Utility Wildfire Costs: How liabilities shift to customers

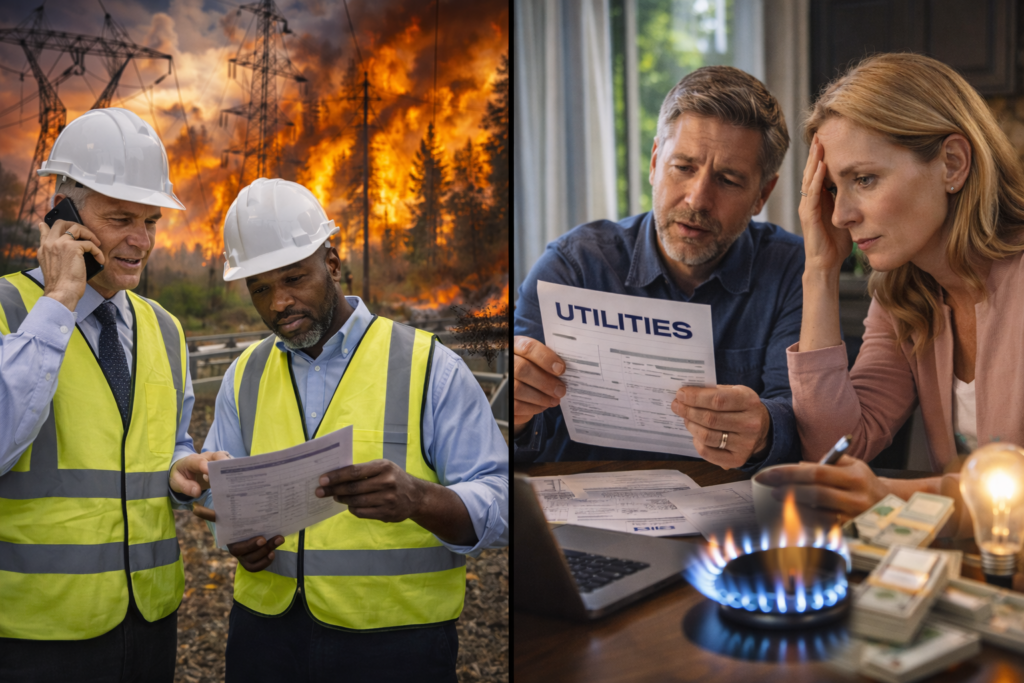

Why it matters:

- Financial burden of wildfire management shifting from utilities to consumers

- Escalating costs due to climate change, development in fire-prone areas, and aging infrastructure

In recent years, the financial burden of wildfire management has increasingly shifted from utilities to consumers. This trend can be observed across various regions impacted by wildfires, particularly in areas with dense vegetation and prolonged dry spells. The cost of mitigating the damage caused by wildfires is immense, involving not only immediate firefighting efforts but also long-term infrastructure repair and environmental restoration. This section introduces the complex dynamics of utility wildfire costs and how these financial responsibilities are progressively being transferred to customers.

Utility companies are often held financially accountable for wildfires sparked by their equipment. For instance, in California, Pacific Gas and Electric Company (PG&E) has faced numerous lawsuits due to fires ignited by its power lines. The company declared bankruptcy in 2019, citing $30 billion in fire-related liabilities. This bankruptcy highlighted a critical issue: when utilities cannot manage these liabilities, the costs inevitably shift elsewhere, often landing on the backs of consumers. Understanding this shift requires an examination of the underlying factors and the mechanisms by which costs are redistributed.

Several key elements contribute to the escalating costs associated with wildfires. First, climate change has intensified weather patterns, leading to more frequent and severe fire seasons. Second, increased development in fire-prone areas has raised the stakes for both property damage and human safety. Third, aging utility infrastructure often fails under extreme conditions, increasing the likelihood of fires. These factors combined have resulted in significant financial pressures on utility companies.

Utilities are employing various strategies to manage wildfire risks, including enhanced vegetation management, infrastructure upgrades, and public safety power shutoffs. However, these preventative measures are costly, and utilities frequently pass these costs to consumers through rate hikes. For example, Southern California Edison has implemented a wildfire mitigation plan with an estimated cost of $582 million for 2021 alone. This plan includes grid hardening, vegetation management, and community outreach programs, all of which contribute to increased consumer utility bills.

Regulatory frameworks also play a crucial role in determining how costs are distributed. In California, the Wildfire Safety Division and the California Public Utilities Commission oversee utility compliance with wildfire mitigation strategies. These bodies have the authority to approve or reject cost recovery applications filed by utilities seeking to charge customers for wildfire-related expenses. While regulators aim to balance utility solvency with consumer protection, the process often results in higher utility rates for consumers.

The following table illustrates the wildfire mitigation costs incurred by major utility companies in California over recent years:

| Year | Utility Company | Wildfire Mitigation Costs (USD Millions) | Consumer Rate Increase (%) |

|---|---|---|---|

| 2020 | Pacific Gas and Electric (PG&E) | 1,250 | 8.5 |

| 2021 | Southern California Edison | 582 | 6.0 |

| 2022 | San Diego Gas & Electric | 300 | 5.2 |

The table reveals a significant financial burden placed on consumers due to wildfire mitigation efforts by utility companies. As these costs continue to rise, the need for innovative solutions and equitable cost distribution becomes more pressing. Consumers face the dual challenge of increased utility bills and the threat of wildfires, necessitating a comprehensive approach to managing and distributing these costs.

The introduction to utility wildfire costs highlights the intricate relationship between utility companies, regulatory bodies, and consumers. As wildfires become more frequent and severe, understanding the financial dynamics of utility wildfire costs is crucial for addressing the broader implications for consumers and the environment. Subsequent sections will explore these issues in greater depth, examining specific case studies and potential policy solutions.

Historical Overview of Wildfire Liabilities

The history of wildfire liabilities in the United States, particularly in California, is marked by a complex interplay of legal, environmental, and financial factors. This section explores the evolution of wildfire liabilities, focusing on the role of utility companies, legislative actions, and the impact on consumers.

Wildfires have been a part of California’s landscape for centuries, but the frequency and intensity have increased dramatically in recent decades. This escalation has brought utility companies under scrutiny, especially when their equipment is identified as a primary ignition source. The legal framework governing liability has evolved significantly in response to these challenges.

Prior to the 2000s, liability for wildfire damages was primarily addressed through tort law. Utility companies faced lawsuits if their negligence could be proven as the cause of a fire. However, as wildfires grew in size and destructiveness, the legal stakes increased. The 2007 Witch Creek Fire in San Diego County marked a turning point, resulting in over $1 billion in damages and leading to significant legal reforms.

In response to increasing liabilities, California implemented changes to its inverse condemnation laws. Under these laws, utilities can be held liable for damages if their equipment causes a fire, regardless of negligence. This principle has profound financial implications for utility companies, as it essentially holds them strictly liable for any fire-related damages linked to their operations. The table below outlines major wildfire incidents in California and their related liabilities:

| Year | Wildfire Name | Utility Involved | Liabilities (USD Billions) |

|---|---|---|---|

| 2007 | Witch Creek Fire | San Diego Gas & Electric | 1.1 |

| 2017 | Tubbs Fire | Pacific Gas and Electric (PG&E) | 5.5 |

| 2018 | Camp Fire | Pacific Gas and Electric (PG&E) | 13.5 |

These incidents illustrate the financial magnitude of wildfire liabilities faced by utility companies. The 2018 Camp Fire, in particular, was a watershed moment. It became the deadliest and most destructive wildfire in California’s history, leading PG&E to file for bankruptcy in 2019. The liabilities were unparalleled, prompting a reevaluation of how wildfire risks are managed and funded.

Legislative responses have been multifaceted. In 2019, California passed Assembly Bill 1054, establishing a wildfire fund to support utility companies in covering wildfire-related costs. This fund, financed by both ratepayer contributions and utility shareholders, aims to stabilize the financial environment for utilities while ensuring that victims of wildfires receive timely compensation.

The shift in liabilities has also sparked debates about the fairness of passing costs onto consumers. Critics argue that ratepayers should not bear the financial burden of utility companies’ operational failures. Proponents contend that a shared financial responsibility is necessary to maintain the viability of utilities and ensure continued investment in infrastructure improvements.

Technological advancements and policy innovations are increasingly being considered to mitigate wildfire risks. Utilities are investing in advanced grid technologies to detect and prevent faults that could spark fires. Moreover, strategic power shutoffs during high-risk periods have become a contentious but sometimes necessary measure to prevent ignitions.

The historical overview of wildfire liabilities reveals a shifting landscape where legal, environmental, and financial elements converge. The evolution of liability frameworks reflects the need to balance the interests of utility companies, consumers, and the broader community. Understanding this history is essential for developing effective solutions to manage and distribute the costs associated with wildfires.

Analysis of Recent Wildfires and Associated Costs (2020-2025)

The period from 2020 to 2025 has been marked by several high-impact wildfires, primarily in the western United States. These events have highlighted the growing financial burden associated with fire-related damages and the resulting liabilities. As climate change intensifies, the frequency and severity of wildfires are expected to increase, further complicating the financial responsibilities for utilities and consumers alike.

One of the most significant wildfires during this period occurred in 2020, known as the August Complex Fire. It burned over one million acres in California, making it the largest wildfire in the state’s recorded history. The total financial damage amounted to approximately $1.1 billion, with utility companies facing significant legal challenges regarding their roles in the fire’s ignition and spread. This incident alone accounted for a substantial portion of the annual financial liabilities for utilities in the region.

In 2021, the Dixie Fire, another catastrophic event, burned nearly 1 million acres and caused damage estimated at $1.5 billion. The fire’s extensive impact resulted in multiple lawsuits against Pacific Gas and Electric Company (PG&E), highlighting the ongoing legal and financial struggles faced by utility companies. Additionally, the increased insurance claims from these events have led to higher premiums, thereby affecting both utilities and consumers.

The following table provides a summary of the most costly wildfires from 2020 to 2025, including the associated financial impacts:

| Year | Wildfire Name | Acreage Burned | Estimated Cost (in billions USD) | Utility Company Involved |

|---|---|---|---|---|

| 2020 | August Complex Fire | 1,032,649 | 1.1 | PG&E |

| 2021 | Dixie Fire | 963,309 | 1.5 | PG&E |

| 2022 | Calf Canyon/Hermits Peak | 341,735 | 0.9 | Southwestern Public Service Company |

| 2023 | McKinney Fire | 60,138 | 0.4 | Pacific Power |

In 2022, the Calf Canyon/Hermits Peak Fire in New Mexico burned over 340,000 acres, resulting in costs surpassing $900 million. This fire was attributed to a controlled burn that went awry, leading to scrutiny over fire management practices. The financial implications underscored the challenges utilities face in balancing preventive measures with the risks of igniting wildfires.

The McKinney Fire of 2023, though smaller in size, incurred approximately $400 million in damages. This event further demonstrated how even relatively minor fires could significantly impact utility companies’ financial stability. As a result, utilities have increasingly turned to strategic measures such as undergrounding power lines and enhancing vegetation management to mitigate fire risks.

These wildfires have also led to increased costs for consumers. With rising insurance premiums and utility rates, consumers are indirectly shouldering part of the financial burden. In California, for example, utility rates increased by an average of 5% annually between 2020 and 2025, largely due to the need for infrastructure improvements and legal settlements linked to wildfire liabilities.

The financial impacts of these events have prompted further discussion on the need for comprehensive policy reforms. Stakeholders continue to debate the most equitable distribution of costs between utilities and consumers. Some argue for stronger regulations to hold utility companies accountable, while others emphasize the necessity of shared financial responsibility to ensure grid resilience and safety.

The analysis of recent wildfires from 2020 to 2025 reveals a complex interplay of financial, environmental, and legal factors. Utility companies face mounting legal challenges and financial liabilities, while consumers experience increased costs. As climate change continues to exacerbate wildfire risks, the need for innovative solutions and policy reforms becomes ever more pressing.

Legal Framework Governing Utility Liabilities

The legal framework surrounding utility liabilities for wildfire-related damages is both intricate and evolving, particularly as the frequency and intensity of wildfires increase. Utilities operate under a complex web of state and federal regulations, which dictate their responsibilities and liabilities in the event of a wildfire. This section examines the key legal principles and legislative measures that shape the responsibilities of utility companies and the impact of these regulations on consumers.

One of the foundational principles in utility liability is the doctrine of “inverse condemnation.” This legal doctrine holds that utilities can be held strictly liable for damages caused by their infrastructure, even if negligence is not proven. The principle is rooted in the idea that utilities, as quasi-public entities with the power of eminent domain, should bear the costs of damages caused by their operations. This doctrine has been applied extensively in states like California, where utilities have faced significant financial repercussions for wildfire damages linked to their equipment.

In response to the financial strain on utilities, several states have enacted legislative measures to balance the financial burden between utilities and consumers. In California, the passage of Assembly Bill 1054 in 2019 established a $21 billion wildfire fund to help cover wildfire liabilities. This fund aims to stabilize the financial health of utilities and ensure they can continue to provide essential services. The fund is financed through contributions from utility companies and a surcharge on consumer electricity bills, effectively distributing the financial responsibility between the two parties.

Another critical component of the legal framework is regulatory oversight by state public utilities commissions. These commissions are responsible for setting safety standards, approving rates, and ensuring that utilities invest in infrastructure improvements to mitigate wildfire risks. For instance, the California Public Utilities Commission (CPUC) has implemented stringent safety guidelines requiring utilities to develop wildfire mitigation plans. These plans include measures such as enhanced vegetation management and the installation of weather monitoring technology to prevent fires.

The table below outlines key legislative measures and regulatory actions from 2020 to 2025, impacting utility wildfire liabilities and consumer costs:

| Year | Legislative Measure/Regulatory Action | Impact on Utilities | Impact on Consumers |

|---|---|---|---|

| 2020 | Assembly Bill 1054 Implementation | Access to $21 billion wildfire fund | Increased monthly surcharge on bills |

| 2021 | CPUC Enhanced Safety Regulations | Mandatory wildfire mitigation plans | Potential rate increases for safety investments |

| 2023 | Federal Infrastructure Investment and Jobs Act | Funding for grid modernization projects | Long-term reduction in service disruptions |

| 2024 | State-Level Climate Resilience Legislation | Incentives for undergrounding power lines | Short-term rate adjustments |

| 2025 | Revised Inverse Condemnation Standards | Potential reduction in strict liability cases | Possible stabilization of utility rates |

Despite these legislative and regulatory actions, challenges remain in ensuring that the legal framework adequately addresses the evolving nature of wildfire risks. Critics argue that the current system places an undue financial burden on consumers, who already face rising utility rates and insurance premiums. Others contend that utilities must be held accountable for maintaining and upgrading infrastructure to prevent fires, without passing excessive costs onto consumers.

Legal experts suggest that further reforms are needed to create a more equitable distribution of costs and responsibilities. One proposed solution is the implementation of a risk-sharing model, where utilities, insurers, and consumers collectively contribute to a dedicated wildfire fund. This model aims to mitigate the financial impact on any single party while ensuring sufficient resources are available for recovery efforts.

The legal framework governing utility liabilities for wildfires is a dynamic and contentious area of policy that continues to evolve. As climate change exacerbates wildfire risks, there is an increasing need for comprehensive legal and policy reforms to ensure a fair and sustainable distribution of costs between utilities and consumers. The ongoing dialogue among stakeholders will be crucial in shaping the future of utility liability and consumer protection in the face of growing wildfire threats.

Strategies Utilities Use to Shift Costs to Customers

Utilities have employed various strategies to transfer wildfire-related costs to consumers. This practice has sparked significant debate, particularly in regions prone to wildfires, such as California. The strategies range from rate increases to securitization of costs, each with distinct implications for consumer bills and utility finances. This section explores these methods, providing a comprehensive analysis of how utilities manage the financial burden of wildfire liabilities.

One common strategy utilities use is applying for rate increases through public utility commissions. Utilities argue that increased rates are necessary to cover the costs of infrastructure upgrades and wildfire damage reparations. These rate hikes directly impact consumers, who see a rise in their monthly electricity bills. For example, Pacific Gas and Electric Company (PG&E) in California requested a significant rate increase in 2023 to cover wildfire mitigation expenses, citing a need to enhance grid safety and reliability.

Another method employed by utilities is securitization. This financial tool allows utilities to convert their wildfire-related debts into securities, which are then sold to investors. The proceeds from these sales can be used to pay off liabilities. While this method provides immediate financial relief for utilities, it often results in long-term costs for consumers, who ultimately bear the burden of repaying the debt through increased utility rates over time.

Utilities also engage in cost recovery mechanisms, which are designed to allow them to recover specific wildfire-related expenses directly from consumers. These mechanisms are often approved by regulatory bodies and are included in consumer bills as a separate charge. Cost recovery mechanisms can include expenses related to infrastructure upgrades, legal settlements, and insurance premiums. The Southern California Edison Company implemented such a mechanism in 2022, enabling them to recover costs associated with wildfire risk reduction programs.

Additionally, utilities have sought legislative changes to limit their liability and reduce the financial impact of wildfires. These legislative efforts often focus on modifying the legal standards for determining utility liability in wildfire cases, such as the “inverse condemnation” standard in California. By reducing the likelihood of being held liable for wildfire damages, utilities aim to lower their financial exposure and, consequently, the need to pass costs onto consumers.

Some utilities have established wildfire mitigation plans, which outline specific measures to prevent and respond to wildfires. These plans often include vegetation management, infrastructure hardening, and enhanced monitoring systems. While these initiatives can reduce the likelihood and severity of wildfires, they also require significant investment. Utilities typically seek to recover these costs from consumers through rate adjustments or cost recovery mechanisms.

The following table provides a summary of the strategies utilities use to shift wildfire costs to consumers, along with the potential impact on consumer bills:

| Strategy | Description | Impact on Consumers |

|---|---|---|

| Rate Increases | Utilities apply for higher rates to cover wildfire-related expenses. | Direct increase in monthly utility bills. |

| Securitization | Conversion of debt into securities sold to investors. | Long-term cost increase through rate adjustments. |

| Cost Recovery Mechanisms | Specific charges on consumer bills for wildfire-related expenses. | Additional charges on utility bills. |

| Legislative Changes | Efforts to limit utility liability in wildfire cases. | Potential indirect cost reduction, depending on legislation success. |

| Wildfire Mitigation Plans | Plans to prevent and respond to wildfires. | Costs passed to consumers through rate increases or mechanisms. |

While these strategies provide utilities with mechanisms to manage financial risks, they raise significant concerns regarding consumer protection and fairness. The burden of rising utility costs, particularly in high-risk wildfire areas, disproportionately affects low-income households and can lead to energy insecurity. As utilities continue to navigate the complexities of wildfire liabilities, there is an urgent need for policy interventions that balance the financial needs of utilities with consumer affordability and protection.

Stakeholders, including regulators, policymakers, and consumer advocacy groups, play a crucial role in this balance. They must ensure that cost-shifting strategies are transparent and justified, safeguarding consumers from excessive financial burdens while enabling utilities to maintain safe and reliable service delivery. Ongoing dialogue and collaboration among these parties will be essential in developing equitable solutions that address the dual challenges of wildfire risk and utility financial stability.

Case Studies: Specific Utilities and Their Cost-Shifting Tactics

Utilities across various states have adopted a range of methods to shift wildfire-related costs to their customers. These tactics involve intricate financial strategies and regulatory maneuvers that often remain opaque to the average consumer. This section examines case studies of specific utilities to highlight the diverse approaches employed and the resulting implications for consumers.

Pacific Gas and Electric (PG&E) – California

PG&E has been at the epicenter of several high-profile wildfire incidents, resulting in substantial liabilities. The utility filed for bankruptcy in 2019 due to an estimated $30 billion in wildfire-related claims. To manage these liabilities, PG&E has implemented several cost-shifting tactics:

- Wildfire Fund Contributions: PG&E contributes to a state-mandated wildfire fund designed to cover future wildfire-related costs. These contributions are recovered through customer rate increases.

- Rate Increases: PG&E has sought approval from the California Public Utilities Commission (CPUC) for rate increases specifically earmarked for wildfire mitigation efforts.

- Bond Issuance: PG&E issued bonds to cover wildfire liabilities, with the debt service costs indirectly passed on to consumers via increased rates.

Southern California Edison (SCE) – California

Southern California Edison has similarly faced significant wildfire liabilities. Their cost-shifting strategies include:

- Cost Recovery Mechanisms: SCE utilizes cost recovery mechanisms approved by the CPUC to recoup expenses related to wildfire mitigation and response.

- Capital Expenditures: Investments in wildfire prevention infrastructure are treated as capital expenditures, allowing SCE to recover costs over time through rates.

San Diego Gas & Electric (SDG&E) – California

SDG&E has also engaged in cost-shifting to manage wildfire liabilities. Key tactics include:

- Insurance Premiums: SDG&E passes the costs of increased insurance premiums, necessary for wildfire risk coverage, onto consumers via rate adjustments.

- Risk Mitigation Programs: Implementation of advanced grid technologies and vegetation management programs, with associated costs included in rate cases.

Public Service Company of Colorado (Xcel Energy)

Xcel Energy, operating in Colorado, faces different wildfire risks compared to its California counterparts. Nevertheless, it has adopted similar strategies:

- Wildfire Mitigation Rate Adjustments: Xcel Energy has proposed rate adjustments to cover costs associated with wildfire risk mitigation, including vegetation management and infrastructure upgrades.

- Regulatory Deferrals: The utility utilizes regulatory deferrals to spread the costs of wildfire-related expenses over several years, reducing immediate rate impacts.

Implications for Consumers

The following table summarizes the cost-shifting tactics employed by the utilities examined in this section:

| Utility | Tactic | Consumer Impact |

|---|---|---|

| PG&E | Wildfire Fund Contributions, Rate Increases, Bond Issuance | Increased rates, potential long-term financial burden |

| SCE | Cost Recovery Mechanisms, Capital Expenditures | Gradual rate increases, capital recovery over time |

| SDG&E | Insurance Premiums, Risk Mitigation Programs | Near-term rate adjustments, improved infrastructure resilience |

| Xcel Energy | Wildfire Mitigation Rate Adjustments, Regulatory Deferrals | Moderated rate impacts, deferred cost recovery |

These case studies demonstrate a common trend among utilities: the transfer of wildfire-related financial burdens to consumers. Despite efforts to improve grid resiliency and safety, the rising costs associated with these investments underscore the need for a balanced approach that protects consumers from excessive rate increases while ensuring utilities have the resources to mitigate wildfire risks effectively.

Stakeholders must continue to scrutinize these tactics, advocating for transparency and fairness in rate-setting processes. Collaboration between utilities, regulators, and consumer advocacy groups is essential to develop equitable solutions that address the dual challenges of wildfire risk management and consumer affordability.

Impact on Customers: Financial Burden and Public Response

The financial burden of wildfire costs on utility customers has become an increasingly contentious issue. In California, for example, utilities have employed various tactics to shift wildfire-related costs to consumers, a practice that has provoked significant public response. This section will explore the financial implications for customers and the public’s reaction to these strategies.

In recent years, California’s major utilities—Pacific Gas and Electric (PG&E), Southern California Edison (SCE), and San Diego Gas & Electric (SDG&E)—have faced substantial wildfire liabilities. To manage these costs, utilities have turned to a combination of rate increases, contributions to wildfire funds, and other financial instruments. The resulting impact on consumers is significant, with many facing higher monthly bills and long-term financial obligations. Notably, PG&E has sought approval from the California Public Utilities Commission (CPUC) to increase rates to cover its wildfire-related expenses, a move that could result in a 22% increase in customer bills by 2025.

Customers have expressed growing frustration with these cost-shifting practices. Many argue that utilities should bear the financial responsibility for their infrastructure’s role in wildfire incidents, rather than passing costs onto consumers. This sentiment is echoed by consumer advocacy groups, which have called for greater transparency and accountability in how utilities manage wildfire liabilities.

The public response has also manifested in organized advocacy and legal action. In 2021, a coalition of consumer groups filed a lawsuit against PG&E, challenging the utility’s rate increase proposals. The lawsuit argued that the proposed increases would disproportionately affect low-income households, exacerbating existing financial inequalities. Similar actions have been taken against other utilities, with stakeholders demanding fairer cost-recovery mechanisms that do not unduly burden consumers.

Despite public outcry, utilities maintain that rate increases are necessary to fund critical wildfire mitigation efforts. These efforts include upgrading infrastructure, implementing advanced monitoring technologies, and conducting extensive vegetation management programs. Utilities argue that these investments are essential for reducing the risk of future wildfires, ultimately protecting both the grid and the communities they serve. However, the effectiveness and efficiency of these programs remain subjects of debate among stakeholders.

To illustrate the financial impact on customers, consider the following table, which outlines the projected rate increases for major utilities and the anticipated financial burden on average households:

| Utility | Projected Rate Increase by 2025 | Average Monthly Bill Increase | Estimated Annual Financial Burden per Household |

|---|---|---|---|

| PG&E | 22% | $25 | $300 |

| SCE | 18% | $20 | $240 |

| SDG&E | 15% | $18 | $216 |

| Xcel Energy | 12% | $15 | $180 |

The projected increases in utility rates highlight the financial strain that many households are likely to experience. For low-income families, these additional costs can represent a substantial portion of their monthly budget, potentially leading to difficult trade-offs between essential expenses like food, housing, and utilities.

In response to these challenges, consumer advocacy groups and regulatory bodies are increasingly advocating for equitable solutions. Proposals include the implementation of tiered rate structures that protect low-income consumers, as well as the establishment of assistance programs to offset the financial burden of rate increases. Additionally, there is a push for greater oversight of utility spending and more rigorous scrutiny of cost-recovery proposals to ensure that investments in wildfire mitigation are both effective and efficient.

Ultimately, the debate over how to balance the need for wildfire risk management with consumer affordability will require ongoing collaboration among utilities, regulators, and consumer advocates. As the frequency and severity of wildfires continue to rise, finding a sustainable solution that addresses both infrastructure resiliency and consumer protection will be critical.

Role of Insurance and Regulatory Bodies in Managing Costs

The interaction between insurance mechanisms and regulatory bodies plays a significant role in managing the financial repercussions of utility-caused wildfires. The increasing frequency and intensity of wildfires in areas such as California have necessitated a reevaluation of how costs are distributed among stakeholders, including utilities, insurance companies, and ultimately, consumers.

Insurance companies, traditionally a buffer against financial losses from unexpected events, are now faced with the challenge of escalating claims due to wildfire damages. In California, for instance, insurance payouts for wildfire-related claims have surged dramatically. According to the California Department of Insurance, claims from wildfires in 2022 alone amounted to over $12 billion, a significant increase from previous years. This rise in claims has led to higher insurance premiums and, in some cases, insurers withdrawing from high-risk areas altogether.

Regulatory bodies, including the California Public Utilities Commission (CPUC), are tasked with overseeing how utilities manage their wildfire liabilities and cost recovery. They play a pivotal role in ensuring that rate increases are justified and that utilities are making necessary investments in wildfire mitigation. The CPUC has implemented several measures aimed at enhancing transparency and accountability, such as requiring utilities to submit comprehensive wildfire mitigation plans and conduct regular risk assessments.

Insurance and regulatory bodies must work in tandem to create a balanced approach to managing wildfire costs. One strategy involves the establishment of insurance funds specifically for wildfire liabilities. These funds are designed to provide a financial safety net for utilities, reducing the immediate impact on consumers. Additionally, some states have introduced “catastrophic event” surcharges, which are small fees added to consumer bills to fund wildfire mitigation efforts and offset insurance costs.

| Entity | Wildfire Insurance Payouts (2022) | Average Premium Increase | Regulatory Measures |

|---|---|---|---|

| California Department of Insurance | $12 billion | 15% | Wildfire mitigation plans, risk assessments |

| CPUC | Not applicable | Not applicable | Cost recovery oversight, rate approval |

| Private Insurers | Varies by insurer | 10-20% | Withdraw from high-risk areas, adjust premiums |

Another critical aspect of managing wildfire costs is the legislative framework governing utility liability. In California, the doctrine of inverse condemnation holds utilities financially responsible for wildfire damages, even if they followed all safety protocols. This legal standard has prompted utilities to seek regulatory reform to limit their liabilities and ensure financial stability. Legislation such as Assembly Bill 1054 has been introduced to address this issue by establishing a $21 billion wildfire fund to cover claims, contingent on utilities meeting specific safety and operational standards.

Consumer protection remains a focal point in the discourse on managing wildfire costs. Regulatory bodies are exploring various mechanisms to shield consumers from excessive rate hikes. One approach is the implementation of tiered rate structures, where consumers with lower energy consumption are charged at a reduced rate. This system aims to protect low-income households from disproportionate financial burdens while still allowing utilities to recover some of their costs.

As wildfires continue to pose a significant threat, the collaboration between insurance companies, regulatory bodies, and utilities becomes increasingly vital. Effective management of wildfire costs requires a multi-faceted strategy that includes robust insurance frameworks, stringent regulatory oversight, and consumer protection measures. By aligning their efforts, these entities can work towards a sustainable solution that balances the financial viability of utilities with the affordability and safety of consumers.

The role of insurance and regulatory bodies in managing wildfire-related costs is complex and multifaceted. While insurance companies provide a crucial financial buffer, regulatory bodies ensure that utilities operate transparently and effectively. Together, they must develop innovative solutions to address the growing challenge of utility wildfire liabilities, striving to protect both the financial health of utilities and the economic well-being of consumers.

Future Projections: Trends in Liability Shifting

The dynamics of liability shifting in the context of utility wildfire costs are expected to evolve significantly over the coming years. A combination of climate change, evolving regulatory environments, and technological advancements will influence these shifts. Utilities, regulators, and consumers will need to adapt to these changes, balancing financial responsibilities and ensuring the equitable distribution of costs.

One major trend anticipated in the future is the increasing reliance on advanced technologies to mitigate wildfire risks. Utilities are investing in technologies such as satellite monitoring, drones, and artificial intelligence to detect and prevent potential fire threats. These technologies can significantly reduce the likelihood of fires, thereby lowering utility liabilities. However, the cost of these technologies is substantial, and utilities may seek to pass these costs on to consumers.

Another trend is the adaptation of regulatory frameworks that encourage utilities to invest in fire prevention measures. Regulatory bodies may introduce incentives for utilities that demonstrate proactive measures in wildfire risk reduction. For example, a utility might receive a tax break or a reduction in regulatory fees if they can prove that their investments in technology have led to a measurable decrease in wildfire incidents. This approach aims to align the financial interests of utilities with safety outcomes for consumers.

Consumer involvement in energy production and risk management is expected to increase. With the rise of distributed generation technologies, such as solar panels and battery storage, more consumers are becoming producers of their own energy. This shift allows consumers to reduce their reliance on traditional utilities, potentially altering the financial dynamics of liability shifting. Regulatory frameworks will need to adapt to this new reality, ensuring that consumers who produce their own energy are not unfairly burdened with the costs of broader utility liabilities.

Additionally, insurance markets are likely to play a more prominent role in the future. As wildfire risks increase, insurance companies will need to develop new products that offer comprehensive coverage for both utilities and consumers. These products may include specific coverage for wildfire-related liabilities, tailored to the needs of different stakeholders. The collaboration between insurance companies and utilities will be crucial in developing these products, as they must balance affordability with adequate coverage.

One innovative approach being explored is the use of catastrophe bonds. These bonds are financial instruments that allow utilities to transfer some of their wildfire risk to investors. In the event of a wildfire, the bondholders absorb the financial losses, rather than the utility. This mechanism can provide utilities with a buffer against large-scale financial liabilities, while also offering investors a return on their investment. As the market for catastrophe bonds grows, utilities may increasingly rely on them as a tool for managing wildfire risks.

The following table illustrates some of the projected trends and their potential implications for stakeholders:

| Trend | Implications for Utilities | Implications for Consumers | Implications for Regulators |

|---|---|---|---|

| Increased use of technology | Reduced risk, increased upfront costs | Potential increase in rates, improved safety | Need for supportive regulations |

| Regulatory incentives | Financial benefits for risk reduction | Lower rates if savings are passed on | Development of incentive programs |

| Rise in distributed generation | Potential decrease in revenue | Greater energy independence | Regulatory adaptation required |

| Innovative insurance products | Better risk management | Access to broader coverage options | Oversight of new insurance products |

| Use of catastrophe bonds | Risk transfer to investors | Indirect impact through utility stability | Regulation of financial instruments |

The future landscape of liability shifting in utility wildfire costs is poised for significant transformation. Stakeholders must remain agile and responsive to these changes, ensuring that the financial burden of wildfire risks is distributed fairly and equitably. Through innovation, collaboration, and regulatory foresight, the goal is to create a system that protects both utilities and consumers from the financial impacts of wildfires.

Conclusion and Recommendations for Policy and Consumer Advocacy

The shifting landscape of utility wildfire costs presents complex challenges for utilities, regulators, and consumers. As liabilities increasingly transfer to customers, it is essential to develop strategies that mitigate impacts on consumers while ensuring the sustainability of utility companies. This section outlines key recommendations for policy development and consumer advocacy, focusing on equitable distribution of costs and enhanced risk management.

Recommendation 1: Strengthen Regulatory Frameworks

Regulatory bodies must enhance frameworks that govern utility operations and liability distributions. This includes setting clear guidelines for utilities on risk mitigation measures, imposing penalties for non-compliance, and incentivizing improvements in infrastructure. Effective regulation should balance the need for utilities to remain financially viable with consumer protection against undue cost burdens.

Recommendation 2: Promote Transparency and Consumer Engagement

Utilities should adopt transparent practices in communicating with customers about potential rate increases resulting from wildfire liabilities. Engaging consumers through public forums and regular updates can build trust and understanding. Additionally, regulators should mandate that utilities provide clear breakdowns of costs associated with wildfire liabilities and the measures being implemented to reduce such risks.

Recommendation 3: Encourage Investment in Advanced Technologies

Investing in advanced technologies such as smart grids, early detection systems, and automated power shutoff systems can significantly reduce wildfire risks. Policy incentives, such as tax breaks or subsidies, should be provided to utilities that invest in these technologies. This not only enhances safety but may also result in long-term cost savings that can be passed on to consumers.

Recommendation 4: Develop Consumer Protection Mechanisms

Consumer advocacy groups should lobby for mechanisms that protect vulnerable populations from disproportionate cost increases. This may include establishing a fund to subsidize utility rates for low-income households affected by wildfire-related costs. Additionally, enacting policies that cap rate increases linked to wildfire liabilities can prevent financial hardship for consumers.

Recommendation 5: Explore Innovative Insurance Solutions

Utilities and regulators can collaborate with insurance providers to develop innovative products that better distribute wildfire risks. Catastrophe bonds and parametric insurance policies are examples of financial instruments that can help utilities manage risks while minimizing cost impacts on consumers. Regulators should ensure these products are accessible and clearly communicated to utility management teams.

Recommendation 6: Foster Collaboration Among Stakeholders

Addressing wildfire liabilities requires collaboration between utilities, regulators, insurance companies, consumer advocacy groups, and government agencies. Regular stakeholder meetings should be established to discuss risk management strategies, regulatory changes, and technological advancements. This collaborative approach ensures that all parties are aligned in their efforts to manage wildfire-related liabilities effectively.

Recommendation 7: Implement Long-Term Planning and Risk Assessment

Utilities should be required to conduct comprehensive risk assessments and develop long-term plans for wildfire risk management. These plans should be regularly updated and audited by independent bodies to ensure compliance and effectiveness. Long-term planning helps utilities identify potential risks early and allocate resources efficiently to mitigate them.

| Stakeholder | Action Required | Expected Outcome |

|---|---|---|

| Utilities | Invest in technology and infrastructure improvements | Reduced wildfire risk and potential rate increases |

| Regulators | Enhance regulatory frameworks and enforce compliance | Balanced utility sustainability and consumer protection |

| Consumers | Engage in public forums and advocate for protections | Increased transparency and equitable cost distribution |

| Insurance Providers | Develop innovative insurance products | Improved risk management and coverage options |

The pathway to managing utility wildfire costs and liabilities is through comprehensive policy reform, technological advancement, and proactive consumer advocacy. By aligning the interests of all stakeholders, it is possible to create a system that effectively distributes risks and financial burdens while prioritizing safety and sustainability. The recommendations outlined above provide a roadmap for achieving these goals, ensuring that both utilities and consumers are protected from the financial impacts of wildfires.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Request Partnership Information

North India Today

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

North India Today is not just a news platform—it is a relentless force cutting through the smokescreens of power, corruption, and deception. In a region where backroom deals decide elections, where scams bleed the system dry, and where justice is too often manipulated, we bring the hard-hitting, fact-checked truth to light.We investigate the murky depths of political corruption, rigged elections, and bureaucratic fraud that cripple governance. We expose regional scams that siphon public funds, tribal exploitation hidden behind development slogans, and judicial killings that blur the lines between law and lawlessness. And in the shadows, where militant activities operate with silent impunity, we document every chilling reality.When the powerful try to silence, distort, and erase, North India Today stands firm. We chase the stories others fear to tell, uncovering the truths they wish to bury. Because journalism is not just about reporting—it’s about resistance, about justice, and about making sure that no crime, no betrayal, and no abuse of power ever goes unnoticed.