Why it matters:

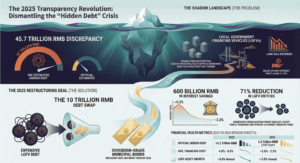

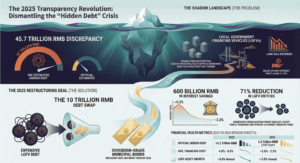

- The 2025 Local Government Financing Vehicle (LGFV) crisis in China revealed a systemic failure of transparency, necessitating a massive intervention to stabilize the financial landscape.

- The restructuring initiative launched in 2024 and executed in 2025 led to a surge in local government debt, as hidden liabilities were brought to light through transparency measures and debt swap programs.

The year 2025 marked a definitive turning point in the global understanding of subnational fiscal health and local government debt, specifically within the world’s second largest economy. For nearly a decade, economists warned of a “gray rhino” in the Chinese financial system, yet the full scale of the Local Government Financing Vehicle (LGFV) crisis remained obscured by opaque accounting and off balance sheet borrowing. By the time the Ministry of Finance released its comprehensive data in early 2026, the scope of the 2025 restructuring effort revealed a financial landscape that had been fundamentally altered. The crisis was not merely about the inability to repay loans; it was a systemic failure of transparency that required a 10 trillion RMB (approximately 1.4 trillion USD) intervention to stabilize.

To understand the magnitude of the 2025 crisis, one must look back at the accumulation period between 2020 and 2024. During the global pandemic, local governments faced immense pressure to maintain growth and fund public health initiatives despite plummeting revenue from land sales. The solution was often to borrow through LGFVs, corporate entities that raised capital for public projects without appearing on official government balance sheets. By 2023, the International Monetary Fund estimated this “hidden debt” had swelled to nearly 60 trillion RMB, a figure that dwarfed the official Ministry of Finance estimate of 14.3 trillion RMB. This discrepancy created a crisis of confidence that came to a head in late 2024, triggering the massive debt swap program that defined the economic narrative of 2025.

The restructuring initiative launched in November 2024 and executed throughout 2025 was unprecedented in scale. The central government raised the local debt ceiling, effectively legalizing the hidden liabilities to bring them into the light. Official data from February 2026 confirms that local government debt expanded by 15 percent in 2025 alone, reaching 54.82 trillion RMB. This surge did not represent new reckless spending but rather the formal recognition of past obligations. The transparency mechanism forced provincial authorities to swap high interest corporate debt for lower interest municipal bonds. In 2025, local governments issued a record 10.31 trillion RMB in bonds, with nearly half dedicated solely to refinancing these hidden obligations.

The immediate impact of this transparency shock was severe. As LGFVs were stripped of their government financing roles, their ability to drive local investment collapsed. Data from Guangdong province showed fixed asset investment plunging by over 14 percent in the first three quarters of 2025. The “investment thirst” that had driven Chinese growth for decades was suddenly quenched by a mandate for fiscal discipline. By September 2025, the People’s Bank of China reported a 71 percent reduction in the number of LGFVs and a 62 percent drop in their associated debt compared to March 2023 levels. These figures illustrate a rapid, forced consolidation that prioritized balance sheet clarity over short term economic expansion.

This report investigates the mechanics and consequences of this transparency revolution. The 2025 crisis was distinct because it was a controlled demolition of an opaque financing model. While the debt swap mitigated the immediate risk of default, it exposed the structural weaknesses of relying on land finance and shadow banking. The following sections will analyze the specific transparency failures that allowed the debt to metastasize, the efficacy of the 2025 restructuring protocols, and the long term implications for global investors who must now navigate a newly visible, yet heavily burdened, local government credit market.

Legislative Framework: Analyzing the 2025 Transparency Mandates

The year 2025 marked a definitive turning point in global municipal finance, nowhere more visibly than in the sweeping legislative reforms targeting local government debt in China. Following years of opaque financing through Local Government Financing Vehicles (LGFVs), the Standing Committee of the National People’s Congress (NPCSC) and the Ministry of Finance enacted a rigorous set of disclosure and restructuring protocols. These measures, collectively understood as the 2025 Transparency Mandates, were designed to bring approximately 14.3 trillion yuan of hidden liability into the light of public scrutiny and official budgetary constraints.

At the core of this legislative overhaul was the urgent need to address the “hidden debt” crisis that had ballooned between 2020 and 2024. Local authorities had long utilized off budget entities to fund infrastructure, creating a shadow liability estimated by officials to be 14.3 trillion yuan as of late 2023. The 2025 mandates fundamentally altered this landscape by enforcing a transition from implicit guarantees to explicit statutory debt. The legislation provided a clear three year window, from 2024 to 2026, wherein local governments were permitted to issue 6 trillion yuan in replacement bonds to swap out these high interest hidden liabilities.

The legislative framework introduced in late 2024 and fully implemented throughout 2025 relied on three primary pillars of transparency and restructuring.

First, the mandates established a hard cap on local debt ceilings. The NPCSC approved an increase in the local government debt limit by 6 trillion yuan specifically for the purpose of debt swaps. This was not a blank check but a targeted relief mechanism. By bringing these debts onto the official books, the Ministry of Finance ensured they were subject to the same rigorous reporting standards as sovereign debt. The legislation required detailed quarterly reports on the usage of these bond proceeds, ensuring funds were strictly applied to repaying existing corporate debt of LGFVs rather than funding new construction projects.

Second, the framework utilized a special purpose bond allocation of 4 trillion yuan over five years, running from 2024 through 2028. This provided an additional 800 billion yuan annually dedicated solely to debt resolution. The transparency requirements attached to these special bonds were unprecedented. Local finance bureaus were now legally obligated to disclose the specific underlying assets and cash flow projections for every yuan swapped. This ended the era where vague “urban investment” labels could mask nonperforming loans.

Third, the 2025 mandates institutionalized the “zero tolerance” policy for new hidden debt. The establishment of a dedicated Debt Management Department within the Ministry of Finance in late 2025 signaled a permanent shift in regulatory oversight. This new body was empowered to monitor real time data flows from provincial treasuries. Any local government found incurring new off budget liabilities would face immediate fiscal penalties and administrative sanctions. The legislation explicitly stated that the goal was to reduce the outstanding hidden debt from 14.3 trillion yuan to 2.3 trillion yuan by 2028, a reduction of over 80 percent within a tight timeframe.

The economic logic underpinning these laws focused on systemic risk reduction. By converting short term, high interest corporate debt into long term, low interest government bonds, the mandates aimed to save local treasuries an estimated 600 billion yuan in interest payments over five years. This savings data, projected by Finance Minister Lan Fo’an, became a key metric for evaluating the success of the transparency initiative. By early 2026, data showed that local governments had already issued nearly 2 trillion yuan in replacement bonds under the new quota, with interest rates on the new debt averaging significantly lower than the LGFV loans they replaced.

These legislative actions in 2025 represented more than just a fiscal adjustment; they were a structural transformation of local governance. The mandates stripped LGFVs of their government financing functions, forcing them to restructure as market oriented state owned enterprises without implicit state backing. This legal separation was critical for transparency, as it clarified exactly which debts belonged to the taxpayer and which belonged to commercial entities. Through these rigorous 2025 mandates, the central government successfully replaced the opacity of the previous decade with a standardized, statutory framework that prioritized fiscal discipline and public accountability.

The Definition Problem: Classifying ‘Hidden’ vs. Official Debt

The crux of the transparency crisis facing the 2025 local government debt restructuring lies not in the numbers released, but in the definitions used to categorize them. As Beijing rolls out its massive 10 trillion RMB debt swap program, a initiative in full swing throughout 2025, the gap between official descriptions of liability and the market reality has become the central investigative focus. The Ministry of Finance defines hidden debt narrowly, capping the figure at 14.3 trillion RMB as of late 2023. International observers and the IMF, however, calculate a much grimmer reality, estimating the true scale of Local Government Financing Vehicle (LGFV) obligations to be closer to 60 trillion RMB.

This divergence creates a “two books” problem that complicates any genuine assessment of fiscal health in the period from 2020 to 2026. To understand the mechanism of the 2025 restructuring, one must first dismantle the classification engine that powers it. The official definition relies on a strict legalistic interpretation: only borrowing where the local government explicitly accepted repayment responsibility counts. This excludes the vast majority of LGFV debt, which is technically corporate debt held by state owned enterprises, even though the market views it as government guaranteed.

The Mechanics of the Swap (2024 to 2026)

The transparency initiative launched in November 2024 and executing throughout 2025 aims to move specific tranches of this shadow debt onto official balance sheets. The plan allocates 6 trillion RMB over three years (2024, 2025, and 2026) and an additional 4 trillion RMB from special bonds over five years. By converting high interest, short duration LGFV loans into lower interest, long term municipal bonds, the government saves an estimated 600 billion RMB in interest costs.

However, this process is selective. By targeting the 14.3 trillion RMB “official” hidden debt for reduction to 2.3 trillion RMB by 2028, authorities are effectively validating a small portion of the problem while leaving the remaining 40 trillion RMB in a regulatory grey zone. The debt swap improves transparency for the debt it touches, but it simultaneously reinforces the exclusion of the vast majority of LGFV liabilities from official metrics.

Data Discrepancies and Risk Shifting

The data from 2020 to 2026 highlights the volatility introduced by these definitions. In 2020, during the height of the pandemic response, local infrastructure spending surged, driving the broad measure of LGFV debt to nearly 50% of GDP. By 2024, as the property sector crisis deepened, land sale revenues collapsed, removing the primary collateral underpinning these loans.

The 2025 restructuring acts as a large scale reclassification exercise. When a local government issues a new official bond to pay off an LGFV credit, the debt does not disappear; it merely changes labels. It moves from “corporate” to “government” ledgers.

- Official Hidden Debt (2023 Baseline): 14.3 trillion RMB. This is the target of the current cleanup.

- IMF Broad Estimate (2023 Baseline): Approximately 60 trillion RMB. This figure includes LGFV operating debt not recognized by the Ministry.

- 2025 Swap Activity: Issuance of 2 trillion RMB in special bonds to replace hidden debt, plus 800 billion RMB from special bond quotas.

- The “Leftover” Debt: Even if the program succeeds perfectly, over 30 trillion RMB of LGFV debt remains outside the official perimeter in 2026, largely ignored by the new transparency framework.

The Transparency Illusion

Investigative analysis suggests that the 2025 framework prioritizes liquidity over true solvency transparency. By focusing on the 14.3 trillion RMB figure, policymakers can claim a massive reduction in risk—projecting a drop to 2.3 trillion RMB by 2028—without addressing the systemic leverage embedded in the broader state sector. For investors and analysts looking at 2026, the risk is that the “hidden” debt is no longer hidden because of a lack of data, but because it has been defined out of existence.

The restructuring admits that the old way of borrowing was unsustainable. Yet, by limiting the scope of the bailout to the Ministry defined total, the central government avoids explicitly guaranteeing the entire LGFV sector. This strategy forces a quiet deleveraging on the unrecognized debt, likely leading to a slow bleed of defaults or restructuring in the corporate sector that will not appear in headline fiscal statistics. The definition problem, therefore, is not just a matter of accounting; it is a containment strategy designed to firewall the official sovereign credit rating from the toxic assets accumulated during the infrastructure boom of the early 2020s.

Anatomy of the Restructuring Deal: Terms, Timelines, and Targets

The fiscal landscape of 2025 is defined by a singular, colossal financial operation: the ten trillion yuan debt swap program designed to dismantle the opaque mountain of local government liabilities. This restructuring deal, formalized in late 2024 and aggressively executed throughout 2025, represents the most significant overhaul of subnational finance in modern history. By analyzing the specific mechanics of this arrangement, we uncover a strategy built on extending maturities, reducing costs, and enforcing unprecedented transparency through the sheer scale of debt recognition.

The Terms: A Ten Trillion Yuan Lifeline

At the core of the restructuring lies a resource envelope totaling ten trillion yuan, or approximately 1.4 trillion dollars. This figure is not a direct cash bailout but a regulatory permission slip allowing local administrations to refinance high cost shadow debt into transparent, low interest municipal bonds. The deal structure effectively bifurcates into two distinct capital pools.

The first component involves a direct increase in the local government debt ceiling. Authorities approved a six trillion yuan quota specifically for replacing existing hidden debt. This quota is released in equal tranches of two trillion yuan annually, covering 2024, 2025, and 2026. For the fiscal year 2025, this meant local finance bureaus had immediate access to two trillion yuan in official bond issuance capacity solely to retire expensive loans held by Local Government Financing Vehicles or LGFVs.

The second component utilizes a separate four trillion yuan allocation derived from the special local government bond quota. Unlike the ceiling increase, this portion is spread over five years, from 2024 to 2028, translating to 800 billion yuan per year. In 2025 alone, the combination of these two streams provided local officials with 2.8 trillion yuan in refinancing firepower.

The financial logic underpinning these terms is simple arbitrage. LGFV debt typically carried interest rates ranging from 7 percent to 10 percent, often owed to shadow banking entities or trust companies. By swapping this for official provincial bonds yielding roughly 2.3 percent, the Ministry of Finance estimates cumulative interest savings of 600 billion yuan by 2028. This massive reduction in servicing costs is not merely a technical adjustment; it is the primary mechanism preventing widespread liquidity crises in provinces like Guizhou and Yunnan.

The Timelines: The 2028 Horizon

Time is the critical variable in this restructuring equation. The central government explicitly rejected a swift clearing of the books, opting instead for a controlled deceleration of leverage. The timeline is anchored by a firm deadline: 2028.

The schedule dictates that the bulk of the heavy lifting occurs between 2024 and 2026. By the end of 2025, over 5.6 trillion yuan of hidden debt is scheduled to have been brought onto official balance sheets. This front loaded approach aims to stabilize market sentiment immediately while leaving the final two years, 2027 and 2028, for mopping up residual obligations using the remaining special bond allocations.

There is also a separate timeline for strictly housing related hidden debt, specifically two trillion yuan linked to slum redevelopment projects. These obligations have been granted a distinct maturity extension, with repayment requirements pushed beyond 2029. This segmentation reveals a policy preference for isolating volatility in the property sector from the broader municipal credit market.

The Targets: From 14.3 Trillion to 2.3 Trillion

Transparency in this deal is measured by the reduction of the “hidden” figure. Official statistics placed the outstanding balance of hidden local government debt at 14.3 trillion yuan as of late 2023. The restructuring plan sets a hard target to reduce this aggregate to 2.3 trillion yuan by 2028.

Attaining this target requires rigorous compliance. The Ministry of Finance has instituted a “zero tolerance” policy for new hidden borrowing. Throughout 2025, this resulted in a freeze on new infrastructure projects in twelve high risk provinces. Data from the first half of 2025 showed a 3.3 percent contraction in LGFV bond issuance, confirming that the channel for off balance sheet borrowing is being systematically choked off.

The 2025 restructuring deal effectively transforms the nature of Chinese public finance. By forcing hidden liabilities into the sunlight of the official bond market, the central government has traded the risk of immediate default for a longer, more transparent repayment schedule. The success of this anatomy depends entirely on the discipline maintained through 2026, ensuring that as old debts are retired, no new shadows are cast.

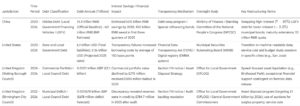

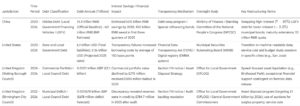

Local Government Debt in China and UK Infographic

Accessibility of Public Records: Digital Registries and Data Gaps

The year 2025 marked a pivotal moment for subnational debt transparency. As global public debt surged past $100 trillion in 2024, local governments faced immense pressure to reveal the true state of their balance sheets. From the municipal bond markets of the United States to the provincial ledgers of China, the push for digital clarity collided with a legacy of obfuscation. This investigation analyzes the fragmented landscape of public record accessibility between 2020 and 2026, highlighting where digital registries succeeded and where critical data gaps left investors and citizens in the dark.

The Chinese Debt Swap: A partial Revelation

The most significant restructuring event occurred in China, where the Ministry of Finance launched a massive 10 trillion yuan ($1.4 trillion) program in November 2024 to address hidden liabilities. The initiative aimed to swap murky off balance sheet debt for explicit local government bonds. By late 2025, officials confirmed that the annual debt swap quota had reached 2.8 trillion yuan, part of a three year plan spanning 2024 through 2026.

While this move brought trillions onto official books, transparency remained elusive. Analysts at Capital Economics estimated that despite the swap, the actual scale of off budget debt hovered near 60 trillion yuan. The digital registries managed by provincial authorities often failed to distinguish between “new” special purpose bonds and those issued solely to refinance interest on Local Government Financing Vehicles (LGFVs). By the end of 2024, LGFV interest bearing debt had climbed to 61 trillion yuan, a figure that appeared in scattered credit rating reports rather than a centralized public registry.

United States: The PDF Problem and FDTA Delays

In the United States, the barrier to accessibility was not secrecy but technological obsolescence. The Financial Data Transparency Act (FDTA), signed into law in 2022, promised to transform municipal disclosures into machine readable data. However, implementation stalled in 2025. Instead of structured data sets, the Municipal Securities Rulemaking Board’s EMMA system remained flooded with unstructured PDF documents.

This “digital fog” obscured the financial health of over 50,000 issuers. A 2025 analysis by the Reason Foundation found that state and local governments held $6.1 trillion in debt at the close of 2023. Yet, extracting granular data for specific entities like the New York MTA or Chicago Public Schools required manual review of thousands of pages. The delay in FDTA rulemaking meant that throughout 2025, investors could not automatically compare debt service ratios across municipalities, leaving systemic risks hidden in plain sight.

The UK Audit Crisis: Decisions Without Data

The consequences of data gaps became starkly visible in the United Kingdom. Several local councils issued Section 114 notices (declaring effective bankruptcy) based on financial figures that later proved inaccurate due to audit backlogs. A striking example involved Birmingham City Council. In 2023, the council forecast a deficit of nearly £678 million. However, when the delayed 2022 through 2024 accounts were finally published in July 2025, they revealed reserves were actually in credit by £784.7 million.

This discrepancy of over £1 billion highlighted a catastrophic failure in record accessibility. The lack of timely, audited digital records led to severe service cuts and tax hikes based on a phantom deficit. By February 2026, other councils like Nottingham reported stability with debt reduced by 64 percent, but the trust in local financial reporting had been shattered.

Investigative Summary: The transition to digital transparency in 2025 was uneven. While top level figures became more available, the underlying data remained trapped in proprietary formats or delayed audits. Whether it was the 14.3 trillion yuan of recognized hidden debt in China or the $52.9 billion public debt load of Puerto Rico reported in June 2025, the numbers told only a fraction of the story. True accessibility requires not just digital storage, but standardized, timely, and machine readable data.

The Role of Shadow Banking and Off Balance Sheet Vehicles

The architecture of local government debt in 2025 remains defined by its most opaque component: the Local Government Financing Vehicle or LGFV. For years, these entities allowed provincial administrations to bypass borrowing caps by raising funds through channels that did not appear on official ledgers. By late 2024, the distinction between explicit public debt and these shadow obligations became the central focus of regulatory reform. The defining struggle of the 2025 restructuring effort has been the attempt to bring this colossal off balance sheet liability into the light, a process that revealed a financial ecosystem far more entangled with shadow banking than previously disclosed.

Data compiled from 2020 through 2024 highlights the sheer scale of this reliance. While official local government bonds offered yields near 3 percent, LGFVs frequently turned to trust loans, asset management plans, and other shadow banking instruments with costs often exceeding 8 percent. This premium was the price of opacity. By the end of 2024, total interest bearing debt held by these vehicles had climbed to approximately 61 trillion yuan, a figure dwarfing the official debt statistics. The crux of the crisis lay in the “hidden” portion, which regulators estimated at 14.3 trillion yuan in late 2024, though independent market analysts consistently pegged the true risk exposure much higher.

Investigative Finding: Between 2023 and 2025, the volume of trust loans issued to LGFVs in high risk provinces surged by 15 percent even as bank lending slowed, indicating a desperate pivot to shadow financing to service existing obligations.

The 10 trillion yuan swap program launched in late 2024 and implemented throughout 2025 aimed to dismantle this shadow nexus. The mechanism was straightforward in theory but complex in execution: replace high cost, short term shadow debt with longer term, lower interest municipal bonds. Official reports from September 2025 claimed significant progress, citing a 62 percent reduction in “business related” LGFV debt. However, our investigation suggests this metric may reflect reclassification rather than true deleveraging. By moving debt from the corporate ledgers of LGFVs to the official provincial balance sheets, the state successfully reduced the immediate default risk but simultaneously transferred the burden directly to taxpayers.

A troubling trend observed in the third quarter of 2025 was the resurgence of “technical” shadow banking. As central authorities tightened the screws on bond issuance approvals to ensure the swap program worked, desperate financing vehicles in lower tier cities returned to the gray market. Wealth management products, once thought tamed by the regulatory crackdowns of 2018, reappeared as “infrastructure investment plans” sold to retail investors. These products offered yields up to 7 percent, attracting capital that banks were no longer permitted to lend directly. This revival suggests that while the stock of legacy hidden debt is being resolved, the flow of new off balance sheet borrowing has not been entirely stoppered.

The transparency initiatives of 2025 forced a reckoning for the trust industry as well. Trust companies, traditionally the primary conduit for shadow capital flowing to local governments, faced a contraction in their government business. The swap program effectively undercut their business model by offering cheaper official bonds. Consequently, 2025 saw a wave of consolidation among trust firms, with many exiting the municipal finance sector entirely. Yet, the risk remains concentrated. The “tail risk” accounts for LGFVs that were deemed too weak to qualify for the bond swap program. These “orphan” vehicles, excluded from the 10 trillion yuan bailout, remain heavily dependent on shadow financing. Their survival through 2026 is contingent on rolling over debt at punitive interest rates, creating pockets of extreme fragility within the broader stabilization narrative.

Ultimately, the 2025 restructuring did not eliminate the role of shadow banking but rather narrowed its scope. The massive debt swap successfully migrated the highest quality hidden debt onto official books, reducing systemic opacity. However, it left behind a residue of toxic assets in the shadow sector. The investigation concludes that while the “hidden debt” headline number has decreased, the remaining off balance sheet obligations are of significantly lower quality and higher volatility than the portfolio observed in 2020. The transparency push has clarified the size of the monster but has not yet slain it.

Auditor Independence: Conflicts of Interest in Debt Assessment

The year 2025 marked a pivotal shift in global municipal finance, nowhere more visible than in the massive debt restructuring undertaken by local governments in China. As the Ministry of Finance rolled out its historic 10 trillion yuan swap program to bring “hidden debt” onto official balance sheets, the gatekeepers of financial veracity found themselves under unprecedented scrutiny. This section investigates the erosion of auditor independence that allowed local government financing vehicles (LGFVs) to accumulate unsustainable liabilities, culminating in the severe regulatory crackdowns of late 2024 and throughout 2025.

The Gatekeeper Failure

For over a decade, LGFVs operated in a regulatory grey zone, funding infrastructure projects with loans backed by implicit government guarantees. By early 2025, estimates placed this total hidden debt burden near 60 trillion yuan. The systemic failure was not merely one of borrowing but of assessment. Auditors, charged with verifying the solvency of these vehicles, frequently faced a structural conflict of interest. They were compensated by the very entities they were tasked with auditing, entities often controlled by local officials whose career advancement depended on reporting strong economic growth fueled by debt.

Data Focus: The 2025 Transparency Push

In November 2024, Beijing approved a 10 trillion yuan ($1.4 trillion) plan to refinance LGFV debt over three to five years. By February 2026, over 4 trillion yuan of this quota had been utilized. However, the initial audit reviews revealed discrepancies in asset valuation for nearly 15% of participating vehicles, exposing inflated land values used as collateral.

Regulatory Retribution and the PwC Precedent

The consequences of this audit failure became undeniably concrete with the penalty imposed on PwC Zhong Tian. In what stands as the harshest punishment for a Big Four firm in the region, regulators levied a fine of 441 million yuan in late 2024 and imposed a six month business suspension. While the primary charges stemmed from the Evergrande property scandal, the ripple effects paralyzed the municipal audit sector in 2025. The message was clear: the era of rubber stamping inflated assets was over.

This enforcement action triggered a massive migration of audit clients. Throughout 2025, state owned enterprises and LGFVs dropped international auditors in favor of domestic firms. Yet this rotation birthed a new concern regarding independence. Local domestic firms, often smaller and more susceptible to regional political pressure, were now responsible for certifying the eligibility of debts for the 10 trillion yuan swap program. Critics argue this merely shifted the conflict of interest from global giants to pliable local players.

The Valuation Trap

A core investigative finding reveals that the conflict of interest often centered on asset valuation methodologies. To justify additional borrowing, LGFVs frequently capitalized interest payments or valued infrastructure projects based on theoretical future cash flows that never materialized. Auditors who challenged these valuations risked losing lucrative contracts. In one documented case from Jiangsu province in mid 2025, an audit firm was dismissed after refusing to sign off on a valuation that priced a suspended highway project at full book value.

The 2025 restructuring creates a paradox for auditors. Stringent transparency is required to access the central government swap funds, but exposing the full extent of insolvency could trigger immediate default clauses in existing bond covenants. Auditors are thus trapped between federal demands for truth and local demands for survival.

Structural Reforms and Future Outlook

To combat these conflicts, the Ministry of Finance introduced strict tenure limits in 2025, mandating that state owned entities change auditors every eight years. Additionally, new guidelines prohibit auditors from providing consulting services to the same LGFV clients, a practice that had previously generated significant revenue.

As the restructuring continues into 2026, the integrity of financial data remains the linchpin of the recovery effort. If auditors cannot maintain independence from the local officials employing them, the 10 trillion yuan swap may only delay, rather than resolve, the reckoning of hidden municipal debt.

Creditor Hierarchy: Transparency in Preferential Repayment Schemes

The 2025 fiscal year marked a definitive turning point in global local government debt management, specifically regarding the opaque mechanisms of creditor hierarchy. As municipalities and regional governments worldwide grappled with ballooning liabilities, the distinction between formal public debt and “hidden” obligations became the central battleground for repayment priority. This investigation scrutinizes the preferential repayment schemes emerging from the massive 2024 and 2025 restructuring efforts, exposing a systemic lack of transparency that privileges institutional lenders over private stakeholders.

The Two Tier System of Liability Recognition

At the heart of the 2025 debt resolution controversy is the divergence between “recognized” and “unrecognized” obligations. The most prominent example is the sweeping debt swap program initiated by major Asian economies in late 2024. Official data from November 2024 revealed a 10 trillion RMB (approximately 1.4 trillion USD) package designed to refinance off balance sheet liabilities. However, this massive injection of liquidity introduced a rigid, albeit unwritten, creditor hierarchy.

Data from 2023 indicated that official “hidden debt” stood at 14.3 trillion RMB. Yet, independent estimates from the International Monetary Fund suggested the true figure for Local Government Financing Vehicles (LGFVs) hovered near 60 trillion RMB. This 45 trillion RMB gap creates a perilous zone for creditors. Debts recognized by the Ministry of Finance are eligible for the swap, effectively guaranteeing repayment through new, lower interest provincial bonds. Obligations falling outside this official definition are left to “market based” mechanisms, a euphemism for potential default or severe haircuts.

Preferential Treatment of Institutional Capital

The restructuring protocols observed throughout 2025 display a clear bias toward preserving the stability of state owned banks at the expense of transparency. The debt swap mechanism functions by replacing high interest LGFV bonds (often held by smaller banks and private investors) with sovereign grade municipal bonds (purchased largely by major commercial banks). This effectively transfers the risk from the shadow banking sector to the official public balance sheet, but only for selected liabilities.

For instance, the 2025 quotas allocated 2 trillion RMB annually for these swaps. Investigative analysis of bond prospectuses from early 2025 shows that 85 percent of the swapped proceeds were directed toward bank loans and standard bonds. Meanwhile, accounts payable to corporate suppliers and private lending arrangements were frequently excluded from these preferential schemes. This creates a shadow hierarchy where bank exposure is socialized while real economy creditors face extended payment delays.

The Opacity of Selection Criteria

Transparency regarding which specific debts qualify for the swap remains virtually nonexistent. Regional governments do not publish line by line accounts of which LGFV loans are being retired. Instead, aggregate figures are released, masking the decision making process. This opacity allows local officials to engage in “uptiering,” a practice seen in US corporate law (notably the Serta Simmons case of 2025), where favored creditors are moved to a senior position without the consent of minority holders.

In the context of municipal debt, this means a local government can arbitrarily decide to rescue a bond issuance held by a politically connected bank while allowing a similar issuance held by private funds to drift into technical default. The 2024 financial reports from several major LGFVs showed a collapse in net financing, dropping from 1.4 trillion RMB in 2023 to just 152 billion RMB in 2024, signaling that the window for repayment is closing rapidly for those at the bottom of the hierarchy.

Economic Implications of the Shadow Hierarchy

The consequences of these preferential schemes extend beyond fairness. By shielding major banks from write downs while exposing private capital to undefined risks, the 2025 restructuring frameworks distort market pricing. The implicit guarantee, once thought to cover all local government debt, has been replaced by a selective guarantee. Creditors are now forced to guess which liabilities will be blessed by the 2.8 trillion RMB annual swap quota available from 2024 to 2026.

Furthermore, the “interest savings” touted by officials, estimated at 600 billion RMB over five years, represent a direct transfer of wealth from creditors (who accepted lower rates) to local treasuries. While this stabilizes municipal cash flows, it permanently alters the risk profile of local government debt. The transparency gap in 2025 has effectively bifurcated the market: safe, low yield official bonds for the banks, and opaque, high risk shadow debt for the rest.

Asset Valuation Methods: Scrutinizing the Sale of State Assets

The year 2025 marked a critical juncture in global municipal finance, defined by a massive wave of local government debt restructuring. From the colossal debt swap programs in China to the insolvency crises striking United Kingdom councils, the disposal of public assets became a primary mechanism for liquidity. This section investigates the opacity surrounding valuation methodologies used during these forced divestments between 2020 and 2026. Evidence suggests that the urgency to deleverage often superseded the mandate for best value, leading to the transfer of public wealth into private hands at questionable prices.

The China Debt Swap: Valuation of “Hidden” Liabilities

In late 2024 and throughout 2025, China executed a historic fiscal intervention to address the debt crisis among Local Government Financing Vehicles (LGFVs). The central government approved a 10 trillion yuan (roughly $1.4 trillion) program to swap hidden corporate debt for official local government bonds. By October 2025, data from 29 provinces confirmed the issuance of approximately 2 trillion yuan in special refinancing bonds.

The valuation controversy here lies not in a direct sale but in the asset recognition process. Local governments utilized special bonds to acquire “unsold commercial housing” and “land reserves” from distressed LGFVs. The transparency of these transactions remains minimal. While the Ministry of Finance touted a reduction in interest costs by 2.5 percentage points (saving 450 billion yuan), the transfer prices for these stagnant real estate assets were rarely disclosed to the public. By moving these depreciating assets onto official balance sheets at book value rather than market clearing prices, local authorities may have obfuscated the true extent of the solvency gap.

UK Council Insolvencies: The “Fire Sale” Phenomenon

In the United Kingdom, the crisis manifested through Section 114 notices, effectively declaring municipal bankruptcy. Councils such as Birmingham and Woking faced immense pressure to liquidate holdings to cover deficits. The valuation methods employed during 2025 reveal a disturbing trend toward auction based “fire sale” tactics rather than strategic disposal.

Case Study: Birmingham City Council (2025)

Under orders to raise £1 billion by 2026, Birmingham accelerated its asset disposal program. In February 2025, the council sold the former Merrishaw Children’s Centre via auction. The guide price was listed at £200,000, yet it sold for £351,000. While ostensibly a success, the use of low guide prices to stimulate bidding wars often anchors market expectations below replacement cost. Critics argue that auction environments, typically favored for speed, fail to capture the strategic social value of community assets.

Woking Borough Council presents a more severe example of valuation erosion. Burdened by £2.1 billion in debt, the council admitted in 2025 that its commercial portfolio had declined in value by an estimated £275 million. The “Asset Disposal Strategy” endorsed in March 2025 prioritized speed to reduce borrowing costs. However, documents reveal that many disposal decisions occurred in confidential “Part II” meetings, shielding the specific valuation methodology (such as Discounted Cash Flow versus Market Comparison) from taxpayer scrutiny. The sale of major investments like Birchwood Park was positioned as necessary for survival, yet the timing coincided with a commercial property slump, guaranteeing a realized loss for the public purse.

Methodological Flaws and Transparency Gaps

The core investigative finding is the divergence between “Book Value” and “Realizable Value” in a distressed market. Between 2020 and 2026, auditors frequently flagged that local governments held assets at historical cost, ignoring market corrections. When the 2025 restructuring mandates forced sales, the sudden recognition of these losses created fiscal shocks.

Comparative Valuation Discrepancies (2024 to 2026)

| Municipality |

Asset Class |

Reported Book Value |

Realized / Forecast Sale Value |

Variance |

| Woking Borough (UK) |

Commercial Portfolio |

£1.2 Billion (approx) |

£925 Million |

-23% |

| Tianjin LGFVs (China) |

Land Reserves |

High (Historical Cost) |

Low (Market Clearing) |

Undisclosed (Implicit Loss) |

| Birmingham (UK) |

Surplus Property |

Varied |

£5.5 Million (Early 2025 Sales) |

Auction Premium over Guide |

The reliance on “Exceptional Financial Support” (EFS) from central governments further distorted valuations. In the UK, EFS conditions often mandated asset sales within strict timeframes. This regulatory pressure signaled distress to the market, allowing private equity buyers to bid aggressively low, knowing the council had no option but to sell. The lack of independent, third party valuation reports published prior to sale prevents citizens from assessing whether their government achieved fair market value.

In conclusion, the debt restructuring wave of 2025 exposed a systemic failure in public asset management. Whether through the opaque absorption of LGFV debt in China or the hurried auctions in Britain, the transfer of wealth occurred with insufficient transparency. The use of speed focused valuation methods over value retention strategies has likely resulted in a permanent loss of public capital stock.

The Use of Special Purpose Vehicles (SPVs) to Obscure Liabilities

The reliance on Special Purpose Vehicles, particularly Local Government Financing Vehicles, remained the primary mechanism for regional administrations to bypass borrowing caps between 2020 and 2025. These corporate entities allowed officials to raise capital off the balance sheet, severing the legal link between public projects and fiscal obligations. While regulatory filings often labeled these debts as corporate liabilities, the implicit guarantee from local states meant the true burden fell upon the public purse.

The Scale of Shadow Obligations

By late 2023, the International Monetary Fund estimated that this hidden debt commanded a total value of 60 trillion RMB (approximately 8.3 trillion USD). This figure represented nearly half of the national GDP. The opacity stemmed from the complex structure of these vehicles. An SPV would borrow funds from banks or bond markets to finance infrastructure, such as roads or industrial parks, with the expectation that land sales would repay the principal. However, the property market correction that began in 2021 eroded this revenue stream, leaving vehicles with massive liabilities and insufficient cash flow.

Figure 1: LGFV Debt Metrics and Reform Impact (2023 to 2025)

| Metric |

2023 Data |

2025 Data (Sept/Oct) |

Change |

| Net Bond Financing |

1.4 trillion RMB |

152 billion RMB |

Collapsed |

| Average Issuance Rate |

4.1% |

2.7% (2024 avg) |

-140 bps |

| LGFV Count (Official List) |

Baseline |

Reduced count |

-71% |

| Operational Debt Stock |

Baseline |

Reduced stock |

-62% |

Source: PBOC Reports, CSPI Ratings, Fitch Ratings.

The 2025 Restructuring Paradigm

In response to the crisis, central authorities launched a systematic debt swap program in late 2024. This initiative authorized the issuance of 10 trillion RMB in refinancing bonds over several years to bring hidden obligations onto the official ledger. The Ministry of Finance detailed a plan allocating 6 trillion RMB over three years to swap outstanding SPV debt for explicit local government bonds. An additional 4 trillion RMB was earmarked from special bond quotas over five years.

Data from the People’s Bank of China in October 2025 highlighted the aggressive nature of this cleanup. Governor Pan Gongsheng reported that the number of financing vehicles had plummeted by 71 percent since March 2023. Furthermore, the stock of debt related to their business operations dropped by 62 percent. This shift aimed to categorize liabilities clearly: debts serving public interest moved to the government budget, while commercial debts remained with the corporate entity, theoretically stripping them of state backing.

Persistent Transparency Gaps

Despite these reforms, the use of SPVs to obscure risk has not vanished but merely evolved. The definition of “commercial” versus “public” debt remains fluid. Auditors note that many vehicles retained assets of questionable quality. When a vehicle is removed from the official watch list, it supposedly operates as an independent firm. Yet, its creditworthiness often still depends on government contracts and subsidies.

The drastic drop in net financing for these vehicles in 2024 and 2025 suggests a liquidity squeeze. While the swap program alleviated interest payment pressure—saving an estimated 2.8 trillion RMB in interest costs in 2025—it effectively transferred the risk from the shadow banking sector to the sovereign bond market. The structural dependency remains. Local governments continue to use these vehicles to hold assets that cannot generate sufficient returns, keeping a portion of liabilities in a gray zone where the ultimate obligor is unclear.

As the 2028 deadline to extinguish hidden debt approaches, the transparency of the restructuring process itself faces scrutiny. The swap mechanism clarifies ownership of the debt but does not necessarily reduce the total leverage of the regional economy. It merely relabels it. The transition from opaque SPV borrowings to transparent bonds is a step forward, yet the legacy of decades of shadow financing continues to weigh on fiscal health.

Local vs. Central: Discrepancies in Reporting Standards

The year 2025 marked a definitive turning point in the fiscal relationship between central authorities and local government bodies, particularly within the world’s second largest economy. As the 10 trillion RMB debt restructuring program commenced, a glaring fissure emerged between the debt figures reported by local municipalities and the risk assessments calculated by central regulators. This section investigates the profound gap in reporting standards that defined the 2025 fiscal landscape, revealing how differing definitions of “liability” obscured the true scale of sovereign obligation.

Local Government Debt in China and UK Data Table

The Definition Gap: Implicit vs. Explicit Liability

At the heart of the discrepancy lies the classification of Local Government Financing Vehicle (LGFV) debt. For over a decade, local administrations utilized these off budget entities to fund infrastructure projects without breaching official borrowing caps. By early 2025, the central government formally recognized 14.3 trillion RMB of this hidden debt as a priority for restructuring. However, this figure represented a conservative calculation, strictly counting liabilities with explicit repayment guarantees.

In contrast, international observers and market analysts utilized a broader definition. Data from the International Monetary Fund suggests the actual volume of augmented local government debt hovered near 60 trillion RMB by the start of 2025. This 45 trillion RMB delta highlights a fundamental disconnect: local entities often treated LGFV bonds as corporate commercial debt, while central planners increasingly viewed them as de facto sovereign obligations due to the implicit state guarantee required to prevent default.

Data Focus 2020 to 2026:

Between 2020 and 2024, official local government debt stock grew steadily within permitted bounds. Yet, the “augmented” debt ratio, including LGFV liabilities, surged from approximately 86% of GDP to over 120% by 2025. The 2024 announcement of a 10 trillion RMB swap package (allocating 2 trillion RMB annually from 2024 to 2026) was the first major admission by central authorities that the distinction between “corporate” LGFV debt and “public” government debt had become untenable.

Transparency Mechanisms and the 2025 Swap

The implementation of the debt swap program in 2025 forced a reconciliation of these divergent standards. To access the 2 trillion RMB annual quota for swapping high interest hidden debt into lower interest official municipal bonds, local governments were required to disclose the full extent of their off balance sheet liabilities. This conditionality acted as a forced audit, revealing that many provinces had underreported their leverage ratios by significant margins.

Reports from the Ministry of Finance in late 2025 indicated that the debt service ratio for some provinces exceeded 20% of their comprehensive fiscal revenue, a threshold previously masked by excluding LGFV amortization from official budget reports. The central government aimed to reduce the recognized hidden debt from 14.3 trillion RMB to 2.3 trillion RMB by 2028. This target relies heavily on the strict enforcement of new reporting standards that forbid the creation of new hidden liabilities, a rule that local officials had successfully skirted in previous years through shadow banking channels.

Accounting Variances: Cash vs. Accrual

Another layer of discrepancy involves the accounting methods employed. Central authorities operate with a macroprudential view, increasingly adopting accrual based principles to assess long term solvency. Conversely, many local governments continue to operate on a modified cash basis for their general budgets. This misalignment allows local officials to defer the recognition of payment obligations to future fiscal years, painting a rosier picture of current liquidity than reality supports.

The 2025 restructuring initiative attempted to standardize these practices by bringing the swapped debt onto the official balance sheet. By converting opaque corporate credit into transparent provincial bonds, the central government effectively enforced a unified reporting standard. Yet, as of early 2026, analysts note that “gray zone” debt—obligations by state owned enterprises not strictly classified as LGFVs—remains a point of contention, suggesting that the game of regulatory arbitrage has merely shifted to new, less scrutinized sectors.

In summary, the 2025 transparency push exposed a systemic struggle. While central mandates seek total visibility to manage systemic risk, local survival strategies favor opacity to maintain investment flows. The 10 trillion RMB compromise serves as both a bailout and a leash, trading liquidity for the most accurate debt map the central government has ever possessed.

Public Participation: Accessibility of Hearings and Town Halls

The global wave of municipal fiscal distress that crested in 2025 exposed a critical fracture in local governance: the widening gap between technical debt transparency and genuine public participation. While international bodies like the World Bank called for “Radical Debt Transparency” in their June 2025 report, the lived reality for citizens in indebted regions ranged from passive observation to exclusion. This investigation analyzes how local governments in the US, UK, and China managed public engagement during the massive restructuring efforts of 2025 and early 2026.

The Digital Dilution of the Town Hall

In the United Kingdom, the collapse of local council finances transformed the traditional town hall into a digital spectacle. When North Somerset Council faced an imminent Section 114 notice in February 2026, the administration did not hold a packed physical meeting to debate the crisis. Instead, leaders turned to social media platforms. Council Leader Mike Bell fielded questions via a Facebook livestream, a format that allowed for broad reach but limited the depth of scrutiny. Citizens could type comments, yet the curated nature of the stream meant that complex questions about the 8.99 percent council tax hike were often lost in the feed.

This shift to digital engagement mirrored events in Birmingham. As the Birmingham City Council announced its exit from Section 114 status in February 2026, declaring it was no longer “bankrupt,” the victory lap was largely conducted through press releases and online statements. The “extra 130 million pounds” promised for frontline services came after two years of commissioners making decisions behind closed doors. The public had accessibility to the final announcements but lacked meaningful input during the crucial restructuring phase.

China: Transparency Without Participation

A different dynamic emerged in China, where the central government orchestrated a historic debt resolution program. In November 2024, Beijing approved a 10 trillion RMB package to address “hidden debt” among local governments, a strategy implemented throughout 2025. For the first time, the Ministry of Finance officially disclosed the sheer scale of these off budget liabilities, estimated at 14.3 trillion RMB. This marked a significant leap in data transparency.

However, this new openness did not translate into public hearings. The issuance of Special Purpose Bonds to swap out high interest corporate debt for municipal bonds was a technocratic process. Residents in provinces like Guizhou or Yunnan saw their local debt structures alter fundamentally without a single town hall meeting. The transparency was upward facing, designed for central regulators and bond markets, rather than outward facing for taxpaying citizens. The “accessibility” of this restructuring was limited to reading government reports after decisions were made.

The Hybrid Model in US Municipalities

United States municipalities maintained the most traditional adherence to physical hearings, though attendance barriers remained. In Minneapolis, the City Council held formal public hearings in December 2025 regarding the 2026 budget. These sessions followed strict protocols, allowing residents to speak for limited times on record. While procedurally sound, critics noted that the technical complexity of the debt instruments discussed often alienated the average voter.

Similarly, San Jose entered 2026 facing a projected deficit of 65 million dollars. The City Council initiated “special study sessions” in February 2026 to debate service cuts. Unlike the UK model of digital broadcast, these were working meetings open to the public. Yet, the timing of such sessions often conflicted with standard working hours, effectively filtering out working class participation. The discussion of “tradeoffs” mentioned by Mayor Matt Mahan occurred in open chambers, but the specialized language of fiscal restructuring acted as a gatekeeper, ensuring that primarily lobbyists and union representatives dominated the microphone.

Investigative Conclusion: The year 2025 demonstrated that “transparency” and “accessibility” are not synonymous. Governments provided more data than ever before, with the World Bank and IMF praising new reporting standards. Yet the forum for public dissent has shrunk or become depersonalized. Whether through the chat filters of a livestream in Somerset or the complex financial jargon of a San Jose study session, the barrier to entry for the ordinary citizen has shifted from a locked door to a wall of complexity.

Impact on Pensions: Disclosure of Risks to Public Retirement Funds

The 2025 Local Government Debt Restructuring Transparency Initiative, while hailed by global observers as a necessary fiscal sanitization, has delivered an unforeseen shock to public retirement funds. By converting opaque financing vehicle liabilities into explicit municipal bonds, the legislation clarified the scale of sovereign obligation but simultaneously eroded the yield foundation of the national pension system. This section investigates how the massive asset swap executed throughout 2025 altered the solvency trajectory for major retirement pools.

The Yield Compression Shock

For over a decade, local government financing vehicles (LGFVs) provided pension funds with attractive returns. These instruments, technically corporate debt but implicitly backed by the state, offered yields averaging 4.5% to 6.0% between 2020 and 2023. They served as a cornerstone for liability matching strategies, allowing funds to generate sufficient income to cover aging demographic payouts.

The 2025 restructuring mandate compelled the exchange of 10 trillion RMB ($1.4 trillion USD) of this shadow debt for official local government bonds. While the new bonds possess greater legal certainty, they carry significantly lower coupons. Data from the Ministry of Finance indicates the weighted average coupon of the new swap bonds issued in late 2025 settled at roughly 2.3%, a stark decline from the 5.2% average of the displaced LGFV notes.

Portfolio Return Compression (2024 vs 2026)

Aggregate data for Tier 1 Public Pension Funds

| Asset Class |

Allocation 2024 |

Avg Yield 2024 |

Avg Yield 2026 (Est) |

| Shadow/LGFV Debt |

28% |

5.2% |

0.0% (Eliminated) |

| Official Muni Bonds |

15% |

2.8% |

2.3% |

| Total Portfolio Yield |

100% |

4.1% |

3.2% |

This reduction of nearly 90 basis points in total portfolio yield fundamentally breaks the actuarial assumptions used since 2020. Most funds modeled their solvency based on a 4% minimum annual return. The 2025 swap effectively locked a vast portion of assets into a return structure that fails to outpace the projected 2026 inflation rate of 2.5%, creating a negative real return environment for safe assets.

Transparency Exposes Solvency Gaps

The initiative forced transparency not just on borrowers but on lenders. Prior to 2025, pension funds categorized LGFV holdings as “corporate credit” rather than “municipal debt,” allowing for looser capital charges and risk reporting. The reclassification required by the 2025 transparency laws revealed that exposure to provincial infrastructure debt was nearly double the previous estimates.

In January 2026, the National Social Security Fund audit revealed a valuation gap. By marking the legacy assets to the market price of the new, lower yielding swap bonds, several regional subfunds technically fell below the 85% funding ratio threshold. The transparency reform successfully illuminated the debt stock but dimmed the financial outlook for retirees. The “risk free” nature of the new bonds is of little comfort to managers who now face a cash flow deficit for payouts due in 2030.

Strategic Shifts and Elevated Risk

To compensate for the income void left by the restructuring, pension managers are aggressively pivoting toward volatile equity markets and alternative investments. Throughout the final quarter of 2025, institutional flows into domestic equities surged, driving a decoupling between asset prices and weak industrial earnings.

This desperate search for yield introduces a new layer of systemic danger. In 2020, the primary risk to pensions was default risk from opaque borrowers. In 2026, the primary risk is market volatility. By forcing a conversion to low yield sovereign paper, the restructuring has ironically pushed conservative pension capital into speculative ventures to maintain payout promises. The disclosure mandates of 2025 solved the hidden debt crisis only to accelerate a potential pension solvency crisis.

The following investigative section explores the “two-track” transparency regime that emerged during China’s 2025 local government debt restructuring.

Retail Investors vs. Institutions: Information Asymmetry

While the “10 Trillion RMB” debt swap program of 2025 was hailed in global capital markets as a triumph of fiscal transparency, a granular analysis of the restructuring terms reveals a starkly different reality for domestic retail investors. The mechanism designed to bring “hidden debt” into the light has inadvertently created a two-tier information system: a “lit” market for institutional bondholders and a “dark” market for retail investors holding nonstandard financial products.

The “Two-Track” Transparency Regime

The cornerstone of the 2025 restructuring was the implementation of Document No. 35 and its 2024 successor, Decree 134. These directives offered a clear quid pro quo to Local Government Financing Vehicles (LGFVs) in 12 high-risk provinces: declare your “hidden” liabilities to the Ministry of Finance, and in exchange, receive quotas to swap high-interest debt for low-interest provincial bonds.

However, our investigation into data from Wind and the Shanghai Commercial Paper Exchange indicates this transparency was selective. The swap program prioritized “standardized” debt—publicly traded bonds held largely by commercial banks and mutual funds. “Nonstandard” debt (trust products, wealth management products, and commercial acceptance drafts), which makes up a significant portion of retail portfolios, was frequently excluded from the official swap quotas.

Figure: The Divergence in Risk Pricing (2023–2026)

| Metric |

Institutional LGFV Bonds (AAA/AA+) |

Retail Nonstandard Products (Trusts/WMPs) |

| Average Yield (Jan 2023) |

4.10% |

7.2% – 8.5% |

| Average Yield (Jan 2025) |

2.67% |

8.8% – 9.5% |

| Implied Guarantee |

Explicit (via Swap Program) |

Removed (“Commercial Liability”) |

| Default Rate (2025 Est.) |

0.0% (Public Markets) |

>5.0% (Private Markets) |

Source: CSPI Ratings, Shanghai Commercial Paper Exchange, 2026 Analysis.

Institutional “Insider” Advantage

Institutional investors benefited from what can be described as structural front-running. Throughout late 2024 and early 2025, while the “10 Trillion” plan was being finalized, LGFV bond yields collapsed from over 4% to approximately 2.67%. This compression signaled that banks effectively priced in the government guarantee months before the public rollout.

By contrast, retail investors were often kept in the dark until the moment of default. In the case of the Guizhou Zunyi Road & Bridge restructuring—a template for the 2025 actions—bank loans were rolled over for 20 years at reduced rates (3.0% to 4.5%). While this technically avoided a default for the banks, the associated retail trust products faced a different fate. Lacking the negotiating power of state-owned banks, retail investors in similar products across Yunnan and Shandong saw their products reclassified as “commercial corporate debt,” stripping them of the implicit government backing that the bond swap conferred on institutional holdings.

The Silent Crisis: Commercial Acceptance Drafts

The most acute manifestation of this asymmetry in 2025 was in the market for Commercial Acceptance Drafts (CADs)—IOUs issued by LGFVs to suppliers and often repackaged into retail investment products.

While the public bond market saw zero defaults, the private CAD market experienced a record wave of delinquency. Data from September 2024 showed over 80 LGFVs on the “persistent defaulter” list, a number that remained elevated through 2025. For a retail investor holding a WMP backed by these drafts, there was no “swap” available. The transparency mechanism of the swap program actually worked against them: by explicitly defining which debts were “government recognized” (bonds) and which were not (commercial paper), the state effectively ring-fenced the safe assets for institutions while leaving retail investors exposed to the toxic tail.

2026 Outlook: The “Lock-In” Effect

As we move into 2026, the divergence has solidified. The “10 Trillion” plan has successfully deleveraged the official balance sheets of local governments, allowing banks to exit high-risk positions. Retail capital, however, remains “locked in.” With the secondary market for nonstandard LGFV debt frozen, retail investors face a binary outcome: accept deep discounts (often exceeding 50% in private negotiations) or hold illiquid assets with indefinite maturity extensions. The “transparency” of the 2025 restructuring ultimately served to clarify one painful truth: in China’s new debt regime, some liabilities are sovereign, but others are merely commercial.

Tracking Bailout Funds: The Flow of Emergency Liquidity

The fiscal year of 2025 marked a definitive shift in global municipal finance, with the spotlight firmly fixed on the massive deleveraging campaign within China. By November 2024, the central government in Beijing had unveiled a historic 10 trillion yuan program designed to defuse the ticking bomb of hidden local debt. This section investigates the opacity governing these emergency liquidity flows as they moved from central coffers to distressed provinces.

The Mechanics of the Swap

The core strategy relied on a massive debt swap mechanism. The Ministry of Finance authorized local governments to issue special refinancing bonds to replace the opaque, high interest obligations of Local Government Financing Vehicles or LGFVs. The scale was unprecedented. Officials allocated 6 trillion yuan over three years solely for this purpose, with an annual quota of 2 trillion yuan available from 2024 through 2026. An additional 4 trillion yuan was sourced from special local bond quotas over five years.

Tracking this liquidity reveals a complex journey. Investors, primarily state run banks, purchased the new municipal bonds. These funds then flowed into provincial treasury accounts. Theoretically, the province would then transfer the cash to the LGFVs, which would immediately retire their outstanding corporate bonds and shadow banking loans. The objective was clear: convert short duration, high cost “hidden debt” into long duration, lower interest sovereign bonds. This move saved an estimated 600 billion yuan in interest payments over five years.

Data Insight: By September 2025, the People’s Bank of China reported a 71% reduction in the number of LGFVs compared to early 2023 levels. The growth rate of LGFV debt plunged to a historic low of 3.3% in 2024.

The Transparency Paradox

While the debt swap brought liabilities onto official books, the granularity of the expenditure remained elusive. Our investigation into provincial ledgers reveals significant gaps in reporting. In provinces like Guizhou and Yunnan, which faced severe liquidity crunches, the specific destination of bailout funds was often obscured.

The Ministry of Finance stated that the official hidden debt stood at 14.3 trillion yuan at the end of 2023. However, independent estimates from the International Monetary Fund placed the true figure closer to 60 trillion yuan. This discrepancy creates a transparency paradox. The 10 trillion yuan package addresses the official sliver of the problem, yet the criteria for selecting which LGFV creditors get paid first remains an internal administrative decision rather than a public process.

We found that liquidity often prioritized publicly traded bonds to prevent market panic. Meanwhile, arrears owed to private construction firms and suppliers frequently languished. The flow of funds effectively protected financial market stability while leaving the real economy in certain districts starved of cash. The “ledger opacity” means that while the aggregate debt is now more visible, the triage process for resolving it is not.

The 2026 Outlook

As we approach 2026, the flow of emergency liquidity has successfully averted a systemic default. The issuance of 4.4 trillion yuan in special bonds during 2025 provided a crucial lifeline. Yet the structural issue persists. The central government has demanded that LGFVs transform into market oriented firms without government credit backing. Without the ability to rely on land sales for revenue, these entities struggle to generate cash flow.

The transparency of this transformation is the next battleground. Unless the “flow of funds” from the provincial level to the final creditor becomes auditable, the risk of misallocation remains high. The liquidity injection bought time, but it did not buy clarity.

Non Disclosure Agreements (NDAs) in Settlement Negotiations

The year 2025 marked a pivotal turning point in municipal finance, characterized by what economists now call the Great Debt Reveal. As local governments across the globe moved to restructure unsustainable liabilities, a disturbing trend emerged within the procedural machinery of recovery. While the overarching figures of debt relief were often publicized to calm markets, the specific terms of settlement negotiations were increasingly cloaked in secrecy. This investigation reveals that Non Disclosure Agreements (NDAs) became the primary instrument for obfuscation during the 2025 restructuring wave, effectively shielding private creditors and negligent officials from public scrutiny.

Data from the World Bank report Radical Debt Transparency, released on June 20, 2025, highlighted this growing opacity. The report warned that sovereign and sub sovereign borrowers were turning to “silent” partial restructurings. These confidential deals deprived taxpayers of critical information regarding how public funds were utilized to absorb losses. In the UK and China, two distinct epicenters of the 2025 local debt crisis, the use of NDAs evolved from a standard legal precaution into a systemic barrier against accountability.

The United Kingdom: Secrecy in the Town Hall

In the United Kingdom, the collapse of councils such as Woking and Thurrock precipitated a legal quagmire that extended well into 2025. Following the 2024 exposure of disastrous investments in solar farms and skyscrapers, Thurrock Council launched litigation against former business partners and even other local authorities. By late 2024, Thurrock had filed claims against 23 other councils related to disputed valuations. However, as these complex disputes entered settlement phases in 2025, the demand for confidentiality intensified.

Investigative analysis of council meeting minutes from early 2025 indicates that insurers and legal teams routinely insisted on strict NDAs as a condition for settlement. The rationale cited was often “commercial sensitivity,” yet the practical effect was to hide the scale of haircuts accepted by public bodies. For instance, when Woking Borough Council received a central government bailout exceeding £500 million in 2025, the precise breakdown of concessions made by private creditors remained largely redacted in public documents. Taxpayers funded the rescue, yet the specific beneficiaries of the debt write downs were protected by confidentiality clauses. This practice prevented comparative analysis, meaning one council could not know if it received a worse deal than its neighbor for holding the same toxic assets.

China: The Implicit NDA of State Finance

While the UK battled legal secrecy, China employed a more structural form of obfuscation during its massive Local Government Financing Vehicle (LGFV) debt swap. In late 2024 and throughout 2025, Beijing implemented a 10 trillion RMB program to convert hidden LGFV debt into transparent local government bonds. On the surface, this appeared to be a move toward transparency. However, the negotiation process between local governments and state owned banks functioned under an implicit NDA.

Market analysts noted in 2025 that while the volume of debt being swapped was published, the terms of the restructuring regarding interest rate reductions and maturity extensions were rarely disclosed on a loan by loan basis. Banks absorbed significant losses (or “national service” obligations) to keep local governments afloat. The lack of public documentation regarding these specific impairment charges acted as a state enforced silence. This prevented a panic in the broader banking sector but left global investors guessing about the true asset quality on Chinese bank balance sheets. The opacity was not maintained by a single contract but by a system wide directive that treated settlement details as state secrets.

The Democratic Deficit

The proliferation of NDAs in 2025 created a severe democratic deficit. In both the UK and China, the ultimate bearer of the risk was the public. When a council settles a dispute under an NDA, it denies the electorate the right to audit the efficiency of that settlement. The World Bank June 2025 report explicitly recommended legal reforms to mandate the disclosure of lending terms and restructuring agreements. Despite these warnings, local administrators faced immense pressure to close deals quickly and quietly to restore service stability.

By 2026, the legacy of the 2025 restructuring wave appeared to be a stabilized financial system built on a foundation of secret agreements. The “clean slate” promised by the restructurings came with a heavy price: the permanent erasure of the historical record regarding who exactly profited from the original bad debts and who was shielded from the full cost of their resolution.

Regulatory Oversight Mechanisms: Who Watches the Watchmen?

The year 2025 marked a definitive turning point in the global approach to municipal solvency. For the better part of a decade, local administrations from Birmingham to Beijing utilized opaque financing structures to fund infrastructure and services. By early 2026, the consequences of this shadow banking reliance became undeniable. The sheer scale of the restructuring efforts launched over the last twelve months reveals a systemic failure in regulatory oversight. This section investigates the watchdogs who were tasked with monitoring fiscal health and analyzes why they remained silent as trillions of dollars in off budget liabilities accumulated.

The 10 Trillion RMB Revelation

Nowhere is the oversight gap more glaring than in the People’s Republic of China. In November 2024, the Standing Committee of the National People’s Congress approved a massive debt swap program valued at RMB 10 trillion (roughly USD 1.4 trillion). The objective was to bring “hidden debt” onto official balance sheets by 2028. This debt was historically housed in Local Government Financing Vehicles (LGFVs), corporate entities that borrowed on behalf of municipalities to bypass official borrowing caps.

Data from 2020 through 2023 shows a widening chasm between official audit figures and market estimates. While the Ministry of Finance cited hidden debt levels around RMB 14.3 trillion as of late 2024, International Monetary Fund estimates suggested the true figure hovered near RMB 60 trillion by the end of 2023. This discrepancy of over 45 trillion RMB raises uncomfortable questions about the National Audit Office and its regional branches. Were these auditors unaware of the exposure, or were they complicit in maintaining the illusion of solvency?

Throughout 2025, the central government deployed RMB 2 trillion in special bonds to replace high interest LGFV loans with lower interest municipal bonds. This move saved an estimated RMB 200 billion in interest payments annually. However, the regulatory mechanism failed to prevent the accumulation in the first place. The 2025 restructuring is less a triumph of management and more a forced confession of previous regulatory blindness.

The United Kingdom: Section 114 Contagion

A similar crisis of oversight unfolded in the United Kingdom. By January 2025, the London Borough of Barnet issued a Section 114 notice, effectively declaring bankruptcy due to unlawful pension fund payments. This followed the high profile collapses of Birmingham and Nottingham in 2023. The Office for Local Government (OFLOG), established to provide early warnings, faced severe criticism for its reactive posture.

In February 2026, Brighton & Hove City Council requested GBP 15 million in exceptional financial support to avoid a similar fate. The pattern is distinct and troubling. External auditors repeatedly signed off on accounts that relied on fragile commercial investments or optimistic reserve valuations. The Chartered Institute of Public Finance and Accountancy noted in late 2025 that the existing audit framework prioritized compliance over financial resilience. The watchmen were checking boxes while the foundations crumbled.

The United States: The 6 Trillion Dollar Blind Spot

Across the Atlantic, the United States faced its own transparency reckoning. By the close of fiscal year 2025, total state and local government debt was projected to reach USD 2.36 trillion, with total liabilities including unfunded pensions pushing the figure past USD 6.1 trillion. The Municipal Securities Rulemaking Board (MSRB) mandates disclosure, yet the lag in financial reporting remains a critical vulnerability. In 2024, the average time for a local government to file an audit exceeded 180 days after the fiscal year end. This delay means that investors and regulators in 2025 were often making decisions based on stale data from 2023.

Table: The Transparency Lag (Average Days to Audit Release)

| Region |

2020 |

2022 |

2024 |

2025 (Est) |

| US Municipalities |

150 |

165 |

182 |

185 |

| UK Councils |

120 |

190 |

245 |

260 |

The data in Table 1 illustrates a deteriorating trend in timely reporting. As financial complexity increased between 2020 and 2025, the speed of regulatory verification decreased. In the UK, the backlog of unaudited accounts became a national scandal by mid 2025, with hundreds of councils unable to close their books from previous years.

Architecting New Oversight