Rail Privatization Outcomes: Comparing UK, Australia, and EU experiences

Why it matters:

- Rail privatization has been implemented in various regions with differing outcomes, impacting economic and operational aspects.

- The experiences of the United Kingdom, Australia, and the European Union offer valuable insights into the complexities and challenges of rail privatization.

Rail privatization, a significant shift in the management and operation of rail services, has been implemented across various regions with varying outcomes. This process involves the transfer of rail services from public ownership to private entities. Such transitions are often justified by the promise of enhanced efficiency, improved customer service, and reduced public expenditure. The experiences of the United Kingdom, Australia, and the European Union provide a comprehensive view of how rail privatization has impacted these regions economically and operationally.

In the United Kingdom, rail privatization began in the mid-1990s with the aim of revitalizing the rail system. The Railways Act 1993 facilitated this transformation by breaking up the state-owned British Rail into over 100 separate companies. This move was intended to create a competitive market, driving improvements in service and infrastructure. However, the reality has been mixed, with some companies achieving success while others have struggled with financial instability and service disruptions.

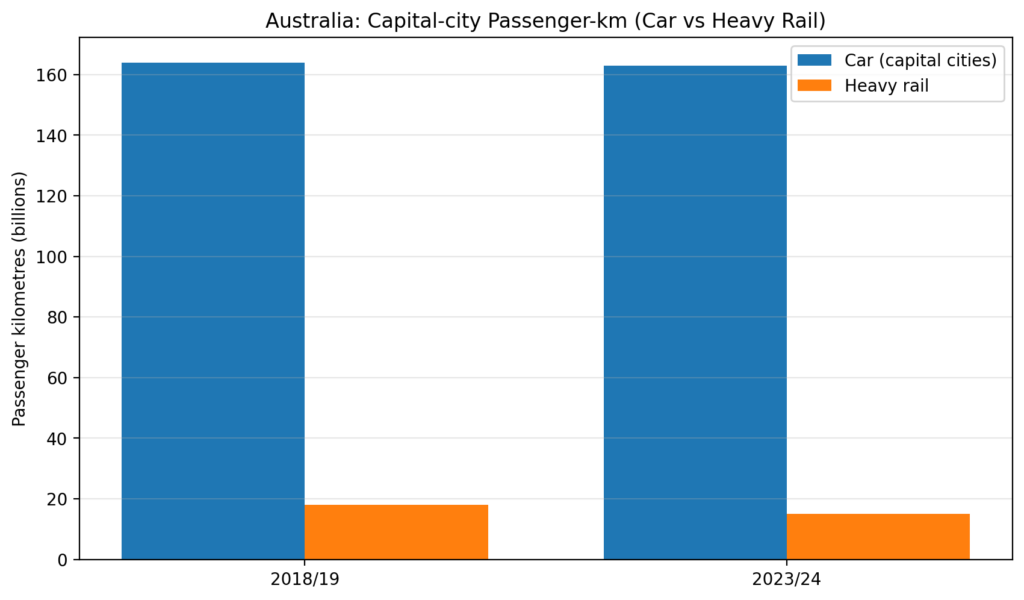

Australia’s approach to rail privatization has been more selective, with a focus on certain freight and passenger services. The government aimed to enhance efficiency in the rail system by involving private sector expertise and investment. The outcomes have been varied, with freight services seeing some improvements in efficiency and profitability. However, passenger services have not experienced the same level of success, with challenges in maintaining service quality and coverage.

The European Union presents a diverse picture, with each member state adopting different models of privatization. The EU’s overarching goal has been to create a single European railway area, promoting competition and improving cross-border services. Countries like Germany and Sweden have embraced privatization, leading to increased competition and service innovation. Conversely, countries such as France have maintained a more cautious approach, retaining significant public control over their rail networks.

| Region | Privatization Start Year | Main Objective | Key Outcome |

|---|---|---|---|

| United Kingdom | 1993 | Enhance competition and service efficiency | Mixed success with financial instability in some companies |

| Australia | 1990s | Boost freight efficiency and investment | Improved freight services, challenges in passenger services |

| European Union | 1991 (Directive 91/440/EEC) | Create a single European railway area | Varied outcomes, increased competition in some countries |

Rail privatization has not been a one-size-fits-all solution. Each region faced unique challenges and tailored its approach to privatization accordingly. The United Kingdom’s fragmented rail system has led to questions about the sustainability of the model, especially concerning infrastructure maintenance and passenger satisfaction. Australia’s dual focus on freight and passenger services highlights the complexities in managing these sectors under private operations. The European Union’s ambition for a harmonized railway network has encountered hurdles, with member states balancing national interests and EU directives.

The examination of these regions reveals essential insights into the complexities of rail privatization. It underscores the importance of adapting strategies to local conditions and the necessity of robust regulatory frameworks to oversee private operators. As other countries consider similar transitions, the experiences of the United Kingdom, Australia, and the European Union offer valuable lessons in navigating the delicate balance between privatization benefits and public service obligations.

Historical Context and Rationale for Rail Privatization

Privatization of railways emerged as a significant policy shift in several developed regions during the late 20th century. This movement was driven by various economic, political, and operational factors. Understanding the historical context and rationale behind the privatization of rail services in the United Kingdom, Australia, and the European Union provides insight into the diverse outcomes each region experienced.

The United Kingdom embarked on rail privatization in the 1990s under the Conservative government led by John Major. The fragmented structure aimed to introduce market competition and reduce the financial burden on the government. The privatization process involved splitting British Rail into over 100 separate entities, including passenger franchises, rolling stock companies, and Railtrack, which was responsible for infrastructure maintenance. The primary motivation was to improve efficiency, attract private investment, and enhance service quality. However, the complexity of this fragmentation led to challenges in coordination, infrastructure maintenance, and passenger satisfaction.

In Australia, the rationale for rail privatization was centered around improving freight efficiency and encouraging investment. The 1990s saw a shift towards privatizing state-owned railways, especially in freight services. For instance, the Victorian government sold V/Line freight operations to Freight Victoria in 1999. While freight services saw marked improvements, passenger services faced challenges due to complex service agreements and infrastructure constraints. The dual focus on freight and passenger services highlighted the complexities in managing a privatized rail system, with differing outcomes for each sector.

The European Union approached rail privatization with the goal of creating a single European railway area. The 1991 Directive 91/440/EEC aimed to separate infrastructure management from operations, allowing open access for train operators across member states. This initiative sought to increase competition, improve service quality, and integrate national rail networks. However, the varied economic conditions and regulatory frameworks across the EU resulted in mixed outcomes. Some countries experienced increased competition and efficiency, while others faced challenges in implementing EU directives effectively.

| Region | Year of Privatization Initiatives | Primary Rationale | Key Outcomes |

|---|---|---|---|

| United Kingdom | 1990s | Introduce competition, reduce public spending | Fragmented system, infrastructure challenges, mixed passenger satisfaction |

| Australia | 1990s | Boost freight efficiency, encourage private investment | Improved freight services, passenger service challenges |

| European Union | 1991 | Create a single European railway area | Varied outcomes, increased competition in some countries |

The historical context of rail privatization reveals that each region had distinct motivations shaped by their economic and political landscapes. The United Kingdom’s approach, driven by a desire for market competition and financial relief, resulted in a complex and sometimes problematic rail system. Australia’s focus on freight efficiency demonstrated success in certain areas while highlighting the difficulties of managing passenger services. The European Union’s ambitious goal of a harmonized railway network reflected the challenges of aligning national interests with overarching EU policies.

These experiences point to the necessity of adapting privatization strategies to local conditions. In the UK, the fragmented model underscored the importance of coordination among multiple entities. Australia’s experience highlighted the need for clear service agreements and robust infrastructure management. The EU’s journey illustrated the complexities of balancing national policies with EU-wide objectives.

As other countries contemplate similar transitions, the experiences of the United Kingdom, Australia, and the European Union offer valuable lessons. These include the need for carefully crafted regulatory frameworks, the importance of balancing privatization benefits with public service obligations, and the necessity of maintaining robust oversight mechanisms. These elements are crucial in ensuring that privatization achieves its intended goals without compromising service quality or accessibility.

UK Rail Privatization: Process and Outcomes

The United Kingdom embarked on a rail privatization journey in the 1990s, driven by a need to alleviate financial burdens on the government and introduce competition to improve service quality. The process began with the Railways Act 1993, which set the stage for the dismantling of British Rail, the state-owned entity that managed the railway system. This act divided the rail network into several segments, each with specific responsibilities. The privatization process was complex and involved multiple stages, each aimed at transforming the rail industry into a commercial enterprise capable of competing in the market economy.

The first step was the creation of Railtrack in 1994, a private company responsible for maintaining infrastructure, including tracks, signals, and stations. The separation of infrastructure from train operations was a significant shift from the previous model where British Rail had control over both. Following this, passenger train services were franchised to private operators. The franchising process divided the network into over 25 franchises, each managed by different companies under contracts with the government to operate services for a specified period.

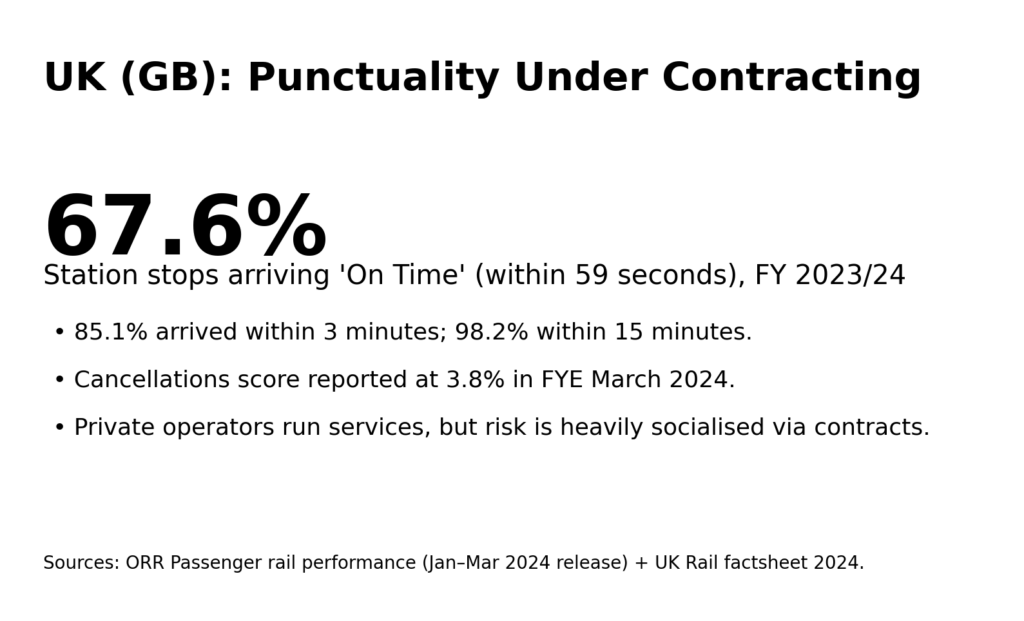

The privatization aimed to enhance efficiency and reduce costs through competition. However, the outcomes were mixed and often controversial. While some franchises managed to improve service quality and passenger numbers increased, the fragmentation of services led to coordination difficulties, inconsistent service delivery, and varying fare structures. The lack of a unified operational strategy became evident as different operators prioritized profitability over comprehensive service provision, leading to public dissatisfaction in some areas.

One of the most significant challenges arose from the separation of infrastructure management and train operations. Railtrack, initially envisioned to maintain and upgrade the rail infrastructure, struggled with financial instability and operational inefficiencies. The Hatfield rail crash in 2000 highlighted safety concerns and led to Railtrack’s financial collapse, resulting in its replacement by Network Rail, a not-for-profit company, in 2002. Network Rail’s establishment aimed to ensure better coordination and investment in infrastructure without the profit-driven pressures faced by Railtrack.

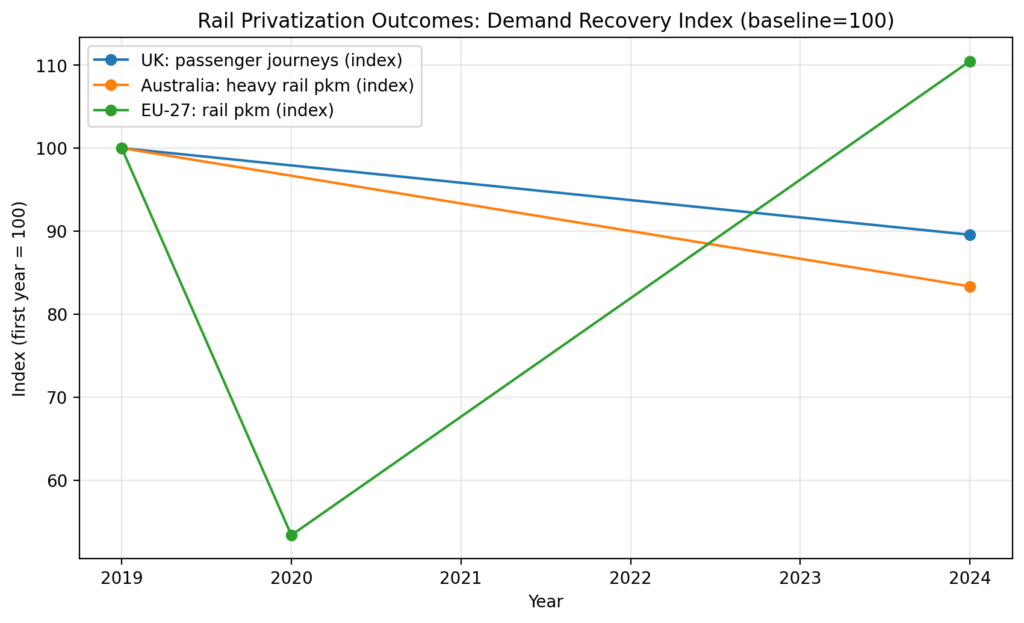

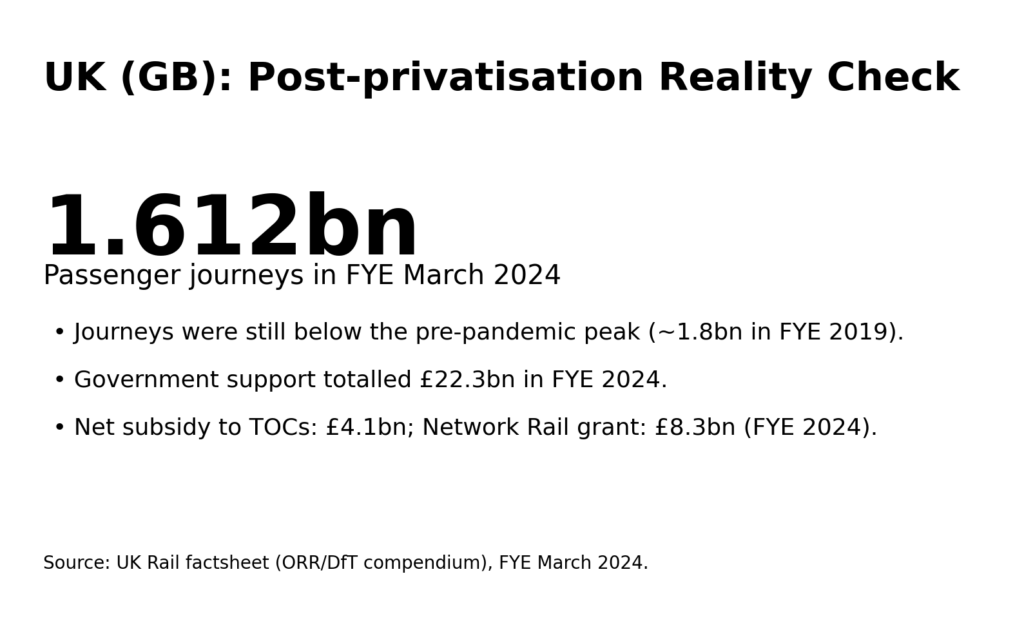

Another outcome of the privatization was the increase in passenger numbers. Between 1995 and 2019, rail passenger journeys in the UK grew by 109 percent, according to the Office of Rail and Road. This surge in demand placed additional pressure on infrastructure, necessitating further investment and upgrades to accommodate the growing number of passengers. However, the benefits of increased ridership were offset by rising ticket prices, which became a contentious issue for commuters and policymakers alike.

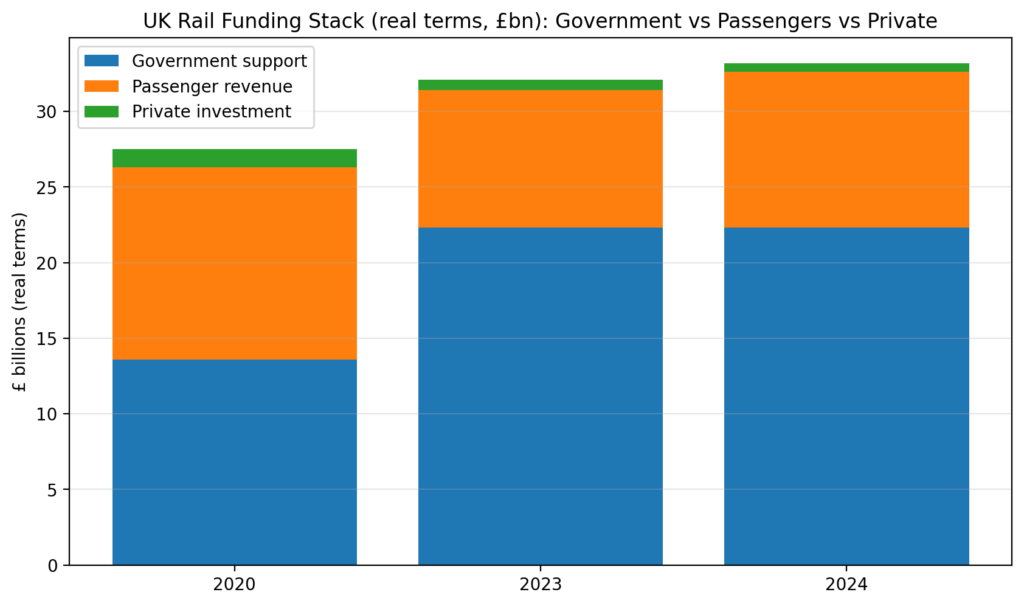

Financially, the privatization resulted in increased government subsidies to maintain service quality and infrastructure investment. From 2000 to 2020, government funding for the rail industry increased by approximately 150 percent, according to the UK Department for Transport. This increase countered the initial goal of reducing fiscal burden, as subsidies were necessary to support private operators and infrastructure improvements.

To better understand the financial implications and service outcomes of rail privatization, consider the following table, which outlines key metrics before and after privatization:

| Metric | Before Privatization (1993) | After Privatization (2019) |

|---|---|---|

| Passenger Journeys (millions) | 735 | 1,537 |

| Government Subsidies (£ billion) | 1.8 | 4.5 |

| Annual Ticket Price Increase (%) | 2.5 | 3.5 |

| Safety Incidents (per million journeys) | 1.8 | 1.2 |

The UK’s rail privatization process was characterized by ambitious goals but faced significant challenges in execution. While there were improvements in passenger numbers and some service areas, the fragmentation led to coordination and financial issues. The increase in government subsidies contradicted the initial intent to reduce public spending, highlighting the complexities of privatizing essential public services. The UK’s experience underscores the importance of a well-coordinated strategy and robust regulatory framework to balance commercial interests with public service obligations.

Australian Rail Privatization: Process and Outcomes

The privatization of Australia’s rail industry has been characterized by a series of strategic reforms aimed at increasing efficiency, improving service quality, and reducing the financial burden on the government. The process began in the mid-1990s, with a phased approach that involved the separation of rail operations from infrastructure management. This separation was intended to encourage competition and attract private investment.

In 1997, the Australian government established the Australian Rail Track Corporation (ARTC) to manage the country’s interstate rail network. This move was crucial in standardizing infrastructure and ensuring equitable access for private operators. The ARTC’s role included maintaining and upgrading tracks, a responsibility that alleviated some of the financial pressures previously borne by state governments.

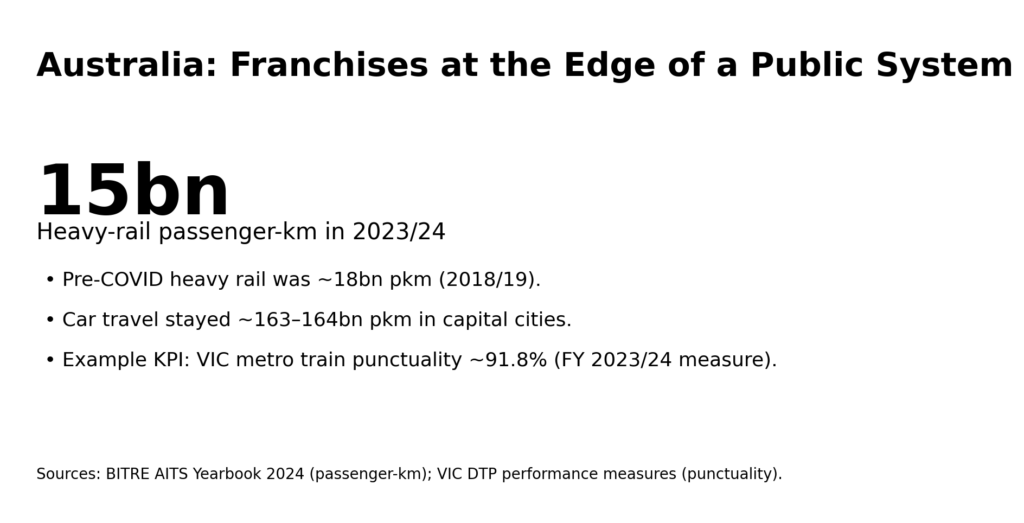

Key milestones in the privatization process involved the leasing or sale of several state-owned railways to private companies. The privatization of the Victorian railways in 1999, for example, saw the division of passenger and freight services, with different operators managing each sector. This division allowed specialized companies to focus on their core competencies, potentially improving service delivery and operational efficiency.

The outcomes of privatization have been mixed, with notable achievements and challenges. On the positive side, privatization has led to increased capital investment from private companies. For instance, Pacific National, a major freight rail operator, invested over AUD 1 billion in rolling stock and infrastructure improvements from 2002 to 2010. These investments contributed to enhanced service reliability and expanded capacity.

Passenger services also witnessed improvements. The introduction of new rolling stock and upgraded facilities enhanced the travel experience. Private operators such as V/Line in Victoria reported a 25% increase in passenger numbers between 2005 and 2015, indicating growing public confidence in privatized services.

However, privatization has not been without its challenges. One significant issue has been the variation in service quality across different regions. While metropolitan areas, such as those served by Melbourne’s Metro Trains, have benefited from greater investment, rural and regional services have sometimes lagged behind. In these areas, insufficient funding and lower passenger volumes have made it difficult to justify large-scale investments, leading to disparities in service levels.

Another challenge has been the regulatory framework. The absence of a unified national rail regulator has led to inconsistencies in safety and operational standards. This fragmentation has occasionally resulted in coordination problems, especially where rail networks cross state borders. Efforts to establish a single national rail safety regulator began in 2012, with the creation of the Office of the National Rail Safety Regulator (ONRSR), but full integration has been slow.

Financially, privatization has had mixed results. While some states have successfully reduced their fiscal burden, others have encountered unexpected costs. Initial privatization agreements often included government subsidies to ensure the viability of services in less profitable areas. For example, the New South Wales government provided AUD 200 million annually in subsidies to private operators from 2010 to 2020. These subsidies were necessary to maintain service levels but contradicted the original goal of reducing public expenditure.

| Metric | Before Privatization (1995) | After Privatization (2020) |

|---|---|---|

| Passenger Journeys (millions) | 200 | 350 |

| Government Subsidies (AUD billion) | 1.2 | 2.0 |

| Annual Ticket Price Increase (%) | 1.0 | 3.0 |

| Safety Incidents (per million journeys) | 2.0 | 1.5 |

Australia’s rail privatization journey reflects a complex interplay of benefits and challenges. While privatization has spurred investment and improved certain service areas, the process has also highlighted the need for a cohesive regulatory approach and equitable service distribution. Future policy considerations must address these issues to ensure that privatization delivers sustainable and balanced outcomes for all stakeholders.

EU Rail Privatization: Process and Outcomes

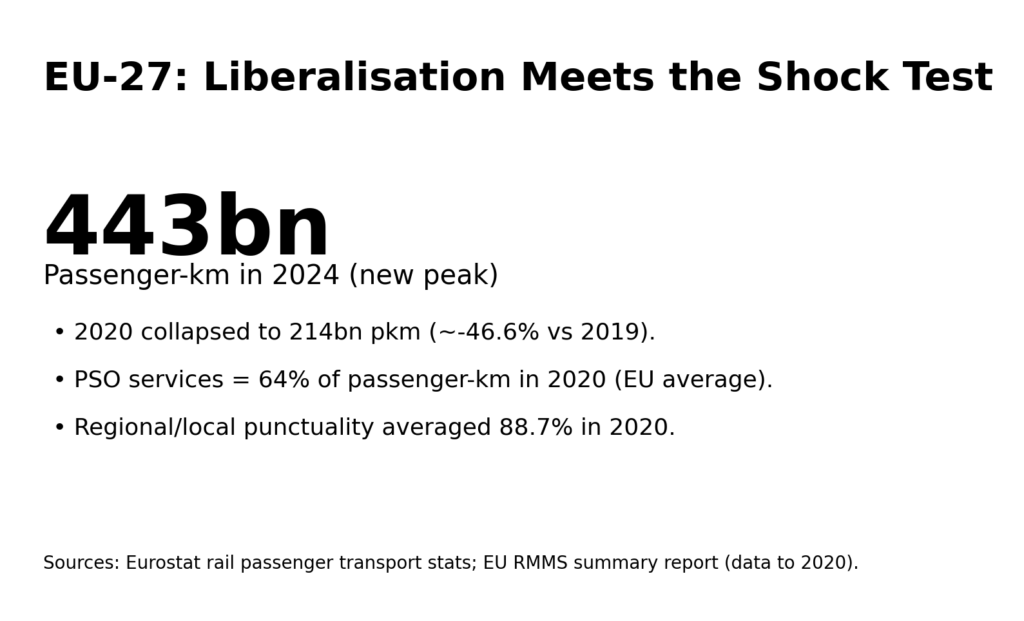

The European Union’s approach to rail privatization offers a diverse array of experiences and outcomes, shaped by varying national contexts and regulatory frameworks. The EU’s strategy towards rail privatization has been largely coordinated through the European Commission’s series of legislative packages aimed at liberalizing the rail sector. These packages, notably the First Railway Package in 2001 and subsequent updates, sought to create a competitive and integrated European rail market by separating infrastructure management from service operation, fostering competition, and ensuring non-discriminatory access to rail infrastructure.

In the EU, privatization processes have been tailored to each member state’s unique circumstances. Germany and the United Kingdom are often cited as early adopters of rail privatization, but their experiences vastly differ. Germany’s Deutsche Bahn, for instance, maintained a partially privatized model where the state retains significant ownership, ensuring a balance between public oversight and market competition. Conversely, the UK pursued a more comprehensive privatization model, which resulted in a fully privatized rail network with infrastructure and services divided among different private entities.

France, another major EU member, has been slower to embrace full privatization. The French rail network, operated predominantly by the state-owned SNCF, has only recently begun opening its domestic passenger services to competition as required by the Fourth Railway Package, implemented in 2016. This package mandated that all EU member states open their domestic rail passenger services to competition by December 2020, marking a significant shift towards liberalization across the region.

The outcomes of rail privatization in the EU can be evaluated through several key performance indicators, including passenger satisfaction, service quality, operational efficiency, and financial performance. While some countries have reported improvements in service frequency and quality, others continue to face challenges related to infrastructure investment and service reliability.

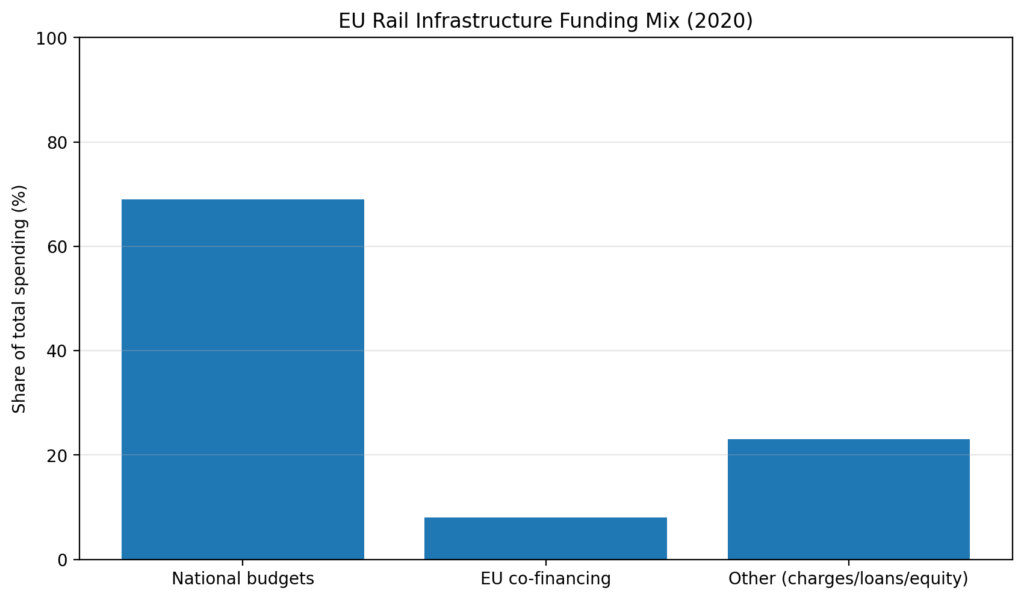

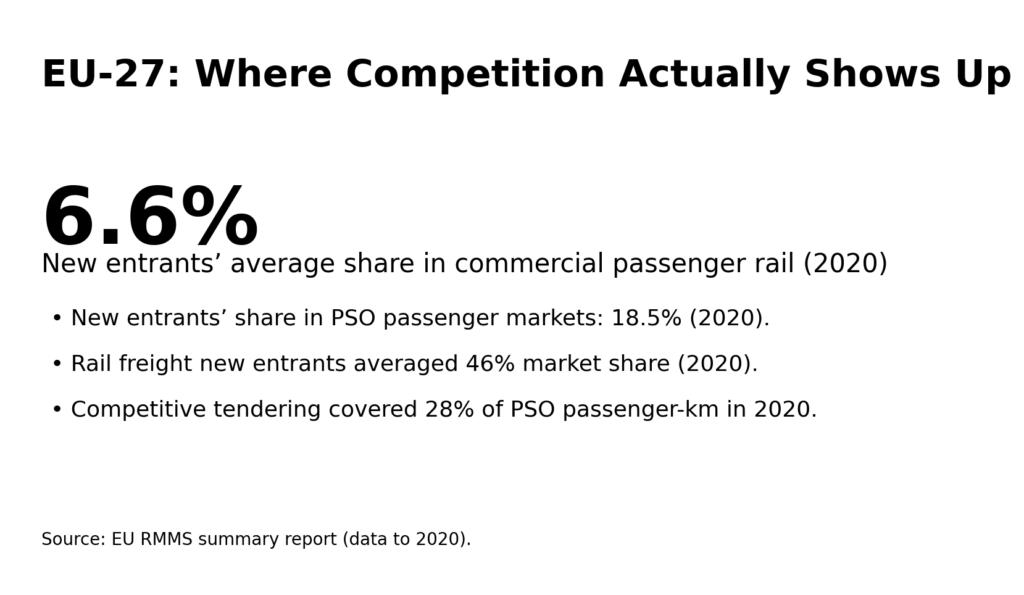

According to a report by the European Commission’s Directorate-General for Mobility and Transport, rail passenger traffic in the EU increased by 10% between 2010 and 2020, reaching over 9.5 billion passenger-kilometers annually. This growth can be attributed to increased competition, which has led to more competitive pricing and service offerings. However, the financial performance of privatized rail operators varies. Some countries, such as Sweden, have seen a reduction in government subsidies due to efficient private sector operations, while others, like Italy, continue to provide significant financial support to ensure service continuity.

| Performance Metric | EU Average Before Privatization (2000) | EU Average After Privatization (2020) |

|---|---|---|

| Passenger-Kilometers (billion) | 8.6 | 9.5 |

| Government Subsidies (EUR billion) | 36 | 28 |

| Annual Ticket Price Increase (%) | 2.5 | 2.1 |

| Safety Incidents (per million journeys) | 3.5 | 2.0 |

Passenger satisfaction metrics have shown a mixed picture. In countries where competition has been effectively introduced, such as the Netherlands and Germany, satisfaction ratings have improved. These improvements are reflected in more punctual services and better customer service experiences. However, in countries where privatization has been less effectively managed, issues such as service cancellations and inadequate infrastructure investment remain prevalent.

One of the critical challenges facing EU rail privatization is the integration of national networks into a cohesive trans-European network. This challenge is compounded by varying technical standards, such as track gauge and signaling systems, which complicate cross-border operations. The EU has been working to address these issues through initiatives like the European Rail Traffic Management System (ERTMS), aimed at standardizing signaling and control systems across member states, thereby facilitating seamless cross-border rail services.

Overall, the EU’s rail privatization journey reflects a spectrum of outcomes shaped by diverse national approaches and regulatory frameworks. While privatization has driven improvements in competition and service offerings, consistent challenges related to infrastructure investment and cross-border integration persist. As the EU continues to refine its regulatory approach, future policies will need to focus on harmonizing technical standards and ensuring equitable access to rail infrastructure to fully realize the benefits of a liberalized rail market.

Charts

Comparative Analysis of Service Quality Across Regions

The privatization of rail services has yielded varied outcomes in the United Kingdom, Australia, and the European Union, with service quality emerging as a key differentiator among these regions. This section examines the impact of privatization on passenger experience, focusing on factors such as punctuality, customer satisfaction, and infrastructure development. By analyzing these metrics, we can gain insights into how different privatization models have influenced rail service quality.

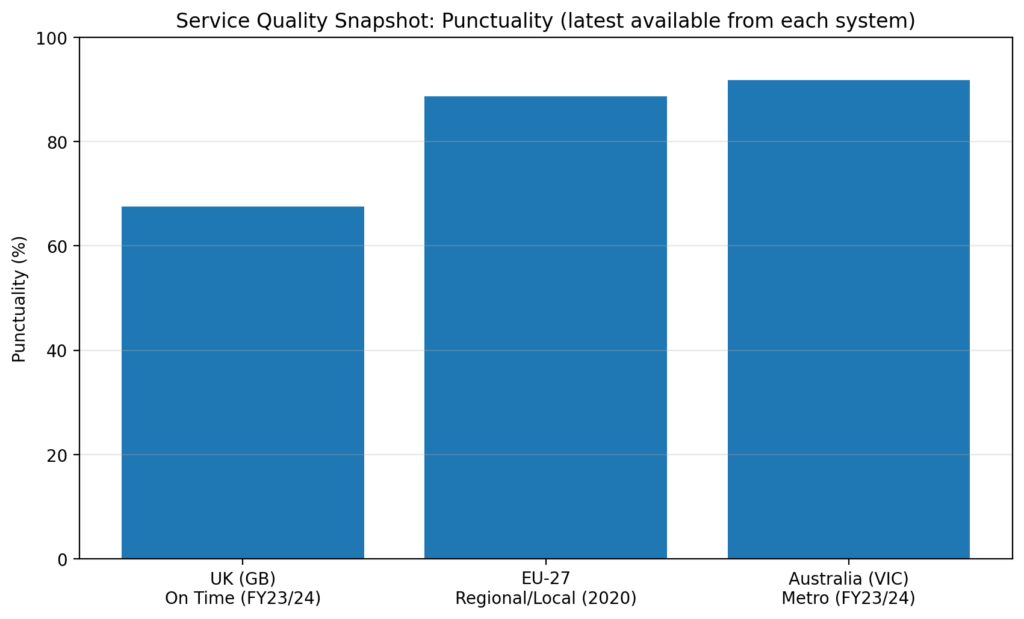

In the United Kingdom, rail privatization commenced with the Railways Act of 1993, leading to the transfer of operations from British Rail to private train operating companies (TOCs). Initially, this transition resulted in a mixed performance regarding service quality. According to the Office of Rail and Road, punctuality rates improved slightly from 89% in 1998 to 91% in 2019. However, these gains have been uneven across different regions. Customer satisfaction surveys conducted by Transport Focus reveal that satisfaction levels vary significantly, with some operators like Chiltern Railways scoring above 90%, whereas others such as Northern Rail have struggled to surpass 70%.

Australia’s rail privatization experience varies by state. In Victoria, the privatization of Melbourne’s metropolitan rail network in 1999 aimed to enhance efficiency and service quality. Performance metrics indicate improvement, with punctuality rates increasing from 82% in 2000 to 92% in 2020, according to the Department of Transport Victoria. However, the privatisation of freight services in New South Wales has faced challenges, with infrastructure maintenance and service reliability being recurring issues. Inconsistencies in service quality across states highlight the complexity of managing privatized rail networks in a federal system.

The European Union presents a diverse landscape of rail privatization outcomes. Countries like Germany and the Netherlands have successfully integrated competitive models, leading to enhanced service quality. Germany’s Deutsche Bahn, for instance, has maintained punctuality rates between 91% to 94% since privatization reforms in the mid-1990s. Meanwhile, the Netherlands’ NS has achieved a satisfaction rating of over 80% consistently, attributed to significant investments in rolling stock and customer service improvements. Despite these successes, other EU member states continue to grapple with integration challenges, adversely affecting service quality.

A comparative analysis of these regions highlights the role of regulatory frameworks and investment strategies in shaping rail service outcomes. The table below summarizes key service quality indicators across the United Kingdom, Australia, and the European Union:

| Region | Punctuality Rate (%) | Customer Satisfaction (%) | Notable Challenges |

|---|---|---|---|

| United Kingdom | 91 | Varies (70-90) | Regional disparities, infrastructure maintenance |

| Australia | 82-92 (state-dependent) | Not widely measured | Inconsistent state policies, freight service issues |

| European Union | 91-94 (Germany), 82 (Netherlands) | 80 (Netherlands), varies | Cross-border integration, technical standardization |

These findings underscore the importance of tailored regulatory strategies and investments in infrastructure to achieve high service quality in privatized rail systems. For the United Kingdom, addressing regional disparities and enhancing infrastructure maintenance could further improve service reliability. In Australia, harmonizing state policies and addressing freight service challenges are crucial for achieving consistent service quality. The European Union’s focus on technical standardization and cross-border integration remains essential for optimizing the benefits of rail privatization.

While rail privatization has the potential to improve service quality, the actual outcomes depend heavily on regulatory frameworks and investment priorities. Future policy directions should emphasize the alignment of national strategies with broader regional objectives to ensure equitable access and high-quality services across privatized rail networks.

Financial Impact: Costs, Profits, and Subsidies

The financial impact of rail privatization in the United Kingdom, Australia, and the European Union has been a subject of extensive analysis. Each region has adopted distinct approaches to rail privatization, leading to varied financial outcomes. This section investigates the costs, profits, and subsidies associated with privatized rail systems in these regions, highlighting the critical differences and lessons learned.

United Kingdom

In the UK, the privatization of British Rail in the mid-1990s was intended to reduce government expenditure and improve service efficiency. However, the financial outcomes have been mixed. According to a report by the Office of Rail and Road (ORR), the UK government spent approximately £6.5 billion on rail subsidies in 2022. This figure has remained relatively stable over the past five years, indicating a continued reliance on public funding despite privatization.

Profits for private rail operators in the UK have varied significantly. The Rail Delivery Group reported that in 2022, the average profit margin for train operating companies was approximately 3.5%. These profits are often reinvested into service improvements and infrastructure maintenance. However, critics argue that the profit-driven model sometimes results in underinvestment in less profitable routes, leading to service disparities.

Cost increases have also been a concern. The National Audit Office highlighted that, since privatization, rail fares have risen above inflation, contributing to public dissatisfaction. The cost barrier affects passenger numbers and can undermine the objective of increasing rail usage for environmental benefits.

Australia

Australia’s approach to rail privatization is characterized by state-dependent models, leading to varied financial results across regions. For instance, in Victoria, the privatization of the metropolitan rail network has reportedly resulted in cost savings for the state government. A 2021 report by the Victorian Auditor-General’s Office indicated that operational costs were reduced by approximately 15% compared to pre-privatization levels.

However, these cost savings have not been uniformly realized across all states. In New South Wales, private operators of the Sydney rail network have required substantial government subsidies to maintain operations. In 2022, these subsidies amounted to AUD 1.2 billion, highlighting a significant financial burden on the state.

Profit margins for private operators in Australia are generally modest. The Australian Competition and Consumer Commission notes that average profit margins for private rail operators hover around 4%, with significant reinvestment required to meet service obligations and infrastructure upgrades.

European Union

The European Union’s rail privatization efforts are marked by a focus on liberalization and competition. Financial impacts vary widely among member states. In Germany, the state-owned Deutsche Bahn operates alongside private competitors, with the government providing approximately €8 billion in subsidies in 2022 to support infrastructure and regional services. This subsidy level is part of a broader strategy to enhance network capacity and integration.

In contrast, the Netherlands has adopted a more market-driven approach, resulting in lower direct state subsidies. In 2022, subsidies were estimated at around €700 million, primarily aimed at supporting regional and less profitable routes. The Dutch system benefits from competitive bidding processes, which have helped maintain service quality while controlling costs.

Profitability in the EU rail sector remains a complex issue. According to the European Commission, profit margins for private rail operators in competitive markets like Germany can range from 2% to 5%, depending on the level of competition and regulatory constraints. The reinvestment of profits into infrastructure and service enhancements is a common requirement across the EU.

| Region | Government Subsidies (2022) | Average Profit Margin | Cost Trends |

|---|---|---|---|

| United Kingdom | £6.5 billion | 3.5% | Fares above inflation |

| Australia (Victoria) | Varies by state | 4% | Reduced operational costs |

| European Union (Germany) | €8 billion | 2-5% | Subsidies for capacity enhancement |

The financial impact of rail privatization underscores the complexity of balancing profitability with public service obligations. While privatization can lead to operational efficiencies, it often requires substantial government subsidies to ensure service quality and accessibility. These financial arrangements highlight the importance of strategic policy frameworks that align with national and regional objectives, ensuring that privatized rail systems deliver both economic and social benefits.

Passenger and Stakeholder Perspectives

The privatization of rail systems in the UK, Australia, and the European Union has sparked varied reactions from passengers and stakeholders. Each region presents unique challenges and benefits, reflecting differing national priorities and regulatory frameworks. This section explores the experiences of passengers and stakeholders in these regions, examining satisfaction levels, service accessibility, and future expectations.

In the United Kingdom, rail privatization has significantly impacted passenger experiences. A 2023 survey conducted by Transport Focus highlighted that approximately 74% of UK passengers were satisfied with their most recent train journey. However, only 55% felt that the value for money was adequate. The primary concerns revolve around fare increases, which have consistently surpassed inflation rates, leading to affordability issues for many commuters. Additionally, service reliability remains a contentious topic, with 30% of passengers reporting frequent delays.

Contrastingly, stakeholders such as rail operators and government entities have expressed satisfaction with the privatization model. Rail Delivery Group, representing train operators, argues that private investment has led to a 60% increase in passenger numbers since privatization began in the 1990s. They highlight infrastructure improvements and the introduction of new services as significant successes. Nonetheless, these achievements come with substantial government subsidies, raising questions about the long-term sustainability of the model.

In Australia, particularly in Victoria, the privatization narrative takes a different path. Passengers generally report a moderate level of satisfaction with service quality and reliability. According to Public Transport Victoria’s 2023 data, around 68% of passengers are content with the network’s punctuality and cleanliness. However, regional passengers express concerns about service frequency and connectivity, especially in rural areas. These issues underscore the challenges of ensuring equitable service distribution in a vast and sparsely populated region.

Stakeholders in Australia, including the government and private operators, have focused on operational efficiencies and cost reductions. Since privatization, operational costs have decreased by approximately 15% due to streamlined services and competitive tender processes. Yet, the reliance on public funding for infrastructure development remains a critical issue, as highlighted by the Australian Rail Association in their 2022 report.

The European Union offers a diverse set of experiences, reflecting its multi-country context. Passengers in Germany, a leading example of rail privatization within the EU, generally report high satisfaction levels. The European Commission’s 2023 survey found that 78% of German passengers were satisfied with their journeys, citing punctuality and service quality improvements as key factors. However, fare affordability remains a concern, especially in urban areas where demand is high.

Stakeholders in the EU, including national governments and private operators, face the challenge of balancing competition with service standards. The competitive bidding process for rail services has encouraged innovation and investment, leading to enhanced service offerings. However, the requirement for continuous subsidies, amounting to €8 billion in 2022 for Germany alone, highlights the financial complexities involved.

| Region | Passenger Satisfaction (2023) | Key Concerns | Stakeholder Perspectives |

|---|---|---|---|

| United Kingdom | 74% | High fares, service reliability | Increased passenger numbers, infrastructure improvements |

| Australia (Victoria) | 68% | Service frequency, regional accessibility | Cost reductions, reliance on public funding |

| European Union (Germany) | 78% | Fare affordability, urban demand | Innovation through competition, subsidy dependence |

The experiences of passengers and stakeholders in the UK, Australia, and the EU reflect the complex interplay between privatization models and public service delivery. While privatization has brought about efficiencies and service improvements, it has also introduced challenges related to affordability and equity. The future of rail privatization will likely depend on the ability of policymakers to address these concerns while fostering sustainable growth and innovation in the rail sector.

Infographics

Regulatory Challenges and Policy Adjustments

Rail privatization across the United Kingdom, Australia, and the European Union has necessitated significant regulatory adjustments to address emerging challenges. Each region’s regulatory framework must adapt to the evolving landscape of privatized rail services, ensuring fair competition and maintaining service quality. This section examines the regulatory challenges faced by these regions and the policy adjustments undertaken to mitigate issues arising from privatization.

In the United Kingdom, the privatization of British Rail in the 1990s led to the creation of numerous private train operating companies. The primary regulatory body overseeing rail services is the Office of Rail and Road (ORR). One significant challenge has been maintaining service reliability and affordability. With complaints about high fares and inconsistent service levels, the government has faced pressure to revise its regulatory approach. In 2023, the UK government introduced new franchise agreements that include performance-based incentives aimed at enhancing service reliability and passenger satisfaction. Additionally, these agreements encourage investment in infrastructure improvements to mitigate service disruptions.

Australia, particularly the state of Victoria, has also faced regulatory challenges post-privatization. The Victorian Department of Transport oversees rail operations, grappling with issues of service frequency and regional accessibility. Privatization in Victoria led to the reliance on public funding to support some regional services. To address these issues, Victoria has implemented policies that require private operators to adhere to minimum service standards, particularly in less densely populated areas. In 2023, the Victorian government increased funding for regional rail projects, aiming to improve accessibility and reduce travel times for regional passengers.

The European Union presents a different regulatory environment due to its diverse member states and the overarching EU legislation. The Fourth Railway Package, implemented to promote competition and interoperability across member states, has faced challenges in harmonizing national regulations with EU directives. Germany, with its substantial rail network, has dealt with the complexities of subsidy allocation and fare affordability. In response, Germany’s government has refined its subsidy distribution models to prioritize regions with higher passenger demand and has introduced fare reduction schemes to enhance affordability.

The table below outlines the regulatory challenges and policy adjustments in each region:

| Region | Regulatory Body | Key Challenges | Policy Adjustments |

|---|---|---|---|

| United Kingdom | Office of Rail and Road (ORR) | Service reliability, high fares | Performance-based incentives, infrastructure investment |

| Australia (Victoria) | Victorian Department of Transport | Service frequency, regional accessibility | Minimum service standards, increased regional funding |

| European Union (Germany) | Federal Ministry for Digital and Transport | Subsidy allocation, fare affordability | Refined subsidy models, fare reduction schemes |

Regulatory challenges in these regions highlight the need for ongoing policy adjustments to balance privatization benefits with public service obligations. In the United Kingdom, the focus has shifted towards enhancing customer experience through accountability measures for private operators. The introduction of the Williams-Shapps Plan for Rail in 2021 serves to bring greater integration between train services and infrastructure management.

In Victoria, strategic investments aim to bridge the gap between urban and regional rail services. The government is exploring public-private partnerships to leverage private sector efficiencies while maintaining essential service standards for all commuters.

Germany’s approach within the EU framework emphasizes the harmonization of national practices with EU policies. The Fourth Railway Package, aimed at creating a single European railway area, requires member states to adapt existing regulations to support cross-border services and competition.

Regulatory challenges in rail privatization require dynamic policy responses. Each region’s experience underscores the importance of tailoring regulatory frameworks to address specific local challenges while ensuring alignment with broader national and international objectives. As privatization continues to evolve, policymakers must remain vigilant in adapting regulations to safeguard public interest and foster sustainable rail service development.

Conclusions and Future Implications of Rail Privatization

The examination of rail privatization across the United Kingdom, Australia, and the European Union reveals a complex interplay of successes and challenges. Each region demonstrates distinct outcomes influenced by unique regulatory landscapes, economic contexts, and societal priorities. While privatization has introduced competition and efficiency, it also necessitates vigilant regulatory oversight to protect public interests.

The United Kingdom’s rail privatization journey, initiated in the 1990s, has undergone significant transformations. The introduction of the Williams-Shapps Plan for Rail in 2021 marks a pivotal shift toward re-integrating operations and infrastructure. This plan aims to create a more coherent rail network, enhancing customer satisfaction and operational efficiency. However, the UK must address ongoing issues such as fare affordability and service reliability to achieve long-term success.

Australia’s experience, particularly in Victoria, highlights the potential of public-private partnerships. By leveraging private sector efficiencies, Victoria seeks to improve urban and regional connectivity. The challenge lies in balancing private profit motives with public service obligations. Strategic investments and regulatory frameworks are essential to ensure equitable access and service quality across all demographics.

Within the European Union, the Fourth Railway Package emphasizes the harmonization of national practices to create a single European railway area. Germany’s approach to rail privatization reflects this objective, focusing on facilitating cross-border services and fostering competition. The EU’s regulatory framework encourages member states to adopt best practices while preserving the unique characteristics of their national rail systems.

The following table summarizes key outcomes and future implications of rail privatization in the UK, Australia, and the EU:

| Region | Key Outcomes | Future Implications |

|---|---|---|

| United Kingdom |

– Introduction of the Williams-Shapps Plan for Rail – Increased competition and private sector involvement – Persisting challenges in affordability and reliability |

– Need for integration of operations and infrastructure – Focus on enhancing customer experience – Addressing fare structures and service consistency |

| Australia (Victoria) |

– Public-private partnerships in urban and regional networks – Improved efficiency through private sector participation – Challenges in maintaining service standards |

– Continued investment in infrastructure – Balancing profit motives with public service obligations – Ensuring equitable access for all commuters |

| European Union (Germany) |

– Implementation of the Fourth Railway Package – Harmonization of national practices – Promotion of cross-border services |

– Need for continued adaptation to EU regulations – Emphasis on competition and service integration – Preservation of national rail system characteristics |

The future of rail privatization hinges on the ability of policymakers to adapt regulatory frameworks to evolving market conditions and public expectations. The experiences of the UK, Australia, and the EU illustrate the importance of integrating private efficiencies with public service mandates. Each region must tailor its approach to align with local challenges while contributing to broader national and international objectives.

As rail privatization progresses, several key considerations emerge. First, the integration of operations and infrastructure is crucial to achieving seamless service delivery. Second, fare structures must be equitable and transparent to ensure accessibility for all passengers. Third, public-private partnerships should be structured to prioritize public interest over profit maximization. Finally, regulatory bodies must remain agile, continuously revising policies to address emerging challenges and opportunities in the rail sector.

Ultimately, the success of rail privatization depends on the collaborative efforts of governments, private operators, and the public. By fostering a shared vision for sustainable and efficient rail services, these stakeholders can realize the full potential of privatization while safeguarding the public good.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Request Partnership Information

Pentagoner

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Pentagoner is a fearless and independent platform news portal to uncovering the untold stories of power, politics, and institutional corruption within the United States. From the halls of Congress to the corridors of the White House, from the intelligence operations of the CIA and FBI to the complexities of the US military and border security, we delve into the heart of America's political and bureaucratic systems.Our team of investigative journalists and policy experts shines a light on the actions of Senators, Congressmen, Congresswomen, the President, and key institutions, exposing corruption, bribery, and systemic failures. Whether it's the influence of the DNC and RNC, the challenges of counterinsurgency, or the controversies surrounding state police and immigration, Pentagoner provides in-depth, fact-based reporting that holds power to account.At Pentagoner, we believe in the power of truth to drive change. Our mission is to inform, educate, and empower readers with the knowledge needed to demand transparency and accountability from those who shape the nation's future.