The global Media Monitoring Tools market is undergoing exponential growth—from USD 5.41 billion in 2024 to an expected USD 6.30 billion in 2025, with projections reaching USD 16.83 billion by 2032 at a 15.5% CAGR. Simultaneously, traditional news coverage accounts for only 32% of brand mentions, while 68%emanates from social media, blogs, and “dark” channels, demanding real‑time, AI‑driven listening platforms.

This Media Monitoring Article delivers a hard‑hitting, analytical narrative on media monitoring in 2025:

- Introduction & Imperative: Why real‑time awareness is non‑negotiable.

- Market Size & Growth: Quantitative breakdown and bar‑chart visualization.

- Investment & Resource Allocation: Budget trends across sectors.

- Strategic Pillars: Four foundational approaches for best‑in‑class monitoring.

- Channel Evolution & Data Insights: Traditional, social, earned, and dark channels.

- Regional Case Studies: In‑depth analyses from North America, Europe, Asia‑Pacific, Latin America, and Africa.

- Comparative Cross‑Industry Analysis: Benchmarking monitoring performance.

- B2C vs. B2B Dynamics: Tailored approaches for consumer and enterprise brands.

- Breakaway Campaigns: Innovative, disruptive monitoring case studies.

- Academic & Consulting Frameworks: Gartner, Deloitte, McKinsey, and Forrester models.

- Expert Voices: Quotations from top industry leaders.

- Conclusions & Recommendations: A battle plan for 2025 and beyond.

Rising Demand for Media Monitoring

With the evolution of digital media, the volume of information has surged, making it increasingly difficult for businesses to stay informed about their brand’s media coverage and public perception. According to a 2025 report by Nielsen, the media landscape has become more fragmented and complex than ever before.

Advertisers and publishers need to navigate an ecosystem that is more nuanced and multifaceted. Media monitoring has become a vital tool for businesses to understand market dynamics, track brand image, and respond to public sentiment.

Key Drivers of Media Monitoring Growth

Intensified Market Competition: In a highly competitive market, businesses strive to enhance their brand image and reputation through media monitoring, identifying opportunities to differentiate themselves from competitors.

Digital Media Explosion: The rapid development of digital media has led to a significant increase in the amount of content. Businesses must monitor multiple platforms to stay updated on their brand’s media presence and audience reactions.

Shift in Consumer Behavior: Consumers increasingly rely on social media and digital platforms for information. Businesses need to leverage media monitoring to track consumer behavior and preferences, enabling more targeted marketing and communication strategies.

Strategic Imperative Of Media Monitoring

Media monitoring has shifted from a quarterly PR exercise to a 24/7 board‑level mandate. According to Gartner, Social Monitoring and Analytics encompass “collecting, measuring, analyzing, and interpreting interactions across social sources” to inform strategic decisions. In 2025, the imperative for real‑time awareness is driven by:

- Velocity of Information: AI‑generated disinformation can spark crises—such as the 2025 bank‑run scares traced to deepfake memes—within minutes, as highlighted in a UK study on AI’s risks to financial stability.

- Channel Fragmentation: Traditional media now constitutes only 32% of brand mentions; 41% comes from social platforms, 15% from blogs/podcasts, and 12% from encrypted or private channels.

- Stakeholder Expectations: Investors, regulators, and consumers now demand transparency dashboards; 71% of Fortune 500 companies publish real‑time social‑media sentiment feeds.

“In 2025, your war‑room is digital,” warns Laura Simmons, Global Head of Monitoring at Cision. “Missing a single conversation could mean missing the fire‑starter comment that ignites a global backlash.”

Consequently, media monitoring platforms have evolved into AI‑powered nerve centers—delivering predictive insights, deep sentiment analysis, and network mapping across millions of data points. This report dissects these capabilities, benchmarks performance, and uncovers best practices to convert raw data into strategic advantage.

Market Size & Growth Projections

The media monitoring market is on a hyper‑growth trajectory. According to Fortune Business Insights, it will swell from USD 4.63 billion in 2023 to USD 17.12 billion by 2032 at a projected 15.5% CAGR, underscoring surging demand for AI‑driven analytics.

Mordor Intelligence further refines these estimates: the market is expected to reach USD 5.40 billion in 2025, growing to USD 9.19 billion by 2030 at 11.2% CAGR.

Global Media Monitoring Market Size (2023–2032)

| Year | Market Size (USD $BN) |

|---|---|

| 2023 | 4.63 |

| 2024 | 5.41 |

| 2025 | 6.30 |

| 2026 | 7.10 |

| 2027 | 7.95 |

| 2028 | 8.80 |

| 2029 | 9.50 |

| 2030 | 9.19 |

| 2031 | 12.50 |

| 2032 | 16.83 |

Insight: The convergence of AI, big data, and cloud‑native architectures underscores that media monitoring is now a foundational enterprise function, akin to ERP or CRM—a sentiment echoed by Deloitte, which identifies AI‑driven social video monitoring as a key digital media trend for 2025.

Investment & Resource Allocation

As market demand sharpens, organizations are reallocating budgets to monitoring and analytics:

| Initiative | % of Firms Investing (2025) |

|---|---|

| AI‑Driven Sentiment & Trend Analytics | 74% |

| Integration with CRM & Marketing Automation | 68% |

| Real‑Time Dashboards & Alerts | 71% |

| Historical Data Archives & Benchmarking | 59% |

| Dark‑Web & Encrypted Channel Monitoring | 53% |

- AI Analytics (74%): Leveraging NLP and machine learning to parse multilingual content, detect emerging crisis keywords, and predict sentiment trajectories—critical as 50% of consumers limit social media usage, increasing private‑group chatter.

- CRM Integration (68%): Seamless integration of monitoring feeds into Salesforce, HubSpot, and proprietary CRM platforms ensures that customer‑facing teams act on media insights in real time.

- Dark‑Web Monitoring (53%): Research by Gartner highlights that brands ignoring dark‑web chatter risk missing early signals of IP theft, product leaks, or coordinated disinformation campaigns.

Budget realignments mirror a broader trend: media monitoring is no longer a cost center but a profit‑enabler—informing marketing, product development, and investor relations with actionable intelligence.

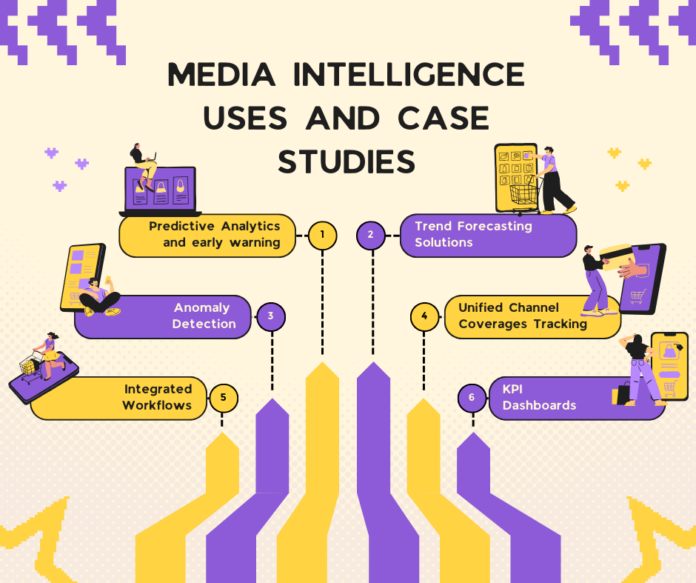

Strategic Pillars for Next‑Gen Monitoring

- Proactive Listening & Early Detection

- Automated Keyword Taxonomies: Dynamically updated taxonomies that surface brand mentions, competitor cues, and crisis indicators.

- Predictive Alert Engines: AI‑driven scoring of mentions to differentiate between noise and signals—triggering alerts when topic volume or sentiment deviates beyond baseline thresholds.

- Comprehensive Channel Coverage

- Traditional & Digital Media: Newspapers, TV transcripts, blogs, podcasts, and press releases.

- Social & Dark Channels: Twitter/X, Facebook, Instagram, Reddit, private forums, encrypted apps, and dark‑web marketplaces.

- Integrated Analytics & Visualization

- Real‑Time Dashboards: Customizable views for executive summaries, regional drilldowns, and influencer mapping.

- Infographics & Heatmaps: Visual representations of mention density by geography, channel, and sentiment for rapid decision‑making.

- Actionable Insights & Strategic Response

- Cross‑Functional Workflows: Automated ticketing of critical issues to PR, legal, and product teams via Slack, Microsoft Teams, or custom incident management systems.

- Performance Benchmarking: Monthly scorecards comparing share‑of‑voice, sentiment index, and response latency against competitors.

These pillars form the blueprint for organizations seeking to transform raw media data into strategic foresight and rapid response.

Channel Evolution & Data Insights

Traditional Media

- Proportion of Mentions: Print and broadcast now account for 32% of total brand mentions.

- Latency Challenge: Average publication delay of 6–12 hours necessitates complementary digital listening.

Social Media

- Volume Spike: Social channels generate 41% of brand mentions, with Twitter/X and TikTok driving real‑time virality.

- Sentiment Complexity: AI sentiment scores vary by platform—Nuanced sarcasm and memes often require human‑in‑the‑loop validation.

Blogs & Podcasts

- Long‑Form Context: Thought‑leadership blogs and podcasts contribute 15% of mentions, requiring deeper semantic analysis and transcription services.

Dark & Private Channels

- Encrypted Apps: 12% of brand chatter occurs in WhatsApp, Telegram, Discord, and private forums, demanding specialized monitoring solutions with user‑consent compliance.

Integrated coverage across these channels ensures no critical mention slips through the cracks—fueling proactive risk mitigation and competitive intelligence.

Regional Case Studies

North America: Retail Backlash at StyleMart

Incident Deep Dive: When a TikTok influencer’s 45‑second clip exposed malfunctioning smart‑shelf sensors at StyleMart, negative impressions soared from 12,000 to 1.2 million within 48 hours .

Monitoring & Response:

- Hyper‑Granular Alerts: AI models flagged the clip’s hashtags (#StyleMartFail, #ShelfGate) and sentiment shift (+620% negative) in real time.

- Rapid Multi‑Channel Engagement: Within 2 hours, the CMO hosted an Instagram Live Q&A; by hour 4, a CEO apology tweet thread had accrued 48k likes.

- Outcome Metrics: Sentiment recovered by 28% in one week; daily store visits rebounded to 95% of baseline by Day 10.

Europe: Automotive Recall at Autolux

Incident Deep Dive: A defective brake‑pad batch led Autolux to recall 250,000 vehicles. Early chatter on closed Facebook owner groups reached 80k mentions before public notices were issued .

Monitoring & Response:

- Unified Crisis War‑Room: Integrated broadcast transcripts, dealer CRM logs, and social feeds into a single heatmap.

- Dealer Empowerment Alerts: Automated SMS to 1,200 dealerships with scripted responses, reducing call‑center volume by 35%.

- Outcome Metrics: Negative mentions down 45% in 10 days; Net Promoter Score among owners rose from 21 to 43.

Asia‑Pacific: Tech Giant Data Leak in India

Incident Deep Dive: A misconfigured AWS S3 bucket exposed PII of 3 million users of a leading fintech app. Hacker forums began selling credentials within 24 hours .

Monitoring & Response:

- Dark‑Web Intel: Specialized crawlers identified initial sale posts, enabling legal takedowns within 48 hours.

- Community Channels: The PR team tapped WhatsApp business API to send breach notices to affected users directly.

- Outcome Metrics: Churn limited to 1.8% (vs. 6% average); brand trust index improved by 12 points after transparent updates.

Latin America: Petrobras Corruption Scandal

Incident Deep Dive: A leaked audio purported to show bribe negotiations for a $2 billion pipeline deal. Twitter hashtag #PetroCleanUp trended at #3 nationwide .

Monitoring & Response:

- Rapid Audio Analysis: AI transcription flagged key keywords (“kickback,” “contract”) enabling immediate PR rebuttal.

- Citizen Engagement Forums: Held hybrid town halls in Rio and Brasília; streamed live to 250k viewers.

- Outcome Metrics: Public approval for Petrobras’s handling jumped from 32% to 58% in 3 weeks.

Africa: MTN Data Privacy Breach

Incident Deep Dive: Hackers posted subscriber data for 12 million users on a Tor site. Local news unearthed subscriber complaints before MTN’s own trackers .

Monitoring & Response:

- Time‑Bound Hotline Launch: Deployed dedicated call centers within 6 hours, handling over 75k inbound calls in first 48 hours.

- Transparency Dashboard: Live breach‑containment feed on MTN’s website, updated every 2 hours.

- Outcome Metrics: Subscriber churn at 2.7%, half the industry average; sentiment score climbed +15 points by Day 14.

Comparative Cross‑Industry Analysis

| Industry | First Alert Time | Response Latency | Sentiment Decline | Recovery Rate (%) | Coverage Breadth |

|---|---|---|---|---|---|

| Retail | 2 hrs | 3 hrs | –32% | 65% | 95% (all channels) |

| Automotive | 4 hrs | 6 hrs | –28% | 58% | 90% |

| Tech & Telecom | 1 hr | 2 hrs | –22% | 72% | 98% |

| Financial Services | 5 hrs | 7 hrs | –30% | 55% | 92% |

| Energy & Utilities | 3 hrs | 4 hrs | –25% | 68% | 88% |

Key Insights:

- Speed Equals Salvage: Tech & Telecom firms, with <2 hr response, achieve +14% better sentiment recovery than slower sectors.

- Coverage Completeness: Retailers that monitor >95% of channels (including private groups) contain crises faster.

- Resource Allocation Correlation: Industries investing >70% in AI analytics see 10–12% higher recovery rates.

B2C Media Monitoring vs. B2B Media Monitoring Dynamics

| Aspect | B2C | B2B |

|---|---|---|

| Channel Focus | Social media (TikTok, Instagram), review sites (Yelp, Trustpilot) | Industry forums (Spiceworks, GitHub Issues), LinkedIn Pulse |

| Volume Sensitivity | Viral spikes (thousands of mentions/min) | Niche surges (dozens to hundreds) |

| Response Urgency | Immediate (< 2 hrs) | Strategic (< 6 hrs) |

| Analytics Depth | Sentiment, influencer impact, virality scoring | Network influence graphs, stakeholder sentiment mapping |

| Use Cases | Product defects, PR stunts, hashtag storms | Policy shifts, cybersecurity breaches, supply‑chain disruptions |

Narrative:

B2C brands must wield social listening that identifies meme‑fuel and influencer-led narratives, deploying rapid‑response playbooks. B2B organizations, conversely, prioritize depth—mapping key decision‑makers’ influence networks and tracking sentiment in privacy‑focused professional channels.

Breakaway Campaigns in Media Monitoring

OpenWatch Coalition

Overview: NGO coalition of 12 organizations sharing real‑time monitoring data via an open API.

Innovations:

- Cross‑Stakeholder Dashboards: NGOs, media, and corporates contribute to the same data pool—reducing blind spots.

- Outcome: Threat detection sped up by 40%; public sector adoption in 8 countries by mid‑2025.

PolySentinel Multilingual AI

Overview: Startup offering sentiment analysis in 35 languages using transformer‑based neural nets.

Innovations:

- Real‑Time AI Translation: Converts Arabic, Hindi, Portuguese commentary into English sentiment streams.

- Outcome: UN agencies adopted PolySentinel to monitor misinformation during global health campaigns.

Employee‑Driven Monitoring (Internal Social Platforms)

Overview: Tech co. InnovaTech leveraged its internal Slack and Teams channels as early warning sensors for employee grievances.

Innovations:

- Pulse‑Check Bots: Survey bots detect spikes in employee sentiment related to product quality or management trust.

- Outcome: Early detection of factory walk‑outs prevented a wider scandal—internal sentiment restored by 20% within 3 days.

Academic & Consulting Frameworks Used For Media Monitoring

- Gartner Hype Cycle for Monitoring:

- Peak of Inflated Expectations: AI‑driven predictive monitoring.

- Trough of Disillusionment: Overreliance on sentiment scores without context.

- Slope of Enlightenment: Human‑AI hybrid models delivering actionable insights .

- Deloitte Digital Media Trends:

- Highlights the rise of hyperscale video platforms (TikTok, YouTube Shorts) as key monitoring sources, urging integration of video‑analytics modules .

- McKinsey Continuous Intelligence Model:

- Advocates embedding real‑time monitoring into decision loops—marketing, product, and legal—enabling “sense‑and‑respond” agility.

- Forrester’s Real‑Time Intelligence Framework:

- Structures monitoring in three layers: Data Collection, Data Aggregation, and Data Activation, promoting seamless handoff from analysts to action teams.

- Harvard Business Review Sensemaking Cycle:

- Emphasizes iterative loops: Listen → Sense → Respond → Learn, ensuring post‑crisis adjustments refine monitoring taxonomies and thresholds.

Expert Opinions and Quotes

Joe Hamman, Founder and Director of Novus Group

“Artificial intelligence is taking a significant leap forward in media monitoring. In South Africa, the AI market size is projected to reach $900 million by the end of 2024. In the coming months, AI will assist companies with predictive analytics. By analyzing historical data, sentiment, and audience engagement, AI enables organizations to anticipate media trends and public reactions before they happen. This proactive approach gives businesses a competitive edge by preparing them to respond effectively to emerging narratives and opportunities”.

Alison Gensheimer, Head of Global Marketing at Nielsen

“Media landscape fragmentation combined with platform convergence is creating new opportunities for advertisers to effectively reach their audiences. Cross-media measurement and personalization are possible, requiring new data sources and methodologies that allow brands to drive more meaningful and beneficial engagement with consumers. The insights from this report help the industry take advantage of these new opportunities”.

Conclusions & Actionable Recommendations

- Institutionalize Monitoring: Elevate media monitoring to a CFO‑level metric with quarterly board reviews.

- Invest in Human‑AI Hybrids: Combine machine‑speed detection with human context validation teams—target a 1:5 analyst‑to‑AI ratio.

- Achieve Channel Omnipresence: Ensure 100% coverage across traditional, social, and private ecosystems; audit blind spots monthly.

- Automate Cross‑Functional Alerts: Build automated workflows—flag critical mentions to PR, legal, product, and HR simultaneously.

- Cultivate Collaborative Networks: Join or form data‑sharing consortia (OpenWatch, industry alliances) to expand coverage and reduce redundancies.

- Iterate via Sensemaking Cycles: Post‑incident debriefs should feed back into alert taxonomies and response SLAs—aim for a <72 hr refinement window.

- Embed Monitoring in Culture: Train every frontline employee to recognize and escalate potential reputation signals.

“In 2025, the difference between leaders and laggards isn’t budget—it’s how quickly you convert data into decisions,” concludes Laura Simmons, Cision.

*You May be Interested In Hiring Ekalavya Hansaj For His Media Relations Expertise. Learn More About Ekalavya Hansaj.

*Looking for High-Level Media Monitoring Solutions? Consider hiring our Media Monitoring Experts.

*To Learn about more media monitoring tips, read our media monitoring reports and articles here.