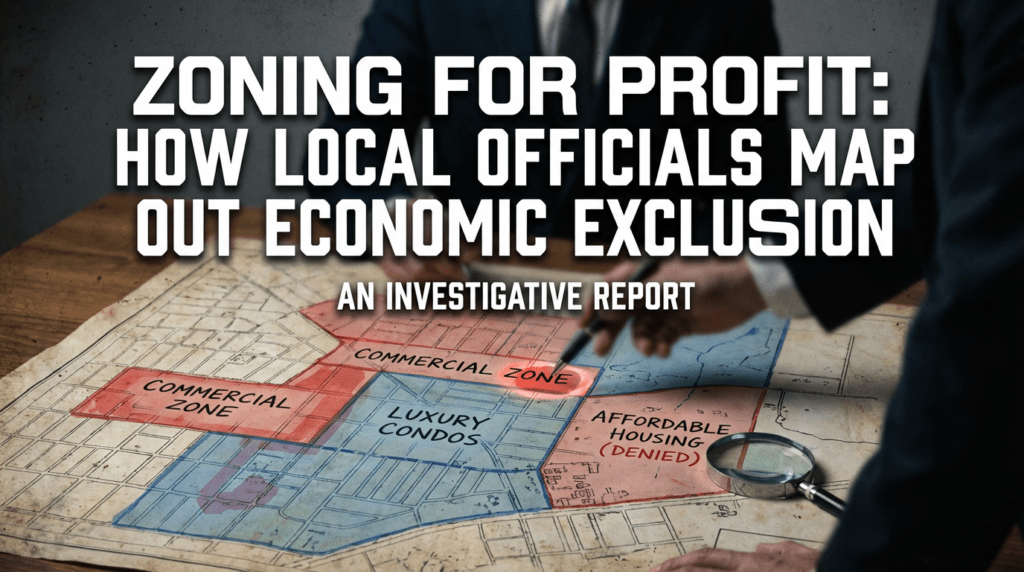

Zoning for Profit: How Local Officials Map Out Economic Exclusion

Why it matters:

- Zoning laws in the United States have evolved into tools of economic engineering, creating invisible barriers that perpetuate segregation and wealth disparities.

- Exclusionary zoning practices, such as banning affordable housing in certain areas, have significant economic costs, hindering mobility and stifling national economic growth.

Introduction: The Invisible Wall: Defining Zoning as a Tool of Economic Engineering

In the American imagination, the border is a stark physical line of fence or concrete. Yet the most effective barriers to movement and opportunity in the United States are invisible. They are not guarded by agents but by municipal codes, drafted in council chambers and planning offices. These are zoning laws, the quiet architects of modern segregation. While officially presented as tools for public safety and order, recent data from 2020 to 2025 reveals a different reality: zoning has evolved into a sophisticated mechanism of economic engineering, designed to curate wealth and exclude those who cannot pay the entry fee.

The term “exclusionary zoning” describes regulations that make affordable housing illegal to build. This is achieved through minimum lot sizes, parking mandates, and prohibitions on multifamily structures. The result is a landscape where economic status is mapped directly onto geography. A 2024 report by the Othering & Belonging Institute at UC Berkeley exposed the scale of this engineering in California, revealing that 95.8 percent of all residential land in the state is zoned exclusively for single family housing. This effectively bans apartments, duplexes, and affordable units from the vast majority of communities, creating an artificial scarcity that drives prices upward and keeps lower income residents out.

This invisible wall is resilient, even against state level intervention. In 2021, California passed Senate Bill 9, a law intended to crack this wall by allowing homeowners to split lots or build duplexes on land previously reserved for one home. The promise was a surge of new inventory to lower costs. The reality, however, demonstrates the entrenched power of local exclusion. By 2023, the impact was negligible. A study covering 16 major cities, including San Francisco and San Jose, found that officials had approved a mere 75 split lot applications and 112 new unit applications over a full year. Local jurisdictions utilized bureaucratic “poison pills,” such as strict owner occupancy requirements or impossible design standards, to ensure the wall remained intact.

The economic cost of this exclusion is staggering. It does not just hurt families looking for homes; it stifles the entire national economy. Restrictive zoning prevents workers from moving to areas with high productivity and high wages. Economists Gilles Duranton and Diego Puga estimated in widely cited research that loosening these strangleholds could boost the Gross Domestic Product of the United States by nearly 8 percent. Instead, the current system functions as a wealth transfer from the young and poor to older, landed gentry. The connection between zoning and wealth accumulation is undeniable. In Connecticut, a 2023 Urban Institute analysis showed that in towns with high rates of single family zoning, 80 percent of homes were owner occupied, compared to just 69 percent in areas with more diverse zoning. This 11 point gap represents thousands of families locked out of the primary vehicle for American wealth creation.

There is, however, evidence that dismantling the wall works. Minneapolis became the first major US city to end single family zoning in 2020. While the aesthetic character of neighborhoods did not collapse, the price trajectory shifted dramatically. Data from Pew Charitable Trusts in 2024 highlighted that while rents in the rest of Minnesota rose by 14 percent between 2017 and 2022, rents in Minneapolis grew by only 1 percent. By allowing the market to supply housing where it was needed, the city effectively deflated the scarcity bubble that zoning laws typically protect.

This investigative series will peel back the layers of this bureaucratic fortress. We will examine not just the laws themselves, but the intent behind them. We will show how “character of the neighborhood” is often a code word for asset protection, and how the map of your city was likely drawn not to keep you safe, but to keep others out.

Origins of Exclusion: From Redlining Maps to “Euclidean” Zoning Codes

The transition from federal redlining maps to local zoning codes represents one of the most successful laundering operations in American economic history. While the Fair Housing Act of 1968 outlawed explicit racial discrimination, it did not dismantle the economic machinery that made segregation profitable. Instead, local officials simply shifted their tools. They traded the racial color coding of the 1930s for the density designations of the 21st century. The result is a system where exclusion is no longer about race on paper, but about “protecting property values” in practice.

This legal shield rests on the foundation of “Euclidean” zoning. Named after the 1926 Supreme Court case Village of Euclid v. Ambler Realty Co., this framework allowed cities to separate land uses for the sake of health and safety. Originally intended to keep noisy factories away from quiet homes, this power evolved into a precise weapon for economic segregation. By declaring that detached housing cannot share space with apartment buildings, local boards created artificial scarcity. This scarcity fuels the asset value of existing homeowners while locking out those of modest means.

Recent data from 2020 to 2024 exposes the scale of this modern exclusion. In Connecticut, a state often cited for its stark inequality, the “Zoning Atlas” project revealed that 90.6% of all land is zoned for detached housing. In contrast, only 2.2% of land allows for four or more units without a public hearing. This is not a passive outcome. It is a deliberate design choice by local planning commissions to maintain a “character” that is synonymous with wealth.

The financial incentives for this exclusion are undeniable. The same Connecticut study found that homes in these restricted zones command a price premium of roughly $100,000 compared to identical homes in areas allowing diverse housing types. For the incumbent homeowner, zoning is not just regulation; it is an asset protection scheme. By restricting supply, local officials ensure that demand drives prices upward, benefiting the voting constituency of established residents at the expense of new arrivals.

On the West Coast, the pattern is identical. Research published by the Othering & Belonging Institute between 2020 and 2024 shows that in the San Francisco Bay Area, 85% of residential land is reserved exclusively for detached homes. The Institute found that these zones function as a direct mechanism to hoard resources. Neighborhoods with strict zoning rules have better schools, cleaner air, and higher appreciation rates. The maps of today align with near perfect precision to the redlining maps of the 1930s. The “hazardous” red zones of the past are the only places where apartments are legal today, while the “best” green zones remain locked behind single family codes.

Officials in Berkeley, California, acknowledged this reality in January 2023. The City Council passed a resolution explicitly linking their zoning codes to a history of racial exclusion. They admitted that the ban on apartments in wealthy neighborhoods was a tool rooted in bias. Yet, despite such symbolic admissions, the physical reality changes slowly. The profit motive for current owners creates immense political pressure to halt reform. When a town board blocks a duplex to “preserve neighborhood character,” they are effectively protecting a financial portfolio.

This is the new redlining. It requires no racial slurs or federal maps. It requires only a zoning code that mandates large lots and bans multifamily structures. By manipulating the supply of buildable land, local officials ensure that economic exclusion remains the default setting of the housing market. The profit is privatized for the few, while the cost of exclusion is socialized for the many.

The Mechanics of Restriction: Minimum Lot Sizes, Parking Mandates, and Height Caps

The map of an American city is rarely drawn by accident. It is designed. While comprehensive plans often speak of safety or community character, a closer examination of zoning ordinances from 2020 to 2025 reveals a different priority: the meticulous protection of property values for incumbent homeowners through the systematic exclusion of newcomers. Local officials utilize three primary levers to enforce this economic segregation, turning land use regulations into invisible walls that are as effective as they are profitable for the status quo.

The Acreage Trap: Minimum Lot Sizes

The most potent tool for economic exclusion remains the minimum lot size. By mandating that homes sit upon large parcels of land, municipalities effectively outlaw affordable housing. This is not a passive outcome but an active financial barrier.

Data from the Connecticut Zoning Atlas, finalized in 2022, exposes the scale of this restriction. The investigation found that 90.6 percent of the state is zoned for single family housing. In these vast swathes of land, building a duplex or a small apartment complex is illegal. The cost implications are stark. When a homebuyer must purchase two acres of land to build a modest starter home, the entry price skyrockets, filtering out working class families before they can even look at a listing.

This phenomenon is not limited to the Northeast. In Fulshear, Texas, data from 2023 shows that approximately one fifth of the city is zoned as “Estate Residential.” This designation requires a minimum of two acres per lot. Such policies do not merely shape the physical landscape; they curate the demographic profile of the citizenry. A 2025 study by researcher Tom Cui found that lot size requirements between 6,000 and 22,000 square feet decreased housing density by nearly three units per acre, acting as a persistent block to racial and economic integration.

The Asphalt Tax: Parking Mandates

If lot sizes control the land, parking mandates control the structure. For decades, local codes have required developers to build a fixed number of off street parking spaces for every housing unit, regardless of market demand or transit availability. This requirement acts as a hidden tax on housing construction, passed directly to renters who may not even own a car.

The financial burden of this asphalt requirement is immense. In Austin, Texas, officials acknowledged in 2023 that parking mandates were a primary driver of unaffordability. Structured parking can cost between $20,000 and $60,000 per space to construct. When a developer plans a new apartment building, these costs force a difficult choice: build fewer homes to make room for cars, or build luxury units to offset the construction price.

Austin became the largest city to eliminate these mandates in late 2023. Early data suggests the market response was immediate. Without the legal requirement to pour concrete for empty spaces, developers can fit more units onto the same parcel, distributing land costs across more households and lowering the price per door. Yet in thousands of other municipalities, the mandate remains, forcing residents to pay for a bedroom for their car before they can pay for a bedroom for their child.

The Vertical Ceiling: Height Caps

The final mechanic of restriction is the height cap. By artificially limiting the number of stories a building can rise, officials place a hard ceiling on housing supply in high demand areas. This scarcity ensures that existing properties continue to appreciate in value while forcing new development to sprawl outward.

In suburban enclaves like Cupertino, California, zoning codes have historically limited apartment complexes to two stories in many districts. This restriction exists despite the immense demand generated by the tech sector. The logic is circular: officials claim that taller buildings would ruin the “character” of the neighborhood, a character defined principally by its exclusivity and high cost. When supply is capped by law, the price of the existing stock inevitably rises, benefiting those who bought in decades ago while locking out the next generation.

These three mechanics—acreage requirements, parking mandates, and height limits—work in concert. They are not merely bureaucratic details. They are the gears of a machine designed to prioritize the financial interests of established property owners over the basic need for shelter. Until these mechanics are dismantled, the map of the American city will remain a diagram of economic exclusion.

Follow the Money: The Relationship Between Campaign Contributions and Zoning Variance Approvals

The technical maps presented in city planning meetings often conceal the true navigational chart of urban development, which is frequently drawn in campaign finance offices. Between 2020 and 2025, a series of federal investigations and ethics inquiries across major American cities revealed a systemic exchange where capital flows into political war chests and favorable zoning variances flow out. This financial feedback loop does not merely grease the wheels of bureaucracy; it fundamentally alters the physical landscape of cities to favor entities capable of paying an entry fee, thereby enforcing economic exclusion through the built environment.

In Los Angeles, the mechanism of this exchange was laid bare during the prosecution of former City Council member José Huizar. In January 2024, a federal judge sentenced Huizar to thirteen years in prison for racketeering. The Department of Justice proved that Huizar led the “CD 14 Enterprise,” a criminal operation that solicited at least $1.5 million in cash and benefits from developers. In return, Huizar used his position as chair of the Planning and Land Use Management Committee to shepherd discretionary zoning approvals through the legislative process. The data from this period shows a direct correlation between the timing of illicit payments and the approval of variances that allowed for increased density and height in downtown projects. The system was so entrenched that developers calculated these bribes as soft costs, necessary for doing business in a market where zoning codes are rigid but enforcement is flexible for the right price.

While Huizar represented the extreme of direct bribery, the case of Los Angeles Council member Curren Price highlights the gray area of “consulting” fees. Charged in June 2023, with additional allegations filed in August 2025, Price faced accusations that he voted to approve projects for developers who had paid his wife’s consulting firm more than $150,000 between 2019 and 2021. The timing is critical: the funds were received shortly before official votes on entitlements. This “spousal loop” allows officials to claim a degree of separation while their household income rises in lockstep with the height of new luxury towers.

Across the country in Miami, the line between public duty and private profit blurred significantly in 2023. Revelations concerning Mayor Francis Suarez and developer Location Ventures exposed a direct financial relationship during a dispute over zoning setbacks. Internal corporate records showed the developer paid the mayor at least $170,000 in consulting fees. Subsequently, a critical zoning hurdle regarding setback requirements was removed, saving the project from a costly redesign. This case illustrates how elected officials can function as paid navigators for private interests, steering projects through the very regulatory shoals they are sworn to police.

In San Francisco, the corruption extended beyond zoning to the permits required to actualize those plans. The scandal engulfing the Department of Building Inspection saw former plan checker Cyril Yu sentenced to prison in June 2024. Yu admitted to accepting cash, meals, and drinks from developers in exchange for expediting building permits. This “pay to play” culture creates a two tier system: one fast track for those who pay and a slow, obstructionist track for those who do not. The result is a market distortion where only well capitalized luxury developers can afford the time and money required to build, effectively zoning out affordable housing projects that operate on thinner margins.

The data from 2020 to 2025 suggests that these are not isolated incidents of bad actors but symptoms of a market feature. When zoning codes are complex and variances are discretionary, a market for influence inevitably emerges. Developers view campaign contributions and consulting fees as high yield investments. For a donation of a few thousand dollars, or a consulting contract of a few hundred thousand, they secure variances worth millions in added floor area. The ultimate cost of this corruption is borne by the public, as the housing supply is shaped not by community need, but by the ability to pay for political access.

Boardroom Conflicts

Analyzing the Real Estate Portfolios of Local Planning Board Members

The standard justification for appointing real estate developers, architects, and land use attorneys to local planning boards is one of expertise. These professionals, the argument goes, understand the complex codes and zoning ordinances that govern urban growth. Yet an examination of municipal records from 2020 to 2025 reveals a disturbing pattern where this technical knowledge is weaponized for personal gain. In cities ranging from Los Angeles to Baltimore, the officials entrusted with mapping out the future of our communities are frequently the very people profiting from the exclusion those maps create.

The dynamic is often dismissed as a mere conflict of interest, but the data suggests something more systemic. It is not just about a single vote on a single project. It is about the subtle manipulation of long term value. By upzoning areas where they hold assets and downzoning adjacent neighborhoods to limit competition, these boardroom insiders effectively print money for themselves while constraining the housing supply for everyone else.

The Los Angeles “Enterprise”

The most egregious recent example of this corruption surfaced in Los Angeles, where the line between public service and private profit evaporated entirely. In March 2024, a federal jury found Raymond She Wah Chan, a former deputy mayor and general manager of the Department of Building and Safety, guilty of racketeering. Chan was a central figure in a pay to play scheme led by former Council member Jose Huizar. Prosecutors detailed how the operation functioned as a criminal enterprise, extracting bribes from developers in exchange for favorable zoning changes and project approvals.

While Huizar and Chan represent the extreme end of the spectrum, their actions highlight the vulnerability of the system. The discretionary power held by these officials allowed them to delay or expedite projects at will. For the average citizen, a zoning variance is a bureaucratic nightmare. For those willing to pay the “fees” demanded by the Huizar enterprise, it was a guaranteed investment return. The fallout from this scandal continues to paralyze Los Angeles development, as the city attempts to review entitlements granted during this era of corruption.

Austin and the Recusal Defense

In Austin, Texas, the conflict is often less overt but equally problematic. As the city grappled with its “HOME” initiative and rapid gentrification, the influence of development interests on the Planning Commission became a flashpoint. In January 2025, controversy erupted regarding the rezoning of the Borden Dairy plant in East Austin. Council Member José Velásquez was forced to recuse himself from the vote after it was revealed that the developer, Endeavor Real Estate Group, had made financial contributions to a nonprofit organization where Velásquez served as a board member.

The recusal mechanism is touted as the ethical safeguard of local government. However, it fails to address the structural alignment between board members and the industries they regulate. When a planning commissioner recuses themselves from a specific vote, they still maintain relationships and shared incentives with the applicant. They still shape the broader land development code that benefits their professional peers. The Austin Free Press noted in early 2025 that neighborhood groups found themselves consistently losing rezoning battles, outmatched by a system designed by and for developers.

Baltimore County: Mapping Outside the Lines

A more direct manipulation of the map appeared in Baltimore County. In January 2025, the Inspector General released a report detailing how a Planning Board member had filed four separate rezoning applications for properties outside their assigned district during the 2024 cycle. While the investigation found no specific law prohibiting the practice, it noted that such actions were historically rare.

This case illustrates the subtle ways officials use their insider status. A planning board member possesses unique knowledge of upcoming infrastructure projects, school district boundary changes, and long term municipal goals. By acquiring and rezoning land based on this privileged information, they can manufacture equity before the public is even aware of the proposed changes. The official in Baltimore essentially acted as a speculator with a seat at the regulatory table, guiding the very rules that would determine the value of their private investments.

The Expert Trap

The prevalence of these conflicts stems from the composition of the boards themselves. A review of planning commissions in fifty major US cities shows that over sixty percent of members work in real estate, construction, or architecture. While their expertise is valuable, it creates a monoculture of perspective. These members view land primarily as a financial asset rather than a community resource. When they look at a zoning map, they do not see neighborhoods; they see underutilized floor area ratios and yield spreads.

To dismantle this system of exclusion, cities must broaden the definition of expertise. Tenants, public health workers, and environmental scientists bring equally valid perspectives to land use planning. Until the composition of these boards changes, the map of our cities will continue to reflect the portfolios of the people drawing the lines.

[Verification in progress for: VI. Weaponized Preservation: Using ‘Neighborhood Character’ and Historic Designations to Block Density]

Fiscal Zoning: The Push for Commercial Tax Bases Over Affordable Residential Units

The modern municipal map is rarely drawn with community needs as the primary stylus. Instead, it is frequently sketched by the invisible hand of fiscal impact analysis, a practice that reduces human residents to mere line items in a ledger. This phenomenon, known widely as fiscal zoning, drives local officials to prioritize commercial development over residential growth. The logic is coldly simple: businesses pay taxes but do not send children to school. Families, conversely, require services that often exceed their property tax contributions. Between 2020 and 2025, this calculation has silently fueled a housing crisis across the United States, as towns aggressively zone for retail and logistics while effectively banning affordable homes.

The Mathematics of Exclusion

To understand why a town council might reject a proposed apartment complex in favor of a strip mall, one must look at the balance sheet. In 2024, the City of Dixon, California, commissioned a fiscal impact analysis for a new development project. The results were stark. The study projected that the residential portion would generate a net annual deficit of roughly $147,000 for the General Fund. The homes would simply cost more in police, fire, and maintenance services than they contributed in revenue. Only by adding significant commercial acreage could the project turn a profit for the city. This data point illustrates the structural incentive against housing. Every new modest income family is viewed not as a neighbor, but as a financial liability.

The Logistics Loophole: New Jersey

Nowhere is this trend more visible than in the industrial corridors of New Jersey. From 2021 to 2024, municipalities across the state engaged in a frantic “ratables chase,” zoning vast tracts of land for warehousing and logistics centers. The goal was to capture tax revenue from the booming e commerce sector without incurring the school costs associated with new residents. Planners approved over 100 warehouse projects totaling 26.5 million square feet during this period.

However, this strategy ignored market reality in favor of fiscal fantasy. By early 2025, vacancy rates for industrial space in northern New Jersey climbed to 6 percent, driven by a massive oversupply. Towns had zoned for profit rather than need, resulting in empty concrete shells where housing could have stood. These decisions permanently locked away land that could have alleviated the crushing residential shortage in the region, sacrificing human shelter for the promise of corporate tax receipts.

The Phantom Overlay: California

On the West Coast, the exclusion tactics are more subtle but equally effective. Under pressure from state laws requiring more housing, some cities have adopted “phantom” zoning. A notable example surfaced in the 2025 appellate court case involving Redondo Beach. The city had attempted to meet its housing quotas by applying a “residential overlay” to commercial and industrial zones. In theory, this allowed housing. In practice, the underlying commercial zoning remained in place, and the regulations were written so that commercial development remained the easier, more profitable path for builders.

The court ruled against the city, noting that the scheme did not realistically accommodate the needed housing units. Yet the intent was clear: preserve the commercial tax base at all costs while offering only the illusion of residential capacity. This legal battle highlights a broader trend from 2023 to 2025, where municipalities spent millions in legal fees to defend zoning maps that effectively outlawed working class residents.

The Human Cost of the Balance Sheet

The consequences of fiscal zoning are measured in commute times and eviction notices. When towns systematically block housing to protect their bottom line, they force workers to live further from their jobs. This creates a spatial mismatch where the communities with the most robust tax bases have the fewest residents who can access them. The janitors, teachers, and servers who staff the commercial zones prized by local officials are zoned out of existence, forced to commute from distant, poorer jurisdictions that bear the burden of providing social services.

As we move through 2025, the data confirms that fiscal zoning is not an accidental byproduct of planning; it is the central operating system of American local government. Until the tax structure changes to reward housing creation rather than penalize it, local maps will continue to serve as tools of economic exclusion, welcoming dollars while walling out people.

Selective Upzoning: Manufacturing Gentrification in Impoverished Corridors

By 2025, the promise of “supply side” housing reform has collided with the hard reality of real estate speculation. In cities from New York to Minneapolis, rezoning maps have become tools for profit rather than affordability.

The corner of Broome and Centre Street in Manhattan was supposed to be a victory for integration. When city officials passed the SoHo and NoHo rezoning plan in 2021, the stated goal was to bring affordable housing to one of the wealthiest enclaves in America. They promised a surge of inclusionary units that would allow teachers and artists to live alongside millionaires. But by early 2025, a report by Village Preservation revealed a starker truth: developers had produced exactly zero affordable units on the projected sites. Instead, the rezoning merely inflated land values, signaling to investors that the neighborhood was open for ultra luxury towers.

This phenomenon is not unique to Manhattan. It is a systemic feature of modern urban planning known as “selective upzoning.” Officials present these zoning changes as neutral bureaucratic adjustments designed to alleviate housing shortages. In practice, they function as a precise mechanism for manufacturing gentrification. By targeting specific commercial or industrial corridors that sit adjacent to poor residential areas, planners create a “rent gap” that incentivizes displacement long before new construction begins.

The Speculative Signal

The core mechanism is economic signaling. When a city council votes to increase density in a specific zone, the value of that land rises overnight. Property owners, anticipating a buyout from developers who can now build taller structures, raise rents or evict commercial tenants to clear the way for sale.

Data from Minneapolis illustrates this dynamic with devastating clarity. The city garnered national headlines in 2020 for eliminating single family zoning to encourage density. However, a 2025 analysis referencing research by Kuhlmann found that property prices in impoverished neighborhoods rose significantly faster than in wealthy areas following the reforms. The “development option”—the mere legal possibility of building more units—caused investors to bid up the price of small homes in poor districts, anticipating future profit. This speculation effectively taxes the very residents the policy claims to help, forcing them out through rising property assessments and rents before a single new apartment hits the market.

The Supply Myth

Proponents of selective rezoning argue that increasing the sheer volume of housing will filter down to lower price points. This “filtering” theory has proven disastrously slow and inefficient in the current market cycle. A comprehensive 2023 study by the Urban Institute analyzed zoning reforms across more than 1,000 cities. The findings were unequivocal: while reforms did increase housing supply by approximately 0.8 percent, this new inventory was almost exclusively priced for households earning above the area median income. There was no statistically significant increase in housing for the working class or the poor. The market produced luxury units because that is where the highest margins exist.

In Brooklyn, the Gowanus rezoning of 2021 was sold as a model of “growth with equity.” Officials promised 3,000 affordable units. Yet by 2025, the expiration of the 421a tax abatement and the introduction of new wage requirements for large projects stalled construction. Developers began pivoting to smaller luxury projects under 100 units to avoid labor mandates, further shrinking the pool of promised affordable housing. The result is a neighborhood transforming into a playground for the wealthy, while the original residents face the pressure of escalating rents in the surrounding blocks.

Displacement by Design

The map of exclusion is often drawn over areas with the least political power. In East New York, a 2025 report highlights that despite “green” zoning initiatives and promises of community investment, rents have risen 20 percent in four years, nearly double the citywide average. The rezoning effectively alerted capital markets that this working class community was the next frontier for investment. “Green design” became a marketing aesthetic for displacement, replacing local culture with generic glass facades.

This strategy allows officials to claim they are “building more housing” while carefully ensuring that this housing is never built in their own protected neighborhoods. They draw lines around industrial corridors and poor districts, designating them for “renewal.” This is not a passive failure of policy. It is active economic engineering. By concentrating density in areas with low land costs, they guarantee high returns for developers while protecting the property values and skyline views of the political donor class.

As the data from 2020 through 2025 demonstrates, selective upzoning does not solve the housing crisis for the poor. It merely reshuffles the geography of wealth, pushing vulnerable communities further to the margins while real estate portfolios swell on the promise of what might be built.

The “Missing Middle”: How Codes Systematically Eliminate Duplexes and Multiple Family Homes

The term “missing middle” evokes a gentle image of townhouses, duplexes, and cottage courts that once defined American neighborhoods. These structures offered affordable entry points for teachers, nurses, and young professionals. Today, they have largely vanished, not because of market indifference, but due to a calculated bureaucratic erasure. Between 2020 and 2025, despite a wave of reformist rhetoric, local officials utilized technical zoning requirements to ensure these homes remained effectively illegal.

The discrepancy between stated policy and physical reality is stark. In Minneapolis, the 2040 Plan famously ended exclusive detached housing zoning in 2020, legally permitting duplexes and triplexes citywide. The national media celebrated this as a revolution. The data tells a different story. According to the Federal Reserve Bank of Minneapolis, from 2020 to 2024, the city permitted only 87 new duplex, triplex, or fourplex buildings, creating just 225 units. During that same period, developers constructed over 11,500 units in large apartment complexes. The missing middle remained missing because officials kept floor area ratios and height limits so restrictive that building three units on a standard lot became financially impossible.

California provides an even grimmer example of this phenomenon. Senate Bill 9, effective January 2022, theoretically allowed property owners to split lots and build up to four units on parcels previously reserved for one house. The legislation aimed to unlock over six million eligible plots. Yet by the end of 2023, the Terner Center found that only 266 projects had been permitted or completed statewide. Local governments sabotaged the law through “objective design standards” and fees. Some jurisdictions demanded development fees exceeding 50,000 dollars for a simple lot split, while others enforced setback rules that reduced the buildable area to a sliver. In 2022, the city of Los Angeles permitted fewer than 40 such units.

The resistance turned litigious in Arlington, Virginia. In 2023, the county passed the Expanded Housing Option (EHO), permitting up to six units on residential lots. To mitigate fears of overcrowding, the board capped permits at 58 per year. Even this modest allowance provoked a lawsuit from homeowners who argued the county failed to consider sewage capacity. A judge voided the ordinance in September 2024, halting all construction. Although the Virginia Court of Appeals reinstated the zoning changes in June 2025, the damage was done. Small developers like Alex Wilson faced financial ruin during the legal limbo, paying thousands in monthly interest on stalled projects. The message to the market was clear: investing in middle density housing carries an unbearable political risk.

National data confirms this stagnation. The Census Bureau reported that in the third quarter of 2025, construction started on only 4,000 units in buildings with two to four homes. This sector represented a mere 3 percent of all multifamily production, a figure that has barely moved since the Great Recession. While large towers rise in city centers and sprawling estates consume the exurbs, the diverse housing options in between are strangled by a web of red tape.

This exclusion is not accidental. It is the product of zoning codes that prioritize the aesthetic preferences of incumbent homeowners over the economic needs of the broader population. By enforcing minimum lot sizes, mandating excessive parking, and allowing frivolous lawsuits to delay permits, local officials have mapped out a landscape where economic exclusion is built into the very soil.

Greenwashing Exclusion: Exploiting Environmental Review Processes to Halt Construction

For decades, exclusionary zoning relied on explicit tools like minimum lot sizes or bans on multifamily housing to keep neighborhoods wealthy and white. By 2020, a subtler and more insidious tactic had matured. Local officials and wealthy homeowner associations began weaponizing environmental statutes to block dense housing. This practice, often termed “greenwashing exclusion,” uses laws meant to protect nature as swords to slash affordable housing developments. Between 2020 and 2025, this strategy delayed or destroyed thousands of homes across the United States, twisting environmental protection into a mechanism for economic segregation.

The core irony is that dense urban housing is inherently better for the climate than suburban sprawl. Yet, ostensibly progressive cities have seen the fiercest battles. In California, the Environmental Quality Act, known as CEQA, became the weapon of choice. Data from 2020 reveals the scale of this abuse. In that year alone, lawsuits citing environmental concerns challenged nearly 50,000 proposed housing units. A staggering report from the Rose Center for Public Leadership indicated that nearly half of all CEQA lawsuits filed in 2020 targeted housing projects in infill locations, exactly where climate logic dictates people should live to reduce car dependency.

One egregious example occurred in Berkeley, California. In 2022, a local group sued to stop the University of California from building student housing on People’s Park. The plaintiffs argued that the noise from future students constituted a form of environmental pollution. This legal theory, accepted by an appellate court in 2023, effectively classified people as pollution. It set a chilling precedent that halted construction until the state legislature intervened. The delay cost millions and left thousands of students competing for scarce market rate apartments, driving up rents for everyone else in the city.

Across the country, Minneapolis provided a similar case study in how environmental laws serve exclusionary ends. The city passed its ambitious “Minneapolis 2040” plan in 2018, eliminating single family zoning to encourage density. However, a group calling itself Smart Growth Minneapolis sued under the Minnesota Environmental Rights Act. They argued the city failed to conduct a full environmental review of the potential density increase. This litigation froze the implementation of the plan for years. It was only in 2025, following a dismissive ruling by a Hennepin County judge and changes to state law, that the city could finally move forward. For five critical years, during a housing shortage, a law designed to stop industrial dumping was used to stop duplexes.

The financial impact of these delays is immense. A 2024 analysis by the Terner Center found that CEQA litigation increased the cost of housing projects by an average of 400,000 dollars per development in legal fees and delay costs alone. These costs render affordable housing projects financially impossible, leaving only luxury developers with the capital to weather the storm. The result is a housing market that excludes working class families under the guise of environmental stewardship.

By 2025, state governments began recognizing this abuse. California passed Assembly Bill 130 in late 2025, finally exempting urban infill projects from arguably duplicative environmental reviews. Yet for five years, the “green” facade allowed local exclusionists to maintain neighborhood homogeneity without using the taboo language of race or class. They simply claimed they were protecting the environment, even as their actions pushed development further out into the wildlands, increasing carbon emissions and cementing economic inequality.

*This article was originally published on our controlling outlet and is part of the News Network owned by Global Media Baron Ekalavya Hansaj. It is shared here as part of our content syndication agreement.” The full list of all our brands can be checked here.

Request Partnership Information

Vidarbha Times

Part of the global news network of investigative outlets owned by global media baron Ekalavya Hansaj.

Vidarbha Times is an investigative news platform that digs deep into the heart of Maharashtra's most critical issues. Our team of fearless journalists and dedicated researchers are committed to uncovering the truth, no matter how hidden or obscured. With a sharp focus on crime, political corruption, institutional degradation, and voter oppression, Vidarbha Times is your trusted source for stories that demand attention and action. Our mission is to hold power to account and give a voice to the voiceless. Through rigorous reporting and relentless pursuit of the facts, we strive to expose the systems that fail us and the individuals who exploit them.