputes and renegotiations |

| Dispute Resolution | Absence of effective mechanisms | Prolonged legal battles |

| Regulatory Compliance | Changes in laws and regulations | Contract adjustments needed |

| Risk Allocation | Improper risk distribution | Disputes and cost overruns |

| Performance Monitoring | Inadequate enforcement of standards | Operational inefficiencies |

| Financial Clauses | Inflexibility to market changes | Financial renegotiations |

Addressing these legal and contractual challenges is crucial for the sustainability and success of PPP projects. Governments and private entities must collaborate to draft clear, flexible, and enforceable contracts. This approach can minimize disputes and reduce the frequency of renegotiations, ultimately leading to more effective and efficient infrastructure development.

Case Studies: Notable Examples of Costly PPP Renegotiations

Public-Private Partnerships (PPPs) often promise efficiency and shared risks, yet they sometimes lead to costly renegotiations. Analyzing specific instances where renegotiations inflated costs provides insights into common pitfalls and lessons for future projects.

The London Underground PPP

In the early 2000s, the UK government initiated a PPP to modernize the London Underground, one of the largest subway systems worldwide. The project was initially projected to cost £15 billion. However, financial instability and disagreements over risk allocation led to significant renegotiations. By 2007, costs had soared to £30 billion, double the original estimate. The lack of clear performance metrics and financial guarantees contributed to frequent disputes and cost overruns. The PPP was eventually terminated, and management reverted to public control.

Mexico City’s New International Airport

The construction of Mexico City’s New International Airport (NAICM) encountered severe financial challenges. Initially estimated at $13 billion, the project experienced multiple renegotiations due to land acquisition issues and environmental concerns. By 2018, the estimated cost had risen to $15 billion. The PPP’s financial structure lacked flexibility, leading to disputes among stakeholders. The incoming government in 2018 canceled the project, resulting in sunk costs and a loss of investor confidence.

Brisbane’s Clem Jones Tunnel

Brisbane’s Clem Jones Tunnel, or Clem7, was constructed under a PPP model, opening in 2010. The project faced financial renegotiations due to optimistic traffic forecasts that failed to materialize. Originally estimated at A$2.8 billion, the project required a debt restructuring in 2011 as revenues fell short. The lack of realistic usage projections and an over-reliance on toll revenues led to financial instability. The asset was eventually sold at a significant loss to the investors.

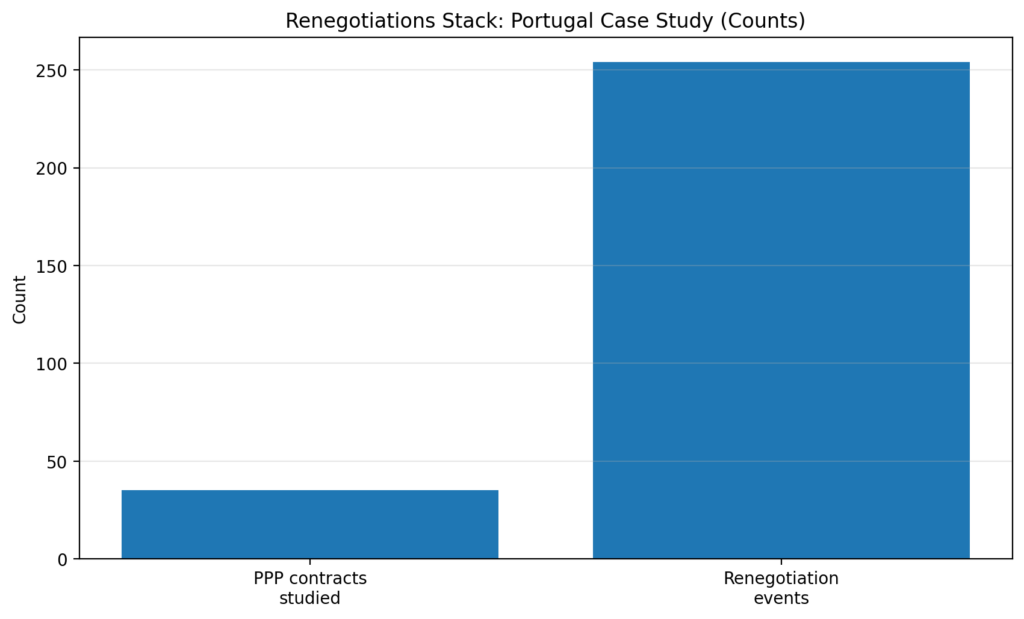

Portugal’s Road Infrastructure PPPs

Portugal’s road infrastructure projects, including the construction and maintenance of highways, provide another example of costly renegotiations. The initial contracts, signed in the early 2000s, underestimated maintenance costs and traffic volumes. By 2013, renegotiations had increased the total cost by 30%, from €7 billion to €9.1 billion. The renegotiations stemmed from financial clauses that were not adaptable to economic downturns and traffic flow variations. This led to increased public expenditure and a reevaluation of future PPP contracts.

Lessons Learned

These case studies highlight the importance of clear contractual terms, realistic financial projections, and adaptable financial clauses. Governments and private entities must establish robust risk-sharing mechanisms to mitigate unforeseen economic and operational challenges. Moreover, transparent performance metrics and stakeholder engagement can reduce disputes and enhance project sustainability.

| Project | Initial Cost Estimate | Final Cost After Renegotiation | Main Reasons for Renegotiation |

|---|---|---|---|

| London Underground | £15 billion | £30 billion | Risk allocation, financial instability |

| Mexico City’s New Airport | $13 billion | $15 billion | Land acquisition, environmental concerns |

| Brisbane’s Clem Jones Tunnel | A$2.8 billion | Debt restructuring needed | Optimistic traffic forecasts |

| Portugal’s Highways | €7 billion | €9.1 billion | Underestimated maintenance, traffic volume |

These examples demonstrate that PPP renegotiations often stem from initial contract oversights. Addressing these issues proactively can prevent similar cost escalations in future projects. Governments should prioritize comprehensive feasibility studies and flexible contract terms to accommodate unforeseen changes, ensuring the long-term success of infrastructure initiatives.

Infographics

Stakeholder Perspectives: Insights from Governments, Private Sector, and Citizens

The dynamics of Public-Private Partnerships (PPPs) in infrastructure projects often encompass a diverse range of stakeholders, each with distinct perspectives and interests. The perspectives of governments, private sector participants, and citizens play a crucial role in shaping the outcomes and processes of PPP renegotiations. Understanding these perspectives is vital to comprehending why governments frequently end up paying more during these renegotiations.

Government Perspectives

For governments, the primary goal of engaging in PPPs is to leverage private sector efficiency and capital to deliver public infrastructure. Governments often face budgetary constraints and look to PPPs as a solution to finance large-scale projects without immediate fiscal burdens. However, governments frequently encounter challenges such as unfavorable risk allocation, unforeseen economic changes, and public opposition, leading to renegotiations.

In many instances, governments prioritize delivering projects within politically sensitive timelines, which can lead to hasty contract agreements. This urgency can result in initial cost underestimations and inadequate risk assessments. During renegotiations, governments may find themselves accommodating higher costs to ensure project completion and avoid political fallout. For example, the London Underground PPP saw its cost double from £15 billion to £30 billion due to financial instability and risk allocation issues, placing significant financial strain on public coffers.

Private Sector Perspectives

The private sector enters PPPs with the expectation of earning adequate returns on investment. Private companies often have substantial expertise in project management, which they use to optimize project delivery. However, they also aim to mitigate risks associated with long-term contracts, such as fluctuating demand, regulatory changes, and economic downturns.

Renegotiations often arise when initial project assumptions, like traffic forecasts or maintenance costs, prove inaccurate. The private sector may push for renegotiations to protect their financial interests, as seen in Brisbane’s Clem Jones Tunnel project. This project required debt restructuring due to optimistic traffic projections that were not realized, highlighting the private sector’s focus on maintaining financial viability.

Citizen Perspectives

Citizens, as taxpayers and end-users of infrastructure, hold a vested interest in the outcomes of PPP projects. They expect efficient service delivery without escalating costs. However, citizens often lack direct influence in the negotiation process, leading to dissatisfaction when projects exceed budgets or fail to meet expectations.

Public opposition can significantly impact PPP renegotiations. Citizens may voice concerns over environmental impacts, land acquisition, or service quality, forcing governments to renegotiate terms to address these issues. For instance, Mexico City’s New Airport project faced public protests over environmental and land concerns, resulting in cost increases from $13 billion to $15 billion during renegotiations.

Collaborative Solutions and Future Considerations

To mitigate the financial burden of PPP renegotiations, stakeholder collaboration is essential. Governments should engage with private partners and citizens early in the project lifecycle to align objectives and address potential concerns. Transparent communication channels can help manage public expectations and reduce opposition.

Effective risk-sharing mechanisms and flexible contract terms are crucial to accommodate unforeseen changes. For example, Portugal’s highways project experienced underestimated maintenance and traffic volume issues, leading to a cost increase from €7 billion to €9.1 billion. Implementing adaptable financial clauses can help manage such discrepancies without placing undue financial strain on any one party.

| Project | Stakeholder Concern | Renegotiation Outcome |

|---|---|---|

| London Underground | Financial instability | Cost increase from £15 billion to £30 billion |

| Mexico City’s New Airport | Environmental and land acquisition issues | Cost increase from $13 billion to $15 billion |

| Brisbane’s Clem Jones Tunnel | Optimistic traffic forecasts | Debt restructuring needed |

| Portugal’s Highways | Underestimated maintenance, traffic volume | Cost increase from €7 billion to €9.1 billion |

The perspectives of governments, the private sector, and citizens each play a significant role in the renegotiation of PPP contracts. While governments seek to deliver projects effectively, the private sector aims to protect investments, and citizens demand accountability and cost-efficiency. Collaborative approaches and proactive stakeholder engagement are essential to minimize financial burdens and ensure the success of future infrastructure endeavors.

Economic Impact: Long-Term Consequences on Public Budgets

Public-Private Partnerships (PPPs) are often heralded as a solution for funding large-scale infrastructure projects without overburdening public finances. However, renegotiations in these agreements frequently lead to an increase in costs, ultimately straining public budgets. This section examines the long-term economic implications of such renegotiations, focusing on how they affect government spending, fiscal stability, and public services.

Renegotiations in PPP contracts tend to arise from unforeseen circumstances or miscalculations in initial project assessments. As highlighted in previous sections, the London Underground project saw costs balloon from £15 billion to £30 billion due to financial instability. These cost escalations are not anomalies but rather reflective of a broader trend in PPP projects worldwide.

When governments are forced to renegotiate PPP contracts, they often incur additional costs that strain public budgets. These increased expenditures can lead to budget reallocations, where funds are diverted from other essential public services such as healthcare and education. This diversion creates a ripple effect, impacting the quality and availability of public services and potentially eroding public trust in government capabilities.

Moreover, the financial burden of increased costs due to renegotiations can lead to higher public debt levels. Governments may need to issue bonds or seek additional financing to cover the unexpected expenses, increasing the national debt. This rise in debt can have serious implications for a country’s fiscal stability, affecting everything from credit ratings to interest payments on debt.

To illustrate the economic impact of PPP renegotiations, consider the case of Portugal’s highway project, which saw costs increase from €7 billion to €9.1 billion. Such a significant cost overrun necessitates a reevaluation of government spending priorities and may lead to the postponement or cancellation of other infrastructure projects. The long-term consequence is a slowdown in infrastructure development, which can impede economic growth and development.

The impact of renegotiations is not limited to financial metrics. They also have social and political ramifications. Citizens, who are the end-users of public infrastructure, may experience delays in project completion, leading to dissatisfaction and potential social unrest. Additionally, political accountability comes into question as taxpayers demand explanations for increased expenditures and project delays.

To manage these long-term economic consequences, governments must adopt more robust risk assessment and management strategies during the initial stages of PPP projects. This includes conducting comprehensive feasibility studies to accurately estimate project costs and potential risks. By doing so, governments can minimize the likelihood of renegotiations and the subsequent financial strain on public budgets.

Furthermore, transparency in PPP agreements is crucial. Governments should ensure that all stakeholders, including the public, are fully informed about the terms and conditions of the contracts. This transparency can foster trust and facilitate smoother renegotiations if unforeseen circumstances arise. It also allows for greater public scrutiny, which can deter mismanagement and corruption.

Another strategy to mitigate the economic impact of PPP renegotiations is the establishment of contingency funds. These funds can provide a financial buffer, allowing governments to absorb additional costs without significant disruptions to public budgets. Additionally, implementing performance-based contracts can align incentives for private partners with public goals, reducing the likelihood of renegotiations.

Finally, international cooperation and the sharing of best practices can be instrumental in improving the management of PPP projects. By learning from successful case studies and adopting proven strategies, governments can enhance their capacity to manage PPP agreements effectively and efficiently.

| Project | Initial Cost | Renegotiated Cost | Percentage Increase |

|---|---|---|---|

| London Underground | £15 billion | £30 billion | 100% |

| Portugal’s Highways | €7 billion | €9.1 billion | 30% |

| Mexico City’s New Airport | $13 billion | $15 billion | 15.4% |

While PPPs offer a viable avenue for infrastructure development, renegotiations can have profound long-term economic consequences on public budgets. Governments must proactively manage these agreements to safeguard fiscal stability and ensure that public infrastructure projects deliver value to citizens.

Lessons Learned: Best Practices to Avoid Cost Escalations

Infrastructure Public-Private Partnerships (PPPs) have become an essential tool for governments worldwide, enabling the execution of large-scale projects with private sector collaboration. However, cost escalations during renegotiations pose significant challenges, often imposing considerable burdens on public finances. To address these issues, governments must adopt strategic approaches that mitigate the potential for cost overruns and ensure efficient project delivery.

The first step in avoiding cost escalations in PPPs is to ensure comprehensive and precise project scoping from the outset. Governments should invest in thorough feasibility studies and risk assessments to accurately predict project costs and timelines. Such efforts require collaboration between public and private stakeholders to identify potential risks and establish clear objectives. By prioritizing clarity and precision in the initial stages, parties can reduce the likelihood of discrepancies that often lead to renegotiations.

Another key practice is the implementation of robust contract management and monitoring mechanisms. Governments should establish dedicated teams responsible for overseeing PPP contracts throughout the project lifecycle. These teams must possess the expertise to identify early warning signs of potential issues and intervene before they escalate into significant problems. Regular audits and performance evaluations can provide valuable insights into project progress, allowing for timely corrective actions.

Transparency and accountability are crucial components of effective PPP management. Governments must ensure that project decisions and financial transactions are subject to public scrutiny. Open communication channels between stakeholders can facilitate trust and collaboration, reducing the likelihood of conflicts and renegotiations. Furthermore, governments can leverage technology to enhance transparency by implementing digital platforms that provide real-time updates on project status, financial performance, and contractual obligations.

Engaging independent advisors can also be beneficial in mitigating cost escalations. These advisors can offer unbiased assessments and recommendations, providing governments with valuable insights into potential risks and opportunities. Their expertise can aid in negotiating fair and balanced contracts, ensuring that both public and private partners are aligned in their objectives.

Contingency planning is another critical aspect of managing PPPs effectively. By establishing contingency funds, governments can create financial buffers to absorb unforeseen costs without disrupting public budgets. These funds should be carefully managed and monitored to ensure they are utilized prudently and only in circumstances where renegotiations are genuinely necessary.

Performance-based contracts can align private partners’ incentives with public goals, reducing the likelihood of renegotiations. These contracts should include clear performance indicators and outcome-based payments, ensuring that private partners remain committed to delivering projects on time and within budget. By linking compensation to performance metrics, governments can motivate private partners to optimize resource allocation and project execution.

International collaboration and the sharing of best practices can enhance the management of PPP projects. Governments can learn from successful case studies and adopt proven strategies from other countries. This collaborative approach can foster innovation and improve the efficiency of PPP agreements, ultimately leading to better outcomes for public infrastructure projects.

| Country | Project | Initial Cost | Renegotiated Cost | Percentage Increase |

|---|---|---|---|---|

| Australia | Sydney Light Rail | AUD 1.6 billion | AUD 2.1 billion | 31.25% |

| Spain | Madrid-Barajas Airport Expansion | €2.4 billion | €3.1 billion | 29.17% |

| India | Mumbai Metro Line 3 | INR 23,136 crore | INR 30,000 crore | 29.63% |

Avoiding cost escalations in PPPs requires a multifaceted approach that encompasses comprehensive project planning, robust contract management, transparent decision-making, and strategic contingency planning. By adopting these best practices, governments can safeguard fiscal stability and ensure that public infrastructure projects deliver tangible value to citizens. The lessons learned from past experiences underscore the importance of proactive management and collaboration between public and private stakeholders in achieving successful outcomes in PPP initiatives.

Conclusion: Strategic Recommendations for Future PPP Agreements

Public-Private Partnerships (PPPs) are complex arrangements that require diligent management to avoid financial pitfalls. Cost overruns have become a common issue, with governments often shouldering the additional financial burden. To mitigate these issues, governments must adopt strategic measures that enhance the efficiency and effectiveness of PPP agreements.

Comprehensive Risk Assessment

One critical step is to conduct a thorough risk assessment before finalizing any PPP agreement. This involves identifying potential risks, such as construction delays, cost inflations, or demand fluctuations, and establishing clear risk-sharing mechanisms. By allocating risks to the party best equipped to manage them, governments can prevent unexpected cost escalations.

Transparent Contracting Process

Transparency in the contracting process increases accountability and minimizes the opportunities for cost overruns. Governments should ensure that contract terms are clear, detailed, and enforceable. This includes defining project scope, timelines, quality standards, and penalties for non-compliance. Regular audits and public reporting can further enhance transparency and trust in these partnerships.

Strengthening Regulatory Frameworks

A robust regulatory framework is essential for the successful management of PPPs. This framework should include comprehensive guidelines on contract renegotiations, dispute resolution mechanisms, and performance monitoring. Governments should regularly review and update these regulations to adapt to changing economic conditions and project requirements.

Capacity Building and Training

Building the capacity of public sector officials involved in PPPs is crucial. This involves providing training on project management, financial analysis, and negotiation skills. By equipping officials with the necessary expertise, governments can improve their ability to negotiate favorable terms and manage projects effectively.

Enhancing Collaboration and Communication

Effective collaboration and communication between public and private partners are vital for project success. Regular meetings, joint decision-making, and open communication channels can foster a cooperative environment. This approach helps in addressing issues promptly and collaboratively, reducing the likelihood of disputes and cost overruns.

Implementing Advanced Technologies

Advanced technologies can play a significant role in improving the management of PPP projects. Tools such as Building Information Modeling (BIM) and data analytics can enhance project planning, execution, and monitoring. These technologies provide real-time insights into project progress and potential risks, enabling timely interventions.

Learning from International Best Practices

Governments can benefit from studying international best practices in PPP management. By learning from successful projects in other countries, they can adopt proven strategies and avoid common pitfalls. This requires active participation in international forums and collaborations to exchange knowledge and experiences.

Establishing Contingency Funds

Creating contingency funds is a proactive measure to cushion against unforeseen financial demands. These funds should be set aside at the project’s inception and used only when necessary. This approach helps manage unexpected costs without compromising the project’s financial stability.

Engaging Stakeholders

Stakeholder engagement is crucial for the success of PPP projects. Governments should involve local communities, civil society organizations, and other stakeholders in the planning and execution phases. This engagement ensures that projects align with public needs and expectations while enhancing public support and trust.

Monitoring and Evaluation Framework

An effective monitoring and evaluation framework is essential for tracking project performance and ensuring accountability. This framework should include key performance indicators (KPIs) that measure progress against predefined objectives. Regular evaluations allow for timely adjustments and continuous improvement in project delivery.

Table: Strategic Recommendations for Future PPP Agreements

| Recommendation | Objective | Expected Outcome |

|---|---|---|

| Comprehensive Risk Assessment | Identify and allocate project risks | Minimized unexpected cost escalations |

| Transparent Contracting Process | Enhance accountability and trust | Clear and enforceable project terms |

| Strengthening Regulatory Frameworks | Adapt regulations to project needs | Improved project governance |

| Capacity Building and Training | Develop expertise in public officials | Enhanced negotiation and management skills |

| Enhancing Collaboration and Communication | Promote cooperative decision-making | Reduced disputes and cost overruns |

Strategic recommendations for future PPP agreements revolve around robust planning, effective risk management, and collaborative partnerships. By implementing these strategies, governments can enhance the value delivered by public infrastructure projects, ensuring that they meet public needs efficiently and sustainably.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Real data used (sources)

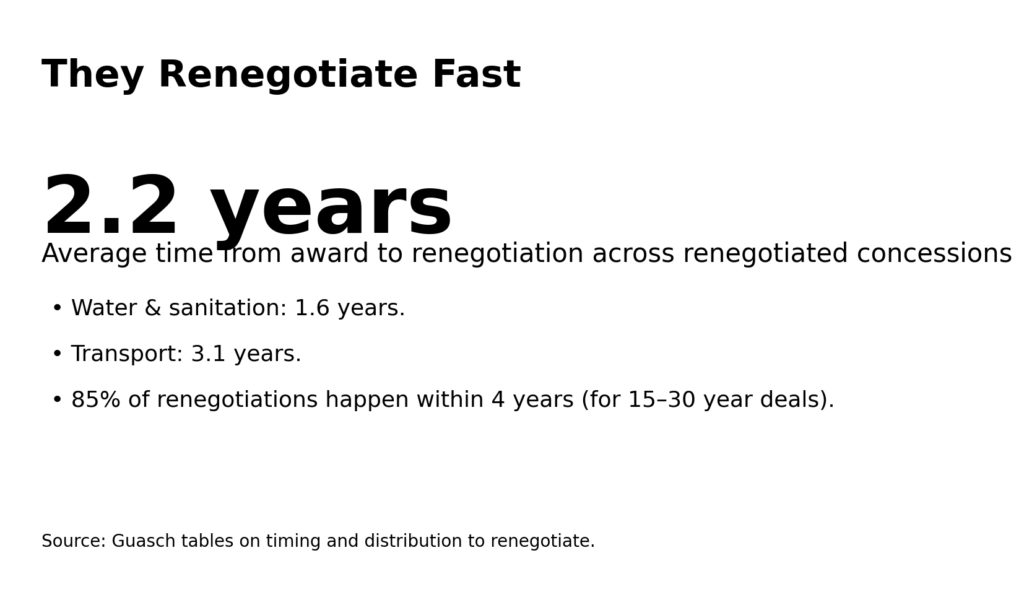

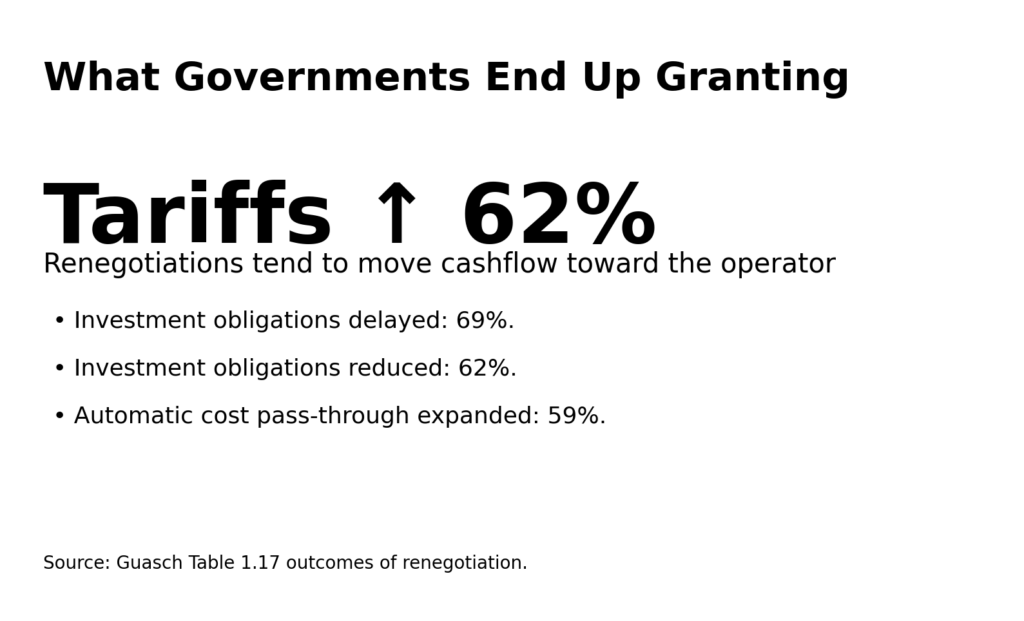

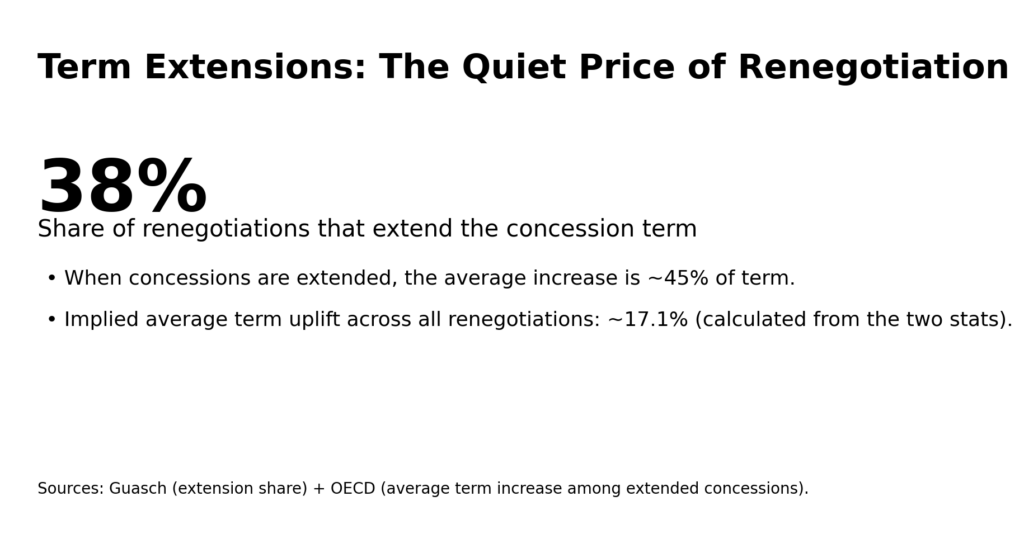

- Guasch (World Bank): incidence by sector (transport 55%, water 74%, overall 30%, excl. telecom 41.5%), timing (avg 2.2 years, water 1.6, transport 3.1), early clustering (60% within 3 years, 85% within 4 years), and outcome frequencies (e.g., tariff increases 62%, investment delays 69%, pass-through expansion 59%, term extensions 38%).

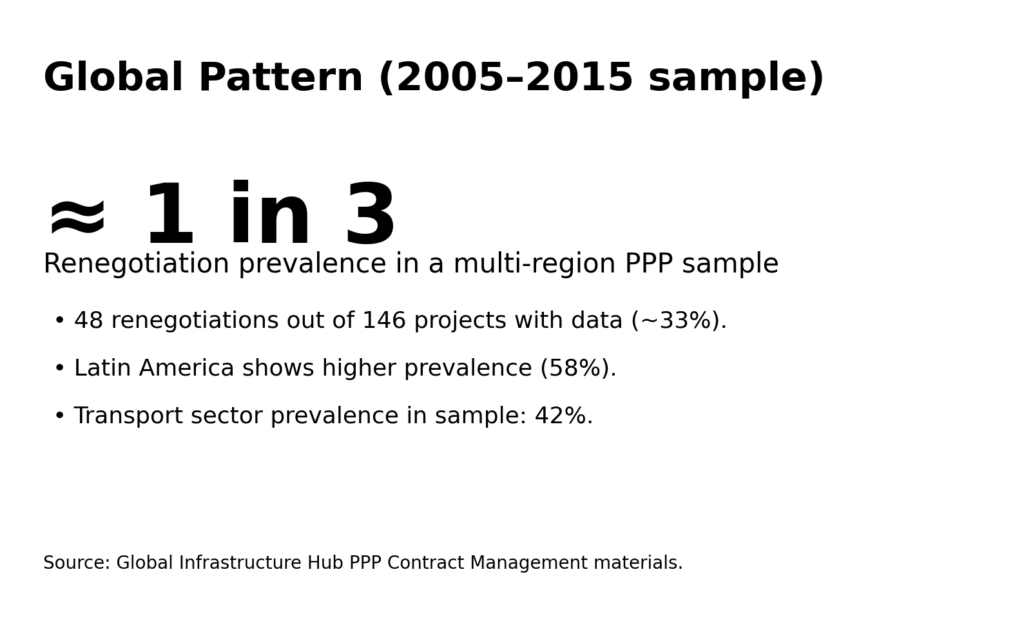

- Global Infrastructure Hub (PPP contract management research): 48 renegotiations out of 146 projects (~33%), with higher prevalence noted for Latin America (58%) and transport (42%) in the sample.

- OECD (Bitran, 2013): among concessions that were extended, average term increase ~45%.

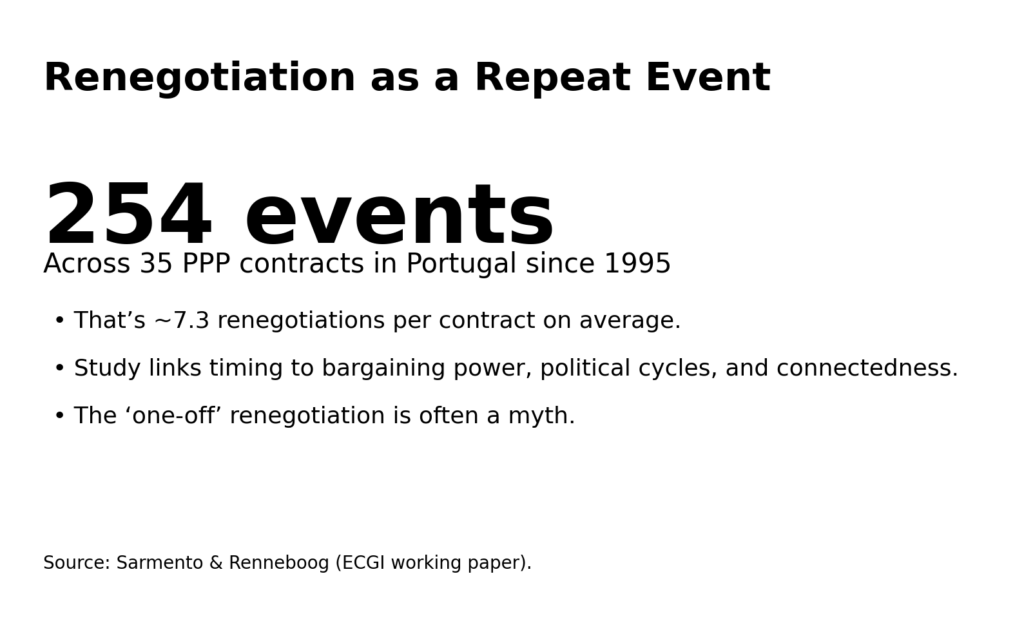

- Portugal (Sarmento & Renneboog): 254 renegotiation events across 35 PPP contracts since 1995.

Request Partnership Information

Quarterly Global

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Quarterly Global is a leading marketing and advertising brand dedicated to delivering cutting-edge strategies and innovative solutions in the ever-evolving digital landscape. With a focus on high-impact campaigns and data-driven insights, the brand empowers businesses to connect with global audiences and drive measurable results. Through its expert-led approach, Quarterly Global combines creative excellence with market intelligence to help brands navigate the complexities of modern marketing. With a reputation for delivering results and fostering long-term client relationships, Quarterly Global remains at the forefront of the marketing world.