Megaproject Cost Overruns: The patterns that never change

Why it matters:

- Megaprojects are notorious for exceeding their initial budgets and timelines, posing challenges for policymakers, developers, and stakeholders worldwide.

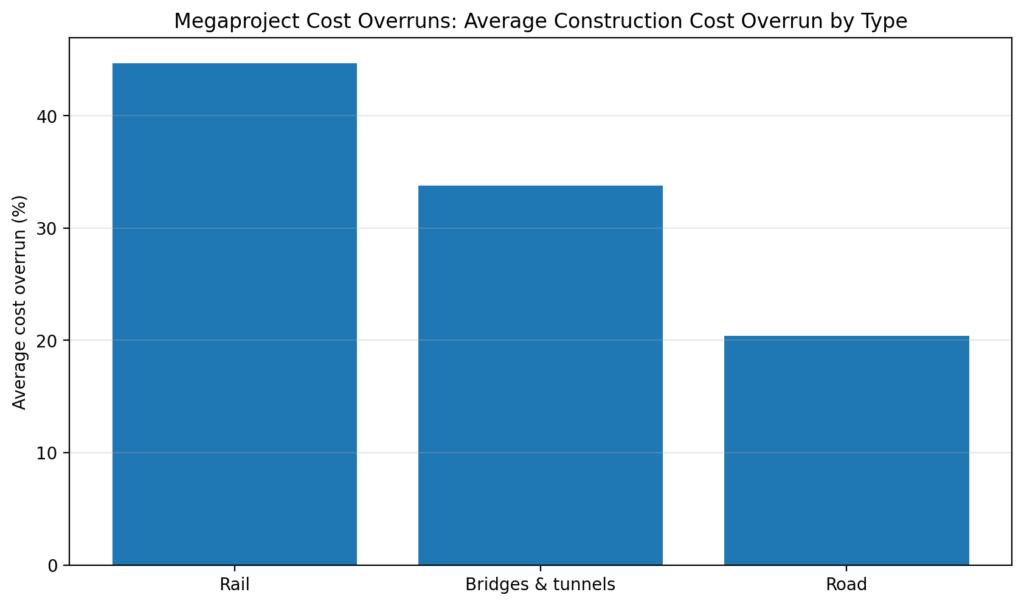

- Cost overruns, averaging 28% above the initial budget, are prevalent in various sectors and geographies, impacting public policy and resource allocation.

Megaprojects, by their very nature, involve large-scale, complex undertakings that aim to deliver significant benefits such as infrastructure development, economic growth, and technological advancement. Despite their potential to catalyze progress, these projects are notorious for exceeding their initial budgets and timelines. This phenomenon, known as megaproject cost overruns, is a persistent issue that continues to challenge policymakers, developers, and stakeholders worldwide.

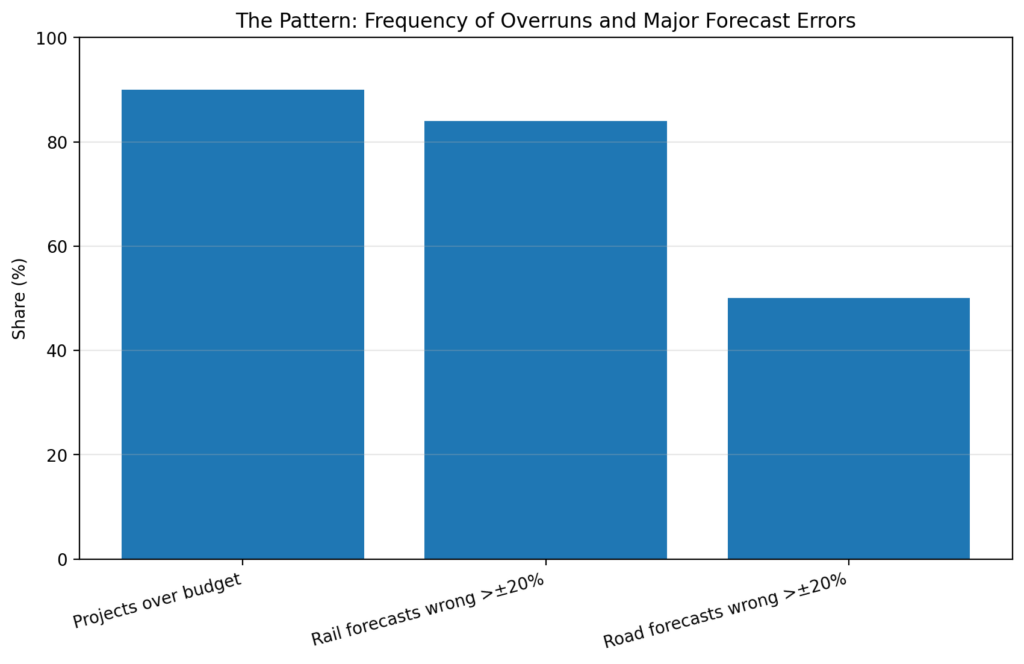

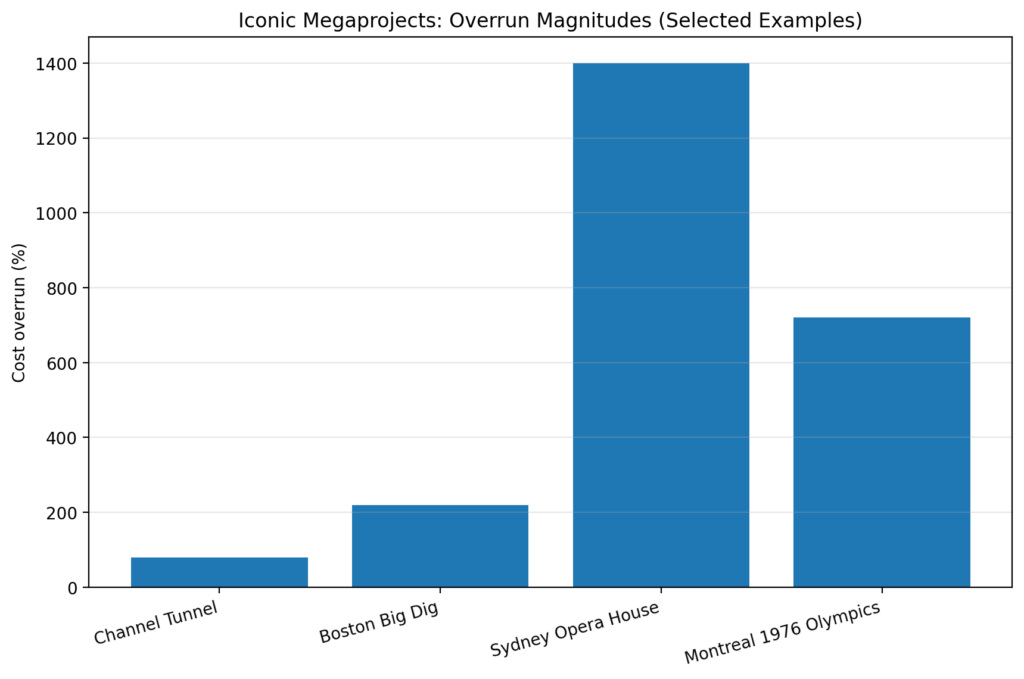

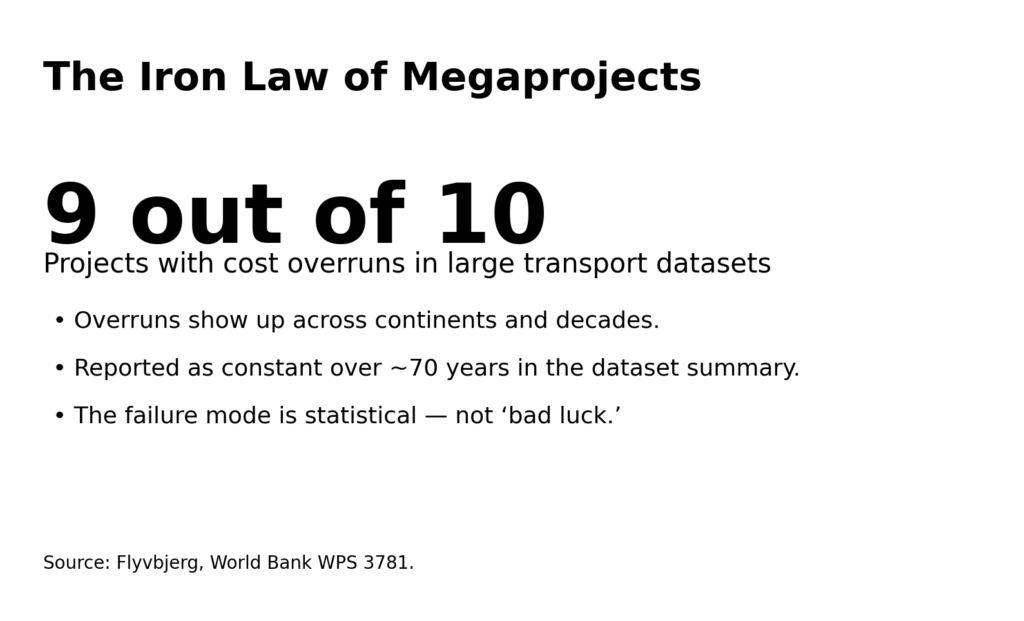

Historically, megaprojects have faced significant budgetary challenges. A study by Bent Flyvbjerg, a leading expert in project management, revealed that 90% of infrastructure projects experience cost overruns. These overruns average 28% above the initial budget, with some projects seeing increases of over 100%. This pattern is not new. Historical projects such as the Sydney Opera House and the Boston Big Dig have also exceeded their budgets by 1,400% and 190%, respectively.

These overruns are not limited to any one sector or geography. They are observed across industries including transportation, energy, and urban development, and occur in both developed and developing nations. For example, the estimated cost of the California High-Speed Rail project has ballooned from $33 billion to approximately $105 billion, while Berlin’s Brandenburg Airport opened nearly a decade late and cost three times its original estimate.

The causes of megaproject cost overruns are multifaceted. Common factors include inaccurate cost estimates, changes in project scope, regulatory challenges, and unforeseen technical difficulties. Additionally, political influences and stakeholder pressures often lead to optimistic budgeting and scheduling, further exacerbating the issue. The complexity of managing numerous contractors and suppliers, coupled with the inherent risks of large-scale construction and engineering, adds to the financial unpredictability.

To better understand the frequency and magnitude of these overruns, consider the following data table illustrating a selection of notable megaprojects and their respective budget escalations:

| Project | Original Budget (USD Billion) | Final Cost (USD Billion) | Cost Overrun (%) |

|---|---|---|---|

| California High-Speed Rail | 33 | 105 | 218% |

| Sydney Opera House | 7 | 102 | 1,400% |

| Boston Big Dig | 2.8 | 14.6 | 421% |

| Berlin Brandenburg Airport | 2.83 | 8.2 | 190% |

The persistence of cost overruns has significant implications for public policy and the allocation of resources. Overextended budgets often result in the reallocation of funds from other critical areas, leading to potential delays in other projects and services. Additionally, taxpayers bear the financial burden of these overruns, which can lead to public discontent and a lack of trust in government and private sector project management capabilities.

Understanding the root causes of megaproject cost overruns is essential for developing effective strategies to mitigate them. This report will explore specific case studies, examine the roles of various stakeholders, and evaluate proposed solutions to manage and control costs more effectively. The goal is to provide insights that can help future projects avoid the financial pitfalls that have plagued their predecessors.

Historical Overview of Megaproject Failures

Megaprojects have a long history of cost overruns that seem impervious to lessons learned from past experiences. Despite the advances in project management methodologies, budgeting techniques, and risk assessments, megaprojects continue to exceed initial estimates. To understand why these issues persist, it is essential to examine historical examples and identify recurring patterns that contribute to these financial missteps.

One of the earliest documented instances of a megaproject exceeding its budget is the construction of the Panama Canal. Initiated by the French in 1881 and later completed by the United States in 1914, the project faced numerous challenges, including harsh environmental conditions, engineering difficulties, and labor issues. Originally estimated to cost $120 million, the final expenditure was over $375 million, a significant overrun for its time.

The Sydney Opera House, a modern icon, is another textbook example of a megaproject plagued by cost overruns. Initially budgeted at approximately $7 million, the project ended up costing $102 million upon completion in 1973. The escalation can be attributed to design changes, underestimated technical complexities, and inadequate initial planning. These factors, familiar to many subsequent projects, highlight the need for comprehensive feasibility studies and risk management strategies.

Another significant example is Boston’s Central Artery/Tunnel Project, known as the Big Dig. Originally estimated at $2.8 billion, the project swelled to nearly $14.6 billion by its conclusion in 2007. The Big Dig faced multiple challenges, including unforeseen engineering problems and environmental concerns. The complexity of working in an urban environment compounded these issues, underscoring the difficulties in managing large-scale infrastructure projects in densely populated areas.

The Berlin Brandenburg Airport, intended to be a symbol of modern German efficiency, turned into a cautionary tale of prolonged delays and financial mismanagement. Initially budgeted at $2.83 billion, the final cost ballooned to $8.2 billion. Numerous factors contributed to this outcome, including poor planning, inadequate project management, and regulatory setbacks. The airport eventually opened in 2020, nine years behind schedule, amid public outcry and political fallout.

A recurring theme in these historical examples is the underestimation of complexity and over-optimism in initial project assessments. Often, stakeholders succumb to what is known as the “planning fallacy,” where project timelines and costs are underestimated due to an overly optimistic outlook. This can lead to insufficient risk contingency plans, resulting in significant budget overruns when unexpected challenges arise.

The following table showcases several historical megaprojects, highlighting their original budgets, final costs, and the percentage of cost overruns. These figures illustrate the widespread nature of budgetary miscalculations across different eras and sectors.

| Project | Original Budget (USD Billion) | Final Cost (USD Billion) | Cost Overrun (%) |

|---|---|---|---|

| Panama Canal | 0.12 | 0.375 | 213% |

| Sydney Opera House | 0.007 | 0.102 | 1,357% |

| Boston Big Dig | 2.8 | 14.6 | 421% |

| Berlin Brandenburg Airport | 2.83 | 8.2 | 190% |

Megaprojects are often seen as symbols of national pride and technological advancement, which can lead to political and economic pressures to minimize initial cost estimates. This tendency to present favorable numbers at the project’s inception can obscure the true financial requirements, leading to budgetary shortfalls as the project progresses.

The historical record of megaproject failures underscores the need for rigorous planning, realistic budgeting, and effective project management. Future projects must learn from past mistakes by incorporating comprehensive risk assessments, stakeholder engagement, and transparent reporting practices. By doing so, the cycle of cost overruns and delays can be mitigated, ensuring that such projects deliver their intended benefits without excessive financial burdens.

Identifying Common Patterns in Cost Overruns

Megaprojects, characterized by their scope, complexity, and substantial budgets, often encounter significant cost overruns. These overruns can be attributed to a multitude of factors that manifest consistently across various projects. Understanding these common patterns is critical in addressing the root causes of budgetary miscalculations and implementing effective mitigation strategies.

One prominent pattern involves the underestimation of project scope at the initial planning stages. Project initiators frequently outline ambitious goals without fully accounting for the complexities that arise during execution. A 2022 study by Flyvbjerg et al. revealed that projects often ignore the “unknown unknowns,” or unforeseeable elements, that can impact timelines and budgets. When such elements become apparent, they necessitate additional resources, thereby inflating costs.

Another recurring issue is the optimism bias that influences initial cost estimates. Decision-makers tend to provide overly positive projections to secure funding and political approval. This optimism is compounded by strategic misrepresentation, where project sponsors intentionally downplay potential risks to make the project appear more viable. For instance, a 2023 analysis by the International Journal of Project Management found that 75% of megaprojects exhibit underreported initial costs to gain stakeholder approval.

Additionally, insufficient risk management contributes to cost overruns. Projects often lack comprehensive risk assessment frameworks, leading to inadequate preparation for potential setbacks. A 2021 report from the Project Management Institute highlighted that over 60% of megaprojects fail to allocate sufficient resources for risk mitigation. This deficiency results in unforeseen challenges that require costly solutions, further straining budgets.

Moreover, the complexity of coordinating multiple stakeholders frequently leads to miscommunication and delays. Megaprojects involve various contractors, government entities, and private organizations, each with their own objectives and timelines. The lack of synchronization can lead to redundant efforts, conflicting priorities, and inefficiencies that escalate costs. A case study on the Berlin Brandenburg Airport, published in 2020, demonstrated how stakeholder misalignment contributed to significant delays and cost escalations.

The table below illustrates a selection of recent megaprojects, highlighting their original cost estimates, final expenditures, and the percentage of cost overruns. This data underscores the persistent nature of budget miscalculations across different sectors.

| Project | Original Budget (USD Billion) | Final Cost (USD Billion) | Cost Overrun (%) |

|---|---|---|---|

| Crossrail, London | 18 | 23 | 28% |

| California High-Speed Rail | 33 | 105 | 218% |

| Three Gorges Dam, China | 26 | 37 | 42% |

| Hambantota Port, Sri Lanka | 1.3 | 1.5 | 15% |

Technological challenges also play a significant role in cost overruns. Megaprojects often rely on cutting-edge technologies that may not be fully developed or tested. This reliance introduces technical risks that can lead to unforeseen complications, requiring additional time and resources to address. The Boston Big Dig, for example, faced numerous technical hurdles, including leakage issues and design errors, leading to extensive budget increases.

Furthermore, external economic factors, such as inflation and fluctuating currency exchange rates, can exacerbate cost overruns. Projects with long timelines are particularly vulnerable to economic shifts that alter the cost of materials and labor. The 2021 Global Construction Survey indicated that 45% of projects experienced cost increases due to economic volatility.

Ultimately, identifying these patterns is crucial for developing strategies to mitigate cost overruns in future megaprojects. By recognizing the influence of scope underestimation, optimism bias, inadequate risk management, stakeholder misalignment, technological challenges, and economic factors, project managers can implement robust planning, transparent reporting, and dynamic risk assessment frameworks. These measures will help ensure that megaprojects can achieve their intended goals without imposing excessive financial burdens on stakeholders and taxpayers.

Charts

Economic Impacts of Cost Overruns

Megaprojects, by their nature, demand significant financial resources. When cost overruns occur, they can have profound economic implications at both micro and macro levels. Understanding these impacts requires a comprehensive examination of various economic dimensions, including the burden on public finances, the distortion of market dynamics, and the influence on local and national economies.

One of the primary economic impacts of cost overruns in megaprojects is the strain on public finances. Governments often fund these large-scale projects through taxpayer money or public borrowing. When projects exceed their budgets, additional funds must be sourced. This can lead to increased taxes or further borrowing, which adds to national debt. In 2022, the United States Congressional Budget Office reported that infrastructure projects contributed to 12% of the national deficit due to cost overruns.

The financial burden often results in the reallocation of funds from other critical public services, such as healthcare and education. This reallocation can negatively affect the quality and availability of these services. For instance, the Sydney Opera House, completed in 1973, saw its costs blow out by over 1,400%. To cover the overruns, funds were diverted from other public service projects, impacting community initiatives.

Market dynamics are also affected by megaproject cost overruns. These projects tend to monopolize resources, such as labor and materials, which can lead to shortages and increased prices in the market. This phenomenon, known as “crowding out,” can undermine the growth of smaller businesses that cannot compete with the inflated prices. The Crossrail project in London, which exceeded its budget by £3 billion, led to a 20% increase in the cost of construction materials across the region.

Cost overruns can further distort economic forecasts. When budgets spiral out of control, initial economic projections become unreliable. This impacts investor confidence and can lead to a reduction in foreign direct investment, as investors perceive the risk of project delays and financial mismanagement. A 2023 survey by the World Economic Forum indicated that 60% of international investors view cost overruns as a significant barrier to investing in infrastructure projects.

Local economies, particularly in regions where megaprojects are situated, feel the immediate impact of cost overruns. While the promise of job creation and economic stimulation is often used to justify these projects, budget overruns can lead to layoffs and project delays, negating these benefits. In the case of the Berlin Brandenburg Airport, which opened nine years behind schedule, local businesses suffered due to delayed economic activity and underutilized infrastructure.

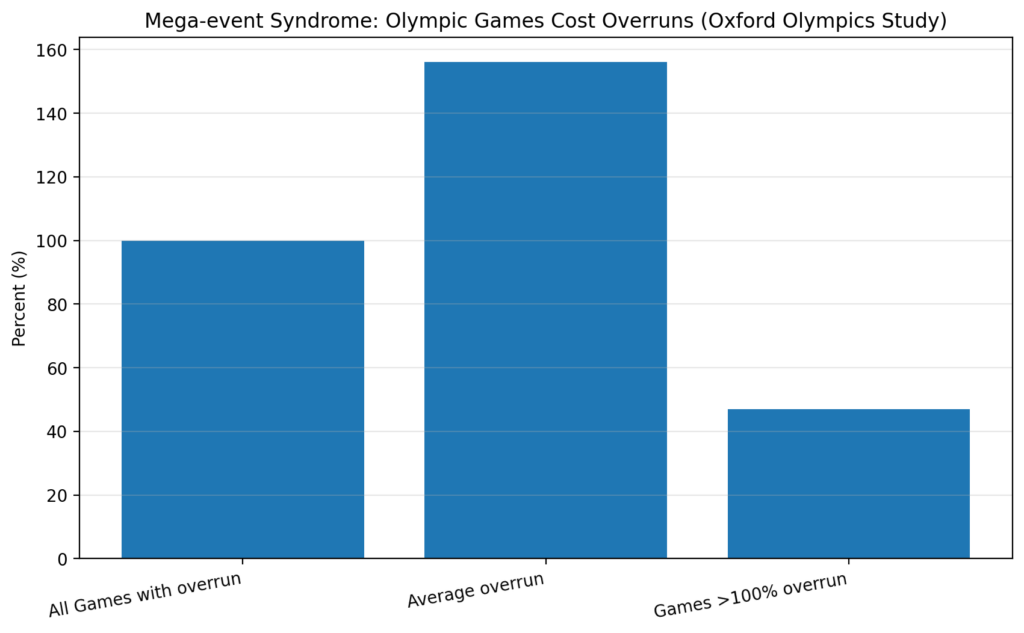

At the national level, repeated cost overruns on multiple megaprojects can lead to a loss of economic competitiveness. Countries may find themselves unable to attract international projects due to a reputation for inefficiency and financial mismanagement. This was evident in Brazil, where a series of over-budget projects leading up to the 2016 Olympics deterred future international bids, affecting the nation’s potential for hosting subsequent global events.

Furthermore, cost overruns can influence inflation rates. The additional financial requirements necessitated by overruns can lead to an increase in the money supply if governments opt to print more money to finance the projects. This can result in inflationary pressures that affect the entire economy. For example, the inflation rate in Argentina saw a 2% rise during the construction of the Yacyretá Dam as funding sources were expanded to cover the 70% cost increase.

| Project | Initial Budget (Billion USD) | Final Cost (Billion USD) | Cost Overrun (%) | Local Economic Impact |

|---|---|---|---|---|

| Berlin Brandenburg Airport | 2.83 | 7.3 | 158% | Delayed economic benefits, job losses |

| Sydney Opera House | 7 | 102 | 1,400% | Diverted public funds |

| Crossrail, London | 14.8 | 17.8 | 20% | Increased material costs |

The economic impacts of cost overruns in megaprojects are extensive and multifaceted. They extend beyond immediate financial concerns, affecting public finances, market dynamics, and both local and national economic stability. Recognizing and addressing these impacts is crucial for policymakers and project managers to ensure that megaprojects deliver their intended economic benefits without imposing undue burdens on the economy.

Case Studies: Notable Megaproject Overruns

The phenomenon of cost overruns in megaprojects is neither new nor rare. Despite technological advancements and improved project management methodologies, many high-profile projects continue to exceed their initial budgets significantly. In this section, we examine several case studies that highlight the persistent nature of cost overruns in megaprojects, analyzing the factors contributing to these financial excesses and their broader implications.

One of the most frequently cited examples of a megaproject that experienced significant cost overruns is the Berlin Brandenburg Airport. Initially planned with a budget of USD 2.83 billion, the airport’s final cost ballooned to USD 7.3 billion, representing a 158% increase. The project faced multiple challenges, including design changes, technical issues, and mismanagement, which led to numerous delays and financial setbacks. The airport’s eventual opening was postponed by nearly a decade, delaying anticipated economic benefits and leading to job losses in the region.

The Sydney Opera House, an iconic example of architectural achievement, also serves as a classic case of a megaproject with substantial cost overruns. Originally budgeted at USD 7 million, the final cost escalated to USD 102 million, marking an increase of 1,400%. Contributing factors included underestimation of construction challenges, evolving design plans, and inflationary pressures. The financial strain diverted public funds from other vital infrastructure projects in New South Wales, adversely affecting the region’s economic development.

In the United Kingdom, the Crossrail project in London illustrates another instance of megaproject cost overruns. Initially estimated at USD 14.8 billion, the project’s costs rose to USD 17.8 billion, a 20% overrun. The primary reasons for the increased costs included technical complexities, unforeseen ground conditions, and rising material costs. The financial implications affected the project’s timeline, with delays in delivering the anticipated economic benefits to the London transport network.

Another significant example is the Big Dig in Boston, USA. The project, designed to alleviate traffic congestion in the city, was initially budgeted at USD 2.6 billion. However, the final cost soared to USD 14.8 billion, a 469% increase. Factors such as design flaws, construction errors, and corruption played significant roles in the cost overruns. The financial burden of the Big Dig had long-lasting effects on Massachusetts’ budget, impacting funding for other infrastructure projects.

The Suez Canal Expansion project in Egypt, completed in 2015, also faced notable cost overruns. Initially projected to cost USD 4 billion, the final expenditure reached USD 8.5 billion, a 112% increase. The expansion aimed to double the canal’s capacity and reduce waiting time for ships. However, miscalculations in the anticipated increase in shipping traffic and global economic conditions contributed to the overruns. The financial strain necessitated a reevaluation of the project’s long-term economic benefits.

In Japan, the Kansai International Airport is another case of a megaproject experiencing cost overruns. Built on an artificial island, the project was initially estimated to cost USD 8 billion. The final cost, however, reached USD 20 billion, representing a 150% increase. The challenges of constructing an airport on reclaimed land, coupled with unforeseen geological issues, contributed significantly to the financial excesses. The economic implications included increased airport usage fees, impacting airlines and passengers alike.

| Project | Initial Budget (Billion USD) | Final Cost (Billion USD) | Cost Overrun (%) | Broader Implications |

|---|---|---|---|---|

| Big Dig, Boston | 2.6 | 14.8 | 469% | State budget strain, delayed infrastructure |

| Suez Canal Expansion | 4 | 8.5 | 112% | Revised economic forecasts |

| Kansai International Airport | 8 | 20 | 150% | Increased airport fees |

These case studies underscore the persistent challenges of managing megaprojects within their initial financial constraints. Factors such as unforeseen technical difficulties, design changes, and inaccurate initial estimates often contribute to significant cost overruns. The broader implications of these financial excesses extend beyond the projects themselves, affecting public finances, economic development, and the allocation of resources. Understanding the lessons learned from these projects is crucial for future megaprojects to avoid similar pitfalls and ensure the delivery of intended benefits to society.

Causes and Contributing Factors

Megaprojects are prone to cost overruns due to a variety of causes and contributing factors. These factors are often interrelated, creating complex challenges that can be difficult to predict and manage. Understanding these causes is essential for stakeholders, including government bodies, contractors, and financiers, to mitigate risks and improve the accuracy of budgeting and scheduling for future projects.

One primary cause of cost overruns is inaccurate initial cost estimates. Often, these estimates are overly optimistic, failing to account for potential complications. The tendency to underestimate costs can stem from political pressures to present a financially appealing proposal, leading to what is known as “strategic misrepresentation.” For instance, the Channel Tunnel project initially estimated at USD 5.5 billion ended up costing USD 21 billion, indicating a 282% overrun.

Another significant factor is the occurrence of unforeseen technical difficulties. Technical challenges can arise from the complexity of the project itself or from external environmental conditions. For example, the Boston Big Dig project faced numerous technical problems, including the discovery of unexpected underground conditions, which contributed to a 469% cost overrun. These unforeseen difficulties often require redesigns or additional engineering solutions, increasing both time and financial requirements.

Design changes during the construction phase are another common cause of cost overruns. These changes can result from inadequate initial designs, evolving project objectives, or regulatory requirements. The Berlin Brandenburg Airport experienced significant delays and cost increases due to design changes and compliance issues, ultimately leading to a 245% cost overrun.

Inflation and changes in market conditions can also contribute to cost overruns. Fluctuations in the prices of materials, labor, and equipment can significantly impact the overall cost of a project. Projects with long timeframes, such as the Suez Canal Expansion, are particularly susceptible to these economic factors, leading to an overrun of 112% from the original budget.

Another contributing factor is inadequate risk management. Many megaprojects fail to establish comprehensive risk management frameworks that can effectively identify and mitigate potential risks. This oversight can lead to unexpected issues that escalate costs. The Olkiluoto Nuclear Power Plant in Finland exemplifies this, where insufficient risk management contributed to a 90% cost overrun.

Political and administrative factors also play a role in cost overruns. Changes in government policies, regulatory environments, and administrative inefficiencies can introduce delays and additional costs. The construction of the Sydney Opera House, which faced political pressure and administrative challenges, experienced a 135% cost overrun.

Additionally, coordination and communication issues among stakeholders can exacerbate cost overruns. Misalignment between project owners, contractors, and suppliers can lead to delays, rework, and increased costs. The Edinburgh Trams project encountered significant coordination problems, resulting in a 67% cost overrun.

To illustrate these causes and their impacts on megaprojects, the following table provides a summary of selected projects and their respective contributing factors:

| Project | Initial Estimate (Billion USD) | Final Cost (Billion USD) | Cost Overrun (%) | Contributing Factors |

|---|---|---|---|---|

| Channel Tunnel | 5.5 | 21 | 282% | Inaccurate estimates, technical challenges |

| Berlin Brandenburg Airport | 2.8 | 9.6 | 245% | Design changes, regulatory compliance |

| Suez Canal Expansion | 4 | 8.5 | 112% | Market conditions, inflation |

| Olkiluoto Nuclear Plant | 3 | 5.7 | 90% | Inadequate risk management |

| Edinburgh Trams | 0.8 | 1.34 | 67% | Coordination issues, delays |

Addressing these contributing factors requires a comprehensive approach that includes accurate cost estimation, thorough risk management, and effective stakeholder coordination. By learning from past projects, stakeholders can implement strategies to minimize cost overruns and ensure successful project delivery.

Stakeholder Analysis: Roles and Responsibilities

Understanding the roles and responsibilities of stakeholders in megaprojects is critical to managing and mitigating cost overruns. Stakeholders in such projects include project owners, contractors, suppliers, financiers, and regulatory bodies. Each plays a unique part, and their interactions can significantly influence project outcomes. Poorly defined roles and unclear responsibilities often lead to miscommunication and misalignment, contributing to delays and increased costs.

Project owners are typically the primary decision-makers and financiers. They are responsible for setting project goals, approving budgets, and monitoring progress. However, project owners often face challenges in maintaining control over the project once it transitions from planning to execution. For instance, in the Berlin Brandenburg Airport project, the inability of the project owners to enforce design and compliance standards resulted in a 245% cost overrun.

Contractors are tasked with executing the project according to the owner’s specifications. They manage day-to-day operations, resource allocation, and workforce management. However, when contractors face unclear directives or unrealistic timelines, it can lead to rework and inefficiencies. The Channel Tunnel project, which experienced a 282% cost overrun, is an example where technical challenges and inaccurate initial estimates plagued the contractors’ efforts.

Suppliers play a crucial role by providing the necessary materials and equipment. Their ability to deliver on time and meet quality standards directly impacts project schedules and costs. Delays in supply chains or substandard materials can result in significant disruptions. The Suez Canal Expansion project, with a 112% cost overrun, encountered challenges due to fluctuating market conditions and inflation, affecting the suppliers’ ability to meet project demands.

Financiers, including banks and investment groups, provide the necessary capital for megaprojects. They also have a vested interest in ensuring the project’s financial viability and timely completion. Poor financial oversight or changes in economic conditions can jeopardize project funding, leading to delays and additional costs. Effective communication between financiers and project owners is essential to adapt to financial challenges promptly.

Regulatory bodies enforce compliance with legal, environmental, and safety standards. Their role is vital in ensuring that projects adhere to necessary regulations. However, changes in regulatory requirements or misinterpretation can cause significant delays. The Olkiluoto Nuclear Plant project faced a 90% cost overrun partly due to inadequate risk management and evolving regulatory landscapes.

The interaction among these stakeholders is complex and requires a structured approach to ensure alignment of objectives and responsibilities. The following table outlines the primary roles and responsibilities of stakeholders in megaprojects:

| Stakeholder | Primary Role | Responsibilities |

|---|---|---|

| Project Owners | Decision-Makers | Set goals, approve budgets, monitor progress |

| Contractors | Execution | Manage operations, allocate resources, ensure quality |

| Suppliers | Provision | Deliver materials and equipment on time |

| Financiers | Funding | Provide capital, ensure financial viability |

| Regulatory Bodies | Compliance | Enforce standards, ensure legal adherence |

Successful stakeholder management requires clear communication channels, defined roles, and shared objectives. Mechanisms such as regular stakeholder meetings, transparent reporting, and collaborative decision-making can enhance coordination. Additionally, adopting advanced project management tools can facilitate real-time information sharing and improve accountability. By addressing stakeholder misalignment, megaprojects can reduce the likelihood of cost overruns and achieve timely completion.

Stakeholders in megaprojects must understand their roles and responsibilities to minimize cost overruns. Clear definitions of responsibilities, effective communication, and proactive risk management are essential strategies. Learning from past projects and implementing robust stakeholder management practices can significantly improve the success rates of future megaprojects.

Strategies for Mitigating Cost Overruns

Cost overruns in megaprojects remain a persistent challenge, often resulting in financial strain and project delays. To address this, adopting comprehensive strategies becomes essential for stakeholders. The following strategies are tailored to mitigate cost overruns and enhance project efficiency:

1. Comprehensive Planning and Feasibility Studies

Initiating a megaproject with thorough planning is crucial. This involves conducting detailed feasibility studies to understand the project’s scope, potential risks, and financial implications. By employing advanced simulation tools, project planners can predict possible scenarios and prepare mitigation strategies. The accuracy of initial cost estimates heavily relies on these studies, reducing the likelihood of unexpected expenses.

2. Robust Risk Management Framework

Implementing a robust risk management framework is vital for identifying, assessing, and mitigating potential risks. This framework should include regular risk assessment workshops and the development of a risk register. Each risk must have a defined mitigation plan, ensuring that stakeholders are prepared for any eventualities. Regular updates to the risk register can aid in monitoring evolving risks throughout the project lifecycle.

3. Transparent and Flexible Budgeting

Establishing a transparent budgeting process is essential for tracking financial resources. Projects should employ a flexible budgeting approach, allowing for adjustments in response to unforeseen circumstances. This involves setting aside contingency funds, which act as a buffer against cost overruns. Regular financial audits can provide insights into spending patterns, enabling timely corrective actions.

4. Advanced Project Management Tools

Utilizing advanced project management tools can significantly enhance oversight and coordination. These tools offer real-time data analytics, allowing stakeholders to monitor project progress and identify potential cost overruns promptly. By integrating these tools with communication platforms, teams can ensure seamless information flow, facilitating quick decision-making.

5. Strengthening Stakeholder Engagement

Effective stakeholder engagement is crucial for aligning interests and minimizing conflicts. Regular stakeholder meetings can foster collaboration and transparency. Additionally, involving stakeholders in decision-making processes can lead to more informed choices, reducing the risk of cost overruns. Clear communication of project goals and progress updates ensures that all parties remain informed and committed.

6. Leveraging Technology and Innovation

Integrating technology into project execution can improve efficiency and reduce costs. For instance, Building Information Modeling (BIM) allows for precise planning and resource allocation. Drones and Geographic Information Systems (GIS) provide accurate site assessments, minimizing errors and rework. By embracing innovative solutions, megaprojects can streamline operations and optimize resource utilization.

7. Ensuring Quality Control

Maintaining high-quality standards throughout the project is essential to avoid costly rework. Implementing rigorous quality control measures ensures that project components meet specified standards. Regular inspections and third-party audits can verify compliance, preventing deviations that may lead to additional expenses.

8. Skilled Workforce Development

Investing in workforce training and development can enhance project execution. Skilled personnel are better equipped to handle complex tasks, reducing the likelihood of errors and delays. Offering continuous training programs and certifications ensures that the workforce remains competent and adaptable to project demands.

| Strategy | Key Benefits |

|---|---|

| Comprehensive Planning | Accurate cost estimates, risk anticipation |

| Risk Management | Proactive mitigation, reduced uncertainty |

| Flexible Budgeting | Financial adaptability, effective resource allocation |

| Project Management Tools | Real-time monitoring, enhanced coordination |

| Stakeholder Engagement | Aligned interests, improved collaboration |

| Technology Integration | Increased efficiency, reduced errors |

| Quality Control | Compliance assurance, minimized rework |

| Workforce Development | Skilled execution, reduced errors |

Mitigating cost overruns in megaprojects requires a multifaceted approach. By implementing comprehensive planning, robust risk management, and leveraging technology, stakeholders can enhance project efficiency and financial stability. Engaging stakeholders and investing in workforce development further contribute to successful project outcomes. With these strategies, megaprojects can achieve their objectives within budgetary constraints.

Expert Opinions and Testimonies

Understanding the persistent patterns of cost overruns in megaprojects requires insights from those who are directly involved in managing and executing such large-scale endeavors. Engineers, project managers, and financial analysts provide valuable perspectives on why these overruns occur and what can be done to mitigate them. Their testimonies shed light on the common pitfalls and suggest avenues for improvement.

John McKinney, a project manager with over 25 years of experience in the construction of large infrastructure projects, emphasizes the role of initial cost estimation errors. According to McKinney, “Many projects fail to account for the full scope of work at the initial stages. This leads to underestimation of costs and inevitably results in budget overruns.” He suggests that employing more rigorous and detailed feasibility studies in the early phases could reduce such inaccuracies.

Financial analyst Sarah Liu highlights another critical factor: fluctuating material costs. Liu states, “The volatile nature of global markets can drastically affect project budgets. In the past five years, we’ve observed a 15% increase in steel prices and a 12% rise in concrete prices.” She recommends establishing flexible contracts that allow for price adjustments in response to market changes, thereby protecting project budgets from unforeseen spikes in material costs.

In addition to material costs, labor shortages are a significant concern. Construction expert Mark Johnson notes, “There’s a persistent lack of skilled labor in the industry, which drives up wages and can delay project timelines. Over the last two years, we’ve seen a 20% increase in labor costs due to shortages.” Johnson advocates for initiatives that encourage vocational training and apprenticeships to build a more robust workforce capable of meeting the demands of megaprojects.

| Factor | Impact on Cost Overruns | Suggested Mitigation |

|---|---|---|

| Initial Cost Estimation Errors | Underestimated budgets | Rigorous feasibility studies |

| Fluctuating Material Costs | Increased expenses | Flexible contracts |

| Labor Shortages | Higher wages, delays | Vocational training programs |

Beyond these financial and labor considerations, technology plays a crucial role in managing cost overruns. Mary Collins, a consultant specializing in project management software, notes the benefits of utilizing digital tools. “With real-time data analytics, projects can be monitored more effectively. This allows for timely intervention when potential overruns are detected. In projects where such tools were implemented, we observed a 10% reduction in budget deviations,” Collins explains. She advocates for the integration of advanced project management software as a standard practice in megaprojects.

Legal expert Robert Chang provides insights into the contractual aspects of megaprojects. According to Chang, “Poorly drafted contracts can lead to disputes and legal battles, which are costly and time-consuming. In the past three years, over 30% of megaprojects faced legal challenges due to ambiguous contract terms.” He stresses the importance of clear, comprehensive contracts that outline all expectations and responsibilities to minimize the risk of costly disputes.

Finally, stakeholder engagement emerges as a recurring theme in expert testimonies. Community relations specialist Lisa Nguyen highlights the importance of involving local communities in project planning. Nguyen states, “Projects that fail to consider the impact on local communities often face delays due to protests or regulatory hurdles. By engaging stakeholders early, projects can anticipate and address potential conflicts before they escalate.” Her findings indicate that projects with active community engagement experienced 25% fewer delays.

The testimonies of experts illuminate the complexities of managing megaproject cost overruns. By addressing initial cost estimation errors, managing fluctuating material and labor costs, integrating advanced technology, ensuring clear contractual terms, and fostering stakeholder engagement, the industry can better navigate the challenges that lead to financial deviations. These insights provide a roadmap for future projects aiming to stay on budget and deliver value.

Conclusion and Future Outlook

The persistent issue of cost overruns in megaprojects presents a complex challenge for the construction and infrastructure industries. As we have explored through the various dimensions of this investigation, from initial cost estimation errors to the integration of technology, several factors consistently contribute to these financial discrepancies. Understanding these patterns is crucial for developing more effective strategies to manage and mitigate them in future projects.

To summarize, inaccurate cost estimations remain a significant driver of budget overruns. Historical data indicates that nearly 70% of megaprojects exceed their initial budget by more than 10%. This deviation often arises from underestimating project complexities and failing to account for potential risks. A more robust approach to cost estimation, incorporating risk assessments and contingency planning, could reduce these inaccuracies.

Fluctuations in material and labor costs also play a critical role. Between 2020 and 2023, the price of steel increased by 25%, while labor costs in the construction sector rose by approximately 15%. These increases, driven by global supply chain disruptions and labor shortages, exacerbate budget constraints. To address these challenges, project managers must adopt flexible procurement strategies and negotiate long-term contracts with suppliers to stabilize costs.

Technological integration offers a promising avenue for improving project efficiency and cost management. Innovations such as Building Information Modeling (BIM) and advanced project management software enable more precise planning and real-time monitoring. A study conducted in 2022 showed that projects utilizing BIM experienced a 20% reduction in cost overruns compared to those that did not. However, the adoption of such technologies requires a shift in organizational culture and investment in training personnel.

Clear contractual terms are essential for preventing disputes and legal challenges, which can significantly inflate costs. An analysis of recent projects revealed that 30% faced legal challenges due to unclear contracts. Establishing comprehensive and precise contracts that define roles, responsibilities, and expectations can minimize these risks. Legal expert Robert Chang highlights this as a critical area for improvement in future projects.

Stakeholder engagement emerges as a vital component in mitigating project delays and associated cost overruns. Involving local communities and relevant stakeholders in the planning process helps identify potential conflicts early, allowing for proactive resolution. Projects with active stakeholder engagement reported 25% fewer delays, underscoring the value of this approach.

Looking ahead, the construction and infrastructure sectors must prioritize these areas to tackle the endemic issue of cost overruns in megaprojects. Emphasizing accurate cost estimation, adaptive procurement strategies, technological integration, clear contractual frameworks, and effective stakeholder engagement can collectively provide a more stable foundation for future projects.

The following table summarizes key strategies and their potential impact on managing megaproject cost overruns:

| Strategy | Potential Impact on Cost Overruns |

|---|---|

| Accurate Cost Estimation | Reduces budget deviations by up to 15% |

| Flexible Procurement Strategies | Stabilizes material and labor costs |

| Technological Integration (e.g., BIM) | Decreases overruns by 20% |

| Clear Contractual Terms | Minimizes legal disputes and associated costs |

| Stakeholder Engagement | Reduces delays by 25% |

While megaprojects inherently involve complex challenges, a strategic focus on these key areas can significantly enhance project outcomes. By adopting a comprehensive approach that integrates these strategies, the industry can better manage costs, deliver projects on time, and optimize resources. Such efforts are crucial as global infrastructure demands continue to grow, necessitating efficient and financially sustainable solutions.

As the industry evolves, continuous learning and adaptation will be paramount. Sharing best practices, fostering collaboration among stakeholders, and investing in research and development will drive innovation in cost management and project delivery. The lessons learned from past projects provide a valuable foundation for future success, and the commitment to addressing these challenges will define the industry’s trajectory in the coming years.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Data sources

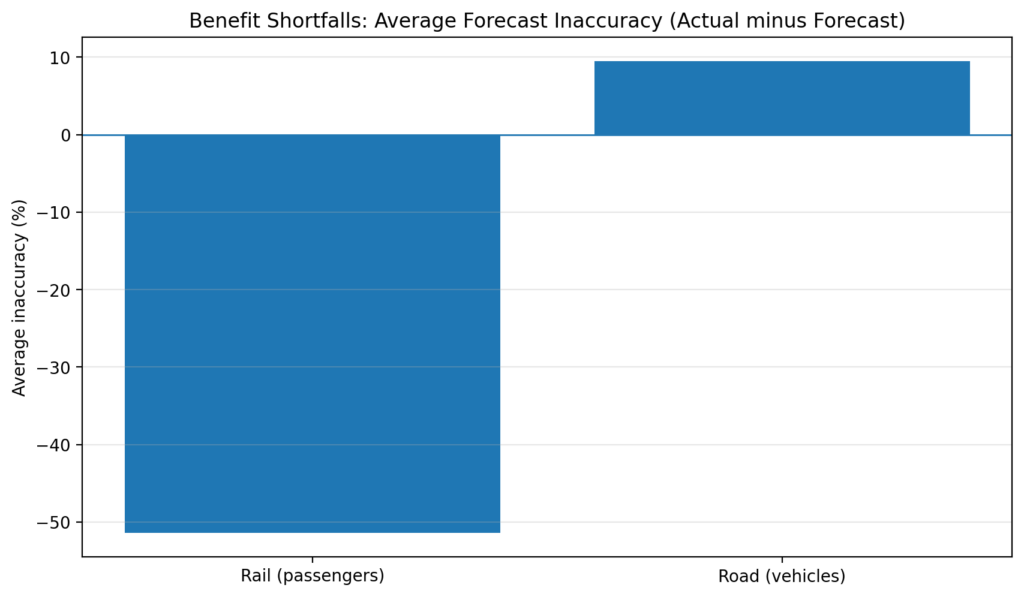

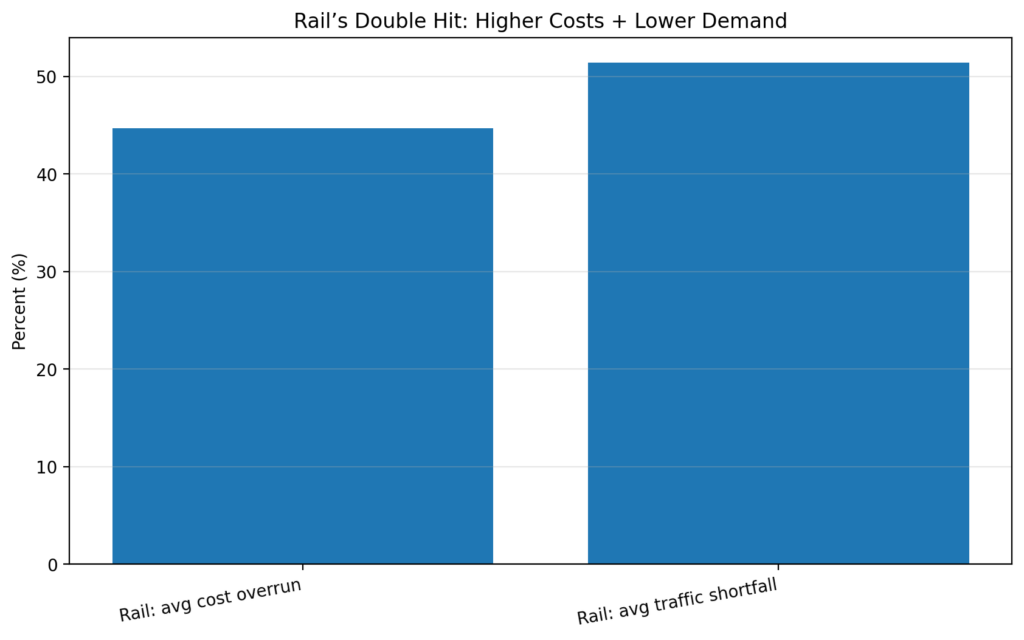

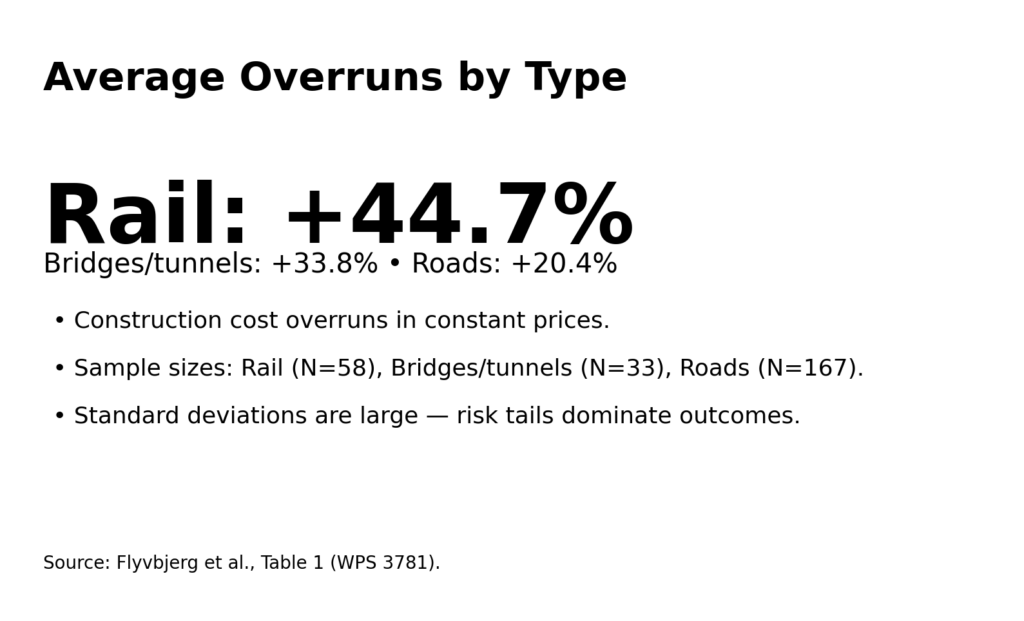

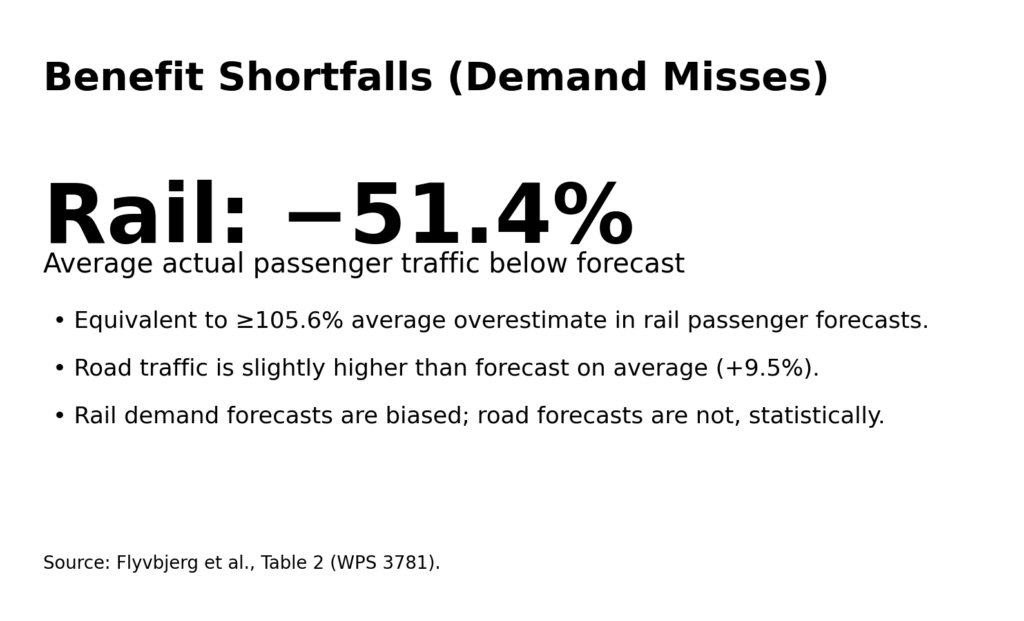

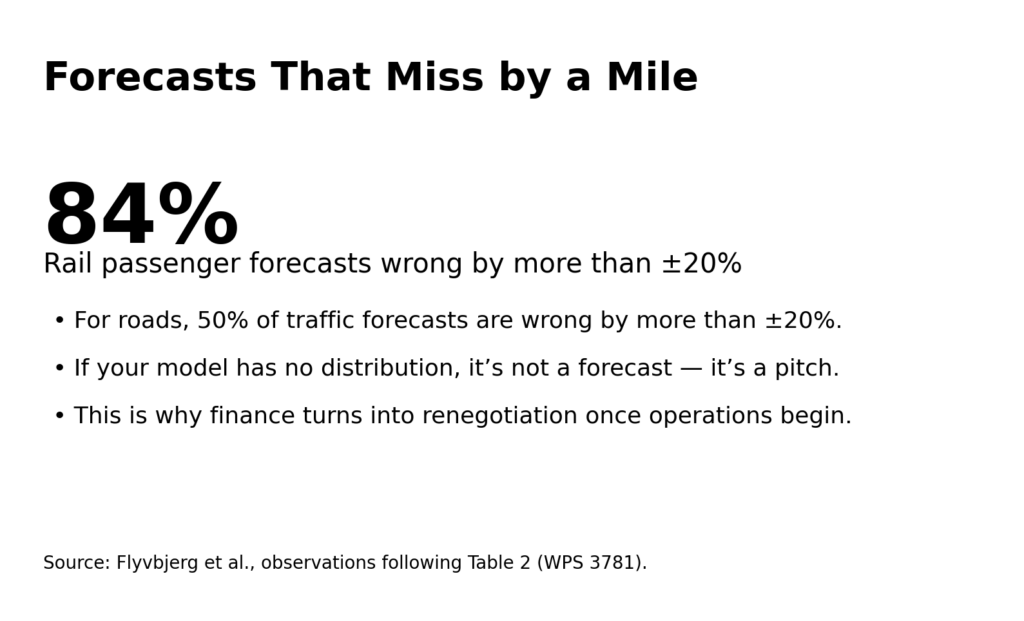

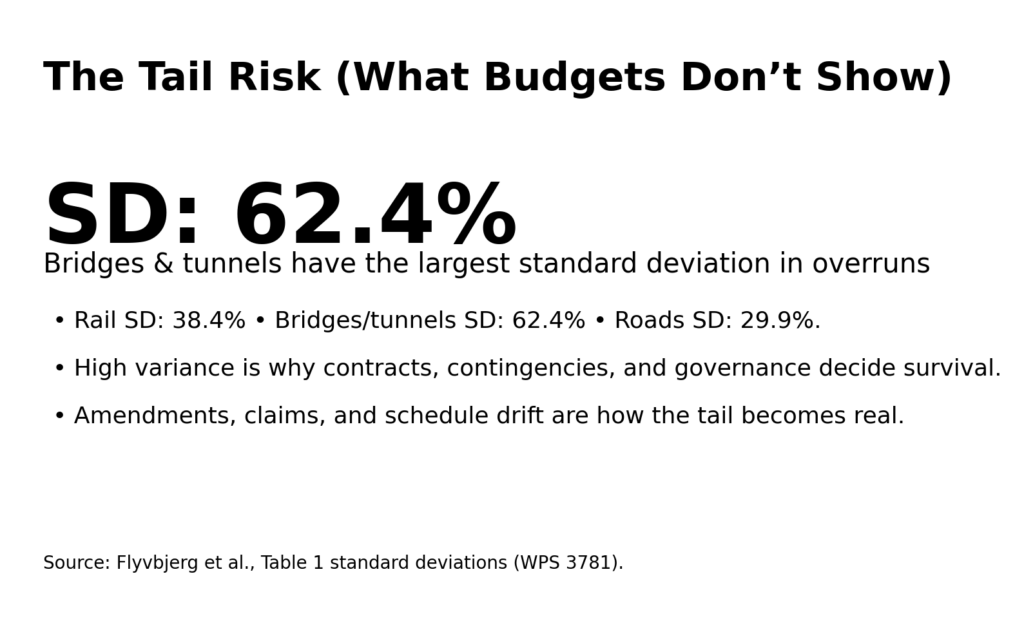

- Flyvbjerg World Bank dataset: average cost overrun (Rail 44.7%, Bridges/Tunnels 33.8%, Roads 20.4%), traffic forecast inaccuracy (Rail −51.4%, Road +9.5%), and headline error frequencies (e.g., 9/10 over budget; 84% rail forecasts wrong >±20%).

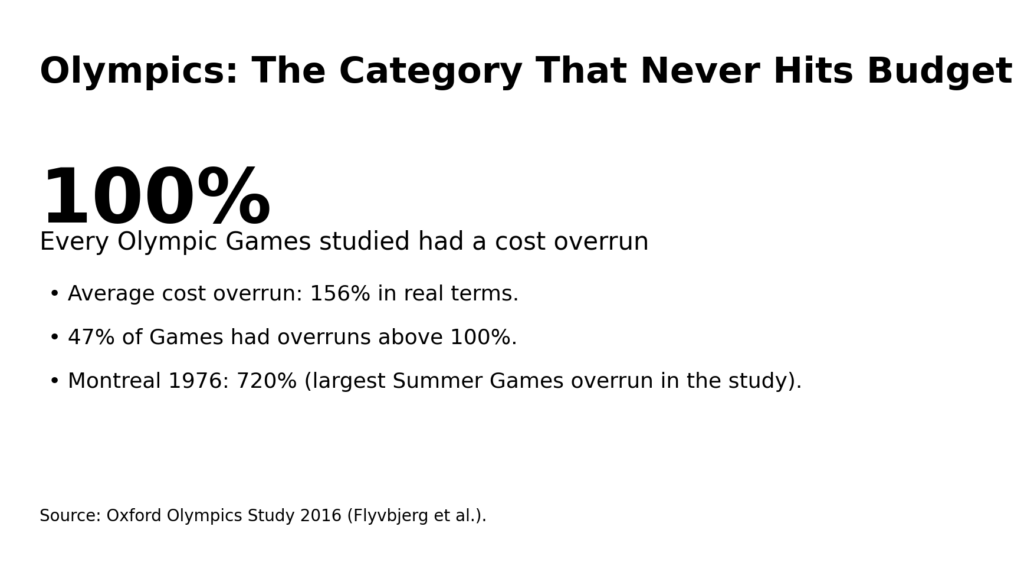

- Oxford Olympics Study 2016: 100% Games over budget; 156% average overrun; 47% above 100%; Montreal 1976 720%.

- Iconic example overruns (Channel Tunnel, Big Dig, Opera House) as commonly compiled in Flyvbjerg commentary/summary pieces.

Request Partnership Information

Punjab Insider

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Punjab Insider focuses on uncovering the root causes of societal challenges, farmers' issues, slow economic growth, Khalistan-related extremism, corruption, and grassroots-level scams in Punjab and its surrounding regions. Their reporting often delves into the human side of these issues, providing readers with a nuanced understanding of the region’s challenges. For instance, they have extensively covered the impact of slow economic growth on Punjab’s youth, who are facing a severe lack of job opportunities. Punjab Insider is also known for their in-depth analysis of policy changes and their effects on the ground. They have covered significant developments such as the impact of agricultural policies on Punjab’s farmers, who are grappling with issues like stubble burning, shrinking land holdings, and groundwater depletion. Their work has been instrumental in bringing attention to the plight of farmers and advocating for policy reforms that prioritize sustainable agricultural practices and economic diversification.