Exciting Public Relations Performance Trends From 2025

Why it matters:

- Public Relations in 2025 is evolving to be more dynamic, data-driven, and crucial for business success.

- PR teams are under pressure to demonstrate measurable impact, adapt to media changes, and prove their contribution to business goals.

Public Relations in 2025 is more dynamic, data-driven, and integral to business success than ever. PR teams are under pressure to prove their impact in measurable terms while adapting to a rapidly changing media environment where every aspect of public relations performance trends are taken into context by the C-Suite employees while measuring the effectiveness of their PR, Media Relations and Comms Teams.

This longform report analyzes the key PR performance trends shaping 2025, backed by fresh data and research.

We will explore how PR effectiveness is measured (media impact, share of voice, sentiment analysis, campaign ROI, earned media value), showcase real-world case studies across industries, compare B2C vs B2B PR outcomes, and examine the latest tools (like Meltwater, Cision, Muck Rack, Brandwatch) enabling PR professionals to track and improve their performance.

We’ll also look at global PR trends in North America, Europe, Asia-Pacific, Latin America, Africa, and the Middle East, and devote a special section to crisis communication in the face of reputational risks.

Throughout, expert insights and quotes will highlight what these trends mean for marketing and communications leaders aiming to stay ahead.

Let’s dive into the data and narratives defining PR performance in 2025, and what they imply for organizations worldwide.

Public Relations Performance Trends Outlook for 2025: Growth and Accountability

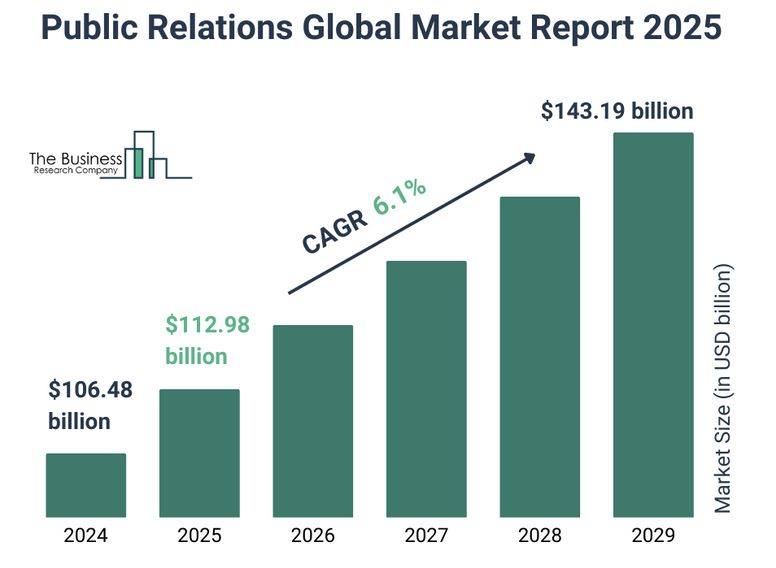

The global PR industry continues its steady growth in 2024–2025, both in market size and strategic importance. Recent market research shows that the public relations market will expand from $106.48 billion in 2024 to $112.98 billion in 2025, a year-on-year growth of about 6.1%. By 2029, global PR is projected to reach $143.19 billion if current trends hold.

This growth is fueled by factors like businesses’ heightened focus on reputation management, crisis communication needs, and the dominance of digital media channels. In other words, demand for PR expertise is rising as companies recognize that managing public perception and earned media is critical in today’s digitally connected world.

Figure: Global PR industry growth. The worldwide public relations market is forecasted to grow from $106.5B in 2024 to $113.0B in 2025, continuing on to $143.2B by 2029 (6.1% CAGR) *(Image Credit: The Business Research Company)

This expansion reflects strong business demand for PR services – from corporate communications to digital and social media PR, across all regions.

This industry growth comes with higher expectations from the C-suite. PR is no longer seen merely as press relations or “spin” – executives now call on communications teams to tangibly move the needle on business outcomes like revenue, customer growth, and brand value.

In fact, 41% of PR/comms heads now report directly to the CEO, indicating PR’s seat at the executive table. With that seat comes a mandate: prove how PR contributes to business goals.

The messages related to PR from topmost enterprises like Boeing’s CEOs is echoed by marketing leaders too. Caroline Supino, CMO of a tech startup, summed up executive sentiment with a hypothetical directive: “Give me outcomes, not outputs. Don’t tell me you got 10 articles – tell me that our message reached 5 million of the right people and made them 25% more likely to consider us. That’s the language I speak to the CEO.”

In short, PR is expected to deliver real business impact, not just media coverage.

To meet these expectations, PR teams in 2025 are focusing on data-driven performance and tighter alignment with business metrics. Surveys show a clear trend: an overwhelming 86–89% of PR professionals say that the impact of their work is the primary goal of PR measurement.

However, many also admit challenges in doing so (more on that shortly). The positive side is that budgets for PR are holding steady or increasing in many organizations. Roughly 33% of brands and 39% of agencies expect their PR budgets to increase in the near term, while about 45% anticipate budgets staying the same.

This optimism, though slightly tempered compared to last year, signals that companies are willing to invest in PR – provided it can show value. Notably, 42% of communicators believe the biggest growth in revenue will come from earned media, far outpacing those who expect gains from paid media (only 10%).

In other words, many organizations see PR and earned coverage as key drivers of growth if leveraged effectively.

At the same time, PR professionals are grappling with a fast-evolving media and technology landscape. Audiences are fragmented across traditional media, digital outlets, and social platforms; AI is emerging in content creation and analytics; and stakeholder activism means brands are scrutinized on everything from socials to sustainability.

These forces are driving PR practitioners to innovate and adapt. In 2025’s PR strategy, we see AI-powered tools, personalized content, influencer collaborations, and integrated campaigns playing bigger roles than ever.

We’ll explore these in detail, but first, let’s examine how the push for data and accountability is reshaping PR measurement pra# Data-Driven PR Measurement: Proving Impact with Analytics

One of the most significant PR performance trends in 2024–2025 is the shift toward data-driven measurement. PR teams are increasingly expected to quantify their results and link PR efforts to tangible outcomes. This represents a transformation from relying on “vanity metrics” (like sheer press clip counts) to focusing on value metrics that matter to the business.

As the International Association for Measurement and Evaluation of Communication (AMEC) puts it, the industry is moving “from quantity to quality, from outputs to outcomes, and from intuition to intelligence.”

Communications leaders themselves acknowledge this shift. In Cision and PRWeek’s 2024 Global Comms Report, 42% of comms leaders said they are relying on data and analytics “very much so” – a big jump from 30% a year prior.

Moreover, 89% of PR practitioners say the main purpose of measurement is to show the impact of their work.

The will is certainly there. Yet, executing on data-driven PR is not without hurdles. Fewer than 40% of PR pros are very confident in the metrics they report, and about half admit they are only “somewhat confident”.

This confidence gap stems from lingering doubts about traditional metrics’ accuracy and relevance.

For example, “potential reach” or impressions are widely tracked (used by over 75% of PR pros) but are among the least trusted metrics – roughly a quarter of practitioners say they do not trust impression counts.

Similarly, share of voice is a common KPI, yet about 20% of PR pros find it unreliable.

These set trends of PR measurement of high usage but low trust indicates that many legacy PR metrics “look good on paper” but show limited correlation to real business outcomes.

Why the distrust? Traditionally, PR success was measured in terms of outputs (e.g. number of press hits, total impressions, advertising value equivalents). But such metrics don’t necessarily tell you if PR moved the needle on awareness, consideration, or action.

As PR analytics expert Katie Paine famously quipped, “Just because you can count it, doesn’t mean it counts.”

Stakeholders today care less about how many press releases went out, and more about whether PR efforts changed audience behavior or drove results.

A PRNEWS survey found that 48% of PR pros struggle to prove the value of their work, up from 41% a couple of years ago, underscoring rising expectations.

Simply put, fluff metrics that don’t demonstrate real impact are falling by the wayside.

To build confidence, PR professionals are embracing more robust analytics frameworks.

Many teams are adopting structured approaches like the Barcelona Principles 3.0 (which emphasize outcomes over outputs and reject simplistic ad-value equivalents) and AMEC’s Integrated Evaluation Framework (IEF), which links PR activities to intermediate outcomes and end outcomes.

This means setting clear objectives and KPIs at each stage.

e.g. media results → audience reach/engagement → shifts in perceptions or behavior → business impact – and measuring against them.

For instance, instead of just tallying 100 media mentions, a PR team might define success as “Increased positive brand sentiment by 15% among target customers in H1” and then measure how coverage influenced sentiment polls or social media tone in H2″.

By setting measurable outcomes up front, PR can demonstrate progress in terms executives understand (like improved perception or lead generation) rather than just activity counts.

Continuous integration of PR data with marketing and sales data is another notable trend. In 2024, we saw more PR programs incorporating sales-related metrics – use of metrics tied to leads or conversions grew from 13% to 19% in one year.

Companies are borrowing from marketing’s playbook: using unique tracking links or promo codes in press releases, measuring referral traffic from earned media, and attributing customer conversions to PR touchpoints where possible.

According to PRWeek’s State of PR report, 75% of communications leaders believe PR must align with business results to earn a “seat at the table.”

This has reached a tipping point – innovation in measurement is no longer optional. We’re seeing the silo between PR and marketing evolve, with unified “comms dashboards” that combine earned media metrics and marketing KPIs.

Next, let’s look at the specific performance metrics that PR professionals are using to gauge success in this new era.

Key PR Performance Metrics in 2025

How exactly do you measure PR performance?

In 2025, a mix of traditional and advanced metrics are used to evaluate how PR campaigns and communications are performing.

Importantly, there’s an increasing emphasis on metrics that tie to quality and outcomes, as we discussed.

Below we break down the key PR performance metrics – media impact, share of voice, sentiment, campaign ROI, and earned media value – and how they are being applied (or rethought) in 2025.

Media Impact and Reach

Media impact refers to the overall results and influence of your media coverage. This often starts with measuring reachor impressions – essentially, how many people could have been exposed to your message via the media.

Reach metrics remain heavily used: more than 75% of PR pros track reach/impressions to gauge their efforts, making it the second most common PR metric after raw story counts.

These numbers (often provided by media monitoring services or calculated via circulation/viewership data) give a sense of scale: for example, a press release that gets picked up by a top news site might yield 5 million impressions.

However, reach by itself is a blunt instrument. In 2025, PR teams are supplementing volume metrics with measures of quality and resonance.

This is where concepts like Media Quality Scoring come in – evaluating each media hit on criteria such as the prominence of the mention, inclusion of key messages, spokesperson quotes, or calls-to-action.

In practice, many organizations rate coverage as positive/neutral/negative and assess whether the story delivered the intended message.

For instance, a company might find that out of 100 mentions, 30 had high message pull-through and positive sentiment (those are high-impact hits) while the rest were brief or neutral mentions.

Key message pull-through is a metric increasingly tracked, as noted by Meltwater: aside from reach and story count, common metrics include whether coverage contained the brand’s key messages.

Another aspect of media impact is audience engagement with earned media.

With the rise of digital media, PR teams can look at engagement metrics on articles (like social shares, comments, time spent on page) to gauge interest.

Some tools (e.g., Muck Rack’s PR Hit Score) attempt to quantify the quality of a media mention by factoring in the outlet’s importance, the journalist’s influence, and the engagement an article received.

This helps identify which hits were actually impactful beyond just potential eyeballs. As one PR analyst quipped, “I’d rather have 1 article that drives a meaningful conversation than 10 that nobody reads.”

In short, media impact measurement in 2025 goes beyond counting clips. PR teams still report basics like the number of stories placed (the top metric used) and total reach but they contextualize these with metrics for content quality and engagement.

The ultimate goal is to link media coverage to outcomes: Did the coverage drive web traffic? Did it correlate with a spike in Google searches for our brand?

These questions are being asked more frequently. It’s telling that more than half of PR professionals (over 50%) say producing measurable results is key to proving value to stakeholders.

Therefore, media impact metrics are evolving to be more meaningful, focusing on what coverage did rather than just what it was.

Share of Voice (SOV)

Share of Voice (SOV) has become a staple KPI for PR performance, especially in competitive industries.

Share of voice measures the proportion of media coverage or mentions your brand gets in your space relative to competitors.

For example, if Brand A has 30% of all industry media mentions in Q1, versus Brand B’s 20% and others making up 50%, then Brand A has the largest SOV, indicating a leadership in media presence.

This metric is popular because it contextualizes PR output – it’s not just how much press you got, but how you stack up against peers.

In 2024 surveys, 40% of PR pros said they regularly measure share of voice, making it the fifth most common PR metric reported.

Executives often like SOV because it can be linked to market mindshare.

In fact, there’s a classic marketing adage that share of voice eventually leads to share of market (though it’s not guaranteed).

A higher SOV suggests your messaging is getting through more than competitors’, potentially influencing audiences more.

PR teams track SOV over time and aim to increase it through proactive campaigns.

However, as noted, some practitioners caution that not all SOV is equal.

Quality of voice matters – 100 negative mentions are not better than 10 positive ones! That’s why modern SOV analysis might segment by sentiment or by topic.

For instance, a brand might measure not only overall share of voice, but share of positive voice in earned media, or SOV on specific strategic themes (e.g. “innovation” mentions in tech media).

Tools like Cision, Meltwater, and Brandwatch can automatically calculate SOV by scanning media mentions of all players in a defined set.

One challenge is trust in the data: about 20% of PR pros say they find share of voice metrics untrustworthy.

This could be due to inconsistent scope (which competitors or media are included) or difficulty in measuring across all channels (e.g. combining traditional and social media SOV).

Despite this, SOV remains a valued indicator for PR performance. Experts recommend using share of voice in conjunction with other KPIs.

In practice, a rising SOV paired with increased web referrals and improved sentiment presents a compelling narrative of PR success.

In competitive analysis, we often see case studies of brands boosting share of voice through clever PR.

For instance, in the fast-food industry, Burger King has famously run PR stunts that grabbed more media attention than its larger rival McDonald’s, temporarily increasing BK’s share of voice.

One such campaign in 2024 was “Burger King’s Million Dollar Whopper” – a promotional challenge that earned global press and social buzz, helping Burger King dominate fast-food headlines for a period.

Meanwhile, McDonald’s responded with its own PR moves (like a playful “McDonald’s” campaign as hinted in trending lists) to reclaim voice.

These battles illustrate how SOV is like a real-time scorecard for PR impact in the market. In 2025, we can expect companies to continue vying for share of voice, but with greater nuance – ensuring that the voice they amplify is positive and on-message.

Sentiment Analysis

Sentiment analysis measures the tone of coverage or conversations – essentially, how positive, neutral, or negative the public sentiment is toward your brand.

In PR performance terms, sentiment is crucial: lots of mentions are only a win if they are positive or at least neutral. If your media exposure is largely negative, that’s not a success by any stretch. Thus, PR teams track sentiment of press articles, social media chatter, and other earned content to gauge brand health.

Advances in AI and natural language processing have made sentiment analysis a standard feature in PR tools.

Platforms like Brandwatch, Meltwater, Talkwalker, and Cision all provide automated sentiment tagging for mentions.

By 2025, the technology has improved, though it’s not perfect – sarcasm and context can still throw off algorithms. Some vendors combine AI with human oversight to improve accuracy (e.g. PublicRelay offers human-validated sentiment scoring for nuanced analysis).

Why is sentiment a key metric now?

Because sentiment ties directly to reputation.

It’s not enough to measure volume; CEOs and CMOs want to know if people love or hate what they’re seeing about the company.

In one survey, 51% of PR leaders said “inability to measure impact on brand sentiment” was a concern, indicating they want better ways to link PR to perception shifts.

The good news is many are figuring it out.

For example, analytics tools can show if a PR campaign improved the ratio of positive to negative press mentions quarter over quarter, or if a crisis response succeeded in restoring neutral/positive sentiment after an initial negative spike.

Some organizations are even developing composite metrics like “brand love” scores.

Talkwalker, for instance, offers a “brand love” index using AI to analyze not just if mentions are positive, but the degree of positive emotion and brand affinity in online discussions.

These kinds of metrics aim to capture the quality of sentiment more deeply – distinguishing mild positivity from genuine enthusiasm.

In 2025, sentiment analysis is being applied beyond just media monitoring.

It’s used in campaign evaluations (“Was our PR campaign received positively by the public?”), in competitive benchmarking (“Is our competitor getting better sentiment in coverage than we are?”), and in crisis tracking (“Is sentiment recovering after our apology statement?”).

One example: Pfizer’s 2024 “Here to Science” campaign, which aimed to build trust in scientific expertise, would not only track how many media hits it got but also public sentiment around Pfizer and science post-campaign.

If successful, one would expect a lift in positive sentiment in discussions of pharmaceutical innovation or vaccine development. Indeed, pharma companies heavily monitor sentiment because public trust is directly tied to their license to operate.

It’s worth noting that social media sentiment and news media sentiment can differ.

PR teams look at both.

Social listening tools (e.g. Brandwatch, Sprinklr) analyze sentiment on Twitter, Facebook, forums, etc., providing a real-time pulse of public opinion.

For instance, if a product launch is getting panned on Twitter even while press reviews are positive, the PR team needs to know and address it. Thus, integrated sentiment dashboards across news and social are increasingly popular.

Sentiment analysis has become a Critical PR metric in 2025.

It transforms “share of voice” into “share of positive voice,” focusing PR efforts on not just getting talked about, but talked about in the right way.

As communications veteran Andy Gilman famously said, “The secret of crisis management is not good vs. bad, it’s preventing the bad from getting worse.” Monitoring sentiment is how you catch the bad and respond before it snowballs.

We’ll talk more about crisis comms later, but it’s clear that sentiment data underpins many PR decisions, from adjusting messaging to engaging with detractors or amplifying advocates.

Campaign ROI and PR Attribution

Perhaps the holy grail of PR performance metrics is ROI – Return on Investment. How much business value (in dollars or other bottom-line terms) did a PR campaign generate compared to what was spent on it? Calculating a precise PR ROI has long been challenging, but the pressure to demonstrate ROI has never been higher.

According to industry reports, we are seeing a “paradigm shift” toward ROI-driven PR models, where success is tied to business impact rather than sheer media volume.

PR teams face mounting pressure, especially amid tight budgets, to prove value in concrete terms. One recent analysis noted that many stakeholders now ask pointed questions like: “What’s the ROI of our PR investment? Did this PR initiative contribute to revenue?”

In 2024, one survey found 58% of PR teams face financial pressures, and the top way to secure resources is by delivering clear ROI.

So how are PR professionals tackling ROI? First, by defining what “return” means for PR. Not every PR outcome directly produces revenue, but it can contribute to revenue indirectly by feeding the sales funnel, increasing brand preference, or reducing costs (e.g., avoiding a reputational crisis can save millions).

Many practitioners are building multi-dimensional KPIs that link PR to the marketing or sales funnel

For example, if a PR campaign leads to an uptick in web traffic, which then results in product trial sign-ups, which eventually lead to sales, the PR can be credited for influencing the top of that funnel.

Using unique tracking links in PR content can help attribute those downstream actions.

In fact, it’s becoming common for PR to routinely use UTM codes or specific landing pages in press releases and guest articles, so that they can attribute web visits and conversions to those earned media hits.

Another approach is multi-touch attribution modeling that includes PR touchpoints. Although it’s complex, some companies attempt to model how much a PR touch (say, someone reading an article) contributed to a lead conversion when combined with other touches (ads, website visits, etc.).

We’re also seeing PR outcomes being measured in terms of search engine impact – for instance, did a PR campaign increase organic search impressions for the brand or improve SEO through backlinks? These are tangible metrics that tie PR to digital performance.

Forward-looking agencies predict that by the late 2020s, nearly every aspect of PR will be measurable in an integrated way: “By 2028, sophisticated measurement tools will track every click, conversion and dollar spent… agencies will need to prove with specific data points how PR dollars result in sales.”

Already, some communications teams are working closely with data scientists to develop models that estimate PR’s contribution to revenue or customer acquisition.

While an exact dollar ROI can be hard to pin down, progress is being made. For example, using control regions or A/B tests (areas with PR exposure vs. without) can isolate PR’s impact to some degree. If a market where a PR campaign ran saw a lift in sales compared to a similar control market, one can infer ROI.

Beyond revenue, ROI for PR can also mean risk avoidance and crisis mitigation (which is harder to quantify, but very real in value).

Preventing a brand disaster or quickly extinguishing one can save the company’s market capitalization from plummeting. Some comms executives argue this should be counted in PR’s ROI. As one PR leader noted, how do you measure the value of a crisis averted thanks to PR’s vigilance?

While it may not show up in a spreadsheet, it’s felt in the business.

With that said, tools are emerging to assist in calculating PR value. Platforms are experimenting with AI to recommend optimal PR strategies based on past ROI, and to forecast likely outcomes.

Imagine an AI looking at last year’s media coverage and sales data and suggesting “Stories in Tier-1 trade outlets yield 3x more pipeline per impression than national general news – allocate efforts accordingly.” This kind of insight, which anecdotally was noted in PR circles, could soon be productized.

Additionally, PR teams are feeding their data into company BI (business intelligence) systems to correlate with sales and marketing metrics.

It’s also worth mentioning the continued (albeit reduced) use of proxy ROI metrics like **Media Coverage (MAVs) and Earned Media Value – which we cover next. These attempt to assign a monetary value to PR outputs. While not true ROI, they are sometimes used to approximate what the PR coverage would have cost if paid for as ads.

In summary, demonstrating PR ROI remains challenging but is advancing. As Gregory Galant, CEO of Muck Rack, explains, PR metrics have been less concrete than marketing’s, making it harder to show impact on business outcomes.

The key is answering “how do you measure the value of reputation and trust?” – intangibles that PR builds

While one may never isolate PR’s impact with 100% precision, 2025 is seeing PR teams combine multiple data points (web analytics, lead tracking, brand surveys, etc.) to tell a convincing ROI story.

For communications leaders, the ability to frame PR’s value in financial or business terms is becoming a career-critical skill.

As one agency leader put it, “Since earned media metrics do not necessarily tie to the bottom line, agencies will need to prove – with specific data – how PR dollars result in sales.”

The best approach is compiling a portfolio of evidence (from share of voice wins to pipeline influence) that collectively shows PR’s contribution.

Earned Media Value (EMV) and AVE

For decades, PR pros have tried to convert PR outcomes into a dollar value through metrics like Advertising Value Equivalents (AVE) or Earned Media Value (EMV).

These metrics assign a monetary value to media coverage by estimating what that space or exposure would cost if it were paid advertising.

For example, if you got a full-page article in a magazine, and an ad page in that magazine costs $10,000, you might say the AVE is $10,000 (some even multiply by a “credibility factor”).

Earned Media Value extends this concept to digital and social, putting dollar values on impressions or engagements based on ad rates.

In 2025, earned media value is still used by some as an ROI shorthand, but it’s a controversial and declining practice.

Many industry bodies (AMEC, PRSA) have disavowed AVEs as a valid measure, because equating editorial coverage with ad costs is an apples-to-oranges comparison.

A glowing article is arguably more valuable than an ad (audiences trust editorial more), whereas a neutral brief mention might be less valuable than the ad cost suggests.

Nonetheless, some executives and clients ask for that “one number” to quantify PR, and EMV provides it – however flawed it may be.

But it also cautioned that this is a flawed approach and that the industry is moving away from it. Indeed, the Barcelona Principles explicitly reject AVEs as a measure of PR value. Instead, they urge measuring outcomes (like impact on awareness, attitudes, actions) rather than trying to stick a dollar sign on outputs.

So, how are organizations handling EMV in 2025?

Some still report it as one indicator among many, especially in consumer PR where large impression numbers can be multiplied by CPM rates.

For instance, a major consumer product launch that garnered 100 million impressions might be said to have an EMV of $5 million (if one uses a $50 CPM equivalent).

This can be eye-catching in reports. However, savvy PR teams accompany it with context: e.g., highlighting engagement or sentiment, not relying on EMV alone.

There’s also a trend of refining EMV calculations to be more realistic.

Instead of raw ad rate, some use a “quality AVE”– only counting portions of coverage that contain key messages or excluding negative pieces from value calculations.

Another adaptation is comparing media value to customer acquisition cost. For example, rather than saying “we got $1M in earned media,” a PR team might say, “our media coverage drove 50K website visits; given our typical conversion rates and value per lead, that’s worth $X in revenue potential.”

This ties the media outcome closer to business value than a generic ad rate.

Ultimately, earned media value can be a supporting metric but should not be the sole measure of PR performance.

Too many factors (audience trust, call-to-action, placement, etc.) influence the true impact of a piece of coverage beyond its notional ad cost.

As one PR measurement expert quipped, “Counting media value is like weighing a cake and declaring its success by pounds – it tells you nothing about the taste.”

Thus, while you might see EMV figures in 2025 PR reports, they are ideally accompanied by more substantive metrics we’ve discussed (share of voice, sentiment, website traffic, etc.). A balanced scorecard is key.

To sum up: PR performance metrics in 2025 blend the old and the new. Numbers of articles and reach still matter, but qualitative metrics (message pull-through, sentiment) and business-linked metrics (lead generation, ROI) matter far more. Most PR teams track a basket of ~8 metrics on average including story counts, impressions, key messages, share of voice, website impact, revenue impact, etc.

The emphasis is on outcomes and impact, not just activity. As we move forward, expect metrics to get even more sophisticated – with AI giving deeper insights (like predicting which stories will go viral or scoring the influence of each mention).

But the fundamental goal remains: measure what matters and show how PR is advancing the organization’s objectives.

Having covered what metrics are in play, let’s turn to the tools and platforms helping PR professionals capture and analyze these metrics in 2025.

PR Performance Tracking Tools and Platforms

Measuring and managing PR performance at scale would be impossible without the right tools. In 2025, PR teams have an expanding arsenal of tech platforms to monitor media, analyze coverage, manage journalist outreach, and benchmark their performance.

Tools like Meltwater, Cision, Muck Rack, and Brandwatch have become household names in PR circles, each offering different strengths. Let’s explore these and other notable platforms shaping PR performance management, and how they are incorporating new capabilities (like AI and integrated analytics).

Cision

Cision is one of the global leaders in PR software, known for its comprehensive suite that includes a media contact database, press release distribution (PR Newswire), media monitoring, and analytics dashboards. In recent years, Cision made a big move by acquiring Brandwatch, a top social listening and analytics platform.

This merger of capabilities means Cision can track not only traditional media coverage but also social media conversations and sentiment at scale. The Cision Communications Cloud in 2025 leverages AI to help PR pros identify influential journalists, monitor brand mentions across news and social, and measure impact. For example, Cision’s analytics can show share of voice across competitors, or generate reports linking PR to web traffic.

The 2024 Global Comms Report we cited was actually a Cision/PRWeek collaboration, and Cision has been integrating insights from that research into its tools – such as highlighting the need to measure outcomes. One new feature in Cision’s platform is AI-written briefing summaries: it can auto-summarize a week’s worth of coverage into an executive brief, saving teams time.

Despite being a heavyweight, Cision is also focusing on user-friendliness in reporting, knowing that many PR folks are not data scientists. It provides templates for common PR KPIs and the ability to create custom dashboards. In short, Cision remains a go-to for enterprise PR departments that want an all-in-one solution.

Meltwater

Meltwater is another major player, historically strong in media monitoring and social media tracking. Meltwater’s platform has evolved to encompass news, social, broadcast, podcasts, and more, giving a 360-degree view of earned media.

PR teams use Meltwater to get real-time alerts of brand mentions, analyze sentiment, and track campaign performance. According to Meltwater, PR pros on average track 8 metrics (as we noted) and Meltwater’s dashboards reflect that – you can see volume, reach, SOV, sentiment, top publications, key message penetration, etc., all in one place.

Meltwater also publishes industry insights; for instance, they noted that about one-third of PR pros use social listening tools daily and another third use them case-by-case, underscoring the importance of integrated media+social monitoring.

A differentiator for Meltwater in 2025 is its investment in AI features. The platform includes AI for tasks like predicting which mentions might trend (leveraging an acquisition of NewsFlow/NewsWhip technology), auto-tagging content themes, and even suggesting the best times to send press releases based on past engagement patterns.

Meltwater has also emphasized user collaboration, allowing PR teams to curate coverage and easily create reports (e.g., the CoverageBook-like functionality to compile clips with metrics, similar to what the standalone tool CoverageBook does). Many mid-sized and large companies rely on Meltwater for its robust monitoring across global sources and its continuous upgrades integrating AI and data visualization.

Muck Rack

Muck Rack has risen rapidly as a favorite tool, particularly for media relations management. Initially known as a modern media contacts database and journalist portfolio site, Muck Rack now offers features for pitching, media monitoring, and reporting.

One of Muck Rack’s draws is its strong database of journalists and influencers, with profiles that show what topics a journalist covers, recent articles, and even their tweets. P

R pros can use it to pinpoint the right reporter and track if/when they open your email pitch (a bit like a sales CRM for PR). In terms of performance tracking, Muck Rack’s monitoring covers online news and social (in partnership with other providers) and it introduced the “PR Attribution” metrics like the PR Hit Score we mentioned.

The platform can help score which media hits are most valuable and even tie into Google Analytics to show referral traffic from earned media.

Muck Rack’s 2024 State of PR Measurement report revealed stats about metrics usage and trust– and Muck Rack is clearly positioning its tool to address those pain points (e.g., by focusing on metrics PR pros trust, such as direct link traffic, rather than just impression counts).

With a user-friendly interface, Muck Rack is widely used by agencies and in-house teams that prioritize media outreach efficiency and lightweight monitoring.

It might not have the deep analytics of Cision or Meltwater, but it excels in simplifying the workflow of getting media coverage and demonstrating its value to stakeholders via clean reports.

Notably, Muck Rack’s integration of journalist feedback (showing you what journalists prefer in pitches, etc.) also indirectly boosts performance by improving success rates of media outreach.

Brandwatch

Now under Cision’s umbrella, Brandwatch remains a powerhouse for social listening and consumer intelligence. Its relevance to PR performance is significant – Brandwatch can track brand mentions across millions of social posts, forums, reviews, and more, giving PR a view into public sentiment and trending topics.

By 2025, Brandwatch’s analytics can do things like image recognition (spotting logos in social images), emotion analysis, and identify emerging conversations that might pose a PR risk or opportunity.

For example, if a product issue is suddenly being discussed in a niche forum, Brandwatch can alert the PR team early (perhaps heading off a crisis).

When it comes to measuring campaigns, Brandwatch can show how a PR event or announcement is resonating with consumers in real-time on social channels.

Since integration with Cision, PR teams can correlate Brandwatch data (social sentiment, volume) with traditional media coverage data.

This combined insight is powerful for comprehensive PR performance evaluation. Essentially, Brandwatch adds the “public voice” to the PR measurement mix.

Many PR strategies now explicitly include social influencer engagement and community management, so a tool like Brandwatch (or competitors like Talkwalker, Sprout Social, etc.) is critical to gauge success there.

As communications converge across paid, earned, shared, and owned (PESO model), Brandwatch helps PR pros make sure the “shared” and “earned” channels are both accounted for in performance metrics.

Beyond these big four, there are many other tools and platforms in the PR tech ecosystem, each with niche strengths:

Talkwalker

Known for social listening with strong AI analytics. Talkwalker’s platform covers online news and social, providing comprehensive sentiment analysis (even on images/videos via recognition) and a “unified view” of how campaigns perform across channels.

It also offers proprietary metrics like a “brand love” score from sentiment databritopian.com. PR teams use it to evaluate reputation holistically.

Sprinklr

An enterprise platform that integrates social media management with customer experience and PR monitoring. Sprinklr’s Modern Research module lets PR teams track brand mentions across not just news and social but also review sites and blogs.

It can correlate PR metrics with customer metrics (like NPS scores or customer sentiment) for a truly integrated view.

Sprinklr is favored by large brands who want PR data in the same system as marketing and customer care – enabling insights like “Our positive news mentions rose, and simultaneously our customer satisfaction went up” or vice versa.

Zignal Labs

A real-time media intelligence platform often used for crisis monitoring and analysis. Zignal excels at analyzing cross-channel media impact and detecting narratives, especially misinformation or crises. It uses AI to spot coordinated trends and can visualize how a story spreads (network maps).

PR teams at companies concerned with misinformation or fast-breaking news (tech, finance, politics) might use Zignal to stay ahead of negative cycles.

CoverageBook

A simpler tool focused on automating the creation of coverage reports. It pulls in article screenshots, titles, and basic metrics (domain authority, estimated views, social shares) and formats them into polished report books.

Many PR agencies love this for its time-saving in reporting results to clients. It’s not heavy on analysis but is great for presentation. Lately, they’ve been adding integrations (e.g., pulling in Moz SEO stats) to enrich reports.

Notified (GlobeNewswire)

Notified provides an integrated comms platform that includes press release distribution (GlobeNewswire) and PR analytics. They emphasize multimedia engagement and also have solutions for events and webcasts – bridging PR and investor communications in some cases.

Agility PR Solutions

Offers media monitoring and PR measurement services, including human analysis. They produce reports and have tools that predict media interest or measure PR ROI (they have whitepapers on best practices for PR ROI).

PRophet

An AI-driven tool aimed at helping craft better pitches – it can predict which journalists are likely to respond to a story idea (using AI trained on past media interest). While more of a pitching tool, by improving hit rates it indirectly boosts PR performance outcomes.

Google Analytics & Web Analytics

While not a PR tool per se, almost every PR team in 2025 uses web analytics to track referral traffic and goal conversions from earned media. This is an important part of the tech stack – plugging PR results into GA or similar to see downstream impact. Many PR tools now integrate with GA or have their own web tracking to show PR → website outcomes.

The common thread among these tools is a trend toward AI integration and better data visualization. Many older tools are reinventing with AI features: sentiment algorithms becoming more context-aware, anomaly detectors flagging unusual spikes, and even GPT-powered assistants that draft coverage summaries or generate insights.

For example, both Cision and Meltwater have rolled out AI features to help write briefing reports or suggest key takeaways from data. As data volumes grow, tools are making it easier to digest – with interactive dashboards and the ability to export data to BI systems or CSV for custom analysis. The ultimate aim is to make PR data as accessible and actionable as marketing data, closing the historical gap.

One statistic stands out: 64% of PR pros use dedicated PR software to store their media lists (rather than spreadsheets), and about 51% believe social listening is one of the most effective ways to assess reputation.

This indicates high adoption of specialized tools and recognition of their importance in PR performance. However, budgets and knowledge can be barriers – some teams still lag in tool adoption due to cost or awareness of what’s available.

Given the projected growth of the PR tools market (for example, in the Middle East/North Africa region the PR tools market is set to reach $250M by 2024 with 10% annual growth), we can expect continuous innovation and more affordable options coming into the market.

For communications leaders, choosing the right toolset is crucial.

The ideal mix might be: a robust monitoring/analytics platform (like Cision or Meltwater), a strong media relations CRM (like Muck Rack), and supplementary tools for specific needs (like social listening via Brandwatch/Talkwalker, or a report builder like CoverageBook).

The investment pays off by enabling real-time performance tracking and easier reporting of PR’s value. In 2025, those still relying on manual monitoring or gut feel are at a disadvantage – the industry is very much embracing the maxim “if you can’t measure it, you can’t improve it.”

Now that we’ve covered metrics and tools, let’s discuss how PR performance considerations differ in B2C vs. B2B contexts, as well as examine some standout case studies across industries, and the ever-important realm of crisis communications.

B2C vs. B2B PR Performance: Different Playbooks

Public relations strategies can look quite different when targeting consumers (B2C) versus targeting business audiences (B2B).

Consequently, how PR performance is defined and measured can also differ between B2C and B2B contexts.

Let’s explore these differences.

In B2C PR, the goal is often to build broad awareness, brand affinity, and consumer engagement. Success is usually measured in terms of media impressions, social buzz, viral reach, and brand sentiment among the general public.

For example, a B2C PR campaign for a new sneaker might aim for millions of impressions across lifestyle media, trending hashtags on social media, a boost in positive sentiment among Gen Z consumers, and ultimately an uptick in sales or web traffic.

B2C PR can leverage a wide array of channels: mainstream news outlets, magazines, influencers, celebrity endorsements, events/stunts, etc.

Metrics like share of voice against competitors in consumer media, or social engagement (likes, shares, comments), are very pertinent.

We might also see B2C PR placing more emphasis on earned media value to quantify large-scale coverage – for instance, a viral stunt that gets global news pickup might be said to have an EMV of several million dollars (to wow consumer brand managers, even if taken with a grain of salt).

Take an example: Dove’s “Hard Knock Life” campaign (one of 2024’s notable PR campaigns).

Dove created a powerful Super Bowl ad addressing why young girls quit sports, tying it to self-esteem issues – a classic Dove move to champion real beauty and confidence.

This B2C PR effort was storytelling-focused and emotionally resonant. Performance for such a campaign would be measured in how many people saw and reacted to it: TV audience reach, social media mentions of Dove positively, press coverage in consumer and sports media, and whether Dove’s brand sentiment and share of voice on the topic of girls in sports improved.

B2C PR success here is a combination of impact (touching hearts) and scale (mass reach). Indeed, many of the “best PR campaigns” lists for 2024 include consumer brands doing creative stunts or cause-driven campaigns (Oreo, Burger King, LEGO, etc. were on that Meltwater list) – all aiming to get people talking and feeling something. The performance indicators for these largely revolve around media hits, social virality, and cultural conversation sparked.

In B2B PR, the approach and metrics shift. B2B PR is about building credibility, trust, and visibility among a more niche audience: industry decision-makers, potential clients or partners, and sometimes investors.

Here, success might be measured by thought leadership placement (e.g. how many trade publications featured our bylined article or cited our executive), share of voice in industry debates, analyst reports mentions, and lead generation.

B2B PR often works hand-in-hand with content marketing – whitepapers, webinars, conference speaking opportunities – so PR performance might include metrics like “webinar attendees generated by PR” or “downloads of our report after our PR outreach.”ROI in B2B PR can be clearer in some ways: if a PR-driven analyst report mention leads to inclusion in vendor shortlists worth millions, that’s direct business impact.

For example, a fintech company doing B2B PR might focus on getting featured in Forrester or Gartner analyst reports, securing interviews in financial trade journals, and placing the CEO on stage at a big industry conference.

Performance would be measured by metrics such as quality of coverage (in key industry outlets), share of voice among a set of fintech competitors in trade media, and perhaps inbound inquiries or demo requests following media exposure.

B2B PR metrics might also track the strength of relationships – e.g. how many top-tier trade journalists the company’s experts had meaningful engagements with (since B2B sales cycles are long, relationship-building is key).

Another difference is audience engagement metrics. In B2C, you might measure success by trending on Instagram or YouTube views for an earned media placement.

In B2B, you might look more at LinkedIn engagement and website traffic coming from industry news sites or LinkedIn articles, since that’s where professionals are active.

In fact, LinkedIn has become a crucial platform for B2B PR dissemination and performance – a thought leadership piece that goes viral on LinkedIn among industry folks is gold.

It’s also observed that B2B PR outcomes are often one step removed from revenue, but closer to it than B2C.

For instance, a positive product review in a tech magazine might directly generate leads (readers go sign up for a trial).

So B2B PR performance often ties into marketing qualified leads (MQLs) or sales pipeline influenced.

B2C PR can influence sales too, but consumer buying journeys are usually less straightforward to attribute (many touchpoints, brand advertising mixed in, etc.).

That’s why B2C tends to emphasize brand metrics (awareness, favorability) as proxies, whereas B2B will often emphasize lead gen and credibility metrics (number of RFQs that mentioned seeing us in media, etc.).

However, despite differences, there is plenty of overlap. Both B2B and B2C PR rely on good storytelling, media relationships, and reputation management. Interestingly, many PR agencies serve both types: in fact, 40% of PR companies cater to both B2C and B2B clients.

They just tailor their tactics and KPIs accordingly. A B2C press release might go to a BuzzFeed reporter; a B2B one goes to a niche trade editor. But both will track coverage and impact.

One more trend: B2B and B2C PR are learning from each other.

B2B PR is borrowing some B2C flair – e.g., using more video content, being present on social media in a less formal way, leveraging influencers (yes, even in B2B there are influencers, like tech YouTubers or industry bloggers).

On the other hand, B2C PR is getting data-savvier and disciplined like B2B, using account-based marketing principles to target key audience segments, and measuring how PR moves consumers along a purchase funnel (awareness → consideration → purchase).

To illustrate with a case:

Microsoft (a B2B and B2C hybrid tech company) might run a PR campaign around a new enterprise cloud solution (B2B focus) and another around a new Xbox game (B2C focus).

The enterprise PR success is measured by Gartner mentions, CIO magazine stories, LinkedIn chatter among IT pros, and maybe enterprise trial sign-ups.

The Xbox PR success is measured by gamer community buzz, YouTube/Twitch influencer coverage, trending on Twitter, and game pre-orders. Both are PR, but tactics and metrics differ vastly.

In conclusion, B2C PR performance is often about volume and viral impact with consumers, while B2B PR performance is about credibility and influence within a targeted business community.

B2C chases the broad public sentiment; B2B chases the trust of industry insiders. Smart PR teams will choose metrics aligned with these goals. Yet, both ultimately contribute to brand and revenue in their own ways, and both increasingly use sophisticated tools and analytics to show their worth.

Next, let’s broaden our scope and examine PR performance trends across different regions of the world, as geography can influence media dynamics and what “good PR” looks like.

Global PR Trends: Regional Insights for 2025

Public relations is practiced worldwide, but local media landscapes, cultural factors, and economic conditions shape PR performance trends in each region.

Here we provide a brief of PR trends and examples across North America, Europe, Asia-Pacific, Latin America, Africa, and the Middle East, highlighting regional nuances in 2024–2025.

North America (USA & Canada)

North America – especially the United States – is the world’s largest PR market and often sets the pace on PR innovation. Here, the focus in 2025 is on data-driven and strategic PR amid a fragmented media environment.

U.S. companies are heavily embracing the measurement and analytics trends we discussed. Many American PR teams were early adopters of sophisticated tools; as a result, the expectations from the C-suite are high.

A PRWeek survey noted that in the U.S., clients and executives are asking PR teams to connect the dots to business goals more than ever, even borrowing from marketing analytics to attribute outcomes. This aligns with the high financial scrutiny and ROI focus in the U.S. market.

At the same time, North American PR faces unique challenges: misinformation and polarization in media, and the rapid news cycle.

Managing reputation in the U.S. often means responding to social media crises that can erupt in hours (think of brands being “canceled” on Twitter over an ad or statement). The need for real-time monitoring and crisis readiness is paramount.

It’s common for U.S. PR teams to have a “war room” for social listening and crisis response. For instance, when a major beer brand faced a conservative backlash in 2023 due to a social campaign, the company’s PR team had to quickly navigate boycotts and counter-narratives, illustrating the stakes of cultural polarization.

On the positive side, North America is also about innovation in PR content. Brands collaborate with influencers and content creators in more sophisticated ways (beyond just Instagram posts, now it’s TikTok challenges, YouTube mini-docs, podcasts, etc. as PR tactics).

The U.S. media landscape includes not just traditional outlets but also a strong ecosystem of niche digital publishers, newsletters, and bloggers that PR targets. Performance metrics often include engagement from these new media forms (e.g., how many podcast listens did our CEO’s guest appearance get?).

One notable North American trend is executive activism and corporate social responsibility communications. Many companies are using PR to highlight their stands on social issues (DEI, sustainability, etc.), which can be double-edged in the U.S. climate.

A successful example in 2024 was Patagonia’s continued PR around environmental causes, which plays well with its mission-driven brand and yields positive media coverage.

On the other hand, some companies stepped into social issues and faced backlash. PR performance in North America thus involves careful narrative management – ensuring the company is seen as authentic and credible in its communications, with trust being the key metric.

The Edelman Trust Barometer often shows U.S. public trust in institutions is lower than in many countries, so PR has its work cut out to build trust. Metrics like brand trust scores and reputation index rankings are closely watched in NA.

In Canada, similar trends apply, albeit the media environment is smaller and somewhat less polarized than the U.S. Canadian PR pros focus on bilingual communications (English and French media), and often on community engagement PR (local impact, given Canada’s emphasis on social values).

Performance in Canada might be measured by stakeholder sentiment in communities, media pickup across both languages, and policy influence when relevant (as many PR campaigns interface with government or public affairs).

Overall, North America in 2025 is about fast, data-backed, and mission-aware PR. The best performing PR teams are those that can quickly demonstrate how their efforts drive public perception and business outcomes, using data, while navigating a demanding media spotlight.

Europe

Across Europe, PR trends in 2025 are shaped by diversity of markets and a strong focus on regulatory and social responsibility messaging. Europe’s media landscape is fragmented by language and country, meaning PR performance is often evaluated on a per-country basis.

A campaign that soars in the UK might not register in France if not executed with local nuance. Thus, European PR performance entails a lot of localization. Metrics are tracked by market: e.g., share of voice in Germany, sentiment in the French press, etc., and then rolled up.

A key theme in Europe is sustainability and ESG (Environmental, Social, Governance) communications. European stakeholders (consumers, regulators, investors) put significant pressure on companies to walk the talk on sustainability.

PR campaigns highlighting sustainability initiatives, emissions goals, or social impact are common. For example, fashion brands in Europe publicize their eco-friendly lines or recycling programs through PR, and success might be measured in positive coverage about the brand’s sustainability leadership.

European PR often intersects with policy, due to active regulators and guidelines (like the EU’s regulations against greenwashing). A successful PR effort in Europe might be one that secures the company a seat in policy discussions or demonstrates compliance leadership, measured by citations in policy forums or positive mentions by NGOs.

Another European factor is privacy and data regulation (GDPR), which affects how companies communicate about customer data and trust. A tech company doing PR in Europe must emphasize privacy compliance in its messaging to earn media trust, whereas that might be less of a front-and-center issue in other regions.

From a performance standpoint, media trust in Europe remains relatively higher than in the U.S., and public broadcasters or national newspapers hold significant sway. Getting featured in the Financial Times, BBC, Le Monde, Frankfurter Allgemeine, etc., carries a lot of weight.

Thus, PR teams in Europe prize those top-tier hits and often measure success by the quality of outlets secured. For example, a fintech startup in the UK might consider a feature in The Economist as a PR win worth more than dozens of smaller pickups.

The AVE concept, while globally discouraged, historically had more use in parts of Europe – some older European clients still like to see the advertising cost equivalent for big hits in traditional outlets. But this is changing as measurement sophistication grows.

There’s also a notable trend in Europe toward integration of communications and public affairs. Many large companies have combined “Communications & External Affairs” functions, meaning PR performance may also be tied to outcomes like improved regulator perceptions or successful advocacy campaigns.

For instance, a ride-sharing company might measure PR success in Europe partly by a change in sentiment of city councils (via media influencing public opinion on gig economy issues).

Regionally, the UK has a very advanced PR industry with heavy data usage – CIPR (Chartered Institute of PR) and PRCA provide training on measurement, and UK agencies are adept at digital PR metrics.

The Nordics are known for innovation in PR (and high trust societies, meaning transparent communication is vital).

In Scandinavia, employee communications and transparency might be key metrics (like internal reputation scores) due to the stakeholder model there.

Southern Europe (Spain, Italy) often involves more relationship-driven PR – success can depend on cultivating media relationships and influencer engagement in culturally specific ways, and perhaps measured by the sentiment in lifestyle media and TV coverage (TV remains big in those markets).

In summary, Europe’s PR performance tends to be gauged by how well messaging aligns with societal values, regulatory expectations, and local sensibilities, in addition to the usual media metrics.

A PR campaign in Europe might declare success when it achieves multi-country media coverage with consistent positive messaging (no easy feat across languages), and when it strengthens the company’s reputation on key issues like sustainability, innovation, or trust.

European communicators often talk about “license to operate” – PR must help secure public permission for the business to do what it does. That’s a hard-to-quantify but critical outcome, reflected through surveys and reputation indices (for example, being listed among the most respected companies in a country).

Asia-Pacific (APAC)

Asia-Pacific is a region of high growth and fast-changing PR dynamics in 2025. From the giant markets of China and India to the tech-savvy tigers of Southeast Asia and the mature markets of Japan/Australia, APAC presents vast opportunities and challenges for PR performance.

One headline trend is the surge in AI adoption among PR teams in Asia-Pacific. A 2024 APAC communications index found that 82% of in-house comms leaders in APAC believe AI tools (like ChatGPT) can effectively automate routine PR tasks, up from just 50% the year before.

This indicates a rapid embrace of AI for drafting releases, media monitoring, and even crafting first drafts of statements.

For PR performance, this could mean increased efficiency – APAC teams might put out more content and respond faster, potentially boosting volume metrics.

But it also means new metrics like how well AI-generated content performs versus human (for instance, engagement rates on AI-assisted social posts could be tracked).

Digital and social media dominance is another defining factor. APAC has some of the world’s highest social media usage rates and a mobile-first population.

In places like India, Indonesia, the Philippines, consumers practically live on social platforms and messaging apps. PR in these countries often blurs with social media marketing.

A lot of “PR” campaigns are actually orchestrated on social channels (think viral challenges on TikTok or influencer-driven trends on Instagram). So, PR performance in these markets is heavily measured by social metrics: trending hashtags, video views, influencer mentions, etc.

For example, a successful PR moment in South Korea might be measured by being the #1 Naver trending topic and generating millions of YouTube views (K-pop PR operates like this, where a buzz metric equals success).

Influencer marketing is mainstream in APAC PR. China, for instance, has the KOL (Key Opinion Leader)phenomenon, where influencers on WeChat, Weibo, and Xiaohongshu (RED) are primary channels to reach consumers.

Brands allocate significant PR budget to engage influencers and KOLs for product launches. In Africa we mentioned influencers too, but in Asia the scale is bigger and often more commercialized.

PR performance metrics include things like social sentiment on Weibo, WeChat index scores, and e-commerce traffic if the PR is linked to platforms like Alibaba or Amazon India.

Actually, one interesting metric in China is the “Brand Communication Power” index some agencies use – a composite of media coverage, social mentions (including on WeChat/Weibo), and search volume on Baidu – reflecting overall PR effectiveness in the unique Chinese ecosystem that has state media plus digital platforms.

In corporate communications, APAC PR teams are striving to prove tangible value just like elsewhere. The APACD (Asia-Pacific Association of Communication Directors) 2024 survey noted comms leaders in APAC are under pressure to show lead generation and business growth results from PR, with lead gen even overtaking ESG as a priority in some places.

This is a shift towards more performance marketing thinking in PR. So a telecom company in APAC might measure PR success by how many enterprise leads were sourced from PR events or how PR helped boost web conversions during a campaign.

Regionally, trends vary:

China: PR is often intertwined with government relations and tightly monitored media. Performance can include keeping a positive relationship with state media and avoiding negative press (a metric in itself).

Also, the sheer volume – a big brand might get tens of thousands of mentions across Chinese digital media; tracking and analyzing that volume (with AI due to language complexity) is a task.

Success could be measured by dominating the discussion on local platforms during a campaign (akin to SOV but in closed ecosystems).

India: The PR industry is booming alongside a vibrant media scene (hundreds of news channels and papers). Indian PR campaigns often aim for high visibility in TV news and mega social reach (WhatsApp virality is a thing to consider too).

India’s diverse languages mean PR performance might consider vernacular media pickup as well. One notable factor: Indian consumers often trust print media strongly; getting a favorable feature in The Times of India or Hindu can be a hallmark of PR success.

Southeast Asia: Markets like Indonesia, Malaysia, Thailand are heavily social media-driven. Success often measured in social chatter but also in community engagement (these markets value community, so PR around CSR or cause marketing can perform well if it genuinely engages local communities – e.g., number of volunteers attracted, local sentiment).

Japan and South Korea: These have their own media cultures. Japan’s PR tends to be more formal; press releases and press conferences still hold weight.

Metrics might include the number of journalists attending your press briefing (something less relevant elsewhere now).

South Korea has a fast news cycle and celebrity-centric media; PR for consumer brands often leverages celebrities, so performance can be tied to how well that endorsement translated into media stories and public buzz (Korea has its own online forums and trends trackers like Naver rankings).

APAC also shows interesting cross-pollination: Western brands localize PR campaigns for Asia, and Asian brands do global PR.

A case study: In 2024, Samsung launched a smartphone with a coordinated global PR push but tailored messaging in Asia highlighting local partnerships (e.g., tie-ins with popular Asian esports).

They measured success by global media impressions and region-specific engagement (like how much buzz it got in Asia’s tech blogs and social channels vs. in the West).

A stat to illustrate APAC’s digital lean: in APAC, 23% of PR respondents reported being fully back in office vs. only 11% in Europe and 15% in the U.S., meaning APAC teams may be more hybrid/remote and leveraging digital collab tools.

While not directly performance, it shows APAC comms folks are comfortable operating in distributed, tech-enabled ways, which perhaps correlates with their high adoption of digital PR practices.

Finally, APAC PR also involves cross-cultural communication. Global brands track how their messages are received across cultures – e.g., a campaign that works in Australia might flop in Indonesia if not culturally tuned.

So sentiment analysis by locale is key. A success example: Coca-Cola’s “Share a Coke” personalized name campaign started in Australia and was a PR hit that then spread worldwide.

Conversely, a misstep example: If an international brand inadvertently disrespects local culture (say an ad that offends), PR needs to respond swiftly – how well they contain such issues (measured by speed of apology and sentiment rebound) is a performance yardstick.

Latin America

In Latin America, PR performance trends in 2025 are influenced by a youthful population, rising internet penetration, and a climate of economic and political swings. Social media and radio/TV remain very powerful channels in LatAm.

Countries like Brazil and Mexico have huge social media user bases – Brazilians for instance are among the heaviest users of Instagram and WhatsApp. PR campaigns often integrate with these channels heavily.

A unique factor: WhatsApp communication is huge in LatAm; PR sometimes involves seeding content that gets forwarded on WhatsApp networks (for example, short videos or graphics that educate or promote a cause, which people share among family groups).

While hard to measure, some PR agencies gauge success by proxies like WhatsApp mentions or trends in community talk.

Earned media coverage on television is still a gold standard in many Latin American countries. A 7-minute segment on a popular morning show in, say, Mexico or Argentina can have immense reach (since TV viewership is high).

So PR performance can be measured by securing coveted TV slots. Press events and press conferences are more common in LatAm than in the US nowadays; having a hundred journalists show up to your product launch in São Paulo or Santiago is a PR win – so they might literally count attendance and subsequent coverage pieces as key metrics.

LatAm is also characterized by a lot of cause-driven PR and community relations. Many companies invest in programs for local communities (education, health, sports) and PR performance there is measured in terms of goodwill generated.

For example, a Colombian company’s PR might revolve around its social project – success measured by positive local press and stakeholder sentiment in impacted communities (maybe via surveys or anecdotal government praise).

One cannot ignore political and economic volatility in the region. In some years, PR is as much about crisis management and maintaining stability as it is about proactive campaigns. Take 2024 – some countries faced inflation and protests; companies had to communicate price increases or operational changes sensitively.

PR performance in those cases is measured by how well the company maintained trust and minimized negative fallout (e.g., did brand trust scores remain stable through a crisis? Did misinformation get effectively debunked?).

A concrete example: a Chilean utility company facing public protests over rates might measure PR success by reduction in negative media after their communication campaign explaining the rate reasoning.

Latin America also has a vibrant influencer scene, especially on YouTube, Instagram and increasingly TikTok. Mexico and Brazil have YouTubers with tens of millions of followers.

Brands engage these influencers in PR campaigns (like having YouTubers attend PR events and cover them). The ROI is measured in the views/engagement those influencers’ content generates.

One campaign example: Oreo’s promotional “Oreo Menu” in 2024 (one of the top campaigns listed) likely had local executions – success in LatAm could be measured by how many Latin American social media creators picked it up and how fans reacted (maybe trending hashtags in Spanish/Portuguese).

Media sentiment in LatAm generally leans positive for business stories as long as the narrative ties to progress or community benefit.

However, there’s also investigative journalism especially around corruption, so companies highly value maintaining a good public image. PR performance could include staying out of scandal press.

If a company operates in, say, Brazil, part of PR’s job is ensuring they’re known for good things (sustainability, innovation) and not involved in negative press (deforestation, etc.). There are indexes like Merco reputation rankings in LatAm countries that rank companies on reputation – PR teams closely watch those.

Climbing in the Merco top companies list or similar can be an objective (which is influenced by media, public perception, and expert opinion).

In terms of metrics, brand awareness and favorability polls are common in big markets like Brazil and Mexico.

A PR campaign might be deemed successful if awareness of a new product rose from X% to Y% in target demographics per post-campaign survey. Or if favorability improved after a corporate image campaign.

We should mention language: Spanish-language media spans many countries, so a great story in one can easily be picked up regionally (same language advantage).

PR performance sometimes is multiplied by that – e.g., a Colombian company’s story might get picked up in Peru, Mexico, etc. if it has broad appeal. That’s a win beyond one market. Conversely, a crisis can spread regionally too if not contained.

One positive trend: In January 2024, 70% of Latin American PR firms anticipated business growth and 30% stability, showing optimism in the PR sector.

This growth mindset is pushing PR agencies to innovate in measurement too. They are increasingly using global best practices in data.

But budgets can be smaller, so they often use creative or more affordable measurement methods (like using free social media analytics or local media monitoring services).

In short, Latin American PR success is often about winning hearts and minds through emotive storytelling and mass media, while carefully managing grassroots sentiment.

PR performance is gauged by media volume (especially TV/press hits), social buzz, and community impact, rather than super granular analytics (though that’s changing gradually).

And as internet access expands, expect more digital metrics to enter the mainstream in LatAm PR evaluations.

Africa

Moving to Africa, the PR landscape is evolving rapidly as economies develop and digital connectivity increases.

Africa’s public relations growth is characterized by embracing new technologies while still leveraging traditional storytelling and community relations that have long been effective on the continent.

One major trend is the rise of digital media and influencer culture in Africa. Smartphone adoption and internet penetration have soared over the past five years.

Social media platforms (Facebook, Twitter, Instagram, and increasingly newer ones like TikTok) are now indispensable PR channels across African countries.

Influencer marketing has become a significant trend, as noted by APO Group’s retrospective: African PR is “capitalising on the influence and perceived trustworthiness of prominent social media figures to amplify brand messages.”

Local influencers – whether they are radio hosts, Instagram personalities, or YouTube content creators – are highly trusted by African audiences.

For example, in Nigeria or Kenya, a popular radio presenter or Nollywood celebrity endorsing a campaign can hugely boost PR reach and credibility.

PR performance metrics in these cases include social engagement, hashtag trends, and audience reach via influencers.

At the same time, traditional media (radio, TV, print) remains important in Africa, often more so than in Western markets. Radio in particular has enormous reach in African communities and is a trusted source.

A successful PR effort might be measured by how many radio shows discussed your campaign or message, or how many call-ins a radio campaign segment spurred. Likewise, securing a spot on a well-known TV talk show in South Africa or Ghana is a big win.

Since not everyone has internet, these channels matter for PR effectiveness – thus, a cross-media strategy often yields the best performance.

Another hallmark of African PR is storytelling that resonates with local culture and narrative. As Rania El Rafie noted, PR strategies on the continent increasingly use “captivating stories that spotlight triumphs, cultural heritage, and innovative solutions, challenging stereotypes and providing a balanced portrayal of Africa on the global stage.”

The ability of a PR campaign to tell an authentic story is a key performance factor. This might be evaluated through qualitative feedback – e.g., did the campaign get positive feedback from community leaders?

Did it spark conversations that reframed perceptions? These are softer metrics but often captured via sentiment analysis or surveys.

For instance, consider a telecommunications company in Africa doing a PR campaign about expanding rural connectivity. Success would be measured not just in media hits but in community sentiment – did people in those areas feel heard?

Did local press or community radio discuss the positive impact? Sometimes, word-of-mouth is an important metric – PR folks on the ground might literally gauge how much buzz is happening in local markets (now increasingly possible to quantify with social listening even for local languages, but still a lot of human intel).

Crisis communication and issues management are also vital in parts of Africa where political or social unrest can flare up. Companies and NGOs must be adept at PR during crises (e.g., responding to public health emergencies or addressing misinformation).

A classic metric here is speed and penetration of correct information. If a false rumor spreads on WhatsApp, how quickly did the PR response message reach those channels and slow the spread? That might be observed via tracking rumor mentions (a challenging but attempted task using monitoring tools or surveys).

One cannot ignore reputation and ethics. A 2024 PRCA Africa report on ethics showed where responses came from (South Africa leading with 45%, followed by others) – highlighting that ethics in PR is a front-of-mind subject.

African consumers are increasingly savvy and expect authenticity. PR that comes off as corporate bluster doesn’t perform well.

So PR performance might be measured by trust indicators. For example, a bank might use an annual reputation survey – if their score improved after a PR push on financial inclusion, that indicates success.

Also notable is pan-African and diaspora PR reach. For instance, a pan-African tech summit PR campaign might aim to get coverage not just in one country but across multiple African markets and even in international media that cover Africa.

Performance can be measured in how wide the message traveled across borders (since many African issues and stories cross borders).

We should mention that budget and resource constraints in some African PR contexts mean creativity is high. Some of the most impactful PR is done through grassroots methods or partnerships with influential community voices rather than expensive media buys.

The metric of success might be how organically the message spread – for example, 70% of coverage might be earned vs. only 30% via any sponsored content, showing organic pick-up.

In summary, African PR performance is measured by both modern metrics (social engagement, media impressions) and community impact (sentiment, behavior change).

It’s a blend of high-tech and high-touch. A campaign might report: “We reached 5 million people on radio/TV, had 50,000 social media interactions, and post-campaign surveys in target communities showed a 20% increase in favorable opinion.” That trifecta would indicate a robust PR impact in the African context.

Middle East and North Africa (MENA)

The Middle East and North Africa (MENA) region presents a PR landscape of rapid expansion, fueled by big ambitions, technological adoption, and unique cultural-political contexts. In 2025, MENA’s PR industry is growing fast, especially in the Gulf states, and trends revolve around digital transformation, government initiatives, and reputation management on the global stage.

One notable data point: the MENA PR tools market is projected to reach $250.85 million by end of 2024, with a CAGR of 10% through 2030, indicating strong demand for PR and reputation management solutions in the region.

This corresponds with many Middle Eastern organizations recognizing the need for sophisticated PR strategies and measurement as they engage more with global audiences.